The three major indexes collectively loses the landscape storage and other track stocks again.

Author:Poster news Time:2022.08.31

On August 31, the three major indexes recovered in the afternoon, and then shocked down. As of the close, the Shanghai Index fell 0.78%, the Shenzhen Stock Exchange Index fell 1.29%, and the GEM index fell 1.6%.

Overall stocks fell more, and over 4100 stocks in the two cities fell, and nearly 80 stocks fell by more than 10%. The turnover of Shanghai and Shenzhen today was 102.4 billion yuan, which was 163.9 billion from the previous trading day.

In terms of plates, the CXO concept rebounded against the market. In the daily limit of wisdom medicine, Tiger Pharmaceuticals, Kailei, and Medici rose more than 4%, Yaoming Kangde and Kang Longcheng also rose more than 2%.

Food and beverage concept stocks have soared collectively. Among them, the black sesame seeds staged the "Di Canchen", and Gui Faiang and Liangpu Shop have daily limit. Many many shares such as Yifen, Haixin Food, and Three Squirrels have risen by more than 4%.

The concept of electrical equipment is collectively frustrated. Gudway fell 18%, Nandu's power supply fell 18%, and nearly 170 shares such as sunlight power and new scenery fell more than 5%.

【Capital flows】

The total net purchase of the northbound funds was 7.901 billion yuan, of which 4.52 billion yuan was bought at the Shanghai Stock Connect, and the Shenzhen Stock Connect net purchase was 3.381 billion yuan.

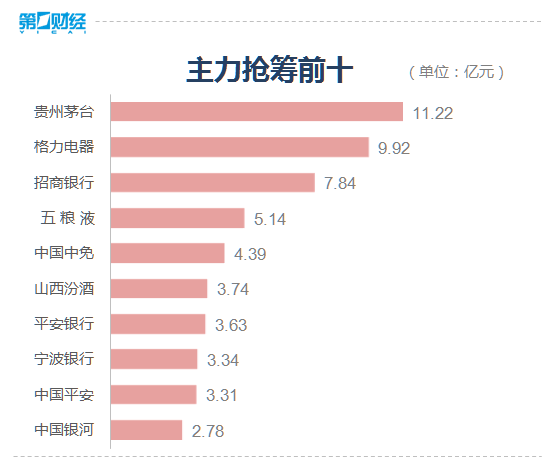

The main funds are continuously inflow into food, banks, non -silver financial sectors, and net outflow of power equipment, non -ferrous metals, basic chemicals and other sectors.

In terms of individual stocks, Guizhou Moutai, Ping An of China, and China were free of its main net inflow of 1.97 billion yuan, 609 million yuan, and 498 million yuan.

In terms of net outflow, Ganfeng Lithium, Tianqi Lithium Industry, and Zhongtian Technology were sold for 616 million yuan, 499 million yuan, and 464 million yuan, respectively.

【During the big event】

1. Li Chao, vice chairman of the China Securities Regulatory Commission, said on the 31st that recently, the CSRC, together with relevant aspects of the National Development and Reform Commission, formulated ten measures to accelerate the normalization of infrastructure REITs, including: promoting the establishment of the provincial and municipal governments of key areas The comprehensive promotion mechanism participated in the department to strengthen work coordination and coordination; hold key areas meetings to strengthen policy counseling and market training, promote the formation of project supply echelons; optimize pilot project recommendation procedures, study clear work time limit, improve work efficiency; On the basis of the level, the concept of reviewing the audit, simplifying the audit procedures, and optimizing the registration process; clarifying the relevant industry access standards, improving transparency and predictability, strengthening continuous supervision; broadening pilot project types, solving new problems facing "new types" projects facing "new types" projects, , Guide market standards for development; strengthen the equipment of professional staff, strengthen the resources guarantee required for normalized distribution; accelerate the pilot of private enterprises REITs, and launch the "green light" investment case as soon as possible; promote the first batch of expansion of projects as soon as possible; promote REITS legislation, actively cultivate majors REITS manager and investor group.

In August and August, the manufacturing procurement manager index (PMI) was 49.4%, which was lower than the critical point, an increase of 0.4 percentage points from the previous month.

【Institutional views】

CITIC Securities: Policies, long -term focus on consumption recovery and carbon neutralization themes. The steady supply of electricity and real estate is the key point of the technology industry. Pay attention to the marginal improvement of the technology industry; In terms of sex, the margin of the main line of energy and safety in August is the most obvious. Comprehensive multi -dimensional factors, the recommendations of the strategy model for a long time are power equipment and new energy, basic chemicals, and computers; combined with the trend of marginal changes, it is recommended to pay attention to real estate and electronics.

Galaxy Securities: At present, the perovskite battery has entered the key node of commercialization and urgently needs to promote the cooperation and development of supply chain companies and the establishment of industry standards. Floody ore battery has low cost, high efficiency, simple craftsmanship, and flexible preparation. It has strong advantages. As related companies increase their layout and development, the industrialization process of perovskite battery is expected to accelerate. Floody ore battery preparation processes involve related equipment such as coating, magnetic control, steaming, laser, etc. are expected to continue to benefit.

Huaxin Securities: Under the continuous improvement of policy promotion and product technology, the economy of energy storage has become increasingly increasing, which has ushered in the explosive growth of the early stage of industrial growth. It is expected to become a super wind outlet for new energy vehicles. Essence

- END -

GCL Technology Leshan 100,000 tons of granular silicon project will be put into production recently

Leshan GCL. Photo source: Company PicturesOn June 21, GCL Technology (HK03800, a s...

Changbai Shenshan Out of Good Medicine "Mountain People" finds the road of prosperity

Villagers in Bandao Dao Village are drying medicinal materials (data map). Intervi...