21st Century Economic Herald Editor -in -chief Chen Chenxing: "Development of Pension Finance Responsibility" is an important long -term issue

Author:21st Century Economic report Time:2022.08.26

21st Century Business Herald reporter Sun Yu Beijing report

On the morning of August 26th, the "Pension China · Responsibility Finance" China Pension Finance Responsibility Development Symposium was successfully held by Southern Finance and Economics Group, hosted by the 21st Century Business Herald, and 21st Century Business Herald and 21st Century Business Herald.

At the seminar, Chen Chenxing, the editor -in -chief editor of the 21st Century Business Herald, announced that the 30 -member Expert Committee of the "21 Huidi Elderly" was officially established.

In 2021, under the large framework of the Southern Finance and Economics Forum, the 21st Century Capital Research Institute and Southern Fund set up pension financial research groups. Under the guidance of the China Securities Investment Fund Industry Association and other departments, the research report of the "Development Report of Pension Finance Responsibility" was launched. Industry forums and closed -door discussions have been held many times.

In 2022, the 21st Century Economic Herald hosted the establishment of the "21 Huisheng Old" 30 -member Expert Committee, which aims to better promote the development of China's pension financial undertakings.

Chen Chenxing said that this year is the first year of the personal pension financial system. The construction of a new pension system in China is the common cause of all parties in the society.

On April 21 this year, the General Office of the State Council officially issued the "Opinions on Promoting the Development of Personal Pension" (hereinafter referred to as "Opinions"), and proposed to promote the development of personal care for the development of personal care for Chinese national conditions, government policies, voluntary participation, and market -oriented operations. gold.

Chen Chenxing said that the "Opinions" introduced means that the "multi -level, multi -pillar endowment insurance system" proposed by the "Fourteenth Five -Year Plan" plan has taken a solid step.

According to the "Opinions", personal pensions implement a personal account system, and participants can purchase financial products in accordance with the prescribed financial institutions or their sales channels entrusted in accordance with laws.

Because of this, financial institutions that are one of the core participants in the future pension system are also an important responsible responsibility.

Chen Chenxing pointed out that for various financial institutions, "the development of pension financial responsibility" is the same as a long -term issue as "innovation of pension financial business".

- END -

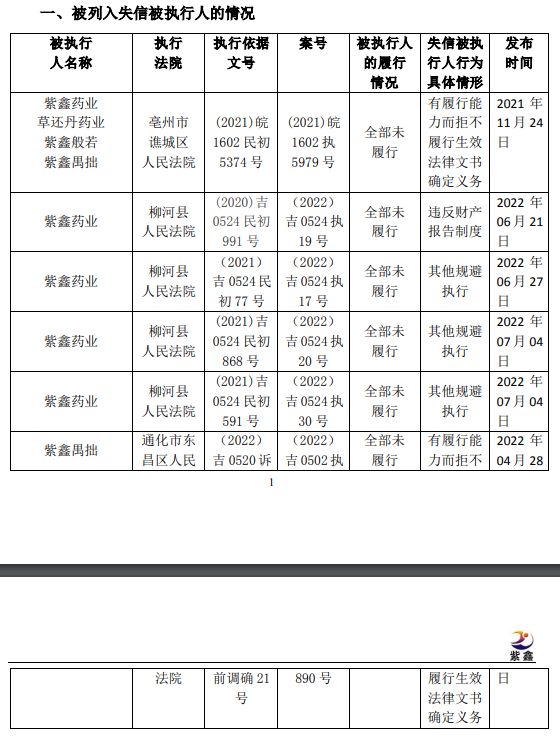

V Guan Finance Report | Zixin Pharmaceutical and many subsidiaries have become "Lao Lai", which lost nearly 1 billion last year

Zhongxin Jingwei, July 18th. Zixin Pharmaceutical issued an announcement on the 18...

The 50th index of science and technology rose 6%week, and semiconductor rising is expected to lead technology stocks to rebound

Affected by the uncertain factors such as geopolitics, the broad market fluctuated...