"Daily Rating" Ningde's era plunged nearly 6%to drag the index. Where will the market go after the track recovery?

Author:Federation Time:2022.08.24

The broader market opened high and low, and the GEM fingers led the decline, the largest single -day decline in the past three months, and the Ningde Times fell nearly 6%. On the plate, the agricultural -related sectors only strengthened the trend, and the black sesame rose daily. Fengle Seeds, New Nong's Development, and Longping Hi -Tech followed up. In terms of decline, the track stocks that rebounded yesterday have once again adjusted the decline, and Guoguang Electric, Xiangxin Technology, Zhongnan Culture and many other high -level stocks have fallen. Overall, the previous stocks fell more, and the two cities over 4,400 stocks fell, and the limit of over 50 shares may fall by more than 10%. The sales of Shanghai and Shenzhen today were 1126.1 billion yuan, which was 123.8 billion from the previous trading day. In terms of sectors, a few sectors such as agriculture and horse racing have risen, and integrated die -casting, lithography glue, Huawei Automobile, Apple concept and other sectors have fallen first.

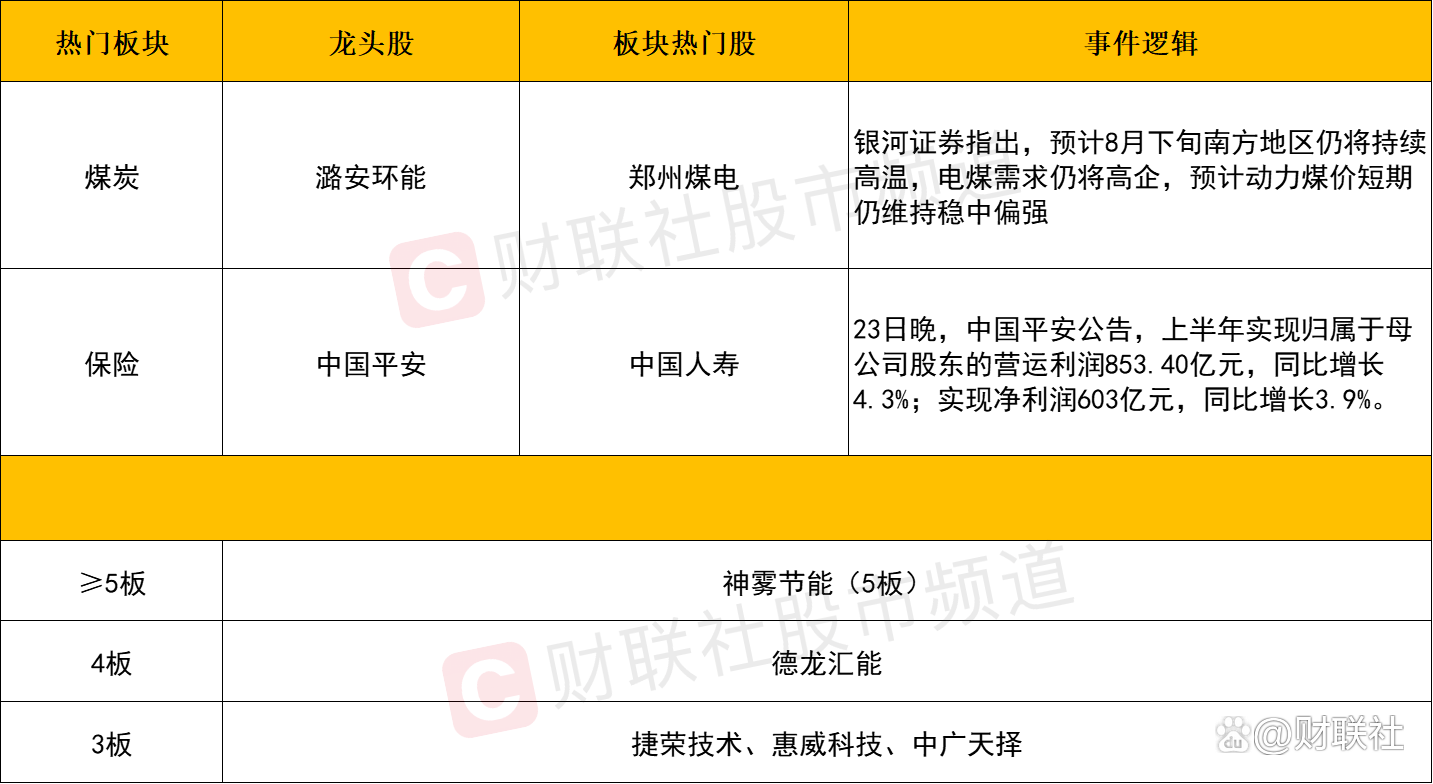

Plate

In terms of sectors, consumer electronics declines first. Among them, the popular high -benchmarking national optical appliances have fallen. Yesterday, the deep textile A of 5 consecutive boards had a long black drop of more than 6%. Essence The core logic of the rise of the consumer electronics sector this round is the rotation switching of the high and low level inside the track, but in the context of the selection of the track stocks today to release the high risk, the short -term low -level docile logic of consumer electronics is no longer no longer no longer the logic of consumer electronics. exist. In addition, because the fundamental prosperity of the consumer electronics itself has not been completely reversed, the medium and long -term certainty is relatively poor than the new energy direction. Therefore, after experiencing the decline in the long black today, the original oscillating inertia of the sector was obviously destroyed. Under the consideration of the security perspective of funds, it was considered at the perspective of the security perspective of funds.

Let's pay attention to the photovoltaic sector, and today there are also more obvious callbacks. Among them, Slaick and Yongfu shares fell more than 10%. Xiangxin Technology, Baomo shares, Sichuan Run, and Baomo shares fell. In terms of news, the General Office of the Ministry of Industry and Information Technology, the General Office of the General Administration of Market Supervision, and the Comprehensive Department of the State Energy Administration issued a notice on promoting the coordinated development of the photovoltaic industry chain supply chain, and supported enterprises related to the photovoltaic industry chain to establish long -term cooperation by signing long orders and participating in each other. Mechanisms to avoid industrial convergence, vicious competition and market monopoly.

Looking back on the market, photovoltaic is one of the core sections of the track market. From the end of April, the overall increase has increased by more than 50%. During this period, Weichun and Jinchen Co., Ltd. increased more than 200%. Under the mutual group of funds, the sector has come to a relatively high level, and there is a need for technical callbacks. The Ningde Times was fulfilled by the favorable performance, which directly triggered the market's emotional ebb to the track direction, and those earlier profit choices of funds were concentrated and profitable. In the short term, under the action of a large number of profit -selling pressure in the photovoltaic sector, it may enter a staged finishing. But it is better that from the current semi -annual report performance, the new energy direction still has strong fundamental support, especially under the catalysis of the European energy crisis, the demand for clean energy such as optical storage has increased, and it is still the surge in demand for light storage. The most certain direction of the follow -up market. Therefore, it is expected that the interior of the photovoltaic sector will be exacerbated. Those high -quality stocks with fundamental guarantees and continuous performance are expected to be relatively against the trend, and individual stocks driven by the concept of partial theme may face large -scale callbacks.

In addition, under the market decline, defensive sectors such as large finance and agricultural stocks performed active today. On the one hand, the two have experienced a relatively good finishing in the early stage, and they are currently at a relatively low level. On the other hand, the trend of the two is relatively independent. In the context of a significant decline in market risk preferences, these defensive sectors may be repeatedly active in recent markets. However, it should be noted that the strengthening of these sectors is mainly to meet the current demand for funding from funds. As for whether the conversion of the subsequent market style will still need to be observed.

Individual stocks

Yesterday evening, the Ningde Times disclosed the semi -annual report in 2022. During the reporting period, the company realized operating income of 112.97 billion yuan, an increase of 156.32%year -on -year, and the net profit attributable to shareholders of listed companies was 8.168 billion yuan, an increase of 82.17%year -on -year. %; Year -on -year in the second quarter of last year, 163.94%. On the whole, the semi -annual report performance was more than market expectations. However, the Ningde era opened high today, and eventually fell nearly 6%in the form of long and black. It is inevitable that people can use the doubts of good dedication to the help of performance. Therefore, for the Ningde era, once the strong return of funds can not be obtained in the short term, the probability of the subsequent probability will continue to be adjusted. At that time

In the context of the full weakness of the track trend stocks, the short -term market has maintained a relative popularity. Some of the short -term funds attempts the game will generate a premium opportunity for tomorrow's emotional restoration. However, it should be noted that the short -term risk has not been fully released at present, and the overall form of the market as a whole is also not very clear. From the perspective of time choice, it is better to look at it as less. It may be more secure to follow up the market for market funds to re -confirm the short -term key break.

Join market analysis

As of the close, the Shanghai Index fell 1.86%, the Shenzhen Index fell 2.88%, and the GEM index fell 3.64%. The north -wing funds sold 6.615 billion yuan throughout the day; of which the Shanghai Stock Connect sold 3.248 billion yuan, and the Shenzhen Stock Connect was sold 3.367 billion yuan.

From the perspective of the index, the volume of a bald feet on the GEM today has a long black retribution, and at the same time, it has fallen below the 5th line and the 30 -day moving average. The probability of bottoming bottoming out. Therefore, the focus is on the supporting force near 2620 ± 20. When the GEM finger can appear clearly stopped signal near 2620, then the GEM can still be treated in the middle of the interval vibration. On the contrary, once the preliminary lows 2610 will be effectively dropped again in the future, while the mid -term trend will return to the medium -term short, the time and space of the subsequent callback will be further stretched, and the focus is still on the reasonable control of the position. In terms of individual stocks, 424 rises, a decrease of 1962 compared with the previous trading day. In the case of excluding ST shares and new stocks, the daily limit was 30, a decrease of 35 compared with the previous trading day; 22 frying boards, a decrease of 5 compared with the previous trading day; Home, one decreased by one than the previous trading day; the limit of 0 daily limit is the same as the previous trading day.

In terms of emotions, the emotional indicators follow the index to fall rapidly. At present, it has come to a downturn area. Once the subsequent index continues to call back, it is expected to see the emotional freezing point this week.

Focus on the market

1. Regulatory reiteration of the release of the research report of the securities firm: exceeding 1%of the shares holding the research target must be disclosed and the research report cannot be operated within two trading days

Financial Association on August 24th that the China Securities Industry Association has strengthened relevant self -discipline management requirements, clarified the requirements of the brokerage company in the research report, and further regulated the management of the investigation minutes. Specifically, the China Securities Association stated that in order to implement the requirements of the "Interim Provisions on the Research Research on Securities" on disclosing the company's shareholding situation, strengthen compliance management, and after research, the securities company issued a clear valuation and investment rating for specific stocks. According to the securities research report, if the company holds the shares to reach more than 1%of the relevant listed company issued shares, it shall disclose the specific situation of the company's holding of the shares in the securities research report (including the category of holding business, the shareholding, the shareholding volume, the shareholding volume, the shareholding volume, the shareholding volume, the shareholding volume, the shareholding volume, the shareholding volume, the shareholding volume, the shareholding volume, the shareholding volume, the shareholding volume, the shareholding volume, the shareholding volume, the shareholding volume, the shareholding volume, and the amount of shareholding. The lock -up period, etc.) and the risk of the potential interest conflict of the research report business, and on the date of release of the securities research report, shall not conduct transactions that are opposite to the viewpoint of securities research reports.

2. The closing crude oil of domestic commodity futures rose more than 5%

Financial Press August 24th that most of the domestic commodity futures closed, most of them rose. Crude oil rose more than 5%, LU rose more than 4%, fuel oil, short fiber, etc. rose more than 3%, palm oil, Shanghai aluminum, etc. rose more than 2%, iron ore, starch, etc. rose more than 1%. Wait slightly; Shanghai nickel and beans fell more than 2%, rubber, NR, etc. fell more than 1%, and pigs and pure alkali fell slightly.

- END -

The Xinjiang delegation specially promoted the new product of the new product of the Xinjiang delegation

Tianshan News (Reporter Hei Hongwei reported) On July 26, at the 2nd China Interna...

Today, 38 years ago, Wuhan announced that the open market to the outside world welcomes domestic and foreign merchants to develop investment | Wuhan calendar

Coordinating | Chen Zhi Design | Wang Yuzhe【Edit: Zhang Jing】For more exciting con...