"Crying poor" in Ningde era?

Author:Zhongxin Jingwei Time:2022.08.24

Zhongxin Jingwei, August 24th (Dong Xiangyi) Speaking of the expensive power battery, I believe many people still have an impression of the words of Zeng Qinghong, chairman of GAC Group. He said at the World Power Battery Conference: "The current power battery industry The price of the upstream chain is high, too high, not general. The cost of power battery has accounted for 40%-60%of the cost of the entire vehicle, and it is still increasing. Then I am not working for Ningde Times? "

Here is the weakness of downstream car companies, but the lithium battery leader "Ning Wang" there is an innocent gesture. Wu Kai, chief scientist in Ningde Times, said, "Although the Ningde Times has not lost money this year, it is struggling at the edge of profit. Pain. Wherever the profit goes, everyone can imagine. "

Is this really the case?

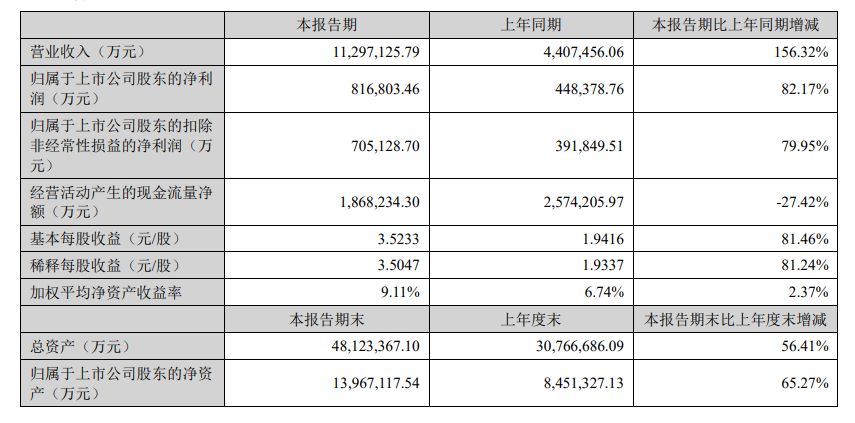

On the evening of August 23, the Ningde Times announced the half -annual report in 2022. During the reporting period, the company realized operating income of 112.97 billion yuan, an increase of 156.32%year -on -year; the net profit attributable to shareholders of listed companies was 8.168 billion yuan, an increase of 82.17%year -on -year, which was overhaul, and oversold market expectation.

At the same time, the company's board of directors reviewed and approved a dividend plan of 1.59 billion yuan in cash. It plans to use the current total share capital of the company to distribute a cash dividend of 6.5280 yuan (including tax) to all shareholders per 10 shares.

Source: Semi -annual report of Ningde Times

From the perspective of the product, in the first half of the year, the power battery system achieved operating income of 79.143 billion yuan, an increase of 159.9%year -on -year; the operating income of lithium battery materials was 13.67 billion yuan, an increase of 174.15%year -on -year; %.

The company pointed out in the semi -annual report that in terms of power batteries, the first 2.2C fast charging ternary product was applied to the passenger car in China, and the AB innovation group method was promoted in batches; in terms of energy storage battery The ENERC delivery of the outdoor prefabrication system launched by CTP electric box technology exceeds 4GWH in batches. The company continued to increase investment in R & D. In the first half of 2022, R & D expenses invested 5.77 billion yuan, an increase of 106.5%year -on -year. The company released the third -generation CTP -Kirin battery. The system integration reached a global high, with a volume utilization rate of exceeding 72%, and energy density can reach 255Wh/kg. It can support 1,000 kilometers of battery life. It can support 5 minutes of fast hot start and 10 minutes fast charging, achieving a comprehensive improvement of battery life, fast charge, safety, life, efficiency, and low temperature performance.

According to SNERESEARCH, the company's power batteries have ranked first in the world for 5 consecutive years. In the first half of 2022, the global market share reached 34.8%, an increase of 6.2 percentage points from the same period last year.

In the Ningde era, during the reporting period, the company overcame the challenges of the new crown epidemic and tight raw material supply. Through strengthening organizational construction, optimizing operational arrangements, and continuous competitive competition advantages such as technology research and development, extreme manufacturing, and industrial chain depth layout to provide customers with first -class providing customers Product solutions to achieve rapid business development.

Obviously, Ningde's era was not only "struggling on the edge of profit", but instead made a lot of money.

The new energy vehicle sales of new energy vehicles, which have issued performance trailers, are difficult to look at the back. In the first half of the year, net profit returned to her mother was about 2.8 billion to 3.6 billion yuan; Great Wall Motors was about 5.3 billion yuan to 5.9 billion yuan; Changan Automobile was about 5 billion yuan to 62 100 million yuan.

Not much to say, experience myself ...

However, with the rise in raw materials, the profitability of Ningde Times has also weakened. In the first half of this year, the gross profit margin of the main business power battery system in Ningde Times was 15.04%, a year -on -year decrease of nearly 8 percentage points. The gross profit margin of lithium battery materials was 20.65%. A percentage point to 6.43%.

The high price of raw materials is still a hurdle, of course, the Ningde era is well known.

Earlier, Zeng Yuqun, chairman of Ningde Times, said: "The price increase of upstream raw materials has led to an increase in cost, which has caused short -term distress to the power battery industry chain, but mineral resources are not bottlenecks in industrial development."

As of the afternoon closing on the 24th, the GEM finger fell nearly 3%. The Ningde era opened high and low, and fell by more than 4%in half a day. The stock price was reported at 532.89 yuan.

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

Copyright Copyright Copyright, without written authorization, no unit or individual may reprint, extract or use it in other ways.

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

When investigating the Maize River to Wufeng Tujia Autonomous County, emphasizing the comprehensive revitalization of the countryside with characteristic and advantageous industries to promote rural areas

Three Gorges Daily (Reporter Gao Wei) From August 20th to 21st, the deputy secretary of the Yichang Municipal Party Committee and Mayor Ma Zejiang from Ma Zejiang to Wufeng Tujia Autonomous County emp

Yixiang, Henan, with garbage recovery, annual income of 80 billion yuan

When it comes to the small business or small projects of one thousand profit, many...