Oil prices have finally signs of "decline"

Author:Fall in love with Shaoyang cli Time:2022.06.18

On the 17th, international oil prices fell sharply over 6.8%

In terms of the crude oil market, affected by the global central bank's interest rate hike, the focus of investors' attention shifted from the supply and demand pattern to the risk of economic recession. In addition, the US dollar significantly strengthened on Friday, which caused the international oil prices to decline sharply on the same day. As of the close, New York's oil price fell 6.83%, and Brent oil prices fell 5.58%. Affected by the market on Friday, international oil prices have fallen significantly this week, and the seven -week rising trend of New York's oil prices and Brent oil prices ended.

On the 17th, the three major US stock indexes rose and fell on the edge of the bear market

This week, the wave of interest rate hikes set off by the Fed and the central banks of many countries around the world has made investors more and more worried about the decline of the US and European economies. On Friday, local time, the three major US stock indexes were under pressure, and the market had turned down, and the end of the Dow rebounded weakly. At the time of close, the Dow reached a 52 -week low in two consecutive trading days, and it has fallen 18.78%from the high level on January 4 this year, and continues to linger on the edge of the technical bear market. Science and technology stocks that have plummeted the day before have rebounded, and leading technology stocks rose across the board. Among them, Amazon rose nearly 2.5%and Tesla rose more than 1.7%. The popular stocks ushered in a rebound on Friday. The Nasdaq's Golden Dragon China Index closed up 3.2%, JD.com rose 5.2%, Xiaopeng Automobile rose about 9.8%, Weilai Automobile rose more than 8%, the ideal car rose more than 4% Essence

This week's three major US stock indexes have fallen across the entire line of S & P 500 Index the largest weekly decline in March 2020

Affruder between the economic growth of the United States and Europe significantly slowed down and the radical interest rate hikes of many central banks, the three major US stock indexes fell across the board this week. Among them, the S & P 500 index fell 5.79%, the largest single week since March 2020, and continued to be trapped in the bear market with Naqi. As of the closing of Friday, the Eleventh Big Section of the S & P 500 Index has fallen by more than 15%from the recent high level.

On the 17th, the three major stock markets in Europe went up and down, and the CAC40 index fell into the bear market

In terms of European markets, energy and mining stocks fell sharply and dragged down some national stock market performances. The three major European stock markets rose and decline on Friday. Among them, the French Paris stock market closed at a new 52 -week low, down 20.25%from the high level on January 5 this year, and fell into a technical bear market.

The US dollar index rose sharply on the 17th

On Friday, Fed Chairman Powell reiterated the Fed's commitment to reduce inflation in a public speech. On the same day, Minnespois Federal Reserve President Kashkali made a eagle speech, saying that it might support 75 basis points in July. Affected by the above eagle signal, the US dollar index that measured the US dollar to the six major currencies rose 1.03%on the same day, and the US dollar rose over 2%in the yen exchange rate disk for the $ 1 against 135 yen.

Can this round of adjustments be successfully reduced?

Do you want to see the last!

- END -

fresh!This delicious taste of Zhejiang people loves to eat, just listed, the price ...

Source: watch Hanghang every dayThe copyright belongs to the original author, if t...

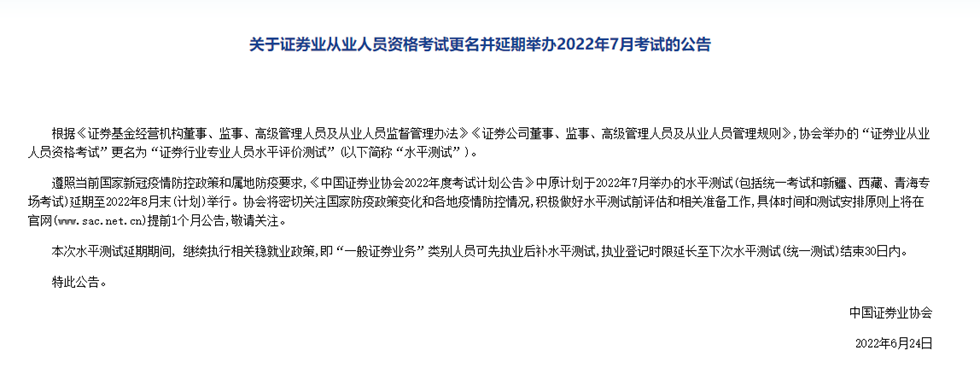

The new name of the "Securities Qualification Examination" is determined, and the test will start at the end of August!Practitioners should pay attention to this

Yesterday, the Securities Association announced on the official website of the Ann...