"Central European Contest" accelerate!Introducing international investors, A -share listed companies have flooded to GDR, and the test of securities firms is here.

Author:Broker China Time:2022.08.28

On August 26, the corresponding new domestic A -share stocks were listed on the Shenzhen Stock Exchange, which was listed on the Shenzhen Stock Exchange on the Shenzhen Stock Exchange. The first batch of GDR projects listed on the Swiss Stock Exchange (referred to as the "Ruixi Stock Exchange") was successfully issued.

In March of this year, "Shanghai -London" officially advanced as "Central and EUS". After three or four months, five A -share listed companies successfully issued GDR, including the first batch of 4 companies listed on the Swiss exchange. According to the incomplete statistics of Chinese reporters from securities firms, at least 11 A -share listed companies have publicly disclosed the GDR issuance plan. foot.

With the rapid increase in project reserves and the increasingly diverse distribution of human types, GDR issuance is becoming a sector that cannot be ignored in international business. Although the entire industry is looking forward to the future scale effect of GDR, how to tell Chinese stories in the global background and introduce long -term international investors are still subjects that intermediary agencies need long -term research.

A -share listed company rushed to GDR

On July 13, Mingyang Intelligent successfully issued GDR on the London Exchange, and successfully raised $ 707 million after exercise of excessive distribution rights. This is the first single GDR in the background of the "China -EUS", which has been released from the previous single GDR, which has passed nearly two years.

And this is just the beginning. On July 28, the GDR issued by the four A -share listed companies of Shanshan, Kodak Manufacturing, Guoxuan Hi -Tech, and Green Mei listed on the Swiss Stock Exchange on the same day. Unlock the new map of Switzerland.

Back to the distribution process of the first batch of four Ruixi Stock Exchange's GDR, it can be found that from the announcement items to the implementation of the issuance, it is only three to four months. CICC's strategy research believes that under the current mechanism, the process of approval and distribution of GDR is relatively smooth, which is more controllable for time management expectations for issuers.

In fact, after the above 5 GDRs listed in July, the teams of A -share listed companies that plan to issue GDR are still growing. According to incomplete statistics from Chinese reporters from securities firms, at present at least 11 listed companies in Shanghai and Shenzhen have announced their plans to issue GDRs and listed on the Switzerland/London Stock Exchange.

Among them, Xinwangda's GDR issuance application has been accepted by the China Securities Regulatory Commission, and the GDR distribution project of Health Yuan and Lepu Medical has even been approved by the Conditions of the Swip Stock Exchange Regulatory Bureau -the first batch of GDR projects to go to Swift from the Swiss It was approved to be officially listed in the Ruixi Stock Exchange Supervision Bureau, and it was only about a week in the middle.

An interesting trend is that companies trying to issue GDR and embark on the international stage are becoming more and more diversified.

On the one hand, as the Shenzhen Stock Exchange was included in the category of the "China -EUS", the listed companies of Guoxuan Hi -Tech and Green Metro Shenzhen Stock Exchange successfully landed in the Ruixi Stock Exchange not long ago. The listed companies of the 4th Shenzhen Stock Exchange are waiting in line. Lepu Medical is even expected to become the first GEM company to complete the GDR distribution.

On the other hand, the four GDRs under the "Shanghai -London" mechanism were all companies in traditional fields such as finance and electricity. The current GDR reserve project covers multiple "new economy" areas, involving new energy, semiconductor, medicine, and medicine. Consumption and other tracks. Mingyang manufacturing recently listed on the London Exchange is a private high -end equipment manufacturing enterprise.

"In the past 'Shanghai -Londonon' only for the Shanghai motherboard, there were relatively more state -owned enterprises in accordance with the conditions, and private enterprises were watching at the time." In an interview with Chinese reporters from securities firms, Sun Lijun, co -headed by UBS Securities Global Investment Banking Department, said that " The China -Europe Connect "is open to the Shenzhen Stock Exchange, and the increase in eligible private enterprises, and more policies have continued to support domestic enterprises to strengthen international business and broaden overseas financing channels.

Zeng Luhai, director of Huatai Financial Holdings Investment Banking Department, also mentioned that this change fully reflects that GDR has gradually received more attention and sought after, and reflects the vitality of the product. From the perspective of Zeng Luhai, combined with the issuance conditions and product advantages of GDR, companies with market value meet the requirements and have overseas business expansion needs can consider the issuance of GDRs to help enterprises' long -term development and increase the international influence of enterprises.

To introduce high -quality investors

At present, many "new economy" industries in China are in the ascendant, and GDR issuers tend to be diverse. Related high -quality companies choose to go public in the sea, which is conducive to the issuer to expand international business in the future, but also attract more high -quality international investors.

"GDR products provide opportunities for overseas investors to invest in high -quality A -share companies." Zeng Luhai said that A shares are assets with good liquidity in the global market. Good investment income.

As far as the investment group is concerned, London, as an old financial center, has a great advantage in attracting international medium and long -term investment institutions; Switzerland, as a well -known offshore wealth management center, is also attractive to many overseas investors; Germany, as a European economic train, Its financial market has also attracted the attention of many investors.

In Zeng Luhai's view, the three major markets that are currently incorporated into the "China -EUS" are not much different, and they are very mature and excellent. When choosing a listing place, the issuer should make judgments based on its own development needs and the business layout of the upstream and downstream industrial chain partners.

However, it is worth noting that, according to preliminary experience, the London Stock Exchange has issued GDRs to face the lack of survival caused by recovery. After all, since the opening of "Shanghai -London" in 2018, the discount rate of GDR issuance is generally around 10%, which has not only made great attractiveness to investors, but also attracted investors to return arbitrage. At present, there are two main ways of gaming differences in GDR: one is to choose to buy the GDR until the restricted period will be returned to A shares; the other is to sell A shares and sell A shares, and buy GDR at the same time. Sun Lijun believes that the issuance of a successful GDR project will make investors more diverse. In the process of participating in the GDR distribution, UBS often pays more attention to the introduction of high -quality domestic and foreign investors that recognize the fundamental of the issuer. These overseas investors are not profitable from short -term transaction differences, and they may not generate GDR redemption or cancellation during transaction, which helps reduce a large amount of redemption.

For enterprises, after the successful issuance of GDR, the purpose of overseas financing has been realized. The issuer usually hopes that the GDR can last for a long time and maintain active transactions to help shape the positive image of the enterprise. Therefore, the pressure of redemption will also in turn promote the company's continuous improvement of performance, increase the attractiveness of fundamentals, and attract more high -quality investors. With the increase of GDR issuers, the problem of redemption may be further differentiated.

Zeng Luhai also mentioned that a large number of GDR returns leads to insufficient deposits. Part of the reason is that there are fewer GDR listed companies, and the overall scale needs to be further growing. It is believed that over time, more and more enterprises are listed, and the activity of the entire sector will also increase. It is expected that this situation will have a limited impact on the power of the enterprise's GDR.

The Huatai Securities Strategic Research Team has previously analyzed that with the maturity of the GDR issuance, the price difference space has quickly converged, considering the risk of RMB depreciation and exchange rate costs, the income space is very limited, and the sensitivity to the pressure on the depreciation of the RMB during the period is increased. In the short term, the positive stocks have obvious negative excess returns and positive liquidity effects after the issue of GDR. In the long run, the issuance of GDRs is a high -quality target in the industry, and the investment cost is relatively high.

It's time to test the brokerage firms

"When a broker does this job, you need to consider how to tell the story of Chinese investors well, so you need to have a certain international perspective." Sun Lijun told the broker Chinese reporter that UBS is a platform for integration at home and abroad to serve in the country. In terms of overseas issuance and listing of enterprises, it has a natural advantage. Each single GDR distribution business is usually completed by teams in Europe, Hong Kong, and domestic, which can accurately control the rules, market conditions, and investor needs of domestic and foreign regulatory supervision.

According to Sun Lijun, the research coverage of the brokerage company itself also played an important role in the process. Through in -depth research reports, investment banks can not only enhance investors' understanding of the issuer, but also help enterprises to further optimize their operations. For example, UBS has been awarded the Global Best Stock Research Company in the world for 4 consecutive years, laying a solid foundation for in -depth excavation of the investment value of the issuer.

GDR investors are mainly divided into strategic investors, Chinese foreign -funded long -term funds and hedge funds. Zeng Luhai said that Huatai International has participated in most of the GDR projects on the market throughout the market. In the process, Huatai team, based on full integration, and industrial investors at home and abroad, well -known long -term investment institutions with international influence And multi -strategic funds are closely linked to achieve double -wheel coverage at home and abroad.

Taking the GDR issuance project of Shanshan Co., Ltd. as an example, Huatai, as a global coordinator, gives full play to the rich capital market experience and extensive, in -depth domestic and overseas integrated business chain and investor coverage advantages, and actively coordinate the promotion of the underwriting group. Within one hour after opening the book, the order coverage of the basic scale is achieved. In just two hours, the bookkeeper is completed and the efficient conversion of orders will be achieved, and the issuance scale of $ 319 million will be achieved.

During the roadshow, he assisted Shan Shan shares to hold nearly 100 non -trading road shows, arranged a large number of internationally renowned investors to exchange, and finally introduced high -quality Investor group.

Sun Lijun also mentioned that securities firms assisted Chinese companies to issue GDRs overseas, and successful listing was just the beginning. Follow -up also needs to assist the issuer to communicate with investors, carry out annual road shows, performance road shows or non -trading road shows, answering questions that investors care about, etc., including subsequent supervision and communication, marketing, and stable market operations. Comprehensive long -term service capabilities.

Responsible editor: Gui Yanmin

- END -

Minghui shares in the semi -annual net profit of 15.7242 million yuan in 2022 increased by 36.41% year -on -year

On August 25, Minghui (Code: 837510.NQ) released the performance report of the 2022 Half -Annual Report.From January 1, 2022-June 30, 2022, the company realized operating income of 281 million yuan, a

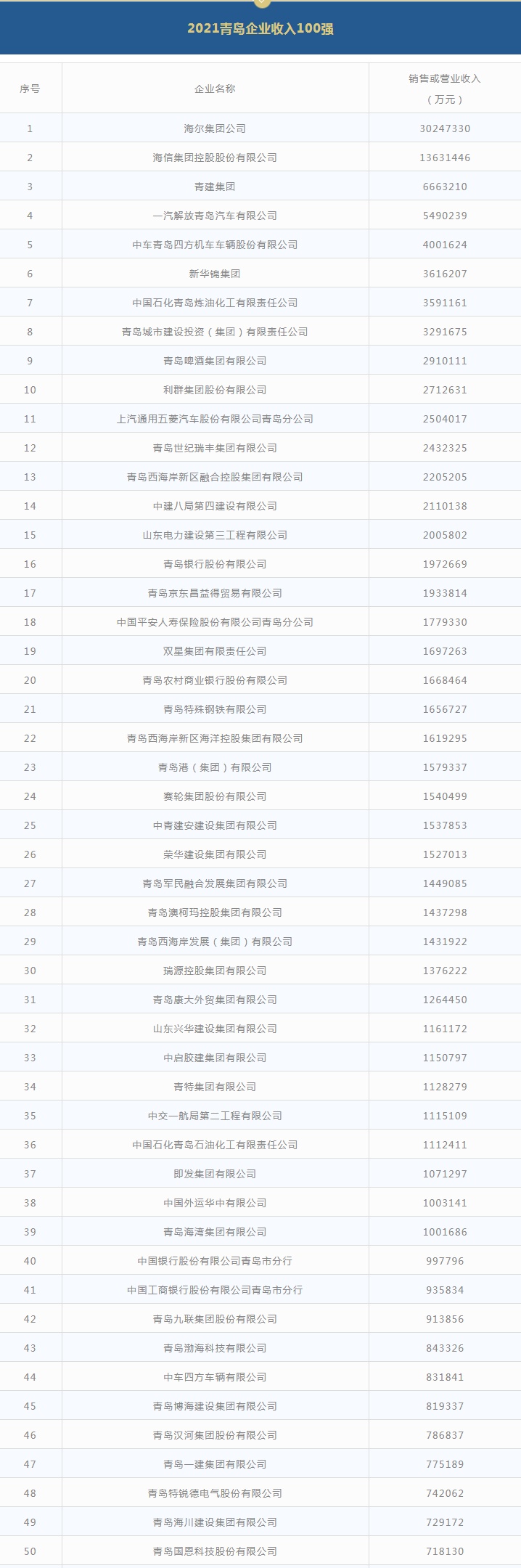

2021 Qingdao Enterprise 100 released, of which 30 are the most profitable!

A few days ago, the 2021 Qingdao Enterprise 100 List was officially released. The ...