Liu Shui: Green financing will become an important part of the financing of real estate companies

Author:Zhongxin Jingwei Time:2022.08.24

Zhongxin Jingwei, August 24th: Green financing will become an important part of the financing of real estate enterprises

Author Liu Shuizhong Finger Research Institute Enterprise Division Research Leader

Under the guidance of the "Carbon Peak" goal, China's green financial system has gradually improved. Green bonds and green credit have become the main part of green finance. In this context, the scale of green bonds of housing companies will grow rapidly. We predict that in the future, green financing will become an important part of the financing of real estate enterprises.

Green financial products are increasingly rich

Building energy consumption is an important part of energy consumption, and the rapid development of green buildings derives the corresponding demand for green finance.

At present, green buildings have been included in the support scope of the central bank and the Green Credit of the Banking Regulatory Commission, as well as the green bonds of the central bank and the Development and Reform Commission. The green financial market will focus on supporting the development of green buildings and buildings. In the "Green Bond Support Project Catalog (2021 Edition)", the categories of the green industry fields that are focused on the development of green buildings and sustainable buildings have been added. The green building field is the key support direction of green bonds.

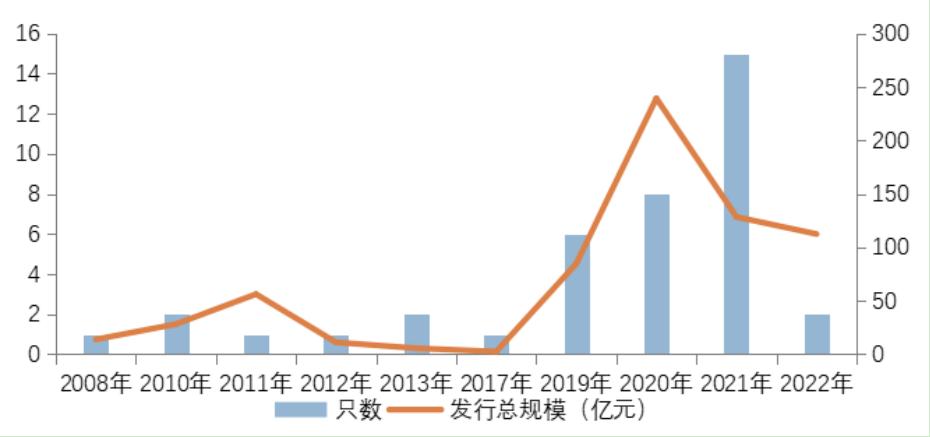

The field of green finance has developed rapidly, a large amount of green financial products have emerged, and the scale of ESG public fund issuance has risen rapidly. In 2019, the scale of ESG public funds soared. At that time, 6 new funds were established with a distribution scale of 8.48 billion yuan. 100 million yuan.

As of June 27, 2022, there were 39 existing ESG funds in Mainland public funds, with a distribution scale of 68.25 billion yuan. From the perspective of investment targets, ESG funds are less involved in the real estate industry. The largest heavy warehouse industry in the ESG public fund is mainly based on power equipment, banks, electronics and biomedicine, with a total proportion of 69%.

Figure: ESG public fund issuance quantity data source: Wind, as of June 27

Green bonds and green credit have become the main part of green finance. Since 2015, China's green bond -related policy system and market infrastructure have become increasingly improved, and gradually realized normalized issuance. It has now become the world's second largest green bond issuance market. As of March 2022, the balance of green loans in China has exceeded 18 trillion yuan, and the growth is rapid. The balance of green bonds in China is about 1.3 trillion yuan.

Green bond products are increasingly rich. Since the beginning of 2021, the inter-bank market has launched carbon neutralized bonds and sustainable development bonds (SLB), and the exchange market has also launched carbon neutralized bonds. Innovative products have greatly driven the growth of green bonds.

The "Green Bond Support Project Catalog (2021 Edition)" jointly released by the three ministries and commissions of the People's Bank of China, the Development and Reform Commission, and the Securities Regulatory Commission, will remove the scope of support for the production and consumer projects of traditional fossil energy, increase climate -friendly projects, and welcome the green bond market to welcome the green bond market. A new development opportunity is here.

In summary, ESG investment is still mainly based on financial products such as green bonds and green credit directly supporting green investment projects. Financial products applied to the investment company at the level of investment companies still need to develop.

The scale of green bonds of housing companies has increased rapidly

For the real estate industry, green bonds refer to the bond financing model based on green buildings as the target of financing, and must follow the regulations of financing purposes, project screening, funding and reporting under the Green Finance Framework (GFF). Essence The following table is the specific explanation of the four elements of Green Bond Principals (GBP), and uses the GFF announced by a certain real estate company as a specific case.

After the housing enterprise sets up a green financial framework in accordance with GBP, the third-party rating agency must provide green certification on the framework and issue a second-party opinion to apply for green bonds.

The issuance of green credit bonds in China is slightly different from the relevant rules of overseas green bonds. Green bonds in the country are limited to supporting the construction and expenditure of green bond support catalog projects, and third -party institutions need to complete the identification of green bond support projects and environmental benefits and social benefits. According to the "Green Bond Support Project Catalog (2021 Edition)", the projects supported by real estate companies are mainly green buildings, and the second phase of green mid -term bills of China Shipping Enterprise Development Group Co., Ltd. 2022 as an example.

In summary, overseas green bond funds have a wider range of funds, which can be used to repay green construction project loans. The supervision is relatively loose. There is no clear specification to establish a supervision account. Overseas green bonds have strict requirements for the establishment of the green financial framework, and rely on third -party institutions to provide corresponding certification and framework construction. The issuance rules of green bonds in the country are closer to ordinary credit bonds, and only strict limitations and certification requirements are made in terms of funding use.

Data show that the scale of green bonds in housing companies has increased rapidly.

According to statistics, in 2021, real estate companies issued a total of about 60.898 billion yuan in green bonds, a double year of the year -on -year increase. The total amount of bonds issued in real estate companies accounted for about 7.5%, and the proportion value increased by 4.5 percentage points year -on -year. The market size expanded sharply.

In addition, enterprises that issue green bonds in the country are mainly state -owned enterprises and state -owned enterprises. Enterprises that issue green bonds abroad are mainly private enterprises, covering large and medium -sized private enterprises and small and medium -sized private enterprises with green real estate characteristics. From the perspective of the distribution variety, the green bond market in 2021 continues to innovate and issues and product types. Among them, Nanjing Financial City Construction and Development Co., Ltd. completed the first batch of sustainable development linked bond issuance. Sustainable development performance goals, if the construction area of Nanjing Financial City is not less than 1.4 million square meters at the end of 2024, the number of ticket interest rates of the two years after the second year of votes is reduced by 50 base points. Relding 50 base points on the ticket rate. However, due to the current difficulty of issuance of overseas bonds and the amount of issuance of issuance, the amount of overseas green bond issuance has decreased sharply. In 2022, only Ocean Group issued US $ 200 million in credit enhanced green bills.

In 2022, the scale of green bonds in the country soared, but due to the tight financing of the real estate industry and the strict use of green bond funds. Issuing enterprises are mainly central enterprises.

In the context of the carbon peak goal, the development of green finance will accelerate, and the green building is an important part of the green development. The regulatory authorities are also encouraging financial institutions to support green institutions from multiple perspectives such as investment scale, business innovation, and improvement of mechanisms. Building development. The green transformation of the real estate industry is inevitable, and the ESG development of the enterprise is an important basis for judging whether the issuer has carried out sustainable transformation. Therefore, the development of enterprise ESG performance and the development of green construction will affect whether housing companies have richer financing channels. (Zhongxin Jingwei APP)

This article was selected by the Sino -Singapore Jingwei Research Institute. The copy of the work produced by the selected work, the copyright of the work, is not authorized by any unit or individual. The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Li Huicong

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Qixia City Finance Bureau: Accelerate the "acquisition of credit improvement"

Qilu.com · Lightning News July 5th. Since the beginning of this year, the Ibixia Finance Bureau has resolutely implemented the decision -making and deployment of provincial and municipalities to over

Why is the manufacturing financing difficulty?Where is it?

At the end of February this year, an exciting news came -after 10 years, the value...