Weekend news is too much, all of which are heavy!Tomorrow A shares will change?

Author:Daily Economic News Time:2022.08.28

In the generation of Z, Brother Z is the most realistic.

This week, the A -share market index fluctuated significantly — a sharp fall on Wednesday, rebounding on Thursday, and fell again on Friday. The market hotspots are difficult to continue. Only coal stocks, petroleum stocks, shipping stocks and other cyclical sectors have maintained strong.

This weekend, the news continues, and many will have an impact on the trend of A shares in the next week.

Let's take a look at the good news this weekend.

First, a high -level meeting held in Zhengzhou on August 27 mainly carried out on -site coordination and services around infrastructure, key projects, and people's livelihood protection projects.

According to the situation of the central bank's president, from the perspective of the situation in the field, Henan's policy measures to promote the stability of the economy's package are strong and effective. The supervision and service team will further improve the long -term coordination mechanism, give full play to their advantages, patiently work patiently, give more support in Henan in terms of expanding investment and financing and improving the efficiency of approval, and actively help solve practical difficulties.

In fact, the National Conference on August 23 issued 19 stable economic continuation policies and measures. At that time, it had positively affected the market, and the valuation temporarily stopped falling. But this Friday, the broader market was adjusted again, and to a large extent, I still felt that the market lacked confidence. In the current stock market, Brother Z believes that it is not a problem of lack of money, nor is there no problem, and the root cause still has no confidence.

The second news on the weekend, China and the United States signed an audit supervision cooperation agreement.

According to CCTV News, the China Securities Regulatory Commission and the Ministry of Finance signed an audit supervision cooperation agreement with the US Public Corporation's Accounting Supervision Committee (PCAOB) on August 26, 2022, which will launch related cooperation in the near future. This is undoubtedly an important step in China -US cross -border supervision and cooperation.

This news is undoubtedly a good stock. In fact, this Friday, some overseas media waited for the news that the news was not predicted in advance, and the Chinese stocks listed in the United States should also rise. On the same day, the educational stocks rose sharply, and they would rise by 10%in the future. In addition, Meituan, Ali, etc. They also rose strongly. On Friday, Hong Kong stocks have significantly strengthened, and the Hang Seng Index rose by more than 1%.

The third news, since this year, Shanghai's economic operation has shown a "V" type rebound.

According to the First Financial Report, on August 27, Shanghai Mayor Gong Zheng said that the city's GDP in the first half of this year fell 5.7%year -on -year. The Shanghai economy showed strong development toughness under the serious impact of the epidemic. It is worth noting that Shanghai Industry has rebounded rapidly, and the growth rate of the total output value of industrial industries has decreased by 61.5%in April, turning to 15.8%in June, and an increase of 16.1%in July. Foreign trade imports and exports quickly recovered. From January to July, the import and export of goods in the city increased by 3%year -on -year. Among them, in July, it increased by 23%year -on -year, imports increased by 16.4%year -on -year, and exports increased by 32.9%year -on -year. In addition, from January to July, the proportion of strategic emerging industries accounted for 42%, the output value of the three major pilot industries increased by 8.4%year -on -year, and the output value of new energy vehicles increased by 57%.

Shanghai is undoubtedly one of the most important areas of China's economy. The above news has a positive effect on stabilizing economic expectations. However, in order to re -sort out market confidence, Brother Z feels that there may be uncertainty. After all, today's V -type reversal can only be said to be expected, there is no super -expected reversal. The most powerful favorable is to exceed expectations.

For the market, if you want to re -sort out confidence, you may still need a hearty rise, a heavy -duty Zhongyang line, or the Changyang line to truly reshape confidence.

There is also a message on the news on the weekend -everyone knows on Friday evening, the Federal Reserve Chairman Powell once again emphasized that the first task of the Federal Reserve is to reduce the inflation rate to 2%, and to use policy tools strongly and strongly In order to achieve the balance of supply and demand, even if this will cause pain to families and enterprises. Powell mentioned many times in his speech that historical experience shows that you cannot relax the monetary policy prematurely.

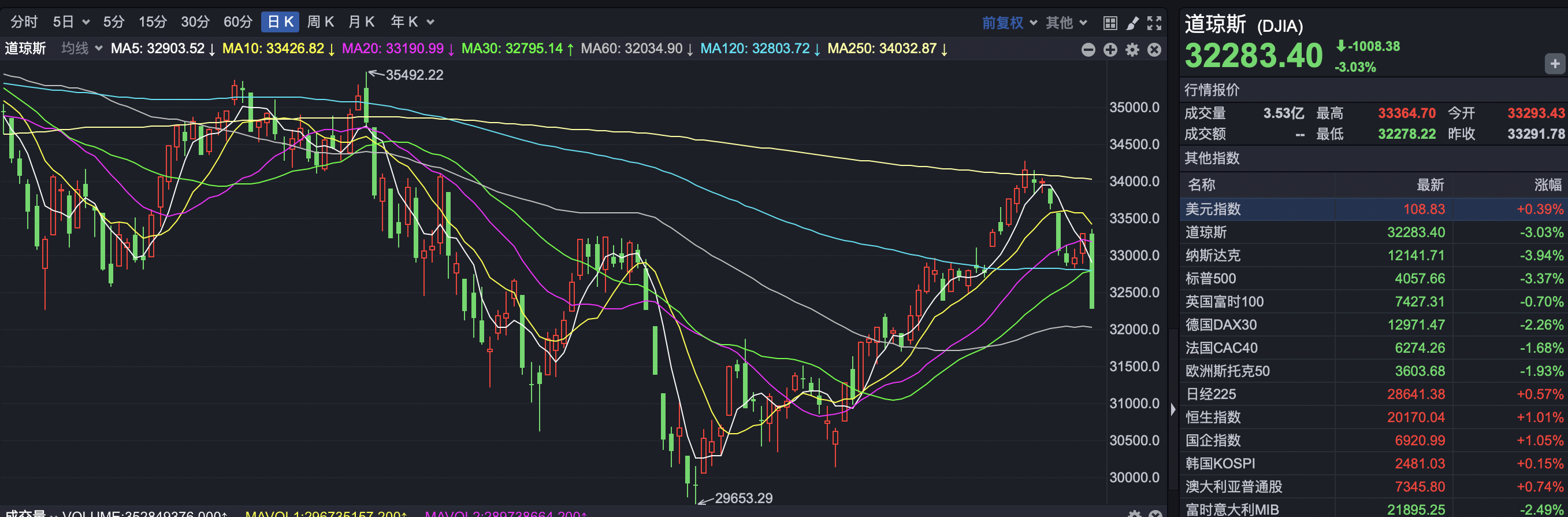

Affected by this news, the Dow Jones Index fell more than 1,000 points on Friday, a drop of 3%; the Nasdaq index fell 497 points, a decline of 3.94%.

Guosheng Securities believes that the Federal Reserve's policy position may only significantly turn in November, and the subsequent interest rate hike is more likely to be: September 75bp, November 50BP, December 25BP, February 25BP next year, then stopped hikes, 2023 2023, 2023 2023, 2023 2023 The probability of interest rates will be reduced in the second half of the year.

However, the interest rate hike itself does not necessarily constitute the stock market profit. Historically, the stock market rising situations have also appeared many times. Considering the current independence of A shares, U.S. stocks do not necessarily drive A shares to kill.

Overall, for the recent adjustment of A shares, Brother Z's attitude has become a bit tangled. In the current market, the effect of making money is not good. If you do n’t buy coal, you can basically only be a spectator. If you want to make a short -term, chase high, and the stocks that have been adjusted at the bottom will fall more. Recently, almost every short -term operation is cut out of meat. Since it is difficult to make money, maybe only rest for the time being. Before the market has not completely changed the market, you can only choose to rest.

The same is true of the fund. If it is not a heavy warehouse coal, the high probability performance is not good.

Since the beginning of this year, several products managed by the Wanjia Fund of Chongkang Coal Stocks can be described as a ride, and Wanjia macro -selected time, the income during the year is as high as 65%; 51%, becoming the only three products with a mixed fund of more than 50%. In addition, Wanjia Zhang Heng managed the flexible configuration of Wanjiayi, and also heavy coal, with 33%of the income during the year, ranking fourth in the mixed ranking. Looking down, the benefits of Yifangda's supply -side reform of Yifangda Yang Zongchang's reform of 29%, also a heavy warehouse coal.

The difference between these products at the top of the ranking is how high the position of coal stocks is. Among them, Wanjia macro -selected time, the positions of coal stocks are as high as 68%, and the real estate stock positions are 17%. Such heavy warehouse coal may be rare in history.

The view of the Yellow Sea is very clear. In the second quarter, the positioning structure of the value stock was appropriately adjusted, the position of the energy stocks was increased, and the position of the real estate stock was reduced. However, the income has gradually been fulfilled in such stocks that are too fast. On the whole, inflation is still the most important theme of the global economy at the moment. Unless the overseas economy has entered the second half of the decline, the upstream resource products such as energy are still a better direction.

Daily Economic News

- END -

For the first time in Shanghai Port, administrative penalties were carried out on the weight of unsatisfactory weight of the carrier container

On August 11, the Yangshan Port Maritime Bureau completed the administrative penal...

The three green companies of Zhongchuang Logistics, East Software, and Soft Control Shares disclosed the semi -annual performance, and the industry leader's performance has increased steadily.

Wind Financial Reporter Wu SiOn the evening of August 11, Zhongchuang Logistics (6...