Sure enough, shelter!Foreign capital is 17 billion to kill A shares, and buy this giant over 2 billion

Author:China Fund News Time:2022.06.19

Source: E company

Last week, due to the sharp interest rate hike in the Fed and the global market fell sharply, the Dow Jones Index fell below 30,000 points, a new low of more than one and a half years.

Recently, A shares have obviously gone out of independence and become the best shelter of funds. The funds north to buy more than 17.4 billion yuan again, which will be added for the third consecutive week. 100 million yuan.

Last week, the banking industry received 2.58 billion yuan in net purchase of funds, becoming the industry with the largest number of warehouses; last week, the funds in the north also bought the food and beverage industry of 2.151 billion yuan, and the 5 industries such as pharmaceuticals and biology, mining, and media won over 1 billion. Yuan's net buy. The three industries of chemical industry, non -ferrous metals, and public utilities were sold over 1 billion yuan last week. In addition, the non -silver financial industry, which was red and purple last week, was reduced by 610 million yuan in the north funds.

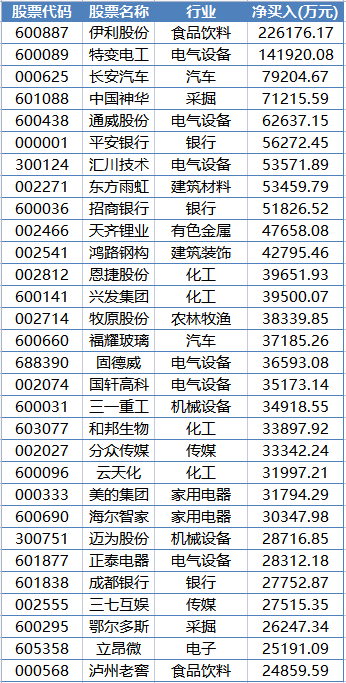

Bei Shang Fund bought a net stock of over 100 million yuan last week

Significantly increased the dairy leader

Last week, Northern Global increased the dragon's leader Yili shares, and bought 2.262 billion yuan in net purchase, which was the only stock that bought over 2 billion yuan last week. Recently, Northern Fund has been added to Yili shares for 10 consecutive days, with a record high in continuous shares, and the market value of holding shares has reached 42.5 billion yuan.

In 2021, Yili Group's revenue reached 110.6 billion yuan, becoming the first Asian dairy company with a revenue of 100 billion yuan, so it has attracted the attention of many institutions. Wind data statistics show that 44 institutions have recently given Yili shares to buy rating, unanimously predicting the average net profit growth of Yili shares this year and next year is 23.66%and 18.19%.

Among them, UBS Securities gave the highest target price of Yili's shares of 56 yuan, which was 38.29 yuan from the closing price last Friday, with more than 46%of the potential space. In addition, Nomura Dongfang International, CITIC Securities, Shen Wanhongyuan, and Guangfa Securities have also given Yili's target price of over 50 yuan.

This chemical stock is nearly 50 times as much as 50 times

The chemical industry is the industry that sells the most funds in the north last week, but Yun Tianhua has become the largest stock in the north to increase its funds last week. Last week, Northern Global funds spent 320 million yuan, and the addition of 9.94 million shares of Yun Tianhua. The positions of only 200,000 shares last weekend increased to 10.14 million shares, an increase of nearly 50 times.

Yun Tianhua is a giant of the agricultural chemical industry. In recent years, it has transformed into the new energy industry. At the end of last year, Yun Tianhua plans to invest 500,000 tons/annual iron phosphate battery new materials and supporting projects with a total investment of 7.286 billion yuan. The first phase of 100,000 tons/annual iron phosphate project will be completed at the end of June this year. Investment.

Last week, Gendewei increased by 1.39 million shares, accounting for 2.42%of the circulating shares. This week, 366 million yuan was reached, an increase of more than 1.17 million shares, accounting for 2.02%of the circulation share capital. Guideway circulation is only 57.39 million shares, a typical microcrory stock. With the continuous buying of huge amounts of funds, Gudewei's stock price has recently risen. Since the low in April, the cumulative cumulative has risen by more than 110%.

Recently, industrial and commercial changes occurred in Heng Heng Micro Semiconductor, Hefei, and new shareholders Gudewei, holding a shareholding of 2.86%. Zhongheng Micro Semiconductor is a high -tech enterprise specializing in the research and development, design, manufacturing and system application of power semiconductor modules. The products are mainly used in new energy vehicles, motor drives, and photovoltaic inverters. Gudwell's strategic shares in China Heng Micro Semiconductor were successfully extended from inverter manufacturers to power semiconductors.

Next week, Guedway will implement the 2021 10 -turn 4 shares of the 12 yuan equity distribution plan. The equity registration date is June 20, the removal (interest) date is June 21, and the new unparalleled sales condition circulation shares listing date It is June 22.

In addition, more than 90 shares of special transformers, Changan Automobile, China Shenhua, etc. also received a net purchase of more than 100 million yuan in funds last week; more than 60 shares such as Tianqi Lithium, Lianhong New Ke, Botten shares, etc. Last week, more than 100%of the position was added. In the Ningde era, it was sold sharply by more than 3.6 billion yuan, BYD was also sold over 1 billion yuan, and Ganfeng Lithium, Salt Lake shares, sunlight power supply, etc. were sold over 100 million yuan.

- END -

Texas: Agricultural Technical Experts Field Guide Science Copy Rain Corn Production Management

Qilu.com · Lightning News, June 27th, from June 26, Texas ushered in a new round...

Capable style construction year | Bin County: let project construction a new engine of high -quality

The feed and logistics park project invested by Zhengda Group, from negotiation an...