"Specialized Special New" special board becomes unblocked and multi -level capital market grasping

Author:Tianfu Stock Exchange Center Time:2022.08.31

In recent years, the cultivation and development of "specialized new" enterprises has become one of the characteristics of my country's industrial policy, and its importance has been mentioned to unprecedented heights; many "specialized new" enterprises have supported the support of national policies and capital markets. Continue to deeply cultivate professional fields, improve innovation capabilities, and add motivation to the high -quality development of China's economy.

As an important part of the multi -level capital market, the regional equity market also actively explores the financial support path of the "specialized new" enterprise. By setting up the "specialized new" special board, it has continuously increased the relevant enterprises. Support, breadth, and depth.

The "Securities Daily" reporter was exclusively learned in the industry that in order to improve the quality of the "specialized new" special board construction of the regional equity market, the relevant regulatory authorities have already Enterprises establish a layered gradient cultivation system, and the national securities market has been adjusted to solicit opinions to the industry for many rules such as the cooperation mechanism of special board enterprises. It is currently a new round of modification based on the feedback from all parties of the market.

Advanced service according to local conditions

The Securities Law, which was implemented on March 1, 2020, confirmed the legal status of the multi -level capital market in my country. important parts of. The Opinions of the Central Committee of the Communist Party of China on April 10, 2022 put forward the cooperation between the regional equity market and the national securities market sector.

The top -level design is clear and the adaptability has become stronger.

Luo Zhiheng, chief economist of Yuekai Securities and Dean of the Research Institute, analyzed that "'' Specialized New 'Enterprise Characteristics is in line with the service positioning of science and innovation boards, GEM and Bei Stock Exchange. , The New Third Board Innovation Floor Enterprise is the Bei Stock Exchange 'Reserve Team, and some companies have successfully transferred from the Beijing Stock Exchange to science and technology board and GEM. If the multi -level capital market wants to truly achieve seamless connection, it will need to be further opened up. The connection between the regional equity market and the national securities market sector, the importance of the "specialty new 'special board."

In order to give play to the role of local capital market hub platforms, the regional equity market provides enterprises to provide corporate basic services and comprehensive financial services to enterprises through the "specialized new" special board.

Providing capital market training services for "specialized new" enterprises, and doing a good job of standard guidance before listing is one of the special services. Zhang Yunfeng, Secretary of the Party Committee and General Manager of Shanghai Equity Custody Trading Center (hereinafter referred to as "Shangshi Jiaotong"), said, "Shanghai Stock Exchange mainly conducts corporate capital market -related training, establishes corporate standards for governance, strengthens corporate governance capabilities, compliance levels, and levels of compliance. Development capabilities have formed a more mature listing training system. "

According to the relevant person in charge of Guangdong Equity Exchange Center (hereinafter referred to as "Guangdong Stock Exchange"), the Guangdong Stock Exchange, the Beijing -Shanghai -Shenzhen Exchange, the New Third Board, and the high -quality securities service institutions continue to provide standardized operation for the "specialized new" special board enterprise , Corporate restructuring, listing (listing) counseling and other training, consultation and services, to assist special board companies to solve problems encountered in the development process. At the same time, encouraging and guiding special board companies to be restructured into joint -stock companies in accordance with the requirements of corporate shareholding system transformation. Activate professional institutions such as securities firms, investment banks to participate in potential, benchmark IPO standards, establish model indicators, issue IPO assessment reports for the intended listed enterprises in the board, and formulate capital operation plans according to this to clarify the goals and make up the gap for each standard according to each standard. Measures and improvement paths.

At the same time, in order to accelerate the pace of the listing of enterprises, the "specialized new" special board cultivates the capital market awareness of enterprises, and through the differentiated information disclosure system and targeted information disclosure system, the "specialized new" enterprise will tell the potential buyers " Investment story.

Yu Chunhui, general manager of the Hunan Equity Exchange (hereinafter referred to as the "Hunan Stock Exchange"), said that according to the characteristics of the enterprise, the Hunan Stock Exchange's "Specialized Special New" special board formulates a special information disclosure system: In principle, listed companies can independently select the content and scope of information disclosure; listed enterprises with equity and debt financing needs, they regularly disclose information in accordance with the requirements of external shareholders and regulatory requirements.

"The implementation of the upper -stock technology innovation board that implements the registration system is high, and the main reason for the recommendation agency will be calculated; the Shanghai Second Security mainly conducts data review, and the recommendation agency must be responsible for investing firstly. Investors. At the same time, the registration system also pays more attention to publicity and strict post -post -post supervision. "Zhang Yunfeng introduced that the" specialized new "special board that is under construction will also use this model.

In addition, the "Specialty Special New" special board will give the IPO review front to help enterprises deeply understand and grasp the review requirements: clear and complete records of corporate equity changes, and can be checked in the fields of equity incentives; Keep talent.

"'Specialized Special New' Enterprises in the process of development, facing issues such as equity and debt financing, equity option transactions, chaos (including various generations) such as equity options, and chaos (including various generations). The sexual equity market is a place that can help companies solve these problems. "The relevant person in charge of Beijing Equity Exchange Center (hereinafter referred to as" Bei Stock Jiaotong ") said that the" special specialty "special board of Beichang will focus on Beijing High -quality "specialized new" enterprises provide services such as equity incentives, mergers and acquisitions, equity financing, equity financing products and other services. At the same time, Beijiao also owns the only non -listed equity registration custody platform in Beijing, which can help the "specialized new" enterprise to standardize the management of equity management. In accordance with the standards of listed companies, the shareholders register and equity structure are clearly sorted out. The needs of operating institutions deposit and upgrade

In order to further improve the quality and efficiency of the "specialized and new" enterprises, CITIC Securities Chief Economist clearly believes that "after the early exploration and development, the operating institutions 'own financial infrastructure and the" specialized new' special board have all reached the need for demand. Further optimize and improve. "

Insiders of an operation agency revealed to reporters that at present, the relevant regulatory authorities are jointly promoting the "specialized new" special board that promotes the establishment of a new concept of the regional equity market. At the same time, regulators have strict requirements for net assets, talent reserves, databases, etc. of the establishment of special boards.

Some people in the industry frankly said that "the net assets of most operating institutions now do not exceed 500 million yuan. In terms of long -term development, there are more net assets to supplement the pressure." Expansion work. "

It is clearly suggested that with the growth of the financing demand of "specialized specialty" enterprises and the increasing regional equity market talent gap, in the future, more talents with corporate listing tutoring or financial services related to work experience will be added. In addition, the "specialized new" enterprises are small and medium -sized enterprises, and the content of information disclosure is incomplete. The regional equity market can establish the basic information, autonomous or disclosed information disclosed in accordance with relevant requirements, visit and investigate visits through services, or disclosed in accordance with relevant requirements. The accumulated enterprise databases such as multi -dimensional information such as information, and evaluate precise portraits and science and technology attributes for enterprises.

Luo Zhiheng believes that the "specialized new" target currently traded in regional equity markets generally has problems such as low liquidity. It is recommended to optimize the transaction mechanism, introduce incremental funds to the market, and set up a special specialty new index to unblock various medium and long -term capital investment "specialized new" channels, bringing market activity and valuation improvement.

Combined with the gradient cultivation system of high -quality SMEs, Luo Zhiheng suggested that "the subsequent regional equity market can also establish a layered gradient cultivation system for 'specialized new' special board enterprises, providing services that are suitable for their characteristics and demand for enterprises on all levels. ","

Looking forward to increasing policy supply

At present, the efficient player of the "Specialty Special New" special board is still blocked. Many operating institutions expect to follow the needs of market entities and further increase policy supply.

The New Third Board has established a common demand for listing green channels for high -quality enterprises of "specialized new" special board. Zhang Yunfeng said frankly, "Now 'Specialized Special New' Enterprises need to be listed on the New Third Board, and they need to deliver them in the regional equity market first and submit relevant materials. I hope that the" specialized new "special board enterprises that meet the conditions in the future do not need to repeatedly submit the materials , Can be transferred directly to the New Third Board. Once there is a problem with the enterprise, you can hold the operator. "

From the perspective of the relevant person in charge of Beijiao, the seamless connection mechanism of establishing the New Third Board and the regional equity market is the primary work.

Yu Chunhui said that the overall quality of the existing listed enterprises is high. After the company is listed, it hopes to provide institutional support in financing, transactions, tax benefits, etc., but it is difficult to achieve under the existing system. In addition, policy cultivation and financial resources are required to be fully focused on the listing of companies after the listing, thereby improving the efficiency of financing docking.

"The continuity and support for the policy of promoting 'specialized new' enterprises to regional equity market listing and financing still need to be enhanced. Especially for the support policies for the listing of enterprises, we should fully consider the compatibility of the enterprise in order to match the different stages of different stages. Different service products, "said the relevant person in charge of Guangdong shareholders.

Source: Securities Daily, reprinting this article is the purpose of passing more information. If there is an error or infringe your legitimate rights and interests, please leave a message, we will correct and delete it in time, thank you

- END -

With the help of the RCEP policy dividend, Linyi Foreign Trade has achieved outstanding results

On August 21, the Journal of the People's Government of Linyi City held a press co...

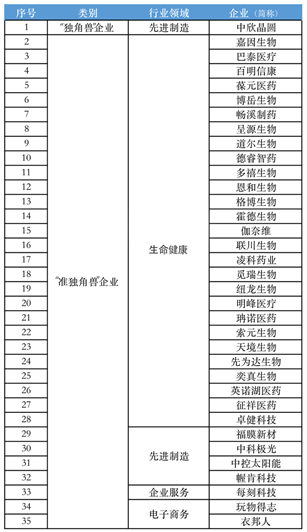

35 Qiantang companies are on the list of 2022 two "unicorn" lists!

A few days ago, the 2022 Hangzhou Unicorn (Quasi -Unicorn) List was released in th...