History is rare!45 billion empty

Author:China Fund News Time:2022.06.19

China Fund Newspaper Green

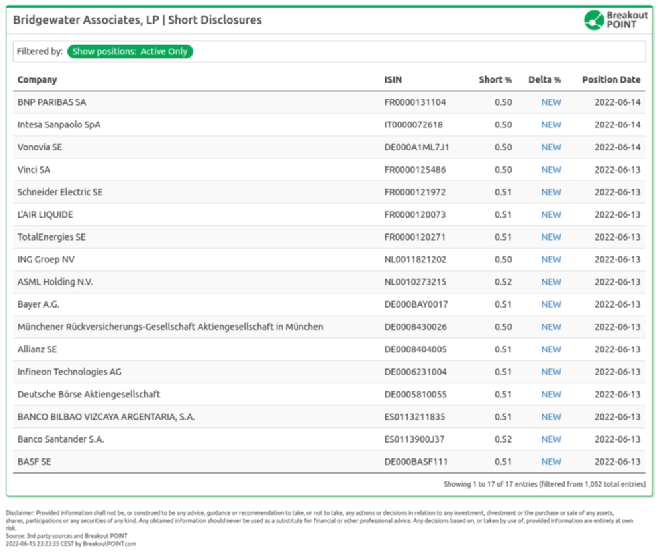

According to the statistics of Breakout Point, a short position tracking website, a few days ago, the world's largest hedge fund bridge has disclosed the net short position of its European company. As of June 13 or June 14 (slightly different in the disclosure cycle of different markets) According to statistics from Breakout Point, according to the closing price statistics on Wednesday, these net short positions are about 5.2 billion euros. According to Reuters quoted the latest data of Breakout Point, the latest net short head position has been equivalent to $ 6.7 billion, which is about 45 billion yuan, involving 21 companies.

Fund Jun learned from the official disclosure platform of major European markets that the bridge water has adjusted the front, and it is not clear whether it is preparing to liquid or tactical adjustments. Bridge water is the world's largest hedge fund, with the latest management scale of $ 150 billion. Ray Dario is the founder of bridge water.

According to the relevant regulatory regulations of the euro zone, when the institution holds the net position of the listed company's stocks exceeding a certain proportion, the institution needs to make disclosure. Fund Jun followed the disclosure of various market information in Europe and found that bridges do not often appear in the short position disclosure websites in these markets. This means that either holding the short positions of these listed companies, but the lower limit that has not reached the requirements of the disclosure, or there is no short position of these listed companies at all.

Breakout Point said that these positions seemed to have accumulated recently. It is not sure if the bridge water is short because of the STOXX European 50 index, because these stocks have a great overlap with the STOXX European 50 index component stocks. Earlier media reports that Qiaoshui said that it was short of European and American corporate bonds because they were worried that global economic growth would slow down.

Breakout Point said that according to its statistics, the total amount of this short position is very large. The short positions held by other fund managers in their impression that they have reached so large. The only exception may be the bridge itself. In the first quarter of 2018 and the first quarter of 2020, Bridge water had a large European company's net short position. At that time in 2020, Breakout Point statistical bridge water held 40 short positions of European companies.

Source: Breakout Point website. Note: It is worth noting that Breakout Point statistics are data from June 13 or June 14th, and the latest net empty head positions in the bridge water have changed.

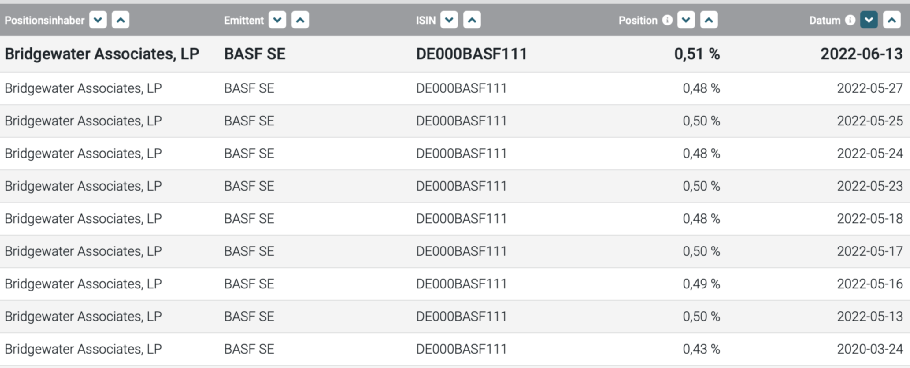

However, the reporter inquired about the official information disclosure platform of Germany and found that Qiaoshui had a net short position for many companies since March 2020, and re -renewed by May 2022 or recently. This shows that before March 2020, before May 2022, the bridge water either holds positions in these short positions, or the net empty head position held is below the minimum line of disclosure. trend. For example, the net short disclosure of Qiaoshui to chemical leader BASF is March 24, and then the next disclosure date is May 13, 2022.

Source: German official website disclosure platform federal bulletin official website

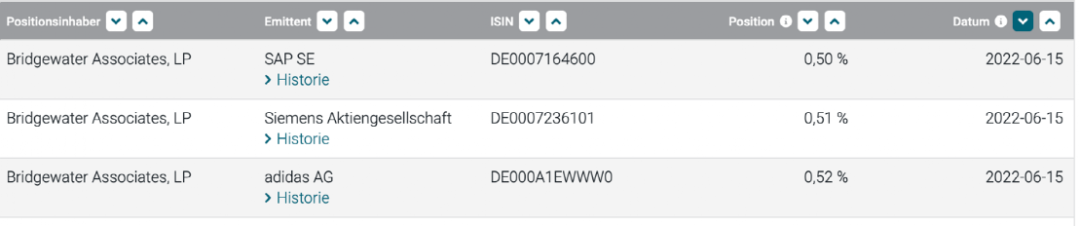

The German official information disclosure platform federal bulletin shows that as of June 15, the net short position of the German company disclosed by Qiaoshui has changed. As of June 15, the shortcomings disclosed by Qiaoshui became SAP, Siemens Co., Ltd., Adidas and other companies.

Source: Federal Gazette official website

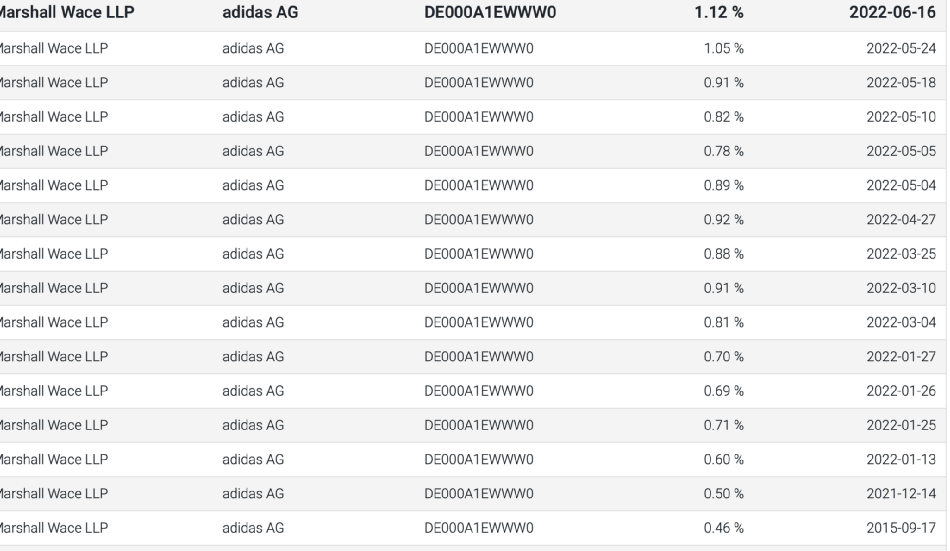

The impact of the epidemic and the frustration of China's business, Adidas' stocks listed on the Frankfurt Exchange have fallen 35.92%this year.

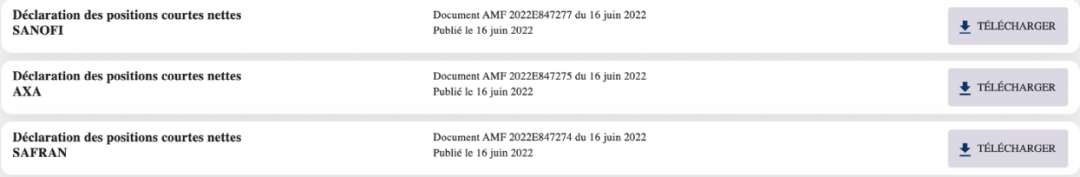

Let's take a look at the short situation of Qiaoshui to French companies. The two -day bridge water is also adjusted to the shortness of French listed companies. For example, the official French official information disclosure platform shows that as of June 16, Bridge water disclosed the three French companies' net empty head position Sanofi, AXA, and Safran. This has changed with Breakout Point statistics.

Source: French official disclosure platform

Let's take a look at Qiaoshui to short the Dutch company. As of June 15, no disclosure of the bridge water on the net short position of the Dutch company (representing the proportion of the net position that it may have liquidated or held is lower than the requirements, and no disclosure is required). Only disclosed that a company's net position is to pay the company ADYEN. However, on June 13, Qiaoshui disclosed the net empty head holding the light -engraved glue giant Asumi.

Source: Dutch official website disclosure platform

Asmore's stock price has also fallen by more than 35%in recent years.

However, as a macro fund, Qiaoshui holds multiple asset -type assets in multiple countries, and it is not advisable to do too much interpretation of its positions. In 2020, when the media reported the short position of the European company that they held, "Although we will not comment on our specific positions, the bridge water has traded in more than 150 markets around the world, so there are many associated positions, usually, usually, usually It is hedging other positions, and these often changes. Therefore, considering any one position at any time, trying to determine a overall strategy is incorrect. "

A few days ago, the European Central Bank officially announced that the European Central Bank will officially announce that the super loose monetary policy has ended for many years. The difference between Italy and German Treasury bonds, as the "European debt risk barometer", expanded to 2.4%this week, close to dangerous areas.

The financial status of the euro area is severely differentiated and inflation is high. At the same time, the euro "falling down", and many institutions issued early warning: the risk of collapse in the euro area intensified.

After the European Central Bank made the eagle statement, the price of the European bond market continued to decline, and the yield was further refreshed for many years. Investors have sold government bonds such as southern European countries such as southern Europe, especially Italy, which is high in bonds.

Chen Dong, director of the Macroeconomic Research in Asian Macroeconomic Swiss Wealth Management, said that the current situation in Europe is very complicated. The impact of Russia and Ukraine's conflict, consumer confidence has dropped to freezing points, and energy prices have soared, which has greatly affected consumers' actual purchasing power. Corporate expectations have also begun to deteriorate. The inflation in Europe is mainly driven by energy prices, and it is not driven by demand, and wages have risen to the United States. In this context, in the face of the rapid rise in inflation, the European Central Bank also turned to be more "eagle."

Some countries are particularly fragile. "Italy is a country with a poor economy in tradition. Recently, due to the rise of inflation and the market's tightening of the central bank, from historical experience, the difference between the rate of return of Italy and German Treasury bonds has entered a relatively dangerous Area. Now the central bank wants to tighten to fighting inflation. Will other unexpected impacts in this process is a very big test. "Chen Dong said.

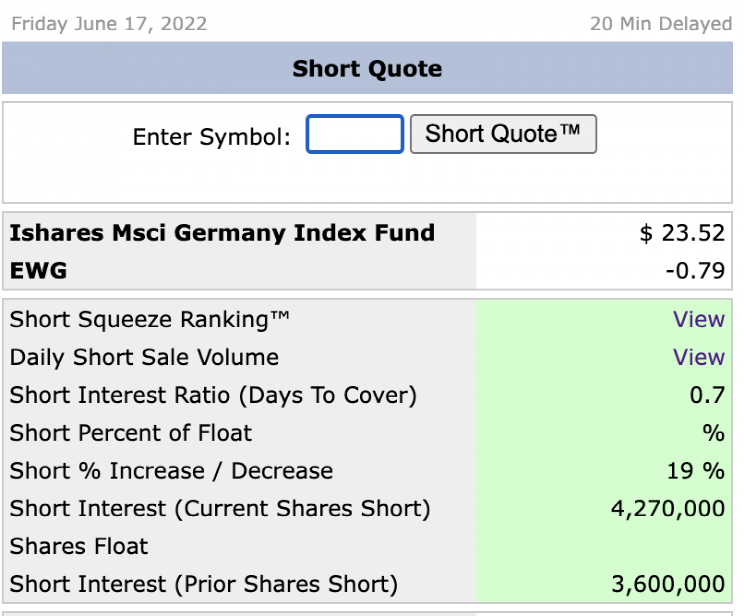

Source: Short Squeeze official website

The information from the short position tracking website Short Squeeze is more consistent with Chen Dong's statement. The net empty head position held in the latest period in June increased by 27%from the previous period. Another German ETF-EWG, the latest short position held by the agency in June increased by 19%compared with the previous period.

Source: Short Squeeze official website

Hedge fund crocodiles shot together

Not only bridges, for various purposes, other global hedge funds have also increased their short -term efforts to European companies.

According to the German official website disclosure of the Federal Communist Party, the information shows that in 2022, it has disclosed the net empty head position of 167 institutions. This value in 2021 was only 33. Which institutions are short -term German listed companies? Including citadel, millennium management, and hedge fund giants such as Marshalli. We take CITADEL's net empty head position called Lazard. Citadel first disclosed that its net short position for it was in March this year.

Source: Federal Communist

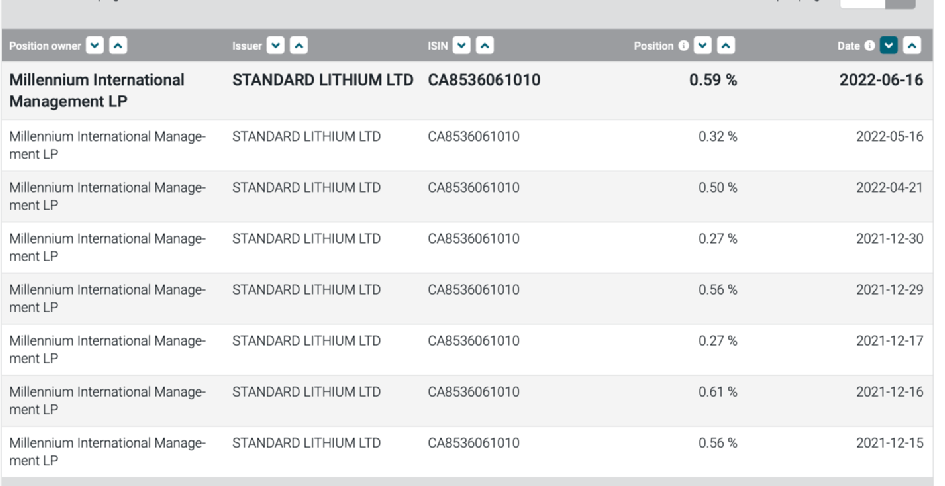

The millennium international management of the millennium of the millennium has began in December 2021 with a net empty head position called Standard Lithium. It has been silent for several months in the middle.

Source: Federal Communist

Marshalli's short -term efforts to Adidas are increasing this year

Source: Federal Communist

Hedge fund betting the euro depreciation

Energy crisis, soaring inflation, and slowing economic growth, many institutions believe that Europe is brewing a "perfect storm". As a result, the exchange rate of the euro against the US dollar is depreciated, and some traders believe that the euro may fall to parity with the US dollar.

Source: Sina Finance

As of now, the exchange rate of the euro against the US dollar is hovering at a level of about $ 1.0484, from about 1 euro against 1.22 US dollars in June last year. Recently, the euro even fell to a slightly higher level higher than 1 euro against 1.03 US dollars. This is the first time that the euro is close to the parity in the 20 years in the past 20 years, and some hedge funds have already bet on this. Traders are betting on the euro to reached the parity of the exchange rate of the euro against the US dollar through foreign exchange options. A large number of bets on the euro's decline in the euro have become the most popular foreign exchange transaction derivatives.

Edit: Captain

- END -

One picture understands: Notice on further implementation of government procurement support for SME policies

Source: Tianjin Finance Review: Wang ShaoyunEditor: Wang An Material Organization:...

Fill in international gaps!Ningbo Enterprise's joint negative pressure ambulance medical cabin international standards have been approved for approval

Today, the reporter learned from the Ningbo Market Supervision Bureau that a few d...