Support to stabilize the economic market Henan banking insurance industry in action | Henan Banking Insurance Bureau: Increase inclusive small and micro -finance support to help stabilize market entities

Author:Henan Daily Client Time:2022.08.26

Henan Daily client reporter Li Peng

It is understood that since the beginning of this year, in the face of the severe and complex economic and financial situation, the Henan Banking Insurance Regulatory Bureau conscientiously implemented the deployment of the provincial government and the China Banking Regulatory Commission's financial services on small and micro enterprises, focusing on incremental, expanding, reducing costs, and reducing costs, reducing costs, and reducing costs, reducing costs, and reducing costs, reducing costs, and reducing costs. Continuous efforts to improve quality and rescue, provide strong financial support for further support for the development of small and micro enterprises, and help stabilize market entities and ensure employment.

Increase credit distribution and maintain steady growth of small and micro credit

Maintaining credit stability is the basis for solving the difficulty of financing for small and micro enterprises. The Henan Banking Insurance Regulatory Bureau adheres to the goal leadership, strengthens the target assessment, and continues to implement the "two increases" assessment of the loan of inclusive small and micro enterprises with a credit of less than 10 million yuan in single households, requiring all banking institutions to listed the inclusive small micro -credit plan at the beginning of the year. Increase the tilt of small and micro enterprises. Focus on building a differentiated multi -level credit supply pattern, clearly require large banks and joint -stock banks to play the leading role of the industry, focus on expanding the first loan households, and strive to cover the "blank area" of small and micro enterprises' financing supply; Actively develop online and offline credit products that are in line with the characteristics of the local market, and continue to expand the radius of service. In June this year, the province's small and micro enterprise loans exceeded 2 trillion yuan, of which the inclusive small and micro enterprise loans were 860.166 billion yuan, an increase of 10.15%from the beginning of the year, and the average growth rate of various loans was 5.78 percentage points.

Gathering policy joint efforts and helping to help the market subjects in the trapped market

In order to cope with the impact of the epidemic and protect the market entities, in early May of this year, the Henan Banking and Insurance Bureau jointly issued the "Notice on Further Strengthening Financial Supporting Small and Micro -Enterprises and Individual Industry and Commerce", which was nearly one Monthly introduced the extension of the principal and interest payment policy, guiding the banking institutions to the affected affected, good credit records, development prospects, temporary difficulties, individual industrial and commercial households, truck drivers and other loans. For 3-6 months of rest, delayed loans do not reduce the risk classification due to the epidemic factors, and do not affect customer credit and no penalties. As of the end of June, the province's cumulative loans for small and medium -sized enterprises, individual industrial and commercial households, and truck drivers have been extended to 67.62 billion yuan, and interest rates were extended by 849 million yuan. At the same time, 27 financial support to support the stability of the economy of the economy, guiding bank insurance institutions to focus on supporting the affected by the affected by the difficulty in the difficulty of the enterprise, and the logistics guarantee and the unobstructed guarantee.

Optimize the credit structure and upgrade "Loan" from "loan"

For a series of issues such as small loan varieties, high loan thresholds, short loan periods, short loan periods, and difficulty in loan, they will guide all banking institutions to innovate small Micro financial products. For example, the CCB Henan Branch innovatively launched more than 30 small and micro enterprises such as merchant cloud loans and first households, and the financing needs of the entire life cycle to cover the expansion increase. Supervise banking institutions to continuously expand the means of slow release of risk, incorporate intellectual property rights, accounts receivables, government procurement contracts, etc. into the category of risks, reduce financing thresholds, and increase the proportion of credit loans; increase advanced manufacturing and strategic emerging industries The medium and long -term credit support increases the proportion of medium and long -term loans; promotes the "borrowing and repayment" model, reduces the transfer of loans and bridges, and strives to be seamlessly connected, reducing the pressure and turnover cost of small and micro enterprises' funds. As of the end of June, the proportion of credit loans and medium- and long -term loans of small and micro enterprises in the province accounted for 14.63%and 55.30%, which was 1.69 and 1.35 percentage points from the beginning of the year, and the credit structure continued to optimize.

Implement the cost reduction and reduce the cost of comprehensive financing for enterprises

Carry out special actions for reducing fees for profit -making, to promote the reduction of corporate financing costs as breakthroughs and efforts to make the real economy and stabilize market entities. It is clear that all banking institutions are required to actively clear the internal interest rate transmission mechanism, dynamically reflect the trend of the loan market quotation interest rate (LPR), reasonably determine the loan interest rate of small and micro enterprises, and ensure that the loan interest rate of the newly issued inclusive small and micro enterprise loan in 2022 is the basis of 2021 in 2021 Further decline. In the first half of the year, the interest rate of the province's inclusive small and micro enterprises was 5.58%, a decrease of 0.53 percentage points from the beginning of the year, and maintained a decline in four consecutive years. Guide the banking institutions to actively bear the fees of pledge evaluation and mortgage registration fees for small and micro enterprises. By issuing credit loans and reducing credit -related expenses, it is expected to reduce the financing burden of 3 billion yuan in financing.

Improve the professional mechanism and enhance the service capacity of dare to loan loan

- END -

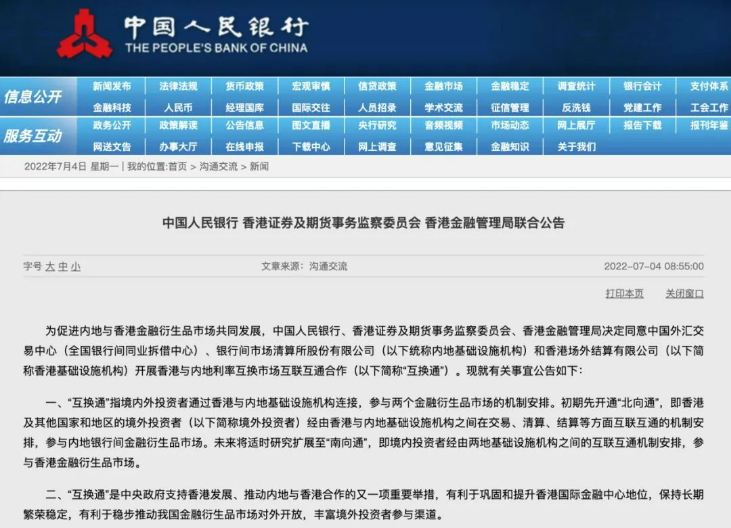

Just now, the central bank announced two major news!The "swap" was born, and the Senate Swap Agreement was signed for the first time!

On the fifth anniversary of the opening of the Bond Connect, two measures to deepe...

Daily Youxian lied to everyone

@新 新 新Author 丨 Bai Yueyue SeeEdit 丨 MonthlyTo this day, Daily Youxian may lie...