Subaru requires the transfer price of all the equity of Subaru China held by the huge group to transfer about 265 million yuan

Author:Daily Economic News Time:2022.08.28

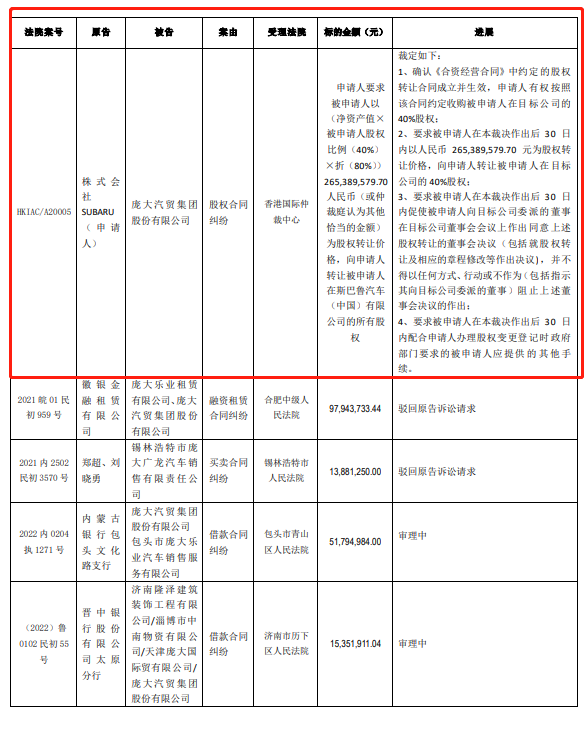

On August 26, the huge group (SH601258, the stock price of 1.28 yuan, and a market value of 13.091 billion yuan) issued the "Announcement on the results of new litigation and litigation" (hereinafter referred to as the "Announcement"). The "Announcement" mentioned that Subaru (hereinafter referred to as Subaru) requested the respondent's huge auto Trade Group Co., Ltd. (that is, huge group) (net asset value × 40%) × discount (80%) about 265 million yuan (or arbitral tribunal considers other appropriate amounts) is the equity transfer price, and the applicant transfers the respondent to all the equity of the respondent at Subaru Automobile (China) Co., Ltd. (hereinafter referred to as Subaru China) to the applicant.

Photo Source: Giant Group Announcement

According to the judgment of the Hong Kong International Arbitration Center, the equity transfer contract provided in the "joint venture business contract" is confirmed and the applicant has the right to acquire the respondent's 40%equity of the applicant's 40%equity in accordance with the contract; Within 30 days after this ruling, it took about RMB 265 million as the equity transfer price, and transferred the applicant's 40%equity of the applicant to the target company; required the respondent to promote the respondent to the target company within 30 days after the ruling was made. The appointed directors make a decision to agree to the above -mentioned equity transfer at the board meeting of the target company (including a resolution on the transfer of equity and the corresponding charter amendments). Directors) Prevent the above -mentioned decisions of the board of directors; the respondent requested the respondent to cooperate with the applicant's other formalities required by the government department within 30 days after the decision made by the ruling.

The huge group stated that the company will resolve relevant litigation cases as soon as possible, advocate its own legitimate rights and interests in accordance with the law, and safeguard the legal interests of the company and shareholders. The company will strengthen the communication and negotiation of relevant parties, properly resolve lawsuits, and maintain the company's smooth operation. The above -mentioned new and conclusion cases will not have a major adverse effect on the company's daily management and production and operation.

Qixinbao data shows that Subaru China was founded on March 10, 2006 with a registered capital of 2.95 billion yen. The shares of Subaru and the huge group were jointly held. The shareholding ratio was 60%and 40%. 1.77 billion yen and 1.18 billion yen. The legal representative is Pang Qinghua. The business scope includes the general dealer of the car company Subaru, imported and wholesale to the brand dealer Subaru brand. Accessories; provide the above -mentioned commodity -related after -sales service, technical support and dealer training (without involving state -owned trade management products, involving quotas and license management products, apply for applications in accordance with relevant national regulations.) Relevant departments carry out business activities after approval by approval.)

At present, Subaru's overall sales in China are under pressure. According to the latest data of the China Automobile Circulation Association, in the first half of 2022, Subaru's imports were 9,822 units, a year -on -year decrease of 36.38%.

As one of the shareholders, the huge group has also been trapped in the business crisis in recent years. Until December 2019, the huge group's bankruptcy and reorganization was completed. Investors, but the development of the future still faces challenges.

The industry analysis believes that Subaru wants to repurchase the equity of Subaru China, or because of the dilemma facing the huge group. According to the 2022 semi -annual results announced by the huge group, in the first half of this year, it is expected that the company's net profit attributable to shareholders of listed companies is 20 million to 30 million yuan, a year -on -year decrease of 94.85%to 96.57%.

As of the press release of "Daily Economic News", the huge group's stock price was reported at 1.28 yuan/share, a decline of 0.78%.

Source of the cover map: each reporter Zhang Jian (data chart)

Daily Economic News

- END -

Sunrise Oriental: Company shareholder Jiao Qingtai reduced its holdings of 280,000 shares of the company

Every time AI News, Sunrise Oriental (SH 603366, closing price: 10.18 yuan) issued...

"World No. 1" and "World First" Ningbo Zhoushan Port ushered in the world's largest container ship

Zhejiang News Customer correspondent Sun Yaonan Jiang Yuhao reporter Zhang Fantu Y...