Too dangerous!The big pig farmer is almost "not debt", and there are 74 million left ...

Author:China Fund News Time:2022.08.31

China Fund reporter Nan Shen

On the evening of August 30, Zhengbang Technology, who was in a debt crisis, was long overdue. Therefore, it has been predicted that it will be a huge loss. What is more concerned about the performance market is whether this large pig farmer from Jiangxi will be negative, that is, "not debt".

Fortunately, despite a huge loss of 4.2 billion yuan in the first half of the year, Zhengbang Technology's net assets still remain 74.38 million yuan, barely held the "red line".

Just more than a month ago, Zhengbang Technology was exposed to no money to buy feed, causing the cooperative farmers to break, and even caused the amazing tragedy of "pig eating pigs". The China Fund reported that it was necessary to prevent the decline in net assets. Maybe, now the stone is released with the interim report.

However, Zhengbang Technology still dare not care about it. Recently, he is dealing with a group of shares of subsidiaries that have been funded, and continue to work hard for "cleaning".

After the huge loss, the net assets are only zero

The average pig only sells 1014 yuan per pig

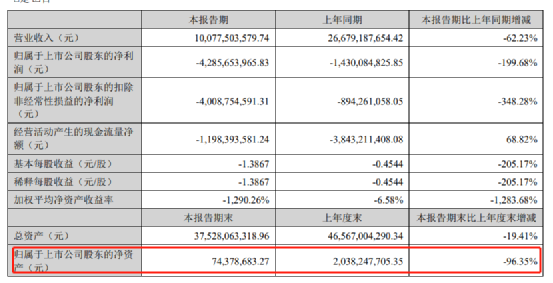

According to this interim, Zhengbang Technology achieved total operating income of 10.078 billion yuan during the reporting period, a year-on-year decrease of 62.23%. The net profit attributable to shareholders of listed companies was -4286 billion yuan, which was doubled from the same period last year. In 2021, Zhengbang Technology has lost 18.8 billion yuan, so that its losses have reached 23 billion yuan since last year.

Fortunately, the company did not have the market's concerns about "funding for debt" after all. The latest central report shows that its net assets have more than 70 million yuan, but decreased by 96%year -on -year. Compared with the net assets a year and a half ago, the number of net assets was 23.25 billion yuan.

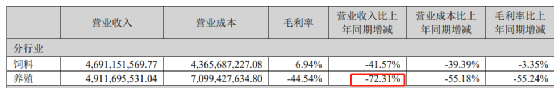

The interim report shows that the company's revenue contribution in the first half of this year mainly comes from feed and breeding. Among them, the feed business revenue fell 41.57%year -on -year, and the breeding business decreased by 72.31%year -on -year.

It is worth mentioning that with the second quarter of the pig price rebound, the operating income of the big pig farmer Muyuan shares of the semi -annual report on the evening of August 30 has risen 42%month -on -month. The shares also increased by 16%month -on -month, but Zhengbang Technology's revenue still fell 44%month -on -month.

Judging from the previous announcements and disclosed semi -annual reports, the weight of the company's commercial pigs is getting smaller and smaller. In January this year, there are about 210 pounds. In June, it was only 151 catties. catty. In the first half of the year, the company sold a total of 4.8452 million pigs, with a cumulative sales revenue of 4.912 billion yuan, that is, the average pig was sold in the early one thousand yuan (1014 yuan).

Stop new capacity

Comprehensively reduce existing capacity

In the first half of this year, Zhengbang Technology terminated new production capacity in some areas, and a total of 22 raised funds investment projects were cut off to save the precarious cash flow.

On June 6, 2022, the company convened the company's first bond holder meeting in 2022 and the third interim shareholders meeting in 2022 to review and approve the "about the termination of some fund investment projects to terminate and the balanced funds raised permanent supplementation funds. The Proposal of the Company will terminate the company's 8 -raised funds investment projects in 2019, and the 14 non -public offering of funds raised funds in 2020 will be terminated, and the balance of funds for the fundraising project will be 3.618 billion yuan (including interest, including interest The net amount after the income deduction fee) permanently supplemented the mobile funds.

For existing capacity, the company is also accelerating.

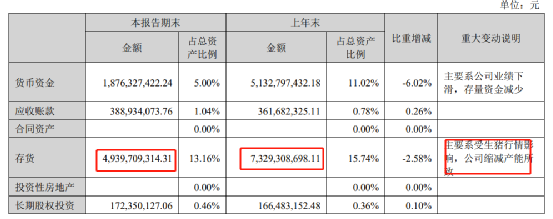

First of all, the company's inventory dropped from 7.329 billion yuan to 4.94 billion yuan early this year. The company said that it was mainly affected by pigs, and the company reduced production capacity. The "productive biological assets" dropped from 2.396 billion yuan to 1.63 billion yuan. The composition of "productive biological assets" was mainly pigs, including boars and sows, and there were very small proportion of ducks.

The company also carried out a certain layoff, which saved some costs. Among them, sales costs fell from 204 million to 124 million yuan, a year -on -year decrease of 39%; management costs decreased by 27.83%year -on -year, from 2.4 billion yuan to 1.733 billion yuan.

Continue to sell assets

Deldo the funds non -debt subsidiaries

In the first half of this year, the company had to repay the assets withdrawal.

On February 28 this year, the company announced the sale of the equity of eight feed holding subsidiaries, with a consideration of 2 billion to 2.5 billion yuan. The company can get an investment income of 1.1-19 billion yuan. At present, it has received 500 million yuan of equity transfer models.

In the second half of the year, the company accelerated the speed of selling assets.

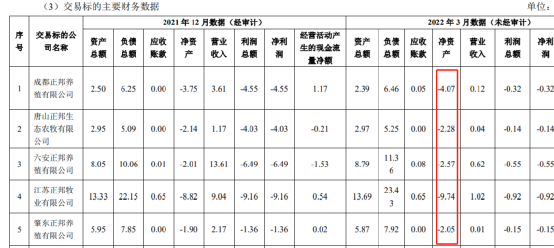

On July 2nd, the company announced that it was planned to sign the "Equity Transfer Agreement" with the controlling shareholder Zhengbang Group. Liu'an Zhengbang breeding, Jiangsu Zhengbang animal husbandry, Zhaodong Zhengbon farming, Lianlian Zhengbang breeding, Luoyang Zhengbang breeding, Liaoning Panjinzhengbang breeding, Yucheng Zhengbang breeding, Hubei Red Ma Zhengbang breeding total 10 wholly -owned subsidiaries.

After the transaction is completed, the company's equity holding the company with the above 10 standards will be reduced from 100%to 51%. The above -mentioned company is still a holding subsidiary within the scope of the company's merger statement. The transaction also stipulates that in the next three years, Zhengbang Technology and its subordinate subsidiaries have the right to repurchase the shares transferred this time by the transaction price of 1 yuan. It is not difficult to find that the affiliated transaction of 1 yuan consideration is mainly to shake debt burdens and clean up assets. The above 10 subsidiaries are already incompetent.

On August 21st, the company announced again that it signed the "Equity Transfer Agreement" with the controlling shareholder Zhengbang Group, and intends to transfer 100%equity of Jiangxi Zhengnong Group to Zhengbang Group to Zhengbang Group. The announcement shows that Jiangxi Zhengnong's total assets are 2.588 billion yuan, total liabilities of 2.699 billion yuan, and net assets of -111 million yuan, which are also insoluble.

On the evening of August 30, while disclosing the semi -annual report, the company announced that it intends to transfer the assets of Yuechi Tongxing Fertilizer Pig Farm (including land and above -ground buildings, structures, equipment, etc.) under Guang'an City, Sichuan Province Giving Jiangxi Zengxin Technology, the transaction price is 38.0596 million yuan, which is used to repay the debt between the company and Zengxin Technology. Zengxin Technology is also the company's controlling shareholder Zhengbang Group's shareholding company. This transaction constitutes a related transaction.

Edit: Joey

- END -

A brief history of the pre -sale of commercial housing, some people are giving birth, some people get rich overnight

Wen | No rust bowlEditor's note:The so -called building flower is the folk nicknam...

He Qing: How can China deal with the global energy crisis

Zhongxin Jingwei June 14th: How to deal with the global energy crisisProfessor of the School of Finance and Finance, Renmin University of ChinaSince the outbreak of the Russian and Ukraine, Western co