During the year, the offering of 56.718 billion yuan of offering shares in A -share listed companies increased by more than 60 % from last year.

Author:Securities daily Time:2022.08.26

26Aug

In particular, financial institutions such as securities firms and banks are the most active reporters from Xing Meng. Since 2022, the financing market in A -share shares is hot, especially financial institutions such as brokers and banks are the most active. On the evening of August 24th, Xingye Securities disclosed the issuance of the issuance of the issuance of shares. The number of effective subscriptions was 1.939 billion shares, the subscription amount was 10.084 billion yuan, and the subscription rate reached 96.53%. According to Wind data statistics, the issuance date is subject to. As of August 25, the seven listed companies have successfully implemented the distribution during the year, with a total fundraising of 56.718 billion yuan, a significant increase of 64.25%over last year. It is worth noting that there are currently 4 companies such as CITIC Bank to promote the distribution plan. If the shares are implemented within the year, the total fundraising of A -shares this year is expected to exceed 100 billion yuan, a record high in the past 12 years. The proportion of fundraising funds for securities firms exceeded 90 % of the "high -funded financing efficiency and relatively controllable prices, which is favored by cash flow controllable. On the one hand, the distribution of shares can increase the transaction chips of the original shareholders and increase the expected income of the original shareholders; on the other hand, the financing financing can reduce the price -earnings ratio and increase liquidity. In addition, the approval procedures for the distribution shares are relatively simple and the operation procedures are relatively simple. The companies that have completed the allocation of shares this year are mainly brokers. Those who are to be implemented are led by banks. Financial institutions have become the absolute main force, and frequent fundraising. According to Wind data, as of August 25, CITIC Securities Securities, Orient Securities, Xingye Securities, and Caitong Securities were funded for 52.367 billion yuan, accounting for 92.33%of the total fundraising. Among them, CITIC Securities ranked first with a fundraising of 22.396 billion yuan, and Oriental Securities and Industrial Securities also exceeded 100 billion yuan. "Under the registration system, securities firms are more common in fundraising through the distribution. Compared with fixed -increase and bond financing, the distribution of shares can not only replenish blood quickly, but also ensure the stability of the equity structure and enhance the core competitiveness, and meet the capital needs." Sha. "Sha." Sha. "Sha Zhou Mingzi, director of Liwen Consulting, said in an interview with the Securities Daily reporter. The reporter noticed that this year, it shows the characteristics of large -scale discounts and high subscription rates. Specifically, from the perspective of the discount rate of the off -share shares (the ratio of the share price and equity registration date), the average value of the 7 companies that have successfully implemented the shares mentioned above is 29%, up to 64%; from the perspective The company's average value is 96%, up to 98%. "In the case of relatively sluggish market, listed companies often adopt high discounts for distribution to increase the participation of the original shareholders. However, the higher the discount, the larger the stock price after removing the rights. More losses. "Wang Weijia, general manager of Beijing Sunshine Tianhong Asset Management Company, told reporters. At the same time, in addition to the 7 companies that have been implemented above, there are 4 companies that are actively promoting. It is expected that the highest fundraising amount will reach 48.4 billion yuan, of which CITIC Bank plans to offer shares not over 40 billion yuan. If it is successfully implemented, the total fundraising of allocation will be increased to over 100 billion yuan during the year, a record of the highest record since 2011. Since the long -term favor of financial enterprises in terms of shares, the proportion of allocation of shares has not been large in the total amount of remansence. Except for financial institutions, most listed companies do not choose to raise funds for financing. Judging from the recent three years, the number of listed companies participating in the shares has a small scale, and the scale of fundraising is small, and it has declined year by year. According to Wind data, from August 25, 2020 to August 25, 2022, the number and proportion of listed companies that implement the non -financial institutions implemented by allocated shares were 10 (59%), 2 (33%), and 2 (29%), respectively. The scale and proportion of fundraising were 10.599 billion yuan (17%), 2.632 billion yuan (8%), and 1.849 billion yuan (3%), respectively. "Dating shares often occupy shareholders' funds for a long time, and may bring the risk of stock price fluctuations. Some shareholders will vote or abandon the shares with their feet before the distribution. The pressure on the contract is weak, so it is often selected to choose other multi -financing channels. "Tian Lihui analyzed that, in view of the needs of the capital supplement of financial institutions and the urgency of some listed companies' financing, it is expected to continue in the second half of the year. However, Wang Weijia believes that the distribution of shares is an early -financing method in the capital market. With the continuous improvement of the domestic capital market, the financing channels of listed companies are also increasingly richer, which can match different financing needs. With the gradual recovery of the domestic economy, the capital market has continued to recover, and the popularity of the offering may gradually decline.

Recommended reading

How will the property market welcome four heavy news within a week?

The price of cement has plummeted, and the "one brother" conch cement cannot be carried! The net profit of the first half of the year fell more than 30%

Photo | Site Cool Hero Bao Map Network Production | Zhou Wenrui

- END -

Greentown: Shouzhong Qiujin

We must clearly see that the market has recovered before we will attack. - Zhang Y...

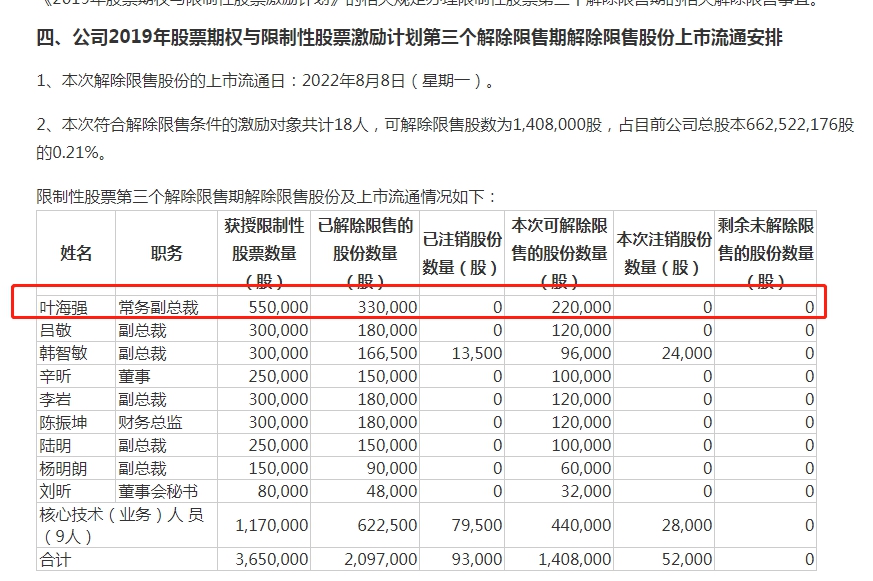

V viewing financial report | "Precision" reduction of more than 100,000 shares in violation of regulations, Ye Haiqiang, executive vice president of Digital Digital Digital

Zhongxin Jingwei, August 17th. Due to violations of regulations, the Shenzhen Stoc...