Xinhua News Agency: Policy development financial instruments have been put on 300 billion yuan to support key infrastructure key areas

Author:Costrit Finance Time:2022.08.29

After the first time the State Council Executive Meeting of the State Council first proposed "determining the measures for policy, developmental financial instruments to support major project construction", within 2 months, the State Kaishin Infrastructure Investment Fund and China Agricultural Development Bank established through the State Development Bank established by the State Development Bank and China Agricultural Development Bank The establishment of the agricultural hair infrastructure fund, policy development financial instruments have been put in 300 billion yuan.

At present, the National Kaisha Infrastructure Investment Fund has signed 422 projects with a contract amount of 210 billion yuan, and has been launched 210 billion yuan. What projects do these funds have been invested in? How to support project construction?

Fund investment orientation of key areas that can start construction as soon as possible

From the perspective of capital investment, policy development financial instruments are mainly used for network infrastructure construction in transportation, energy, water conservancy, etc., information, technology, logistics and other industrial upgrading infrastructure construction, urban infrastructure construction, agricultural and rural infrastructure construction, and the construction of agricultural and rural infrastructure. National security infrastructure construction, major scientific and technological innovation, vocational education and other fields, as well as other projects that can be invested by special bonds of local governments.

Luo Guoan, director of the Fixed Asset Investment Department of the National Development and Reform Commission, introduced at a press conference of the National Development and Reform Commission in August. Recommend a batch of "ideas, and recommend to the National Development Bank and China Agricultural Development Bank.

"After obtaining the recommendation project, we screened from it, and in accordance with the principle of marketization, independent decision -making, independent review according to law, and independent reviews, and carrying out project docking investment." Zhang Hui, deputy governor of the National Development Bank, said that investment projects must have a strong social society. Effects must also have a certain economic feasibility. The National Development Bank gives priority to supporting key areas of infrastructure in the "Fourteenth Five -Year Plan" in the "Fourteenth Five -Year Plan". Play the role as soon as possible to form more physical workload.

On August 28, the Pinglu Canal project with a fund support of 7.273 billion yuan of funding support for the National Kaikai Infrastructure Investment Fund was officially started. After the project was completed, the goods in the southwestern region went to the sea via the Pinglu Canal, which was more than 560 kilometers from Guangzhou to the sea through the sea.

On August 10, Agricultural Development of Hubei Branch launched 62.7 million yuan in the first agricultural hair infrastructure fund in the province to support the construction of the special line project of the Jingzhou Port Cheyang River Railway. The person in charge of the relevant departments of the Hubei Branch of Agricultural issuance stated that in order to quickly and effectively carry out the fund business, the bank specially set up a funding leading group to comprehensively sort out, accurately screen, prefer business backbone, and cooperate with the Provincial Development and Reform Commission to quickly form a list of alternative projects to promote the fund project project In Hubei.

The restrictions on the construction of the project to alleviate the difficulty of project capital in place

How to support project construction in policy development financial instruments is one of the issues of social concern. According to Zhang Hui, the National Development Infrastructure Investment Fund was established by the State Development Bank in full, and the funding of financial bonds was issued to provide large project capital for major projects. In addition, more than 50%of the project owners and social capital are composed of multiple parties.

In the process of promoting infrastructure construction, problems such as difficulty in project capital are important factor restricting project construction and loan investment.

In the Susai Expressway Nanxun to Tongxiang Section and Tongxiang to Deqing Link (Phase II) projects with a total investment budget of 18.01 billion yuan, the project capital accounts for 35%, about 6.3 billion yuan. "This part of the funds could only rely on local state -owned assets to raise funds. After receiving 1.8 billion yuan in funding support from the National Kaishin Infrastructure Investment Fund, the funds pressure on the initial period of the project relieved significantly. The monthly starts. "Li Feng, chairman of Tongxiang City Traffic Investment Group, said.

"By using infrastructure investment funds, you can give full play to the leading role of developing financial financial leadership, expand the source of project capital, attract social capital participation, achieve collaborative efforts, and promote major projects to land as soon as possible." Zhang Hui said.

- END -

Guan Xiaotong's endorsement milk tea shop has been complained many times as possible?Frequent stars involved in catering brand

27.06.2022Number of this text: 820, reading time for about 1 minuteGuide: The comp...

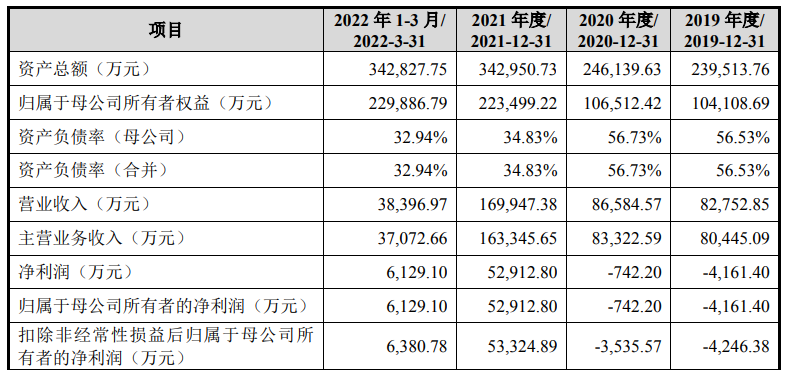

It is planned to raise 2.6 billion yuan!Another A -share IPO of Henan Enterprise was accepted

[Dahe Daily · Dahecai Cube] (Reporter Chen Yuyao Pei Molly) Another Henan enterpr...