"Lehman Time" in the currency circle?Bitcoin fell below $ 18,000 and 150,000 people burst out

Author:Poster news Time:2022.06.19

"Seeing him from the tall building, seeing his banquet, seeing him collapsed ..."

In the past few years, the cryptocurrency field led by Bitcoin has set off a rare speculative frenzy in history. Especially after the epidemic, the central banks of various countries have made a large amount of liquidity to rescue the market. "Congzhan", "Air Coins", and "MLM" have sprung up endlessly, and Bitcoin has reached a historical peak of $ 69,000/piece from November 2021. But now, this "Miracle Miracle" is undoubtedly ushered in "dreaming time"!

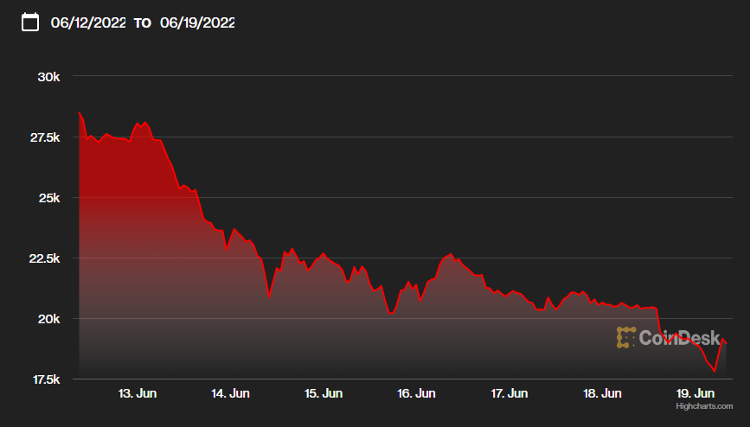

According to the quotation of Coindesk, Bitcoin, the largest market value of Bitcoin, still has a blood flow after Saturday's loss of 20,000 US dollars. Exploring 17601 US dollars, the lowest since December 2020. At present, Bitcoin has fallen for 12 consecutive days, which set the longest continuous decline since its birth in 2009.

Ethereum, which ranked second in market value, also fell below $ 1,000 on Saturday, down nearly 11%to $ 975.24, and hit the lowest position since January 2021.

The two leaders in the cryptocurrency market have fallen from the historical high set by the early November last year.

The plunge of the currency value undoubtedly caused a new round of storms in the entire network -according to data from Coinglass, as of 8:00 on June 19, a total of 150,000 people in the digital currency field have been burst in the past 24 hours. As high as $ 567 million.

At the same time, a intuitive comparison shows that the severe frustration of the cryptocurrency market in the past seven months has caused its market value to damage a "apple" -the current total market value of the entire cryptocurrency market is only about 8340 It was $ 100 million, and in November last year, it was as high as US $ 3 trillion. In just 7 months, the cryptocurrency market had "evaporated" more than $ 2.1 trillion, close to the current US technology stock leader Apple Company's current 2.13 trillion yuan 2.13 trillion yuan The market value of the dollar.

OANDA senior market analyst Edward Moya said on Saturday, "Bitcoin falls below $ 20,000 indicates that confidence in the encryption industry has collapsed, and people are seeing the latest huge pressure. Lala players are also quiet now. They are still optimistic about long -term prospects, but they dare not say that they are buying at low now. "

Tianlei Rolling: The "Lehman Crisis" of the currency circle is fully staged?

Bitcoin traded most of the $ 30,000 mark in May, but in June, with the global new inflation shock and concerns about the Federal Reserve's interest rate hike, the price of Bitcoin fell sharply. Investors have been selling assets that are regarded as high -risk, such as cryptocurrencies and technology stocks.

Local time on Wednesday (June 15), the Fed announced that the benchmark interest rate was raised by 75 basis points, which was the largest interest rate hike since 1994. Fed officials predict that this year will continue to raise interest rates to curb inflation. The interest rate point map of 18 Federal Reserve officials predicts the medium value of the interest rate point. The benchmark interest rate will rise to 3.4%at the end of this year, which indicates that the Fed will likely need to raise interest rates by 175 basis points by the end of the year.

In the context of the tightening of the central bank's currency, the pressure of the encryption industry has continued to intensify. What worsen all the snow was that at this time, the liquidity crisis of decentralized finance (DEFI) platform began to be transmitted to the entire encryption market. More and more encrypted companies have begun to feel the pain of being called the "encrypted market winter".

In the past week, many investors in currency circle suddenly found that they are in a thunder areas that may suffer from a "downturn" every step. The collapse of the Terra blockchain last month seemed to be the beginning of all disasters- — From the Ten billion -scale crypto -loan platform CELSIUS at the beginning of the week at the beginning of the week, CELSIUS suspended withdrawal, transactions and transfer, and the Three Arrows Capital of the Cryptocurrency Hedge Fund in the weekend considers the sale of assets and formulated a assistance plan. Suddenly announced that frozen all account withdrawals, a "Lehman crisis" in a currency circle seems to be fully staged ...

CELSIUS Networks LLC, one of the world's largest cryptocurrency lending platforms, said on the 12th local time that "due to extreme market conditions", the platform will suspend all the transfer of withdrawal, transactions and account transfer. The news first provoked the fragile nerves of investors in the currency circle this week.

Celsius is an important participant in the field of cryptocurrency lending. The platform provides interesting products to customers who deposit cryptocurrencies into the company and borrow cryptocurrencies to earn returns to customers. According to its official website, as of May 17, the company managed $ 11.8 billion in assets with as many as 1.7 million users. The platform provides customers with an annual yield of cryptocurrency deposits as high as 18.63%.

According to CELSIS CEO Alex Mashinsky's previous statement, they almost participated in almost all the main "decentralized finance" agreements. This means that following the crisis of stable currency UST on the Terra blockchain and its sister token LUNA in mid -May, Celsius, a member of the currency circle banking industry, has also been on the edge of the cliff. Some investors are worried: If such large cryptocurrency lending platforms cannot be reopened and allowed to withdraw money, there will be a chain reaction in the entire cryptocurrency market. It is worth mentioning that Tether Limited, the shareholder of Celsius, is also the publisher of the world's largest stablecoin Tether, so people are also closely focusing on whether they will be dragged down. If CELSIUS is facing a crisis to the "Belsden incident" in the currency circle, then Tether Limited is undoubtedly the existence of Lehman -level in the currency circle. HiLary Allen, a financial expert in American universities, said: "Tether can be regarded as the lifeblood of the encryption ecosystem. Once it bursts, it will cause a whole wall to collapse."

After CELSIUS announced the suspension of withdrawal, transactions and transfer, more "Tian Lei" in the encrypted market was also detonated for the rest of the week. Babel Finance, a cryptocurrency loan company headquartered in Hong Kong, told customers on Friday that it will suspend the redemption and withdrawal of all products on the grounds because of the "abnormal liquidity pressure." The company said in a notice on the website, "We are communicating closely with all relevant parties to take action in order to protect our customers."

Bei Bao Finance was founded in 2018 to carry out borrowing and trading business around Bitcoin, Ethereum and Stable Coins. There are about 500 customers in the company, many of which are institutional customers, including traditional banks, investment funds, recognition investors and family offices. The company said in a press release in May that as of the end of 2021, the company's non -repayment loan balance exceeded $ 3 billion.

Not only is the borrowing platform in the encrypted field detonating the "bank crisis" similar to the traditional financial industry, this storm is even spreading to the hedge fund of the industry.

Last weekend, Three Arrows Capital LTD. failed to meet the additional margin requirements of the lenders, which caused investors' concerns. On Friday, Kyle Davies, the co -founder of the hedge fund, focusing on cryptocurrencies, said that after suffering heavy losses due to the extensive market selling of digital assets, the company has hired legal and financial advisers to help investors and investors and and The lender formulates a solution.

Davies said that Sanjian Capital is studying various options, including the sale of assets and rescue from another company. The fund hopes to reach an agreement with the creditors so that there can be more time to formulate plans. The company is still operating while seeking solutions.

The hedge fund, which has a history of nearly ten years, was founded by former alumni, Wall Street foreign exchange trader Su Zhu, and Davies. Its asset management scale once reached US $ 10 billion, but in April this year, it had decreased sharply to about 3 billion US dollars. Its investment portfolio includes tokens such as Avalanche, Solana, Polkadot and Terra. With the recent decline in the cryptocurrency market, almost all the projects invested by Sanjian Capital are in a loss state. The encrypted market information service provider The Block quoted sources this week that the total amount of Sanjian Capital on the lending platform is as high as 400 million US dollars, which may face the bankruptcy crisis.

The next goal of Bitcoin short: fall to $ 10,000?

At present, in the cryptocurrency market, strong pessimism seems to be unable to dissipate anyway. Some investors who have entered the market at a high point have regarded the largest "Ponzi scam" in the history of the history, and even though there are still some fans of the currency circle tried to reorganize the fanfare, it is obviously difficult to compete in a short time. mood.

According to Coinbase's data, the level of the $ 20,000 mark has no special significance to Bitcoin itself, but the price has fallen below the first high of 19783 US dollars in 2017. For a long time, Bitcoin has always believed that this cryptocurrency has entered a new stage of development and acceptance in recent years, and it will no longer be lower than the 2017 level.

"The market analyst of the Japanese cryptocurrency exchange Bitbank Inc. said," For many investors, this will be extremely painful for many investors. "He said that people will lose confidence in the entire crypto market, although some experienced crypto investors will And those who believe that their long -term prospects may still be regarded as the opportunity to buy at a discount.

With the plunge of Bitcoin, the current Bitcoin profit address has reached the lowest since August 2020. GlassNode data shows that the BTC profit address is 23,354,141.

The current price of Bitcoin has even caused some mining machines to face losses -most of the mining machines including Shenma M21 and Awaron 1066 Pro have reached the shutdown price (the cost price of mining). In addition, the ant T17, ant T17E, Awaron 1146 Pro and other mining machines are currently close to the turnover price. Economist Ryan Shea, an economist of cryptocurrency investment company, said that available, expenditure capital (usually called liquidity) suddenly tightened and exacerbated selling, which is not a matter of easy solution. He said, "Unlike the traditional market, no central bank's intervention and interviews, the process of reconstruction must be gradual."

It is quite noticeable that as the price of virtual currencies led by Bitcoin continues to dive, many well -known currency circle investors have suffered heavy losses. According to data that tracks the company's Bitcoin Treasury bonds that have Bitcoin companies around the world, Tesla currently has 4,3200 Bitcoin. Based on the price of about $ 19,000 per Saturday, Tesla owns the value of less than 9 One hundred million U.S. dollars. Compared with the $ 1.5 billion purchase in early 2021, Tesla's related investment losses may have reached more than $ 600 million.

Regarding the market target of Bitcoin at the $ 20,000 mark, the "Debt King" Ganglak warned in an interview on Wednesday that Bitcoin's plunge may not end.

"It seems that it (Bitcoin) is about to be liquidated. So I am not optimistic about Bitcoin at $ 20,000 or $ 21,000. If it falls to $ 10,000, I will not be surprised at all." Ganglak said, " The trend of cryptocurrencies is obviously not optimistic. "

Jay Hatfield, chief investment officer of Infrastructure Capital Management, also said, "The level of 20,000 US dollars in Bitcoin is an important technical level, and falling at this level may cause more additional bonds and cause forced liquidation. With the Fed flow. The foam of sexual drivers is completely ruptured. The level before Bitcoin returns to the epidemic may fall below the $ 10,000 mark this year. "

Sam Callahan, an analyst at the Bitcoin Exchange SWAN, believes that according to the previous bear market experience, Bitcoin may fall by more than 80%from historical highs. This means that Bitcoin will fall to $ 13,800.

Of course, there are currently some big brothers who try to help the market restore the calm currency circle that investors do not need to worry too much about Bitcoin's plunge. They believe that the phased decline is taken for granted. The bear market of encrypted technology is different from the bear market of the stock: the low point is more extreme, but the high point is more extreme.

Jason Yanowitz, co -founder of the cryptocurrency research platform BlockWorks, said, "The bear market of cryptocurrencies usually falls by 85%to 90%. In the past ten years, Bitcoin has experienced two long crypto declines, losing more than 80%of more than 80%. Value, but Bitcoin also rebounds again and again. "

For Wayne Sharp, a retired investment consultant in Columbus, Ohio, the downturn in the cryptocurrency market is not surprising. She purchased a Bitcoin worth about $ 10,000 in 2020, and has been holding it since then, without selling or purchasing more Bitcoin plans. "I have experienced many cycles. I have read it for 45 years," she said. "Humans just make the same mistakes over and over again."

In any case, this weekly "despair weekend" that makes the currency circle's frightening wind will never be the end of the story of the "encrypted winter" story. As for how to write the next story, let us wait and see ...

- END -

Global Central Bank Observation | The inflation rate exceeds 11%of the nightmare, and the British Central Bank's "itching" rate hikes are criticized by the "itching" of the British Bank

21st Century Business Herald reporter Wu Bin Shanghai reportThe British Central Bank has almost lost control of inflation and the economy.On June 17, local time, data released by the EU Statistical Bu

Guazhou: Industrial Xingwang painting is a good "Feng" scene in rural rejuvenation

[Entrusted new journey to build a new era, study and implement the spirit of the 14th Provincial Party Congress]Guazhou: Industrial Xingwang painting is a good Feng scene in rural rejuvenationThe Fo