IPO observation 丨 Taimei Technology is "not too beautiful", nearly 100 million yuan in goodwill, three and a half years of loss of 1.2 billion

Author:Red Star News Time:2022.06.19

Zhejiang Taimei Medical Technology Co., Ltd. (hereinafter referred to as "Taimei Technology") with the "Internet+Medical" halo (hereinafter referred to as "Taimei Technology") has recently updated the financial information and the Shanghai Stock Exchange has restored its issuance and listed audit. Taimei Technology is intended to be listed on the Science and Technology Board, raising a funds of 2 billion yuan, and the sponsor is Huatai United Securities.

However, the Red Star Capital Bureau noticed that Taimei Technology has not been profitable for nine years, and has lost more than 1.25 billion in three and a half years, while its IPO will impact the market value of 10 billion. In addition, the questioning of 700 million yuan of buildings around Taimei Technology, nearly 100 million yuan in goodwill, and doubts about the increase in valuations have never been interrupted.

Three and a half years of loss of 1.25 billion

The total annual salary of executives is 15 million

Taimei Technology is a digital solution provider of life science industries, and products and services cover clinical research, drug warning, pharmaceutical marketing and other links. At present, the company mainly sells SaaS (software as a service) products in the fields of clinical research, drug warning, pharmaceutical marketing and other fields, and provides professional services in related fields.

It is understood that the concept of SaaS is a software application model that has emerged in recent years. The SaaS platform supplier will uniformly deploy the application software on its own server. Customers order the software services required to the manufacturer through the Internet according to the actual needs, pay the cost of the ordering service and the length of time, and obtain the SaaS platform supplier through the Internet to provide value -added services Essence

Stepping on the concept of SaaS, Taimei Technology has also ushered in the rapid growth of performance. From 2018 to the first half of 2021 (reporting period), Taimei Technology achieved revenue of 59.743 million yuan, 187 million yuan, 303 million yuan, and 188 million yuan.

However, in the case of a significant increase in operating income, Taimei Technology not only did not achieve profit, but also gradually expanded. During the reporting period, its net profit was -183 million yuan, -389 billion yuan, -524 million yuan, and -158 million yuan, respectively, with a cumulative loss of 1.25 billion yuan. As of the first half of 2021, the cumulative losses of Taimei Technology's consolidation levels have not made up of 464 million yuan.

In this regard, Taimei Technology said that high R & D expenses, share payment costs and labor costs have made the company still in a state of continuous losses as of the time.

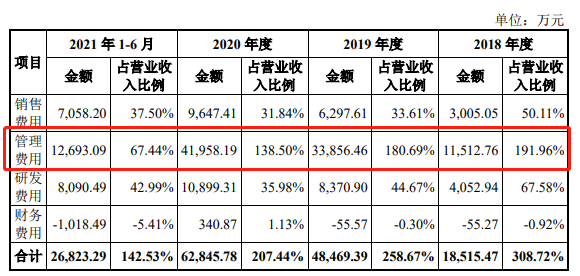

The Red Star Capital Bureau noticed that from 2018 to 2020, Taimei Technology's management costs accounted for more than 130%of the total revenue. Even if the share payment fee was excluded, the company's management cost rate still reached 35%, which significantly exceeded the comparable listed companies that can be comparable to listed companies. Essence

In addition, its sales fee rate maintained more than 30%per year, reaching 50%in 2018, and the R & D cost rate also exceeded 35%per year, all of which are higher than the average value of comparable companies.

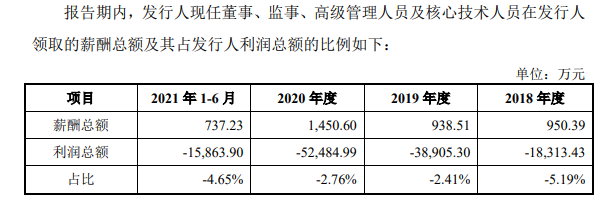

With the increasingly serious "increasing income income", the salary of Taimei Science and Technology executives is very criticized. The prospectus shows that during the reporting period, the total salary of the company's executives was 9.5039 million yuan, 9.385 million yuan, 14.556 million yuan, and 7.3723 million yuan, respectively.

Among them, in 2020, Zhao Lu, chairman and general manager of Taimei Science and Technology, salary of 1.823 million yuan, Director Ma Dong's salary was 1.2524 million yuan, director Zhang Hongwei's salary was 1.7427 million yuan. The salary was 1.486 million yuan, and the total salary of the above four people exceeded 6 million yuan.

8 rounds of financing nearly 3 billion, Tencent and Gaoma platform

The target impacts tens of billions of market value

However, the high loss of years has not affected the enthusiasm of the institution's pursuit of Taimei Technology.

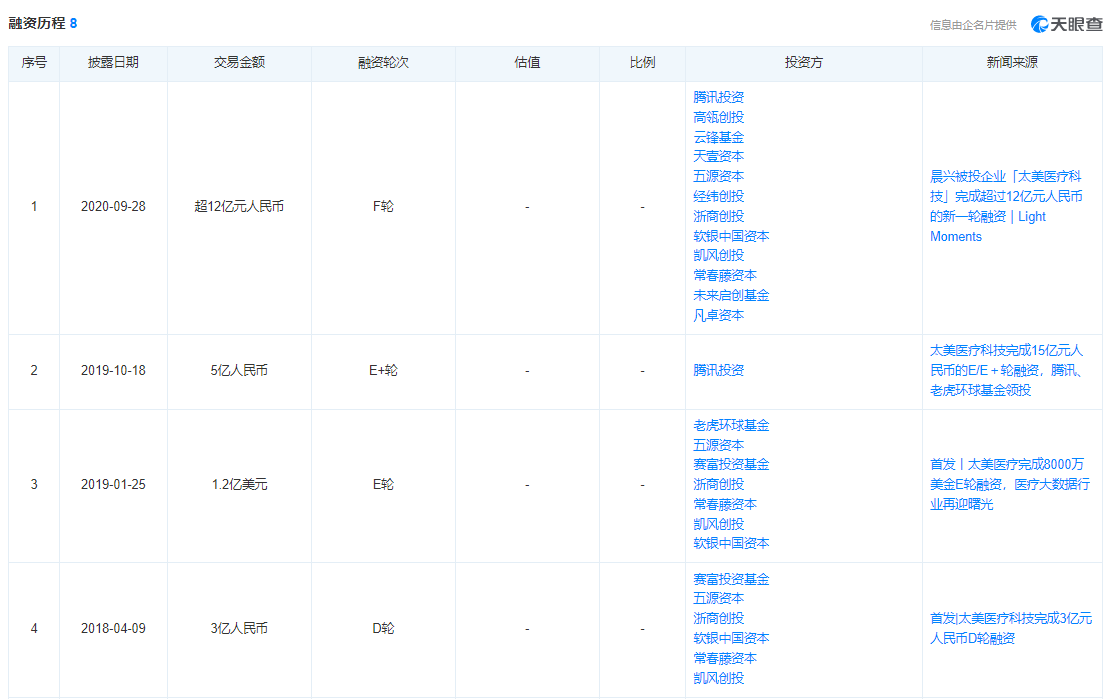

The Tianyancha APP shows that since its establishment, Taimei Technology has gone through 8 rounds of financing, with a total financing amount of nearly 3 billion yuan. Among them, the recent round of F financing has exceeded 1.2 billion yuan, which has attracted Yunfeng Fund, SoftBank China, Gao Zhe, Gao Zhe , Tencent Investment, Jingwei Venture Capital and many other institutions have entered the bureau.

As of the date of signing the prospectus, there were 46 shareholders of Taimei Technology, including 3 of them and 43 shareholders. Among the institutional shareholders, there are 29 shareholders of the filed private equity investment funds, and there are 14 private equity or private equity fund manager shareholders of private equity fund supervision and filing.

During the reporting period, Taimei Technology has conducted multiple capital increases and equity transfer, and the company's valuation has expanded rapidly.

In April 2018, the first capital increase during the reporting period of Taimei Science and Technology increased the registered capital from 8.578 million yuan to 90.29 million yuan. There is no premium.

By September 2020, the seventh equity transfer during the reporting period of Taimei Science and Technology, Nanjing Kaiyuan transferred the equity of Taimei Limited 1%of the equity (investment of 144,700 yuan) at 70 million yuan. The price per share is as high as 483.63 yuan, and the corresponding market value is as high as 4.8 billion yuan.

In September 2021, Taimei Technology, which was changed to a share company, once again transferred its share transfer. The valuation has reached 8 billion yuan. Its valuation has doubled.

It is worth noting that due to the low number of actual controllers (17.24%), Taimei Technology adopts voting rights arrangement, that is, the actual controller Zhao Lu holds Taimei Technology shares to set up to special voting rights ("Class A shares"), and the remaining shareholders The company's shares are ordinary shares ("Class B shares"), and the number of voting rights owned by each Class A shares is 8 times that of the number of voting rights per type of shares. Therefore, Zhao Lu directly held 62.50%voting rights of Taimei Technology, and passed the total of 69.78%of the company's voting rights through 9 holding platforms. According to Article 2.1.4 standards of the "Science and Technology Innovation Board Listing Rules", "If the issuer has the difference in voting rights, the market value and financial indicators shall meet at least one of the following standards: (1) The estimated market value will not be less than RMB 10 billion ; (2) The estimated market value is not less than RMB 5 billion, and the operating income in the past year is not less than RMB 500 million. "

In 2020, Taimei Technology's operating income was 303 million yuan, which was less than 500 million yuan. Therefore, Taimei Technology can only choose "the estimated market value will not be less than RMB 10 billion yuan" as the listing standard.

Some market voices believe that the valuation during the reporting period of Taimei Technology has grown rapidly, or capital operation is undergoing capital operation to meet the listing standards of "market value is not less than 10 billion yuan".

One thing to remind investors is that after the initial inquiry of Taimei Technology, the total market value after issuance is less than 10 billion yuan, and there is a risk of issuance of issuance. In addition, the prospectus also prompts the risk of insufficient subscriptions in this issue.

Nearly 100 million yuan in goodwill

700 million yuan of funds to buy buildings are questioned

The huge losses of Taimei Technology are also related to their goodwill impairment.

In 2019, Taimei Technology formed a total of approximately 161 million yuan in goodwill for the acquisition of soft vegetarian technology and Nobei Technology. Due to the failure to meet the commitment requirements in 2019 and 2020, the company's goodwill was 294.835 million yuan and 34.342 million yuan in the first half of 2020 and 2021.

Data show that as of June 30, 2021, the company's goodwill book value was 9.708 million yuan. Among them, the book value of goodwill and goodwill due to the acquisition of soft vegetarian technology and Nobe Technology was 75.5528 million yuan and 21.476 million yuan. Pay attention to impairment risk.

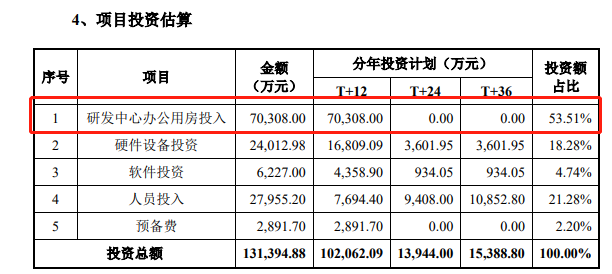

According to the prospectus, the IPO, Taimei Technology plans to raise 2 billion yuan, of which 1.31 billion yuan will be used for the upgrading of the intelligent collaboration platform of clinical research, 350 million yuan for the development and upgrading of clinical research enterprise end systems, 180 million yuan for the use of 180 million yuan for it The independent imaging evaluation system R & D and upgrading, and 160 million yuan for the research and development and upgrading of the drug warning system.

Among them, the intended investment in the intelligent collaboration platform of clinical research accounting for 65%of the total amount of investment is higher than that of other projects. The reason is that the company plans to invest 703 million yuan in office buildings, which is questionable.

In the first round of inquiries, the Shanghai Stock Exchange requested Taimei Technology to analyze the necessity and rationality of buying an office building that does not exceed 26,000 square meters, and whether it is put into the real estate field in disguise.

Taimei Technology said that during the implementation of the fundraising project, the number of employees is expected to gradually increase to 2604 (1492 people at the end of 2021). The existing research and development venues and research and development hardware are expected to meet the office needs and research and development needs of new personnel. R & D and operating venue area, and create good office conditions and environment, attracting more high -level technical talents. There are no cases in disguise in the field of real estate.

For a company that continues to lose money, it costs 700 million to buy a building. Can such a reason persuade the Shanghai Stock Exchange and investors? The Red Star Capital Bureau will also continue to pay attention.

Red Star News Comprehensive Reporter Yu Yao Yu Dongmei

Edit Tao Yiyang

- END -

Nucleic acid sampling staff needs hot

China Economic Weekly reporter Song Jie | Shanghai reportOn May 23, the official p...

The global stock market encountered a wave of plunge, and A shares got rid of US stock shocks

[Global Times Reporter Ni Hao] In order to curb the highest inflation in 40 years, the Fed announced last week that it raised interest rates of 75 basis points. With the support of China's economic da...