Falling six weeks!Hong Kong second -hand housing prices hit a two -year low, and the bank's interest rate hike further impacted the property market?Hong Kong Government promotes supply growth

Author:Broker China Time:2022.08.28

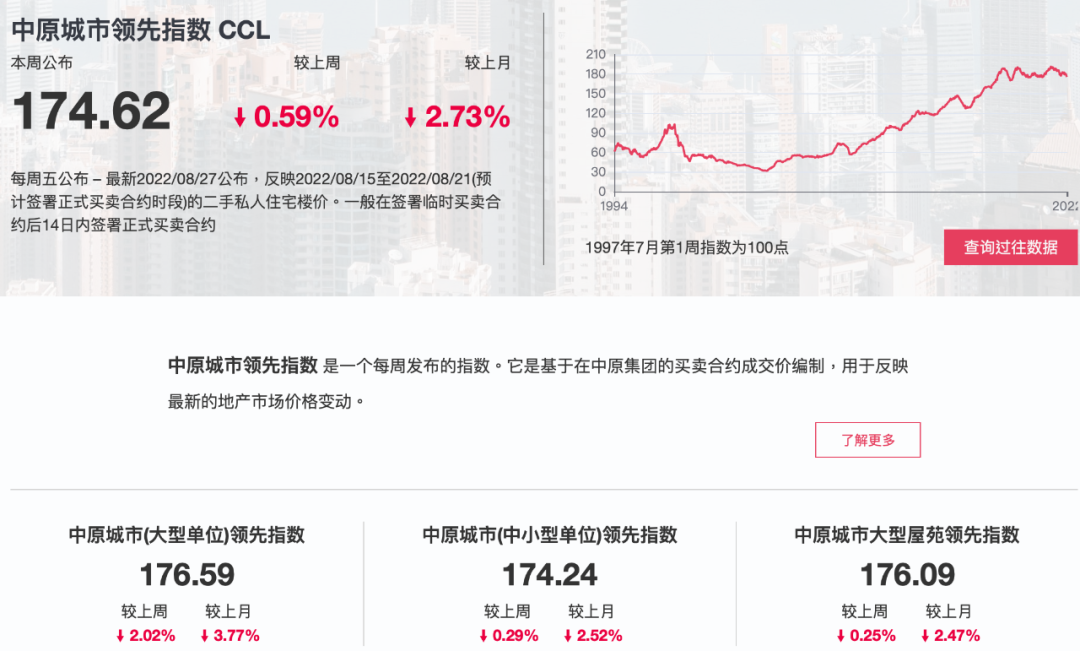

On August 26, the Central Plains City Leading Index (CCL), which reflects the trend of second -hand property prices in Hong Kong, fell 0.59%compared to a week ago at 174.62 points, a six -week low in a row, a new low in the past two and a half years.

Since the Fed started the interest rate hike cycle in March, the Hong Kong HKMA has followed up the base interest rate. The market is expected to increase the optimal loan interest rate (BLR) to increase the real estate mortgage interest rate and further increase the pressure on the real estate market and housing prices in Hong Kong.

Hong Kong's housing problem has a long time. In the past two sessions of the Hong Kong Chief Executives, it is also focusing on the relay, and strives to solve this problem as soon as possible. On July 30, Hong Kong's new Chief Executive Li Jiachao said that the Hong Kong government has established two working groups to deal with the supply of public housing and overall land house supply.

Hong Kong used building is endless

On August 26, the Central Plains City Leading Index (CCL), which reflects the trend of second -hand property prices in Hong Kong, fell 0.59%compared with a week ago to 174.62 points, a consecutive weeks of the past two and a half years. The index is announced every Friday, based on the preparation of the transaction price of the buying and selling contract in the Central Plains Group, reflecting the changes in the market price of the real estate in Hong Kong.

Among them, the large housing estate index was reported at 176.09, a weekly decrease of 0.25%, and a monthly decrease of 2.47%; the small and medium -sized unit index was reported at 174.24, a weekly decrease of 0.29%, and the monthly fell 2.52%; the large unit index was reported at 176.59, a weekly fall of 2.02 %, A monthly decline of 3.77%.

The Central Plains Real Estate Research Department stated that the CCL of the Central Plains City's leading index was reported at 174.62 points, a new low of 128 weeks (at 174.03 points in March 2020). In the past week, CCL fell below 175 points, and the short -term target tried 170 points, and returned to the level in early 2019. CCL has fallen for 6 weeks in a row, and has been seen since October 2019, and property prices have fallen.

Since the Fed started the interest rate hike cycle in March, the Hong Kong Monetary Administration has followed up the base interest rate, which has caused a series of chain reactions: since May, the Hong Kong dollar exchange rate has frequently touched the guarantee of the weak recipes; It dropped to less than 125 billion Hong Kong dollars, and the one -month Hong Kong Bank borrowing interest rate (HIBOR) rose from 0.25%to 1.85%...

In the background of HIBOR, the Hong Kong Central Plains Real Estate Price Index has declined since March 2022, and the price index of small and medium -sized housing in July decreased by 5.1%year -on -year, the largest decline since the refreshing epidemic.

It is expected that the bank's interest rate hike property market pressure

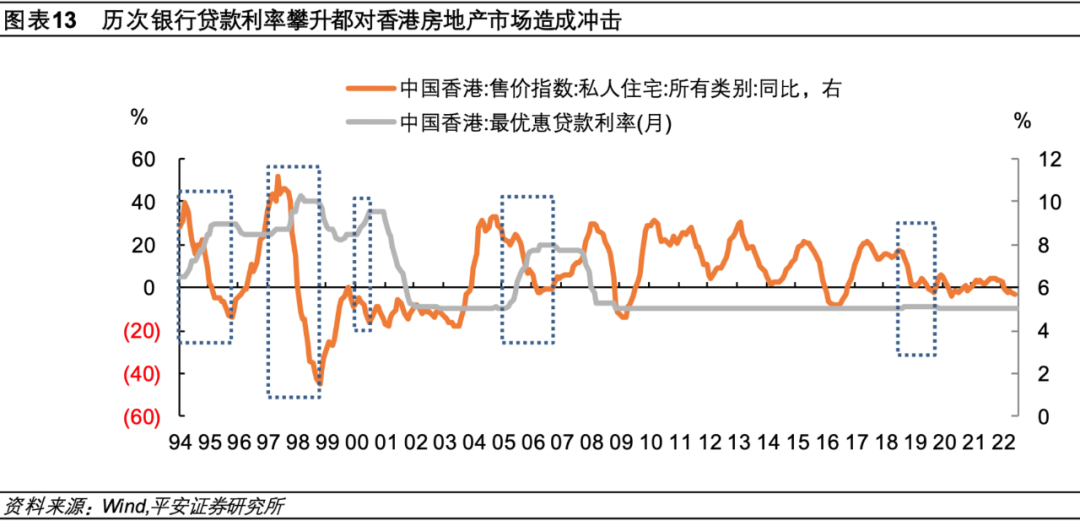

At the same time, analysts are worried that Hong Kong may soon increase the optimal loan interest rate (BLR, referring to the loan interest rate of the best commercial or residents), and then increase the cost of mortgage loans and increase the pressure of Hong Kong's real estate market. According to the data of the Research Department of China Gold, after the previous round of interest rate hikes, the bank raised BLR12.5 percentage points in September 2018. Hong Kong's real estate price was reduced by about 8.4%in February 2019.

"If the BLR is further raised in the future, it may increase the pressure on the interest of housing mortgage loans." Liu Gang, a strategic analyst at the research department of CICC, said that in the future, BLR raising BLR may increase bank costs and promote real estate mortgage interest rates. However, due to the lagging interest rate of the optimal loan interest rate, the impact on the overall financial conditions of Hong Kong stocks has limited impact on the overall financial conditions of Hong Kong stocks.

Zhong Zhengsheng, chief economist of Ping An Securities, mentioned that the current Hong Kong economy is facing large downward pressure. Since this year, Hong Kong GDP has been negatively increased for two consecutive quarters. Compared with the fundamental aspects of Hong Kong's bank raising loan interest rates in September 2018, the fundamentals of the loan interest rate are more fundamental. Weak. The unemployment rate in Hong Kong has risen again since February this year, as of 4.7%as of June, much higher than the 2.8%maintained from March 2018 to July 2019.

"Real estate and building ownership is an important pillar of the Hong Kong economy. In 2021, the actual GDP in Hong Kong reached 19.6%. Historically, each bank's interest rate hikes will cause Hong Kong house prices to be positive and negative. Once. "He predicts that if the interest rate of Hong Kong's loan in Hong Kong has risen significantly compared to the last time, the negative impact on the Hong Kong economy may be more obvious.

It is worth noting that Chen Maobo, the director of the Hong Kong Financial Secretary, stated on July 24 that although the property prices in Hong Kong have been slightly adjusted in the past few months, they still keep it up. Although more than half of the private residential properties in Hong Kong have no mortgage loans, when Hong Kong enters the interest rate hike cycle with the United States, the burden of mortgage repayment for builders will inevitably increase, and citizens still take the prudent strategy when buying a home or other investment decisions.

The Hong Kong Government strives for house problems

Hong Kong's housing problem has a long time. In the past two sessions of the Hong Kong Chief Executives, it is also focusing on the relay, and strives to solve this problem as soon as possible.

On June 9, the then Chief Executive Lin Zheng Yue'e in Hong Kong said that the government boldly tried to build a transitional house, which has now become an important part of the housing ladder. The authorities have promised to build 25,000 units, and have found enough land to build more than 21,000 units. She said that the supply of public houses in the government is 40%more than the supply of five -year term of the previous government. I believe that this number will increase significantly in the next ten years. Essence

By July 30, Hong Kong's new Chief Executive Li Jiachao also publicly stated that the Hong Kong government understands that society pays attention to housing problems. Therefore, two working groups have been established to deal with the supply of public housing and overall land house supply. Regardless of the supply of public housing or general land and houses, the government expects speed up, efficiency, and quantity. Authorities will explore the possibility of various sources of land, but at this stage, the main force will increase the supply from the existing source sources. Among them, the land of green areas is mainly considered. By the way, Chen Maobo said at the establishment ceremony of the Hong Kong Fangtuo Fund Association on August 25 that as of July this year, the market value of the Hong Kong Fangtuo Fund market was more than 21 billion Hong Kong dollars, an increase of nearly five times compared with 2005. The cumulative dividend index of the Hang Seng Real Estate Fund has increased by nearly seven times from the time of launching in 2008. It is far better than the increase in the total dividend index of the Hang Seng Index in the same period.

In order to promote the development of the Fangtuo Fund market, the Hong Kong government has launched support policies with multiple pronges. For example, the Hong Kong Securities Regulatory Commission amended the "Real Estate Investment Trust Fund Code" at the end of 2020 to relax the investment restrictions of the Fangtuo Fund; The foundation of fund investors; the Hong Kong government launched a three -year funding plan last year to further improve the attractiveness of establishing a Fangtuo Fund in Hong Kong.

Responsible editor: Gui Yanmin

- END -

The new blue ocean "hard sunscreen", the 100 billion market "can't cover"

Overview of this article: In the hot summer, sunscreen has become a consumer just ...

Tianjin Dongjiang Comprehensive Bonded Zone issued 73 stable economic measures

The reporter learned from the Dongjiang Management Committee that in order to maxi...