The accounts purchased by the company daily, accounting, the accountant was incorrectly included in the "employee benefits"!

Author:Audit observation Time:2022.08.27

Old accounting can not make accounts

Today, I checked the account of the old accounting of a company and found that the company's old accounting was included in the "payable salary of employees -benefit fees", which caused the company's welfare expenses over the years. The pre -deduction standard, but the old accounting has never been paid during the settlement of the settlement.

As everyone knows, many account risks are caused by people who are not understood by accounting.

What subjects should tea be included?

The tea purchased by the company's office is a "management fee -office expenses". In addition, the barrel water purchased by common company offices is also a "management fee -office fee".

Other common misunderstandings:

1. A company orders for employees. The accountant believes that it belongs to a benefit provided by employees. It is included in the benefits and deducting the VAT invoice certification.

Correct approach: The enterprise is uniformly produced and requires employees to unify the cost of work costumes incurred by the clothing should be listed in office expenses. In terms of corporate income tax deductions, the input tax of the dedicated invoicing of VAT can be certified and deducted.

Tip: The entry of the work expenditure of the enterprise must meet the requirements of the announcement of the No. 34 of 2011 according to the nature and characteristics of its working nature and characteristics. If the employee is unified, the clothing for the employee's sports meeting is obviously the employee welfare expenditure.

2. A company purchases cold drinks, cooling alcohol wet towels and other items in summer to prevent employees from heat stroke during work. Accounting believes that this is the benefit provided by the company, and the accounting of the employee benefits project is included.

Correct practice: The company's cold drinks and other items for the production workshop are the prevention of heatstroke and cooling supplies that prevent heat stroke from employees. It is a labor insurance expenditure. The labor protection fee is deducted before the corporate income tax tax.

3. An enterprise entertains customers in the employee restaurant, and the accounting costs will be included in the employee benefits.

Correct approach: For the business that often occurred in order to contact business or promotions, and handle social relations, it is a business entertainment expenditure expenditure. It cannot be regarded as a cafeteria welfare expenditure expenditure because of the cafeteria where the dining room is located.

02

What is a benefit fee?

What are the welfare fees?

Enterprise employee benefits refer to the subsidies of employees' salary, bonuses, allowances, subsidies for total salary management, employee education expenses, social insurance premiums and supplementary pension insurance premiums (annuity), supplementary medical insurance premiums and housing provident funds Welfare benefits, including cash subsidies and non -monetary collective benefits issued to employees or employees.

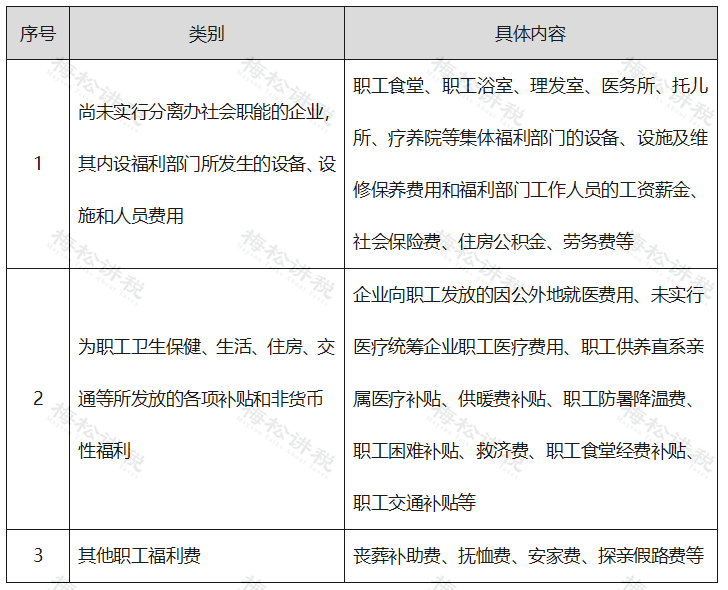

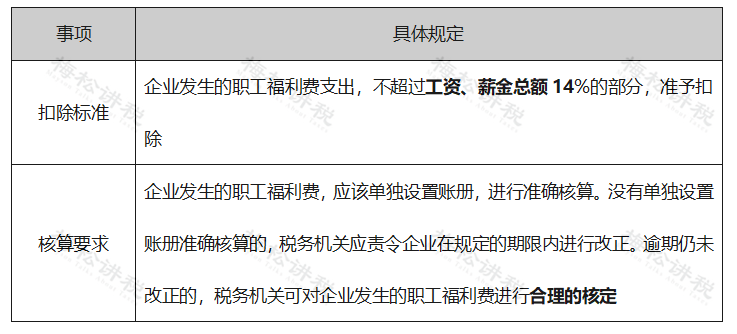

According to Article 3 of the National Taxation letter [2009] No. 3, the specific scope of the welfare fee of enterprise employees is shown in the table:

Note: There are certain differences in the prevailing of the accounting accounting and the tax law. If the actual employee benefit fee that the company is confirmed in accordance with the financial enterprise [2009] No. 242 can be deducted in accordance with the pre -tax fee of employee benefits, it is necessary to follow the National Taxation letter [2009] Judgment of No. 3.

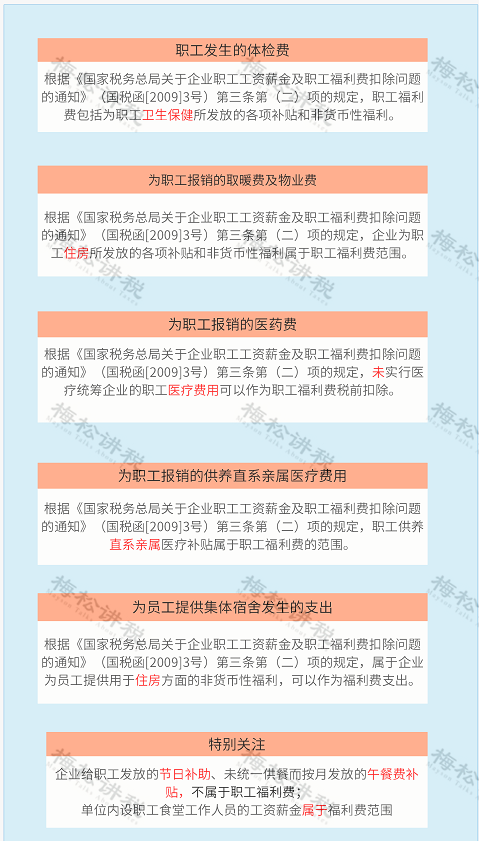

List of common employee benefits in taxation:

03

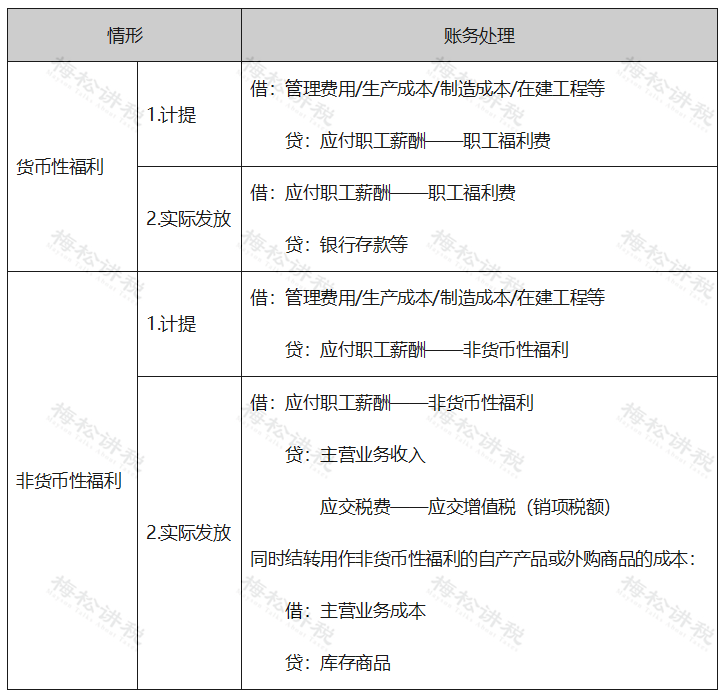

How to pay for employee benefits?

The employee benefits incurred by the enterprise shall be included in the current profit or loss or related asset costs according to the actual amount of actual occurrence. If employee benefits are non -monetary benefits, they shall be measured at fair value.

04

Taxation treatment of benefits

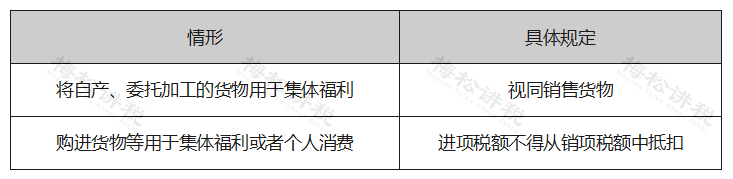

(1) VAT

When enterprises issue non -monetary benefits, it should be distinguished from self -produced goods or purchased goods. The tax treatment of different circumstances is as shown in the table:

Note: Enterprises use cargo for employee benefits. In terms of corporate income tax, they should be regarded as selling goods and determining sales revenue according to fair value.

(2) Corporate income tax

Note: Welfare subsidies for the salary and salary system of enterprise employees, fixed and salary and salary, are in line with the first reasonable salary provisions of (Guate Taxi [2009] No. 3), which can be used as a salary salary expenditure incurred by an enterprise. It is required to be deducted before tax. Welfare subsidies that cannot meet the above conditions shall not be met at the above conditions. It shall be deducted from the employee's welfare fees as the employee's welfare fee stipulated in Article 3 of the State Taxation letter [2009] No. 3 No. 3.

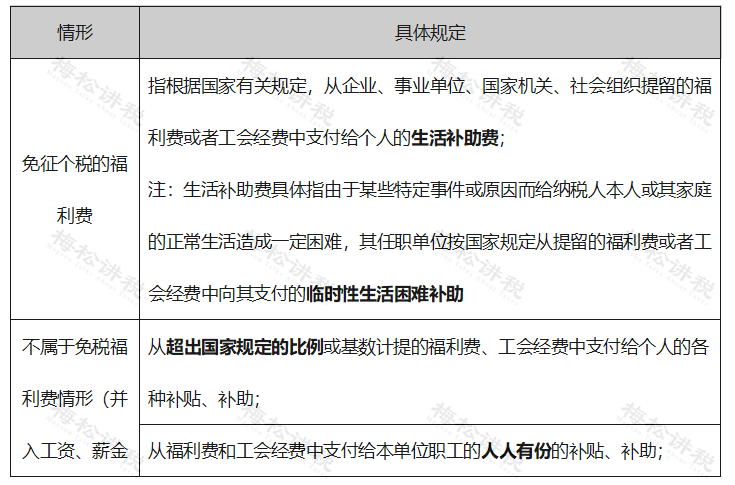

(3) Personal income tax

Source: First Classroom of Finance, Tax Lecture Hall, Meatong Tax, Taxation Station, Finance Manager, Tax Managers, etc.

- END -

[Follow] Hubei "Top Ten Chu medicine" is released!

Jingchu earth, Wuhua TianbaoJuly 15thHubei Top Ten Chu Pharmaceutical authentic me...

The euro, it fell to this ...

LuziThe euro fell again! On the 12th, the exchange rate of the euro fell to 1: 1. ...