Just now, the Asia -Pacific diving, A shares were standing up!180 billion giants pull 13%crazy!This track broke out again, and 70 billion white horse stocks suddenly fell!The newest stocks have a daily limit of 17, soaring 560%

Author:China Fund News Time:2022.08.29

China Fund Newspaper Jiangyou

A -share independent day. The US stocks "collapsed" on Friday night, and the global financial market was turbulent. However, after the low opening of A shares after opening, the science and technology board rose more than 1%.

Affected by the turbulence of the peripheral market, the main index of A shares rose collectively after the early morning of the board was low. The Shanghai Stock Exchange Index fell by more than 1%from the opening, and only fell slightly by 0.14%in the morning. The Shenzhen Stock Exchange Index also fell only 0.38%. The closing in the morning rose 1.01%. Individual stocks rose more, 2688 rose, only fell in 2013, and the market turnover was 553.6 billion yuan.

Machinery, military, catering, tourism and other sectors have led the rise, and heavy real estate, insurance, liquor, banks and other sectors have fallen a lot.

The Asia -Pacific market has plummeted. On Friday evening of Beijing time, the Fed Chairman delivered a speeches of the Monetary Policy Eagle. The US stocks fell to the ground that night. The three major indexes of the US stocks fell more than 2%, and the Nasdaq index fell 3.94%. This morning, the Asia -Pacific market also fell. As of 11:30, the Asia -Pacific major stock market fell across the board. At 6961.4 points. The Hang Seng Index of the Hong Kong stocks also fell more than 0.6%.

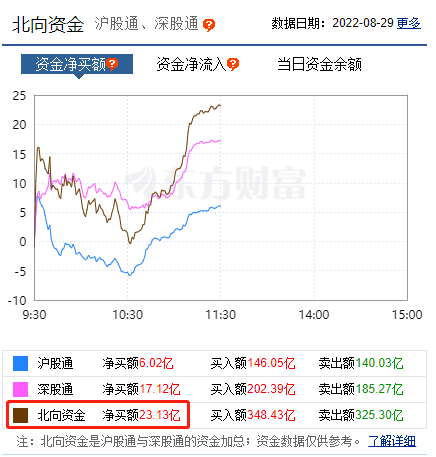

The peripheral market is turbulent. The foreign investment in the north is still buying A shares all the way in the morning and 2.3 billion yuan in the morning.

700 -person performance explanation meeting

180 billion Crystal Energy rose by more than 13%

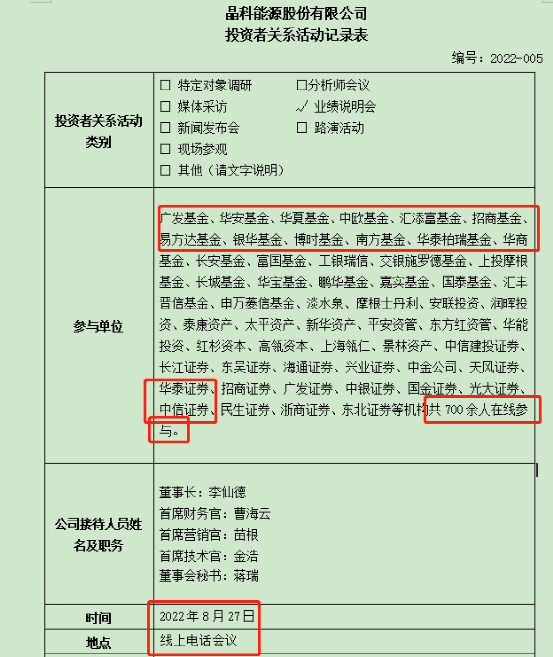

Photovoltaic module giants have not only dazzling performance, but also announced a 100 billion procurement contract. However, the performance briefing was held. Many funds and brokerage giants and more than 700 people attended the meeting.

Then, after opening the market early in the morning, after a slightly high opening of 0.63%, a meal was pulled, the highest rose by over 13%, and the closing of the market rose 10.8%in the morning, with a market value of 176.5 billion yuan, close to 180 billion yuan.

On the evening of August 26, Jingke Energy released a bright semi -annual report. In the first half of 2022, the company realized operating income of 33.407 billion yuan, an increase of 112.44%year -on -year; net profit attributable to mothers was 905 million yuan, an increase of 60.14%year -on -year.

According to the analysis, Jingke Energy will fully benefit from the industry demand volume in the context of global clean energy transformation, and the company's own competitive advantages are significant, such as the increase in the scale of integrated production capacity and the continuous optimization of the structure. TOPCON batteries and component production capacity will also enter Reproductive stage.

The company also issued a 100 billion yuan procurement contract announcement. The announcement stated that from 2023-2030, the company and their subsidiaries purchased 336,000 tons of native polysilicon from the contract. Assume that the average domestic single crystal -to -chip -derivative transaction price was calculated by the latest domestic single crystal tightly material issued by the China Nonferrous Metal Industry Association's Silicon Branch (that is, August 24, 2022), and the total purchase amount is expected to be about RMB 10.02077 billion.

Just after the performance was released, the company held an online performance briefing of more than 700 people on Saturday on Saturday, August 27. Many top -flow funds and securities firms attended the meeting. It can be seen that the company was sought after by institutions.

In the concept sector, the TOPCON batteries, photovoltaic and other sectors related to Jingke Energy have increased.

Among the photovoltaic sectors, Hemai, Ming Guanxin, and Yingjie Electric have risen sharply.

The new stock

17 daily limit soaring exceeding 560%

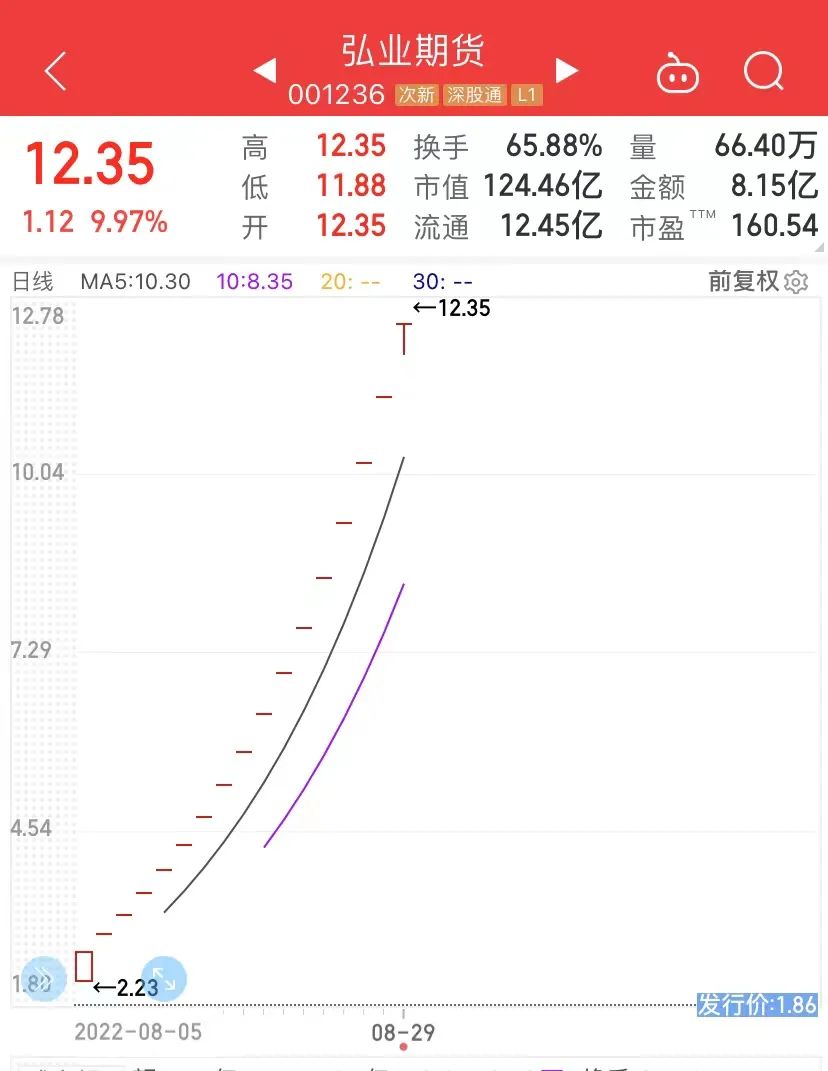

Although the new shares Hongye Futures opened today, the daily limit was opened, but the daily limit was still recovered. Today is the 17th daily limit after listing. The closing price is 12.35 yuan, and the total market value is 12.4 billion yuan. When it was listed on August 5, the issue price was 1.86 yuan, and the stock price increased by 564%.

The latest market value of Hongye Futures A shares is still only 1.2 billion yuan. Market analysis believes that the issue price is low and the circulation is small, which has become an important target for fund hype.

Before this year, before Hongye Futures, the most daily limit for the main board was the 12 consecutive daily limit boards that have established new energy and Hefu China before.

The performance increased, the 70 billion chip bull stocks suddenly fell

Although Jingke's energy performance is bright and the stock price is crazy, there is also a great increase in performance, but the stock price has a limit limit. It is still a popular chip track stock. Last Friday, there was still a market value of more than 70 billion yuan.

In the early morning of this morning, Nasda disclosed the first half of the year. The announcement shows that the company's semi -annual operating income was 12,296,461,669.25 yuan, an increase of 10.03%year -on -year, and the net profit attributable to shareholders of listed companies was 1,065,966,168.63 yuan, an increase of 102.49%year -on -year.

However, the trend of stock prices has made many investors stunned. After opening 2.51%low in the early trading, Nasda's stock price fell quickly and went straight to the limit, and the closing in the morning was close to the daily limit.

Nasda said that in the first half of 2022, overseas gradually relaxed the control of the epidemic, and business activities began to recover, driving the global printing market demand to recover.During the reporting period, the overall operating conditions of the company's printer business were smooth and good. Bentu adopted the test of the shortage of domestic epidemic and supply chain materials in the first half of the year, and achieved positive growth year -on -year;Batch shipments, the renewal rate of printing management services is further consolidated, and the profitability has continued to increase.In terms of integrated circuit business, the company is a leading company as a chip design. It continues to maintain a leading position in the field of consumable chip. It has also made breakthroughs in non -printing fields such as automotive electronics, industrial control, medical equipment, and high -end consumer electronics.Passed the AEC-Q100 certification to lay the foundation for the high growth of the future chip business.

Edit: Joey

- END -

Guangyao Group and Xipa Group signed a strategic cooperation agreement to jointly promote the development

Tianshan News (Reporter Hei Hongwei reported) On the afternoon of August 4, Guangz...

Emergency science 丨 Video: How to prevent and avoid floods

Data-version = 0 data-vwidth = 1920 data-vHeight = 1080 transcoding = 1 style = width: 400px; What is flood?In the event of a flood threat, how to avoid self -rescue in different circ