The investment path of Certificate Gold and Huijin: Reduce holding 13 companies, heavy warehouse biomedicine, power and securities sector

Author:Huaxia Times Time:2022.08.28

China Times (chinatimes.net.cn) reporter Chen Feng, a reporter Zhang Mei Beijing reported

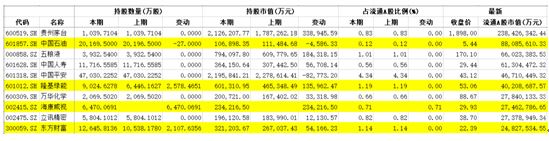

With the semi -annual report of 2022, according to the data of the top ten shareholders of listed companies, China Securities and Finance Co., Ltd. (hereinafter referred to as "China Securities Finance") and Central Huijin Asset Management Co., Ltd. (hereinafter referred to as "Central Huijin") The holding of the shareholders surfaced.

Overall, the biomedicine, power and securities firms are the focus of attention of the two companies.

Chen Li, chief economist of Chuancai Securities, told the reporter of "Huaxia Times" that the electric power sector has been a hot spot in the past year. Whether it is traditional energy or new energy, there are many investment points, especially in overseas electricity prices and energy sources In the context of a sharp rise in prices, the attention is significantly increasing. The latest concepts include virtual power plants and energy storage. Many of them are breakthroughs in future technological breakthroughs. Fund layout of key development is also showing corresponding forward -looking.

Zhang Cheng, chief investment consultant of Datong Securities, told the reporter of the Huaxia Times that as a certificate of gold and Huijin representatives, from the data from the central report, the choice of the two companies is basically the leader of various industries. The characteristics of excellent performance and stability are the variety of investors called "industry". From the perspective of the two positions, one is to reflect the characteristics of long -term investment stability; the other is the characteristics of value investment.

56 shares held at the end of the second quarter of China Securities Finance

According to the Flush iFind data, during the mid -reporting period (before June 30) in 2022, China Securities Finance held a total of 56 companies, compared with 160 in the previous period (the first quarter of 2022), a decrease of 104. CSI Finance held a market value of 193.521 billion yuan, a decrease of 351.484 billion yuan compared with 545.05 billion yuan in the previous period (the first quarter of 2022).

Among the 56 companies holding positions during the CSI Financial During the reporting period, the number of shares of 12 companies such as Huanxu Electronics, Sichuan Investment Energy, Lujiazui, and Dongxing Securities have changed, and the changes in the number of 12 shares in 12 shares are reduced. hold. Hebang's shares were reduced by 984.176666 million shares, the largest number of reduced holdings; the number of Yutong Bus and Soochow Securities were ranked second and third, respectively. Lan Zhijia and Dongxing Securities have been reduced by more than 30 million shares.

The reporter's semi -annual report of the top three companies in viewing the number of reduced holdings found that the net profit of the reduction of the company's return to the mother has decreased significantly.

Specifically, the semi -annual report of Hebang showed that in the first half of 2022, operating income was 71.994 billion yuan, a decrease of 4.05%year -on -year; net profit attributable to shareholders of listed companies was 974 million yuan, a year -on -year decrease of 35.98%; the basic earnings per share were 0.094 yuan, and the income per share was 0.094 yuan. A year -on -year decrease of 27.69%.

Yutong Bus semi-annual report shows that in the first half of this year, Yutong Bus achieved operating income of 8.26 billion yuan, a decrease of 15.78%from the same period last year; the net profit of home mother was -65.26 million yuan.

Soochow Securities semi -annual report shows that the company achieved operating income of 4.301 billion yuan, an increase of 5.64%year -on -year; the net profit attributable to mothers was 818 million yuan, a year -on -year decrease of 38.82%.

From the perspective of the sector, the brokerage sector is the most popular among China Securities Finance. Six listed companies have obtained shares, namely Soochow Securities, Guoyuan Securities, Dongxing Securities, Everbright Securities, Founder Securities, and State Investment Capital.

The pharmaceutical manufacturing industry ranks second. Five listed companies have held shareholding, namely Hengrui Pharmaceutical, Pianzi, Bai Yunshan, Andy Su, and Hualan.

4 companies in computers, communications and other electronic equipment manufacturing have obtained shares, namely Lixun Precision, Dahua, Aerospace Information, and Huanxu Electronics.

Four companies in power and thermal production and supply industries have obtained their holdings, namely China Nuclear Power, Huaneng International, Guodian Power, and Sichuan Investment Energy.

There are 3 companies in the automotive manufacturing industry, which are Huayu, Yutong Bus, and SAIC Group.

Among the wine, beverages and refined tea manufacturing, Guizhou Moutai, Tsingtao Beer, and Wuliangye obtained holdings.

In monetary finance services, Ping An Bank, CITIC Bank, and Nanjing Bank obtained holdings.

In the civil engineering construction industry, Greenland Holdings, China Chemistry, and China Electric Power Construction have obtained holdings.

Among the non -ferrous metal smelting and extension industry, China Aluminum, Nanshan Aluminum, and Jiangxi Copper Industry obtained shares.

Central Huijin held 64 shares at the end of the second quarter

According to Flush iFind data, during the mid -reporting period (before June 30) in the mid -2022, the Central Huijin held a total of 64 companies, which was 92 compared with 156 in the previous period (the first quarter of 2022). Central Huijin held a market value of 92629.448 million yuan, a decrease of RMB 766,653.983 million compared with the previous period (the first quarter of 2022).

Among the 64 companies holding positions during the Central Huijin During the reporting period, 4 companies have changed the number of shares of the company, 3 of which have increased their holdings, 1 reduction, and most of the remaining shares have changed.

Specifically, the four companies of Hikvision, Oriental Wealth, Longji Green Energy, and PetroChina have changed. Among them, Hikvision was increased by 647.0691 million shares, Longji Green Energy was increased by 25.784651 million shares, Oriental Wealth was increased by 210.76356 million shares, and PetroChina was reduced by 270,000 shares.

Hikvision's semi -annual report shows that the company achieved operating income of 37.258 billion yuan in the first half of the year, an increase of 9.90%over the same period last year; the net profit attributable to shareholders of listed companies was 5.759 billion yuan, a decrease of 11.14%over the same period last year. Longji Green Energy Disclosure disclosed that the company achieved operating income of 50.417 billion yuan in the first half of the year, an increase of 43.64%over the same period last year; the net profit attributable to shareholders of listed companies was 6.48 billion yuan, an increase of 29.79%over the same period last year.

The Oriental Fortune Semi -annual report shows that the company achieved operating income of 6.308 billion yuan in the first half of the year, an increase of 9.13%over the same period last year; the net profit attributable to shareholders of listed companies was 4.443 billion yuan, an increase of 19.23%over the same period last year.

From the perspective of the sector, the pharmaceutical manufacturing industry is the most popular among the Central Huijin. 8 companies have obtained positions, namely Hengrui Pharmaceutical, Changchun High -tech, Xinlitai, Jiangzhong Pharmaceutical, Kunyao Group and Kangyuan Pharmaceutical, Hai Xin, Hai Xin Shares and Yongan Pharmaceuticals.

Followed by 6 companies in the real estate industry, they are Lujiazui, Financial Street, Shunfa Hengye, Nanjing Hi -Tech, Black Peony and Shen Zhenye A.

Six companies that are in power, thermal production and supply industry are Guodian Power, Sichuan Investment Energy, Hubei Energy, Inner Mongolia Huadian, Tongbao Energy, and Building Energy.

Three companies in the brokerage sector are Oriental Wealth, Founder Securities, and Northeast Securities.

Editor: Editor Yan Hui: Xia Shencha

- END -

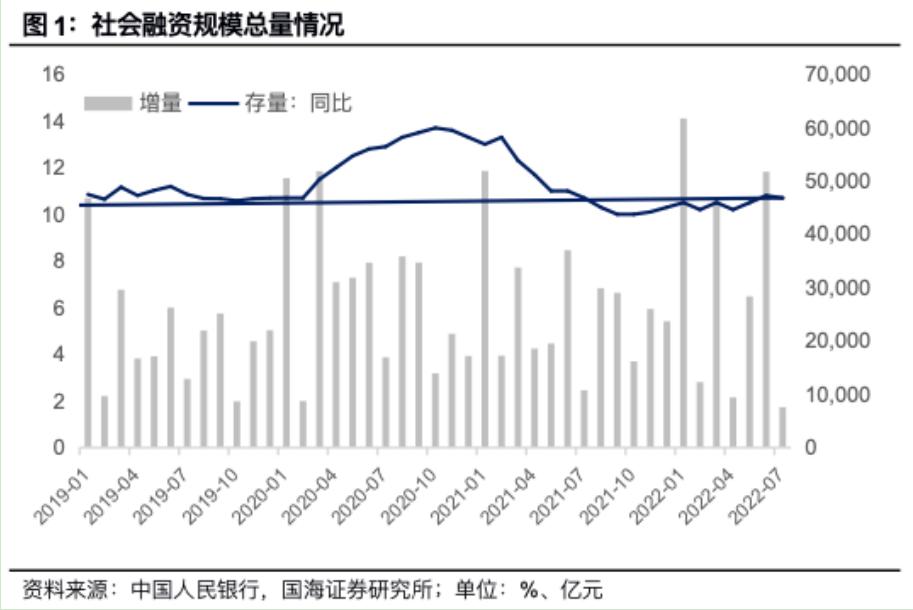

Xia Lei: Why did social merit in July reverse?

Zhongxin Jingwei, August 15th: Why did social merit in July reverse?Author Xia Lei...

Korla City: "Hydroponic Five" makes cattle and sheep "not worry about food" in the four seasons

Hydroponic Female training base. Photo by Zhao ShuangTianshan Net News (Correspond...