What signals did the semi -annual report of the Postal Savings Bank?

Author:Understand APP Time:2022.08.25

On August 23, 2022, I understood the APP invited by Li Zhe, an associate professor at the School of Accounting, Central University of Finance and Economics. The profit disturbance factors have made a detailed analysis. Not only are we very helpful for our understanding of the postal savings bank, it also gives us a methodology for analyzing bank financial reports. The entire analysis is worth reading. If you want to get more financial report interpretations, you can search for WeChat Mini Programs and understand it, and participate in the financial report interpretation meeting of the listed company as soon as possible.

Key points:

1) Strategy: The strategic characteristics of the postal savings bank are small and micro service, and make small dispersion, which is compatible with the policy requirements of regulators.

2) Changes: In addition to continuing to make small doors, postal savings banks have increased their support for key areas and major projects, but this is not the same as the large base, but it is conducive to its risk control, and it is also conducive to optimizing government -enterprise relations. It

3) Asset quality: The bad indicators of the postal savings bank are degraded, but the risks are controllable, and even at the excellent industry;

4) Profitable factors worthy of attention: High cost income, whether the growth of centralized revenue can continue, whether the direct -selling bank can succeed, and the "two high and one left" loan affects geometry

Author | Li Zhe

Associate Professor of the School of Accounting, Central University of Finance and Economics, an expert on apps (TA has settled in the app mini program)

Hello everyone, let's comment on the semi -annual report of the postal savings bank. Then let's talk about the caliber first. Because the postal savings bank is listed in Hong Kong, we compiled the financial report. The caliber does not take into account the caliber of the international financial reporting standards, so as to prevent everyone from understanding, this is also a cornerstone we discussed today.

Let's talk about the principles of reviews first. My principle is to appreciate and analyze substantive analysis. So why do you say that? Forms appreciation is the most basic sensory experience of seeing a report. Opening the postal savings bank's financial report will make everyone shine. Regardless of the financial report data mentioned in it, we depending on the entire artist design, it must have invited a high -price artist to do it. The entire typesetting and color tone structure have been made a lot of improvement than the annual report on December 31, 2021. It can be said that after reading a lot of banks' financial reports, I think there are a few of the better banks. Among them, the postal savings banks are one of them, including Nanjing Bank, which understands the first review of the APP.

Analysis of bank financial reports

Let's talk about the substantive analysis. We need to take a look at the performance of the postal savings bank. Many analysis experts are concerned about operating income and net profit attributable to bank shareholders. Dazzling logo. I want to say that this is the stone of his mountain, but this is not my analytical idea. My analysis ideas are divided into three steps:

The first step is to see if the bank's finances are in line with the company's own strategy. As we usually talk about wearing, the hairstyle must be in line with the shape, and the shape must be in line with clothing. This is called wearing.

Second, let's focus on whether its assets can be preserved. First analyze the financial status and analyze the results of business. It is not recommended to "skip learning to walk and learn to run directly."

Third, let's take a look at the business performance that everyone is paying more attention to.

Why do you want to do this? It is obviously because the semi -annual report has not been audited, and the risk of directly seeing the evaluation of operating performance is very risky.

The above evaluation ideas are also an important way to judge the ups and downs of our entire banking industry.

Strategic characteristics of postal savings banking: small and scattered

Where is the business strategy of postal savings banking?

Regardless of the loan quota or the data of the entire number of households, for the entire commercial bank, it must not be a big household, especially for banks such as postal sale banks, rural commercial banks, urban commercial banks, and village banks. Promote the development of inclusive financial business by making small scattered methods. Then other products including the product of the product are online, which are all gathered in this kind of thought, so it depends on whose small and micro enterprise loans are done well, and whose personal business loan is done well. This is also the greatest feeling of being an independent director of the Rural Commercial Bank for many years.

The regulatory authorities have clearly put forward two major requirements. The strategy of postal savings banks and these two policy hotspots are relatively close. Compared with other state -owned banks, this is a characteristic of the postal savings bank. In February 2022, the CBRC issued a request that the first one is that banking institutions should strengthen small and micro enterprise loans, and the second is to strengthen the rescue of small and micro enterprises in the epidemic.

Let's take a look at the picture below. The regulatory department of the Banking Insurance Regulatory Commission posted data from the banking institution, and the statistical caliber was less than the central bank's financial institutions. The inclusive micro loan data of the banking industry in each year is often smaller than the loan data of financial institutions, so we can see from this place that the Phaseptic small and micro enterprises of the postal savings bank are This caliber, its performance is relatively good.

Therefore, from the first strategy of the State's call, the entire promotional performance of the British Finance of the Postal Savings Bank won the entire market. But what I must say here is. Although my topic is called an increase in households, I am sorry. Generally speaking, it often refers to the business transformation of Rural Commercial Bank. Risk prevention and control is one of the important methods of the Rural Commercial Bank to occupy the rural financial market. It is also an important means to avoid competition in the industry. However, why is it this strategy for the postal savings bank with such a bank that has been rolled out of various outlets of the postal group? Then its policy focus is very similar to Rural Commercial Bank. We can see from the data that this year is very obvious. So why is there such a situation? This was closely related to the changes in the entire competition of the Rural Commercial Bank and the Village Bank.

Compared with other state -owned banks, the bank's advantages are that the bank's outlets are very widely distributed, and the tentacles have risen to various cities, villages and towns. Then these channels of contact customers have a high dependence on the financial services of postal savings banks. This is also the development opportunity and development space for postal savings banks under the current situation. However, is it sustainable? This largely depends on the development strategy of rural commercial banks and village banks. Because in the first half of the year, some village banks were impacted to a certain amount of impact, which caused some storage households to change their strategy. Can the entire strategy still maintain this growth rate now? This is a sustainable issue. We need to "take care of them" during analysis. We must not "take care of this."

From the perspective of the proportion of loan balances of the British small and micro enterprises in our postal savings banks, it has exceeded 15%of the proportion of the entire customer loan balance. This proportion is among the entire state -owned bank, which can be described as rookie and new nobles. Then we combine the number of households that now have a loan balance to calculate. We can see that the average household balance of inclusive finance has reached more than 610,000 on the postal savings bank. The average number of nationwide, then I saw 570,000 yuan per household in February. Assuming that I wiped out the difference between June and February, the postal savings bank was greater than the national average. Of course, why do I start separately, because we have many other national -owned banks that have not come out. Only after it comes out can we really judge whether the postal savings bank is between the state -owned bank, whether it is really true Is it new and rookie? So I can only be regarded as a prediction, and I have to wait.

There is also the issue of this social responsibility, which is by no means a burden on the postal savings bank. On the contrary, active responsibility for social responsibility is the main point of the postal savings bank that is committed to the entire financial service entity. It is very important to attract customers, but unfortunately, we did not see the corresponding data in the middle of the semi -annual report. Remember that at the end of May, there was a credit limit for this kind of small and micro enterprises that calculated it, so the growth rate is relatively fast. This is actually a kind of profit. Operating performance is a kind of hedging, so from this situation, it should be consciously adjusted to the entire business income and net profit of the following business, because it is under pressure from a certain social responsibility. Of course, we can't see the specific data from this semi -annual report. This is a pity.

Financial analysis of semi -annual report

After speaking whether the previous finances are in line with strategy, we will directly enter financial analysis. Many people like to look at revenue and see net profit. This is a intuitive manifestation of the traditional concept of income and expenses. Then I still comply with the analysis of the asset -liabilities. We first look at the financial situation. In fact, the original text is called operating performance. In fact, the standards should be called financial status. Business performance is a practical indicator. The financial situation is a time point indicator. One time point indicator. That semi -annual report showed that at such a time on June 30, the total assets of 1.343 trillion and total liabilities were 12.59 trillion. In fact, compared to the end of the last year, their growth rate is very, very similar. From the perspective of the capital structure, there are only a small fine -tuning.

Why should we look at the assets and liabilities first? Because it may involve the growth of scale. We just first looked at that PPT. Many analysis came to see revenue, looked at net profit, and found that our net profit income was increasing. It was found that the net profit attributable to bank shareholders was increasing. Have you paid attention? This has something to do with the growth of our entire scale and the change of our entire interest rate. Therefore, the reason for analyzing its assets and liabilities is to directly act on the analysis of revenue and net profit. It needs to be based on its entire change rate, and then to calculate its average trend. What is more scientific is to build a financial model and do mathematical analysis.

1) In terms of asset allocation, the postal savings bank has increased its support for key areas, industries, and major projects, but it is not a large base, which is in line with national strategy

Here is a very important place to remind everyone. It is we can see from the half -year report. Postal Savings Bank has increased support for some key areas, industries, and major projects. In fact, this belongs to the big households, and the concept of small dispersed concepts I told you before is inconsistent. But don't worry, in my understanding, key areas, industries and major projects are reliable large households, and it will not fall into the risk control caused by large bases. Because as a postal savings bank, Agricultural Credit Agency, and Rural Commercial Bank, small and decentralized words must have a high frequency of vocabulary. This is the essence of inclusive finance. The core idea is that the amount of loan should be small, and the same is the same, and the same is the same, and the same is the same, and the same is the same. The upper limit of the borrowing on different platforms must be strictly limited. However, the growth of the entire large households mentioned here is active in accordance with the national strategy. This concept of small dispersion of the postal savings bank and the agricultural agricultural account we talked about is not conflicting. To make a small amount? Because I am an independent director at several agricultural and commercial banks, this view is very, very deep, because from the perspective of a single sample or from the decentralization of the entire bank's platform business, it must be a small amount. One of the most important factor in undertaking costs. In other words, this is the financial investors should not put eggs in the same basket. However, for active serving the national strategy, it does not affect the problem of our small sample deviation, but it will promote the optimization of our political and enterprise relations.

Why do I talk more in this paragraph? Because I will focus on the next PPT to tell you about its bad indicators. After the increase in the assets and liabilities we are talking about, I said that a large change in the middle is because of actively serving the national strategy. Please pay attention to this one. In the principle of independence between independence, it does not violate the risks of minor dispersion before, but instead have the characteristics of inclusive finance and decentralized risks. Because from a key point of view, in order to avoid the overdue or bad debts of a large household, we must minimize the bank's capital. Key users must meet the perspective of the national strategy and then consider it. If you can reduce its badness, I will show you the real situation of his bad.

2) In terms of asset quality, the adverse indicators are all degraded, but the risks are controllable, and even at the excellent level of the industry

I first do a simple summary. From his financial situation, the adverse indicators are all degraded, but the risks are actually controllable and even at the industry's excellent level. If you look at PPT alone, you may feel that my title is inconsistent with the comments behind us. In fact, it is consistent. From the perspective of the mail -storage bank's intermediate report in 2022, its adverse rate was 0.83%. In the same period last year, some people said that they had risen a little, but they were actually flat. The coverage of the preparation is a little bit decreased than last year, and it also decreases a little bit more than the beginning of the year, but it doesn't matter. It seems that the bad indicators are all degraded, but everyone must calm down to analyze. What is its inferior change? reason? I want to talk about it, 0.83%is still leading the industry in the entire industry.

0.83%may be equal to last year or even a little higher than last year, but I want to say that 0.83%is properly a state -owned bank that I can see. Said, few people see this number. The drop of 2%to 1%will look like a big progress. Some people will like these banks, but the more decreased, the difficult Simply, it is difficult to 80 to 90. It is difficult to add from 90 to 100, from 1%to 0.83%, which is a very difficult thing.

Then why the non -performing rate of postal savings banks is still a little bit more than the same period last year and early this year. Why? Still because of small and scattered, put a lot of business on personal business. For example, personal consumer loans, buy cars, what decoration, mobile phone, buying bags, and credit loan, credit loan and consumer loan, it has its The non -performing rate is very related to the entire macro environment. Each bank is high, 0.83%. With the promotion of the entire personal business, it is flat compared with last year, and it is a little bit rare.

Even from the entire industry. Why does its adverse rate increase? Specifically, in detail the industry, or the real estate industry is leading to this situation. Then at the beginning of the year, the non -performing rate of the real estate industry in the postal savings bank was only 0.02%, which is now rising to 1%. Many people can see the disconnection of loan breaks in our news. The postal savings bank is also a normal bank and will also be impacted by this. It has a competitive relationship with the Rural Commercial Bank and other. Many of its service targets are farmers, animal husbandry and fisheries. We have found that the adverse rate of agriculture, forestry, animal husbandry and fishery has increased by 6%from 1.54%, and the increase is so large, but its overall non -performing rate only has only an overall non -performing rate. Increased a little bit, this specific reason needs to be considered again.

The most common is the following outlets, engaged in agriculture, forestry, animal husbandry and fisheries, to borrow, and buy a house, and find a bank borrowing. The adverse rates of these industries have all improved, but the overall adverse rate has not improved a little bit, so this is a manifestation of risk control. In addition, from the perspective of the preparation coverage, the decline in the preparation coverage seems to be not very good. But the decline is reasonable, because our regulatory authorities have issued a notice this year. If this large bank with a high coverage rate, especially state -owned banks or high -quality commercial banks, you can orderly reduce dialing dialing dialing dialing. Prepare coverage, release more credit resources, some storage banks belong to this kind of high -level large banks. Of course, there is no need to leave too many allocated funds, but it will affect your operating performance. Therefore This dial -up rate is normal. Business results of postal savings banks: Four focus of attention, cost income ratio, intermediate income, direct selling banks, and voltage drops two high -level lenders

After discussing the strategic and financial situation, I have returned to the business results that everyone is most concerned about. Because only in the case of preserving assets, can we discuss profitability issues. Many website analysts will pay attention to business results because it is directly related to the interests of shareholders, but I want to say. Any interests must be based on the perspective of risks, including our purchase of stocks.

You see that this bank stock has just been raised some time ago, and now it has fallen again. Why? Because risks are closely related to the sustainable development of banks, and the macro environment is closely related to the development of banks, just to see the current revenue and net profit, it may not be able to continue. Analyze the main reasons.

1) High cost income: because it is necessary to pay the savings agency fee to China Post Group

I summarized three characteristics. At the bottom of this PPT, the first one was the double -digit increase in revenue profit. At first glance, this increase was very beautiful, and the revenue increased by 10%. The net profit attributable to bank shareholders, and some of the net profit of returning to the mother is called a problem. There is a problem with this name, which increases by 14.88%year -on -year, which is very high. But what I want to say is whether everyone finds that its revenue is basically equal to whom, and it is very similar to China Merchants Bank. However, the net profit of the postal savings bank is higher than that of the China Merchants Bank. Although the postal savings and China Merchants Bank's operating income is equal, the net profit of the postal savings bank is only 67%of China Merchants Bank. Why is there such a big gap? It is necessary to consider another question, whether the income and cost are proportional, whether it is proportional, this is the principle of income fees ratio of accounting in accounting.

I think there must be experts at this time. Teacher Li, you are wrong. The net profit of the postal savings bank is even faster than the increase in operating income. For such a large state -owned bank with a huge asset, the net profit increases by 14.88%year -on -year. Very good, although the other semi -annual reports of other banks have not come out, everyone is likely to think that the performance of the postal savings bank is likely to take the lead. But what I want to say is that the income fee must be matched. This is what I have talked about just now, which is the most important reason for the existence of accounting. You must look at the income cost of income and expenses. What is the proportion of the income cost? The postal savings bank's cost income ratio (editor's note: cost income ratio refers to the ratio of depreciation to the operating income) of 53%, which is 53%. It is a bit higher than the previous quarter, lower than the beginning of the year. Why? Because its income cost ratio is relatively large, the expenditure still needs to be controlled.

This is also a disadvantage in the middle of competition between postal savings banks, rural commercial banks, and village banks. Because of the outlets of the postal savings bank, it is often taken directly from the post of postal groups. In an office, there are two brands in a store. The Postal Savings Bank absorbs the deposit through the outlets. Many times, it is necessary to pay the corresponding savings agency fee and pay the entire postal group fee for his entire postal group. Is there no such agency fee or a very low agency fee. This is a reason why the postal savings banks have a higher cost. Therefore, while seeing its entire revenue and net profit growth, we have to see that its cost is also high.

2) Whether the growth trend of the collection continues to maintain doubt

The second feature is that its collection has been increasing. After frying it back for a few years, you found that the postal savings bank's collection is always increasing. No matter which section is requisitioned, the agency business fee, wealth management business income, investment bank business income, and custody business income are increasing, and all are increasing. Essence For five consecutive years, it has been increasing. This growth rate makes people feel very panic. Why? Although it is a very good strategy throughout it, the country's entire tax reduction policy is continuously implemented and continuously implemented. Can we still maintain such a high -collection number of this number sustainable? The stamina must be maintained, otherwise it will fall, which is a big risk point.

3) Whether the direct selling bank strategy can be successfully tested

Another risk point is that the postal savings banks are playing such a state -owned retail direct sales strategy. So how to persist, how to adjust? From the current financial figures, it is losing money. Although the number of losses is not large, it must be alert to sufficient. The postal savings bank's strategy is called this post -Hui Wanjia (editor's note: Post Huiwanjia is an independent legal person direct sales bank initiated by the postal savings bank). In fact Advertising, many uncle aunts like to go. But in addition to your main business, how the performance of this direct sales bank is a question that is very recognized and concerned in the market. Our revenue is so high, but we are a negative net profit on the direct selling bank. This needs to adjust the corresponding strategy. This is a risk point. 4) The left -one lending of the two high schools will make the profit be overturned

The "two high and one left" in traditional industries has always been a relatively high proportion of loans, and then if I look at this bank I have worked, their ability to repay the original, their loan demand is large, and they can bear what they can bear. The interest rate is relatively high, but under the regulation of the entire country's entire policy, strictly control the "two highs and one left", which is what high pollution and high energy consumption industry, as well as an industry with overcapacity Both the growth rate of loans and loans are looking at. This is a impact for postal savings banks. It depends on whether you can transform and can it transform to our green financial industry in time and make profits?

In fact, not only our postal savings bank, but major banks will involve this transformation, we can see from the postal savings bank report. For this "two high and one left" industry, its green loan amount has increased rapidly. In the middle of this transformation process, it actually directly affects our financial conditions and business results. The net interest rate of banks has a significant impact, so when we do financial index analysis, we must consider these factors. Then when making a stock price prediction, we are now developing a method of using machine learning to judge the stock price of bank stocks. Because of the stock price of bank stocks, there are very many restricted factors. The 21 other 21 industries are not the same, because bank stocks have more influencing factors. In fact, when we are doing a financial report analysis today, I need to mention that this is a very important factor. This must be placed in the middle of machine learning to give greater weights.

Bank's stock price is the result of the influence of comprehensive factors

Within a short hour, we briefly analyzed the matching of the postal savings bank's strategy and financial reports, and focused on telling everyone about his financial status and this risk prevention method it controlled, and its corresponding profit index Including revenue, net profit, including the entire transformation process that pay special attention to.

I want to talk about it again. The performance of the stock price is now the common influence of 94 factors. For banks, it is a common influence of 116 factors. Today, we just grabbed the focus on the changes of some of these important factors, but these are not enough to predict the stock price of the next two weeks or even a month, so it is necessary to depend on machine learning. For unified judgment, we are doing this job now.

In the future, the postal savings bank will continue to pay attention to it. After other state -owned bank reports come out, we will also compare timely comparisons. At that time, we will continue to disclose our research results when we have the right opportunity. Then I hope to present some of our evaluations and predictions on the banking companies with more professional judgment, more actual combat experience, and more accurate models. Finally, to sum up, the analysis of the bank's financial report needs to focus on more than 100 factors to pay attention to the overall planning, and do not care about it.

Today, our sharing is here. Thank you again for your listening and attention, and you are welcome to communicate and criticize.

- END -

Shanghai people's life profit declines and the solvency of the solution is not up to the standard.

After half a year of loss, Mr. Mi Chunlei, chairman of Shanghai Life Insurance, re...

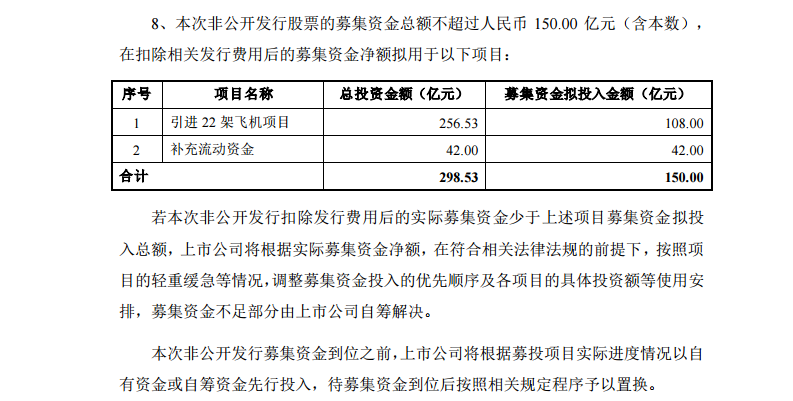

Air China raised 15 billion yuan to purchase the rural aviation industry to accelerate the recovery?

Cover reporter Liu XuqiangFollowing the longest -scale public purchase orders in t...