The threshold for convertible bond transactions is raised, and many brokers renovate the renovation system overnight to prevent "stepping on the line"

Author:Daily Economic News Time:2022.06.18

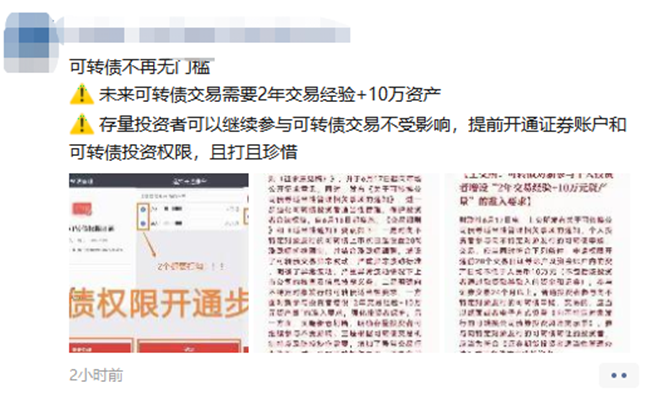

On June 17, the Shanghai Stock Exchange and Shenzhen Stock Exchange released the "Implementation Rules for Convertible Corporate Bond Transactions (Draft for Opinions)" and "Notice on the Proper Management of Corporate Bonds" (hereinafter referred to as the "Notice of Notice" ") 2 documents, adding" 2 -year transaction experience+100,000 yuan assets "for newly participated in the purchase and transaction of new convertible bonds. And the "Notice" will be implemented from June 18, 2022.

In other words, from today (June 18), convertible bonds have increased from almost 0 thresholds to "2 -year transaction experience+100,000 yuan assets", and this new threshold standard is the same as the current account opening standard of GEM Essence

However, through a reporter's investigation last night, it was found that it was not easy for investors to "step on the line" last night. According to the reporter's understanding, the IT department of multiple brokers on the evening of June 17 was launched the relevant upgrade and transformation of the trading system overnight.

"Step on the line" to open convertible claims is not easy

The above -mentioned "Notice" issued by the Shanghai -Shenzhen Exchange today clearly clearly sets up the "2 -year transaction experience+100,000 yuan assets" admission requirements for newly involved in convertible bond purchases and transactions. And the new and old breaks were implemented, that is, the individual investors who had opened convertible bond transactions before the implementation of the notification and the unpaid individual investors were not applicable to this regulation.

The "Notice" also states that if ordinary investors participate in the purchase and transactions of convertible bonds issued to unspecified objects, they shall sign the "Disclosure of Investment Risk of Convertible Company Bonds issued to unspecified objects" by paper or electronic.

In the past, there was almost no threshold for convertible bonds. As long as investors have their own stock securities accounts, they can open it more conveniently.

From June 18th, convertible bonds have increased significantly from almost 0 thresholds to "2 -year transaction experience+100,000 yuan assets", and this new threshold standard is the same as the current account opening standards in GEM.

Some comments believe that the new threshold for account opening of "2 -year transaction experience+100,000 yuan assets" will block some investors opening accounts.

Picture source: network screenshot

In addition, the reporter noticed that some sources of securities firms posted a circle of friends on the evening of June 17, reminding investors who had not yet opened convertible bond transactions to open in time before the threshold was increased.

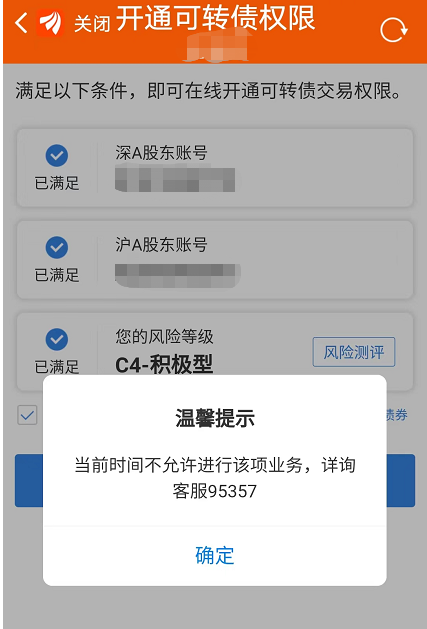

Image source: Cai Tong Securities APP

However, it seemed that it was not easy to open the transaction permissions of convertible bonds to open convertible bonds yesterday night. For example, a number of brokerage APPs are in the evening of June 17, and they cannot log in normally. Those investors who intend to "step on the line" convertible claims may miss the opportunity because of this. According to the reporter's understanding, brokerages that could not be logged in that night that APP could not log in that night include Caitong Securities, Debon Securities, and CITIC Securities.

Image source: intercept an investor securities APP

Mr. Wang, an investor in Shanghai, told reporters that a securities account opened in Oriental Fortune Securities has been basically idle before. Now the funds in the account are only more than 1,000 yuan. Permissions. After 24 o'clock on June 17, he found that although the system prompts that the account meets the conditions for opening convertible bond transactions, when clicking on, the system said that "the current time is not allowed to perform the business."

This morning, the APP of Caitong Securities, Debon Securities, CITIC Securities and other brokerage companies could not be logged in. The above situation that Mr. Wang encountered this morning still exists this morning.

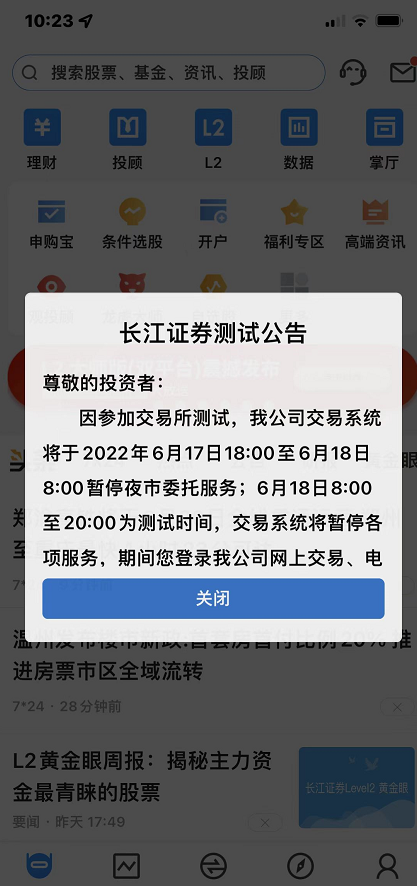

Picture source: netizen app screenshot

It is understood that some securities firms will make detailed announcements that the app could not log in last night. For example, the Yangtze River Securities announced that "due to participation in the exchange test, our company's trading system will be suspended from the night municipal commission service from 18:00 to June 18, 2022; : 00 is the test time, the trading system will suspend the services. "

According to a person in the industry, the test of this exchange is related to the new regulations of the above convertible bonds, but there are other contents.

Many brokerage firms work overtime renovation system overnight

The "Notice" requires that members should conscientiously implement the requirements of this notice and complete the relevant technical transformation as soon as possible. Before the completion of the technical transformation, members should be opened in a reasonable way to handle convertible claims to ensure that investor rights are not affected.

Image source: intercepted "Notice"

At the same time, the relevant requirements of the appropriate management of convertible bond investors in the notice will be officially implemented on June 18.

Under such a situation, the technology of completing relevant convertible bond transactions as soon as possible has been transformed into a top priority for each brokerage company. According to the reporter's understanding, the IT departments of a number of securities firms on the evening of June 17 launched the upgrade and transformation of trading systems overnight. Related brokers include Haitong Securities, Anxin Securities, and Changjiang Securities.

Relevant sources of Haitong Securities told reporters that on the evening of June 17, the Shanghai and Shenzhen Exchange issued the "Notice on the Proper Management of Bonds of Companies", and the company immediately set up a special working group to formulate With the corresponding working plan, the Ministry of Retail and the Network Finance of the Ministry of Finance wrote system requirements, testing plans, employee training content, investor education copy, technical department to make technical development, environmental allocation, and systematic online preparations. Perform appropriate verification tests respectively. Each department is in an orderly manner, go hand in hand, and cooperates together to jointly promote the appropriateness of convertible bonds to complete the upgrade and transformation on Saturday. Sunday investors can handle business through online ways, fully reflecting the "Haitong speed". According to statistics, as of yesterday, about half of the customers who met the appropriate conditions of convertible bonds have opened permissions. A listed broker told reporters that after receiving the notice on Friday night, it sorted out the process overnight. Saturday could start to handle offline business. At present, the number of customer consultation is not large. Online channels have been opened overtime.

In addition, the reporter paid attention to that due to the large number of links involved in the transformation, most securities firms have not yet launched channels on the debt lines under the new regulations.

This morning, the relevant person in charge of a securities firm network in the central region told reporters through WeChat, "Under normal circumstances, the new business will be tested on weekends and can be used by the trading day. In fact, in order to ensure the security and stability of the trading system, we will also do some some of them will do some. Stress testing and other work, operation and maintenance is still hard. "

Daily Economic News

- END -

Directly hit the "San Xia" production: Harvest Harvest Harvest frequently spreads the intensive drums of summer broadcasts

High yield, high quality, good price, the situation is better than expected, and i...

Tai'an Publishing Printing Industry Chain Key Planning Project Signing Project

On the morning of June 20, the centralized signing ceremony of the provincial key ...