"Buy 3200 points of 2900 points", not a joke

Author:Beijing Commercial Daily Time:2022.08.28

Some investors said that they bought stocks at 2,900 points, but they were covered by 3200 points. In fact, this is not a joke. This phenomenon will become the norm in the future.

If investors cannot choose a good sector and individual stocks, they will lose money after seeing the right market.

Earning the index to lose money is one of the most depressed things for investors. Obviously looking at the right trend, but I couldn't make money, and I was stuck. This is really investment tragedy, but this phenomenon has existed before, and there will be more in the future. Because the number of listed companies is increasing, it is impossible for stocks to rise and fall. The index is only a comprehensive response of a large number of constituent stock trends. There is no reason to say that Tianqi Lithium Industry has risen. It will be completely consistent, the performance of the index is the result, not the reason.

When the stock market continues to expand to the huge scale now, the boundary of the bull market at this time is no longer so clear. If it does not take the time to more than a year, it is difficult for investors to say whether it is now in a bull market or a bear market, so this column says that in the future, it will be in the stage of heavy stocks for a long time. Then 2900 points cannot be said to be the bottom of all stocks, and it is impossible for all stocks to be higher than 2900 points at 3200 points.

Therefore, investors who have the ability to study listed companies can choose to buy and hold stocks worth investing at any time. Those investors who are good at analyzing the overall trend of the stock market, but not stock selection will repeatedly earn the index and compensate. money. However, this is not to say that these investors have no speculation opportunities. On the contrary, this column believes that these investors will usher in greater investment opportunities, because funds and financial derivatives now Go to buy specific stocks.

For example, investors believe that the stock market will rise from 2,900 points to 3200 points, so he does not need to choose the stock. Regardless of which sector he performs well, investors can get satisfactory investment income as long as they buy index funds or stock funds directly. If investors feel that they don't make enough money, they can also buy more index funds through financing business, so that they can use leverage transactions.

If investors think that the proportion of leverage of financing is not addictive, then investors can also buy stock index futures and invest in the stock market. If investors buy stock index futures at 2900 points and sell at 3200 points, investors may get capital flip throughout Double income, this level of income will not be less than investors with excellent stock selection. If the investor's research on the stock market is particularly accurate, you can also invest through the stock options or the stock index options, then the gain from 2900 to 3200 points may occur 3 times or even 5 times even more than 10 times.

Therefore, this column says that those investors who look at the index but do not choose stocks must avoid strengths and avoid weaknesses, reduce investment in specific stocks, and increase investment in financial derivatives. This is the investment channel suitable for these investors.

The so -called knowledge is known, and I do n’t know if I do n’t know. The correct explanation is that if you have this advantage, you do this. If you have this advantage, do other things. This is the truth. It has nothing to do with knowing if I know. The same is true for investors. When choosing stocks, when choosing stocks, it is the truth.

Critics 丨 Zhou Kejing

Edit 丨 Zhang Lan

Picture 丨 Vision China

- END -

Baoying County Party Secretary Zhang Xiaohui: Create a good business environment into a "industrial strong county" characteristic business card

Reporter: Ju Dajun Lin MeiToday (June 17), Baoying County held a promotion meeting...

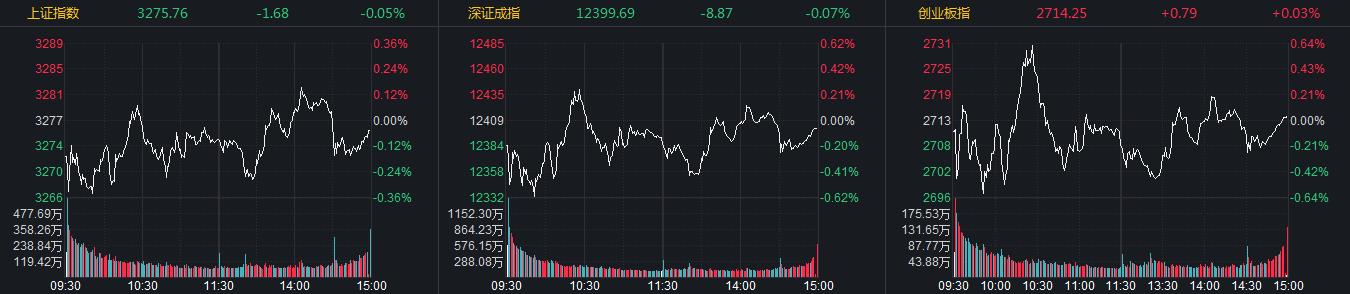

Innovation refers to the reddish daily limit, TOPCON batteries, energy storage and other concepts have risen sharply.

Zhongxin Jingwei, July 27th. On the 27th, the three major A -share stock indexes o...