The first year!"The cheapest chip stock" resumed 488%of the listing, triggering secondary parking

Author:Red Star News Time:2022.08.22

According to the Red Star Capital Bureau, on August 22, after the current A -share A shares, after nearly two and a half years,*ST Yingfang "takes off the star and remove the hat" and resumes the listing in the name of Yingfang Micro (000670.SH). This is the first time to restore listed stocks during the year.

It is understood that Yingfang Wei's restoration on the first day of listing (that is, August 22) does not have the restrictions on rising declines. Since the resumption of listing on the market (that is, August 23), the daily rising decline limit is 10%.

↑ Screenshot of Yingfang Weixi Announcement

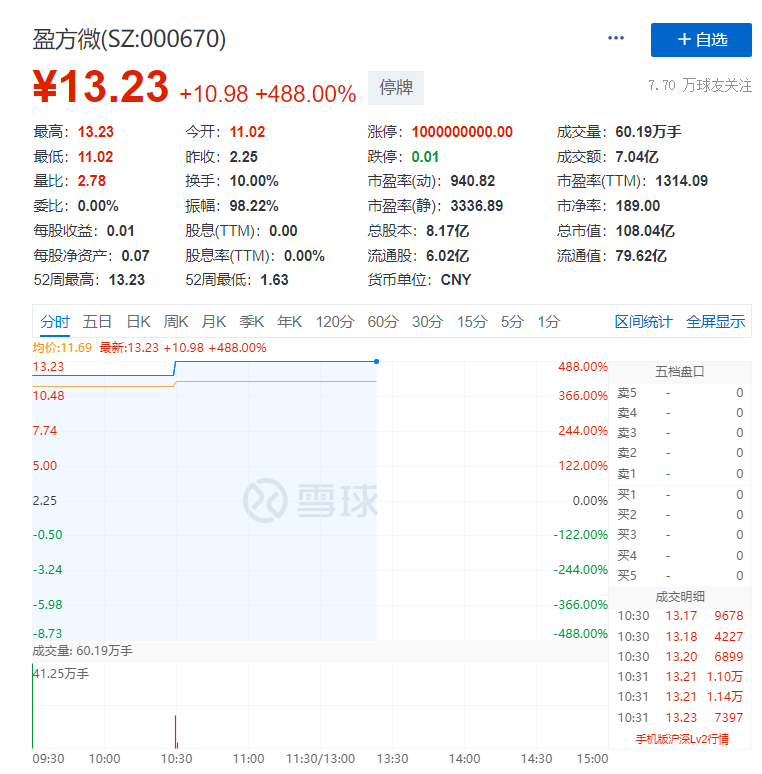

In the early morning of August 22, Yingfang Wei's stock price opened by 389.8%during the bidding stage, and rose to 12.15 yuan/share after the opening, an increase of 440%, and then triggered the suspension. After the resumption of the transaction, it rose to 13.23 yuan/share again, an increase of 488%, triggering a second stop. Based on the stock price after the second stop, the company's current market value is 10.8 billion yuan.

↑ Screenshot of Yingfang Micro Stock Price

Public information shows that Yingfangwei's business scope mainly includes the research and development, design and sales of integrated circuit chips, electronic products and computer software and hardware. The company conducts chip research and development and design business with the wholly -owned subsidiary Shanghai Yingfangwei and Shaoxing Huaxinke, the holding subsidiary of Shaoxing; it will conduct electronic component distribution business through the holding subsidiary Huaxinke and Worldstyle.

In 2017, 2018, and 2019, the audited net profit of the three accounting years continued to be negatively suspended from April 7, 2020. On the last trading day before the suspension,*ST Yingfang's stock price closed at 2.25 yuan/share, with a total market value of 1.837 billion yuan. Some investors once called it the "cheapest" chip stock.

In the two years after the listing of listing, in 2020 and 2021,*ST profitable party realized operating income of about 700 million yuan and 2.89 billion yuan, respectively; the net profit attributable to about 10.12 million yuan and 3.238 million yuan, respectively. About 2.105 million yuan and 2.713 million yuan, respectively.

In the first half of 2022,*ST profitable operating income was approximately 1.264 billion yuan, a year -on -year decrease of 7.24%; the net profit attributable to about 5.742 million yuan, an increase of 657.6%year -on -year; -452.11 million yuan, a year -on -year decrease of 752.38%.

It is understood that one of the conditions for the restoration of listed companies to the listing is the first half -year report disclosed after the suspension of listing, so the performance of*ST Yingfang in 2020 is particularly important.

According to the announcement,*ST Yingfang has restored the company's continuous operating capabilities through major asset reorganization. In order to solve the dilemma, in July 2020, Yingfang Wei completed the asset package composed of 100%equity of Xunxun Technology and Shanghai Yingfang Weimou's claims and its subordinates' subsidiaries. On the month, the company completed the acquisition of Waltoko and World STYLE51%equity/shares.

Yingfang Wei said that after the company's suspension of listing, Shun Yuan enterprise management of the largest shareholder, in order to promote the purchase of major assets, provides the company with support for acquisition funds. After the completion of the major asset reorganization, in order to support the business development of the target company, the listed company provides guarantees for the business expansion of the target company to the target company's capital increase and coordinating related parties, and provides temporary mobile support.

Red Star News reporter Xie Yutong

Edit Yu Dongmei Yu Mange

- END -

Sifang Technology disclosed that the 2022 semi -annual report achieved revenue of 927 million yuan

On August 18, the A -share listed company Sifang Technology (code: 603339.SH) released the 2022 semi -annual performance report.From January 1, 2022-June 30, 2022, the company realized operating incom

CITIC built investment: financing balance increased by 0.42%compared with the previous day, and the securities margin balance decreased by 16.13%compared with the previous day.

601066 CITIC Construction Investment As of July 06, 2022, the financing balance was 21.508 million yuan, an increase of 0.42%over the previous day, and the financing balance ranked 108 among the two b