The full launch of Zhonglebang's funding safety system is "three locks" in corporate funds

Author:Business community Time:2022.08.24

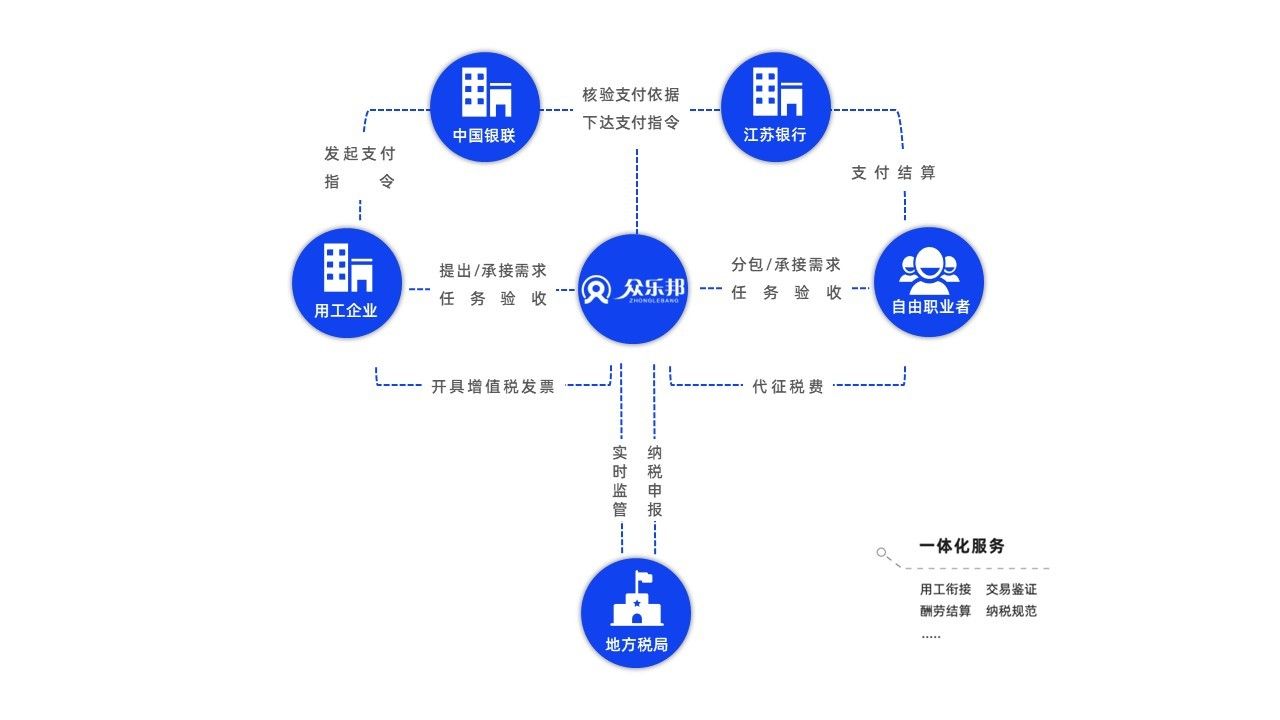

The vigorous development of the digital economy has spawned a large number of new formats and new models, and flexible use of workers has become the choice of more and more enterprises. Payment settlement, as a key part of flexible employment, is an important force for third -party flexible use of work platform services. On August 22, the first funds safety system of the flexible work was launched. The system was jointly built by Zhonglebang's flexible use of work platforms with China UnionPay and Bank of Jiangsu. , Make corporate funds more secure, and each payment is traceable, well -evident.

Zhongle State and China UnionPay and Bank of Jiangsu to create a new paradigm for funds

Under the flexible use of the working three -party cooperation model of the platform, the employment enterprise remit the funds into the platform account in advance, or there is the risk of being stolen by the platform to misappropriate corporate funds and platform accounts. Can't guarantee it in time. From the perspective of the entire flexible employment industry, the situation of illegal funds and invoices of illegal funds and fictional invoices occasionally occurred by the name of the use of spiritual work. Fund safety and compliance settlement are the basic difficulties faced by the flexible use of work platforms.

At present, the flexible employment platform is generally the platform itself to complete the compliance review control of the business. Fund security guarantees are often realized through bank -exclusive accounts, capital co -management, online banking shield review, limited control, third -party guarantee, etc., but they have not yet reached the verification of each payment basis.

As early as July 2021, Zhonglebang and Bank of Jiangsu reached a consensus to formulate a fund settlement plan based on the flexible use of work scenes. Through in -depth research, the two parties found that "the basis behind the payment of a large amount of payment data" is the core issue. The Bank of Jiangsu applied to China UnionPay to provide verification services, and the three parties reached a cooperation to jointly build the first flexible salary security system.

It is reported that the fund security system is introduced to the bank's exclusive account management, introduced China UnionPay co -management bank accounts, and verified the four -current trading of each business to ensure the security of employment enterprises. The system's full launch has opened a new paradigm for the safety management of the industrial industry, which has promoted the flexible use of the funds of the industrial industry to enter the UnionPay supervision level.

Zhonglebang exclusively launched the capital security system, which is a "three locks" for corporate funds.

After Zhonglebang's funds safety system is launched, the concerns of the pre -deposited funds of employees no longer exist. According to Ye Meiyu, the product director of Zhonglebang, the system has a "three locks" for corporate funds. The first "lock" is a bank exclusive account. Face -to -date, transfer and online banking channels, only the payment instructions initiated by the employment enterprise are received; the second "lock" is the risk control of Zhonglebang platform. The full process risk control review, the business is real and the transaction is consistent, the enterprise can initiate the payment instructions; the third "lock" is the verification of China UnionPay. The payment instructions of the enterprise will be passed to the Bank of Jiangsu, which will be paid by the Bank of Jiangsu. If the trading is inconsistent if there is a transaction, the refund will be traced.

Simply put, this "three locks" separate business operations from the permissions of fund payment, which makes corporate funding security more secure. In the operation mode of this fund security system, China UnionPay and Bank of Jiangsu not only participate in the payment link, but also verify the basis of payment, monitor and monitor the risk of trading four times, and control the essence of the business of flexible use of work scenarios from the source to prevent the fact that the transfer of funds circulation of work scenes to prevent the fact that it is eliminated to prevent the fact that it is eliminated. The flexible use of work has become a tool for tax evasion and illegal behavior. It is an innovative practice of digital finance in the flexible use of industrial formats, which is conducive to protecting the stability of the financial market and maintaining social public interests. This is also a exploration and attempt to sharing information and verifying channels between the fourth phase of the gold tax and the bank -enterprise.

It is understood that the fund security system is currently exclusively used on the Zhonglebang platform. The system's unsightly upgrading fund security guarantee will not affect the convenience of corporate operations. The employees on the Zhonglebang platform can directly apply to the service staff of Zhonglebang for free opening to obtain the use permissions of the fund safety system.

Zhonglebang insists on doing "difficult and correct", and continues to build a flexible use of industrial risk control ecosystems

Fund safety is the cornerstone of flexible use of work transactions. Zhonglebang has cooperated with many banks to try different fund settlement models to find a model that truly meets the flexible use of work scenes. The cooperation with China UnionPay and Bank of Jiangsu this time is a major breakthrough in the settlement of work funds and the main milestone in the closed -loop ecosystem of Zhonglebang.

Risk control compliance is not a new thing. Since its establishment, Zhonglebang has adhered to the needs of corporate needs and industry pain in the long -term development, and has always put risk control compliance first. According to the report released by the "Digital Figure 2022-Flexible Usage of Human Resources in China" released this year, as the pioneer of "risk control practice" in the field of industrial fields, Zhonglebang took the lead in practicing digital wind in the industry in the industry. Control management. Since the beginning of this year, Zhonglebang has also integrated user portraits and risk portraits in the original risk control system, strengthened the data management, scoring system and system rules, and built a more refined and full -view intelligent risk control system. Highly recognized.

"The consensus of the four streams is the result of the transaction compliance rationality. The asymmetry of information, the authenticity of the transaction, and the credit system of the human enterprise are the underlying logic of risk control." Ye Meiyu, the director of the product of Zhonglebang, mentioned, "For these underlying data , We rely on professional risk control teams to find cooperative agencies outside, and cooperate in inside and outside to create a complete closed -loop ecosystem. To build a three -dimensional safety protection barriers to flexibly use the industrial business to build a three -dimensional safety protection barriers. Things. "This time with China UnionPay and Bank of Jiangsu, the fund security system jointly created by the flexible use of industrial formats is also based on underlying data and the three parties' own capabilities. It rationally uses scenario design business operation and capital circulation process to form a closed loop. It is understood that before that, Zhonglebang had opened up and connect information and risk control management channels with third -party information platforms such as French Da Da, Tianyancha, and relevant regulatory units such as the taxation department. For more than two years, Zhonglebang has continued to strengthen wind control compliance capabilities, and has embarked on a steady development path in the flexible industry. Lu Ya, vice president of Zhonglebang, said: "Maintain long -term cooperation between the people and enterprises, the platform is healthy, and the compliance of risk control is its vitality. The strengthening of the first place is to continue to build a closed -loop ecosystem of risk control, adhere to a safe, stable, and compliance operating model, and be a bridge for cooperation between people and enterprises. "

- END -

The maximum cash dividend in Moutai pushing the history of cash is divided into 5 months.

Wen | Wang He Feng YuyaoAfter a lapse of five months, the stock price of Mao Wang ...

Ministry of Commerce: In the first July this year, the actual use of foreign investment in the country increased by 17.3% year -on -year comparable caliber

The Ministry of Commerce announced today (August 18) that from January to July this year from January to July, from January to July, the actual amount of foreign investment in the country was 798.33 b