Acetic acid: imbalance between supply and demand price

Author:China Chemical Newspaper Time:2022.08.26

Since early June, the market price of acetic acid has declined all the way, as of August 19th to 3,000 yuan (ton price, the same below), the price has fallen nearly half, and it has been cut compared to the beginning of the year. The industry believes that the decline in this round is due to the fact that the production capacity of some new devices will be implemented in the future, and the downstream expansion will be slow, and the supply and demand relationship will continue to show a loose state. The acetic acid industry may enter the era of overcapacity.

The price is almost cut

Qin Chuang, a Liaoning acetic acid dealer, introduced that since June 4, the average price of acetic acid market has fallen from a phased high of 5,640 yuan, and it has fallen to 3,000 yuan on August 19, a decline of 46.8%. It's already cut. Earlier this year, after the acetic acid market was launched at the average price of 6,190 yuan, the overall decline. As of August 23, the average price of acetic acid market was 3052.5 yuan, a decrease of 50.68%over the beginning of the year, and a year -on -year decrease of 49.63%.

According to Qin Chuang, the acetic acid market has rebounded sharply in March and May this year. When the turning point is close to the average price of 4,200 yuan, it has touched the company's profit and loss cost line. At the same time, traders and downstream users are actively entering the market. Under the changes in mentality, the fundamentals of supply and demand are favorable and promoted the rise of the market.

However, in May, after the phase of 5,640 yuan on June 4, under the darling of weak downstream demand, the trading atmosphere of the acetic acid market gradually lighted, and the price was greatly retracted. As the cash deposits gradually accumulate, the shipment mentality is strong, and the quotation continues to reduce. Under the mentality of buying up and not buying a decline, the acetic acid market continued to fall weakly. By the end of June, the average price was 4150 yuan, which fell below the previous support level of 4,200 yuan.

Since then, the market has always been in a downward trend until it fell to the line of 3,000 yuan. On August 19, the quotation of companies in North China, Shandong, and Jiangsu have fallen below 3,000 yuan.

Supply and demand contradictions appear

According to Zhang Yanqiu, an analyst of Zhongyu Information, the supply increases, the demand does not increase but decreases, and the social inventory is on the rise.

According to Zhang Yanqiu, from the perspective of supply, many sets of acetic acid devices such as Slarunis and Nanjing in Nanjing in May and June have long -term maintenance, and the operating rate is significantly lower than the conventional level. After July, with the resumption of production in the preliminary maintenance device, the domestic acetic acid industry's operating rate has risen, and the average operating rate has been maintained at more than 80 %.

However, the field of terminal consumption is weak, and the downstream enterprises in acetic acid are poorly started, and the demand side shows a weak shrinking situation. Based on factors such as domestic real estate and other terminal consumption fields and weak growth, the main downstream operating rates of acetic acid have decreased to varying degrees. Among them, the current operating rate of ethyl acetate and benzene acid (PTA) is basically at the lowest level of the year; chloroacetic acid and ethyl acetate are also low. In addition, the parking situation of small downstream enterprises such as printing and dyeing, chemicals aids in East China is also concentrated.

At the same time, the export of acetic acid also maintains conventional levels. After the price of crude oil fell, the production cost of coal -made acetic acid was not obvious, and the European and American and Asian acetic acid devices at the moment maintained normal operation, and the supply gap abroad was not large. From July to August, the export volume of domestic acetic acid is expected to be 70,000 to 80,000 tons, maintaining a conventional level.

In summary, the supply of acetic acid market continues to increase, but downstream demand has always been weak. The export performance of the superimposed acetic acid is generally accumulated, and the inventory gradually accumulates. As of mid -August, the total inventory of the acetic acid society has exceeded 180,000 tons, which has caused the market prices to fall over and then fall.

Transformation of supply and demand relationship

In fact, in the past few years, the domestic production capacity expansion, the significant downstream production capacity of the downstream, and the incidents of overseas devices have stimulated the exports, and have been promoted. However, with the implementation of the production capacity of some new devices in the next three years, the growth rate of the downstream expansion of the acetic acid has slowed down, and the supply and demand relationship will be transformed from tight balance to loose state.

Xu Na, an analyst of Jin Lianchuang Chemical Engineering, believes that in recent years, under the attraction of high profits of acetic acid in China, new news is concentrated. News, so the growth rate of acetic acid supply in the next few years will increase significantly. At present, it is reported that Shandong Yankuang 200,000 tons/annual production capacity is planned to be put into production in the second half of this year. Huaneng Hengli 1 million tons/annual production capacity is planned to be put into production in 2023. Dalian Hengli 400,000 tons/annual production capacity, Xinjiang Zhonghe Hehehe The production capacity of 1 million tons/annual capacity will also be put into production in recent years.

However, the demand for downstream of the acetic acid shows a slow growth rate. Although there are new news on PTA, the high probability of this product will return to the era of overcapacity, which will inevitably lead to low operating rates. Except for the development of the photovoltaic industry, in 2023, there are many new news in 2023. There are not many new production capacity such as chlorohide, acetamine, hentide, and acetate.

On the whole, the demand for domestic acetic acid in the next few years is far less than the expansion of supply, and corporate profit margins will also be compressed. The probability of is near the cost line, and the market price is expected to continue to hover at a low level. It is estimated that after 2023, domestic acetic acid may enter the situation of overcapacity.

- END -

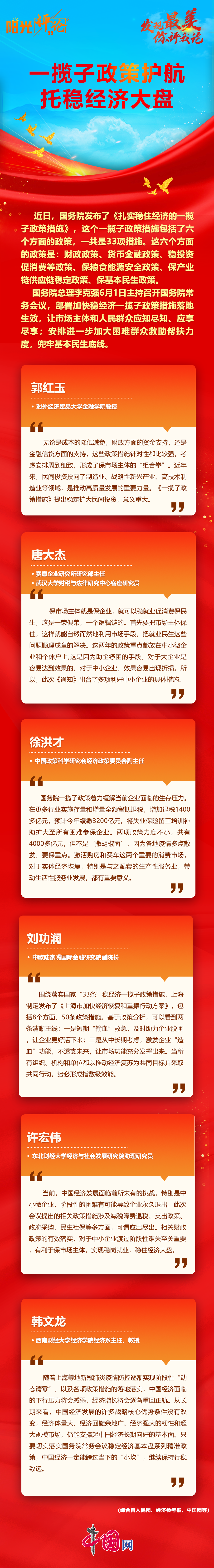

[Sunshine Review] A package of policy escort to stabilize the economic market

Recently, the State Council issued the A Policy and Measures for the Economy. This...

Invite banks to answer the interpretation meeting of Sichuan Finance to help enterprises' rescue policies

Cover reporter Ma MengfeiOn the afternoon of July 14th, hosted by the Sichuan Prov...