A -share low -opening high: GEM refers to 1.64%, the concept of lithium lithium salt lake shows dazzling

Author:Poster news Time:2022.08.22

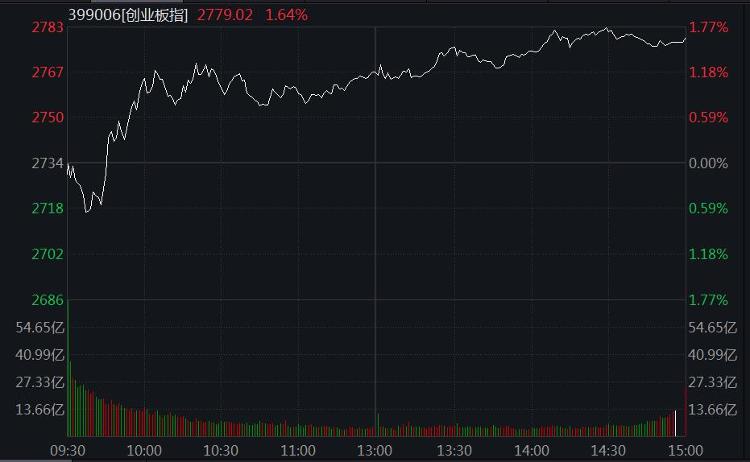

Zhongxin Jingwei, August 22nd. On the 22nd, the three major A -share indexes opened down and shocked, and the Shenzhen Index and GEM index rose more than 1%.

As of the close, the Shanghai Index rose 0.60%to 3277.79 points; the Shenzhen Index rose 1.19%to 12505.68 points; the GEM index rose 1.64%to 2779.02 points. The turnover of the two cities exceeded 1 trillion yuan for the fifth consecutive trading day.

GEM refers to the whole day of the trend source: Wind

On the plate, port shipping, coal, planting and forestry, gas, breeding, media and other sectors have increased; home appliances, brokers, semiconductors, electricity and other sectors have fallen. The concept of salt lake lithium -lifting has soared in the afternoon, Tianqi Lithium, Shengxin Lithium, and Tibet City's daily limit, and many such shares such as Kodak Manufacturing, Tibet Mount Everest, Huayou Cobalt, and Ganfeng Lithium rose more than 5%.

The rise and fall of all trading stocks in Shanghai and Shenzhen was 2906: 1810. The daily limit of the two cities had 88 daily limit and 11 daily limit.

In terms of individual stocks, today's daily limit shares are as follows: Great Smart (10.03%), Tianqi Lithium (10.00%), Zhuoyi Technology (9.95%), Guoguang Electric (10.01%), Great Wall Motor (10.00%). The limit shares are as follows: Sichuan Run (-9.97%), Yuhuan CNC (-10.00%), Setteng (-10.01%), Huaihe River Energy (-9.94%), and Southern Seiko (-10.01%).

The first five stocks are: Lianying Medical, Sanwei, Yuanxiang New Materials, Huicheng Shares, and Ying Weiteng, respectively, 60.759%, 52.212%, 49.391%, 48.137%, and 45.248%.

In terms of northbound funds, the net inflow of northbound funds exceeded 7.2 billion yuan throughout the day, of which the Shanghai stocks were flowed for more than 3.7 billion yuan, and the deep stocks flowed for more than 3.4 billion yuan.

Regarding the market outlook, the analysis of CITIC Construction Investment Securities believes that short -term rotation has not ended. The main popular track market has not ended. Beta opportunities have passed under the high level of staged congestion and short -term fundamentals. However, some industries have accelerated expectations for Q4 and subsequent prosperity. On the other hand, near the "Golden Nine Silver Ten", the consumption/starting season is coming again, and the market concern is expected to change the expected variety in the peak season. Part of the expected low valuation section may usher in a phased rotimal opportunity.

Xingye Securities said that the "new semi -army" in August and September is still the advantage style. It is recommended to pay attention to the leading track leader with significant digestion and more deeper performance: 1) Under the "wide currency", the growth style is expected to continue. The recent national bond interest rates have been significantly downward. 2) According to the leading indicator of the analyst's expectations in the "New Half Army" timing framework, the upward trend of the current "new semi -army" is not over. 3) In the "New Half Army", the crowd of the track of the track has been significantly digested. 4) The performance of the interim report is against the current, and the "new semi -army" leader is the direction where the performance is strong and the high prosperity continues. (Zhongxin Jingwei APP)

- END -

White roses are expensive than red roses ... Ningbo, the "love economy" of Tanabata, is coming

A -share transaction Active 7 months before the 7 months of securities transaction stamp duty increased by 11% year -on -year

On August 17, the Ministry of Finance released data showing that in the first seven months of this year, the national general public budget revenue was 1249.1 billion yuan. After deducting the retaine