In the future, electrical IPO: Last year, the net profit of the net profit declined the capacity of the capacity of the capacity of the capacity insufficient, and the funding was still fundamentally expanded.

Author:Discovery net Time:2022.08.30

In the future, the revenue of appliances fell by 0.55%in 2021, and the net profit fell by 15.05%. In addition, in the future, the use of production capacity has declined sharply and unsaturated will still raise funds to expand production, and the rationality is doubtful

On July 1, Suzhou Future Electric Co., Ltd. (hereinafter referred to as: Future Electric) will pass the GEM on the Shenzhen Stock Exchange, which will be appointed as a sponsor agency.

Public information shows that the number of shares issued in the future will not exceed 35 million shares in the future, accounting for 25%of the company's total share capital after the issuance. It is expected to raise 533 million yuan, of which 417 million yuan is used for new projects for low -voltage road breakers, 80.4317 million yuan for new technology research and development center projects, and 35.25 million yuan for new information system projects.

It is worth noting that in the future, the revenue of appliances fell by 0.55%in 2021 and the net profit fell by 15.05%. In addition, in the future, the use of production capacity has declined sharply and failed to be saturated. In response to the above issues, it was found that the network sent an interview letter to the future email to send an interview letter to the request to be explained, but as of the time, the future appliances did not give a reasonable explanation.

In 2021, revenue and net profit decline

The prospectus shows that in the future, electrical appliances are mainly engaged in the research and development, production and sales of the accessories of low -pressure interruptions, and the main business includes frames of frame circuit breakers, plastic shell circuit breaker accessories, and smart terminal electrical appliances.

From 2019 to 2021, the operating income of electrical appliances in the future was 351 million yuan, 461 million yuan and 459 million yuan, respectively, with a year-on-year growth rate of -0.41%, 31.40%and -0.55%. Yuan, 097 million yuan and 82 million yuan, a year-on-year growth rate of 50.58%, 59.13%, and -15.05%, respectively. It should be noted that in the future, the revenue and net profit of the electrical appliances will decline in 2021. Among them, revenue will decrease of 0.02 million yuan year -on -year, and the net profit attributable to the mother will decline by 1.15 million yuan year -on -year.

Picture source: Wind (future electrical)

Regarding the reasons for the decline in revenue and net profit in 2021, future appliances explained in the prospectus that the company failed to obtain large orders for energy consumption management modules in the second half of 2021. Affected by this, the revenue of the company's energy consumption management module products in 2021 decreased significantly year -on -year, which led to a decline in net profit in revenue.

According to the prospectus, from 2019 to 2021, the revenue of the smart terminal electrical appliances of the smart terminal electrical appliances in the future of electrical appliances is 157 million yuan, 232 million yuan, and 160 million yuan, respectively, accounting for 45.28%and 51.31, respectively. %And 35.98%. Among them, the income of smart protectors accounted for 70.51%, 26.88%, and 45.84%of the smart terminal electrical business, showing a downward trend; the income of smart modules accounted for 29.46%, 73.06%, and 54.12%of smart terminal electrical appliances. Upward trend.

Picture source: prospectus (future electrical appliances)

It is worth mentioning that the income of over -pressure protection modules and energy consumption management modules under the smart module has a decline in 2021, of which the decline ratio of the energy consumption management module is relatively large. The prospectus shows that the revenue of over -pressure protection modules during the reporting period was 38 million yuan, 41 million yuan and 36 million yuan, respectively, accounting for 23.93%, 17.52%, and 22.47%, respectively. From 119 million yuan in 2020 to 36 million yuan, a decrease of 48.87%, and the proportion also declined from 51.21%to 22.59%.

Picture source: prospectus (future electrical appliances)

It should be noted that in the future, the electrical appliances will achieve operating income of 94 million yuan from January to March 2022, and the net profit attributable to the mother is RMB 114 million. And 43.14%, mainly caused by the reduction of energy consumption management module income. The prospectus shows that from January to March 2021, the revenue of the energy consumption management module was 28.1488 million yuan, while the revenue from January to March 2022 was only 23,500 yuan. In this regard, industry insiders said that if future appliances cannot continue to obtain large orders for energy consumption management modules, they will face the risk of continuous decline in the company's operating income and net profit.

Picture source: prospectus (future electrical appliances)

Insufficient capacity utilization rate, still fundraising and expanding production

According to the prospectus, this sprint IPO will be used in the new project of 417 million yuan in the fundraising plan of the future appliances for new projects for low -voltage circuit breakers, accounting for 89.49%of the total fundraising amount. Among them, 374 million yuan was used for capital investment, including plant construction, equipment purchase and installation, etc. 42.6943 million yuan was used for the lamp funds for the bottom of the flow, and the planned construction period was 2 years.

However, analysts said that in the future, electrical appliances fundraising expansion production has doubts. On the one hand, it can be seen from the above situation that the revenue of the energy consumption management module of the main business business in the future has led to a sharp decline in the company's 2021 performance. Affected by this, the growth of electrical appliances in the future is questioned. Therefore, such a significant increase in production capacity, if the company's product income does not improve, how to digest capacity in the future requires investors' attention.

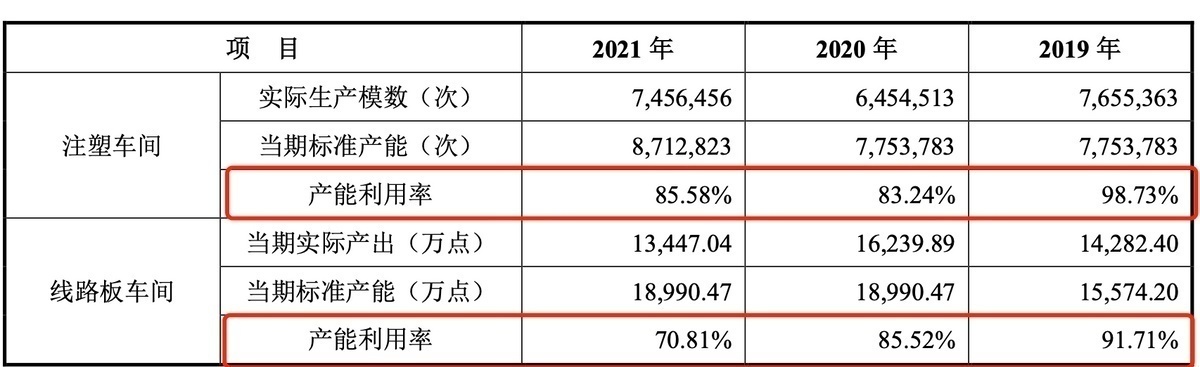

On the other hand, the capacity utilization rate of electrical appliances is not high in the future, and even shows a continuous decline. The prospectus shows that from 2019 to 2021, the capacity utilization rate of the injection molding workshop in the future is 98.73%, 83.24%, and 85.58%, respectively; the capacity utilization rate of the lineboard workshop is 91.17%, 85.52%, and 70.81%, respectively. In the case of a sharp decline in capacity utilization and failure to be saturated, the necessity of raising production and expansion in future appliances is still doubtful. Picture source: prospectus (future electrical appliances)

In addition, during the reporting period, the book value of future appliances was 64 million yuan, 70 million yuan, and 66 million yuan, respectively, accounting for 21.06%, 15.07%, and 14.11%of mobile assets, respectively.

Picture source; prospectus (future electrical appliances)

Although the scale of the inventory of electrical appliances is further decreased in the future, there is a large gap between its inventory turnover and the comparable company. According to the prospectus, from 2019 to 2021, the inventory turnover rate of future appliances is 3.38, 3.76 and 4.14; the average value of the inventory turnover rate of comparison companies such as Zhengtai Electric, Liangxin Co., Ltd. 4.63 times.

Picture source; prospectus (future electrical appliances)

This situation has also been questioned by the regulatory level. The Shenzhen Stock Exchange requires that the company's inventory turnover rate is lower than those of the company's inventory, production, and sales cycle in terms of inventory stocks comparable to the company in the same industry.

(Reporter Luo Xuefeng Financial Researcher Tenghui said)

- END -

The Fed's radical rate hike disturbing the world, industry insiders: may lead to a global economic recession!

[Global Times special reporter Zheng Ke Global Times reporter Ni Hao and Wang Yi] In order to fight against the worst inflation in the United States in 40 years, the Federal Reserve Commission announc

The research results of the Ministry of Finance show that the effectiveness of the combined tax and fees policy has achieved remarkable results -corporate burden reduces boosting confidence in development

Large -scale tax cuts are key measures for macro -control, and are the most direct...