"Half -year Exam" transcript is announced!Which of the six major banks has the strongest profitability?

Author:Dahe Cai Cube Time:2022.08.31

Among the six major banks, which net profit is the highest? What are the main drivers of profit? What is the business situation in the second half of the year?

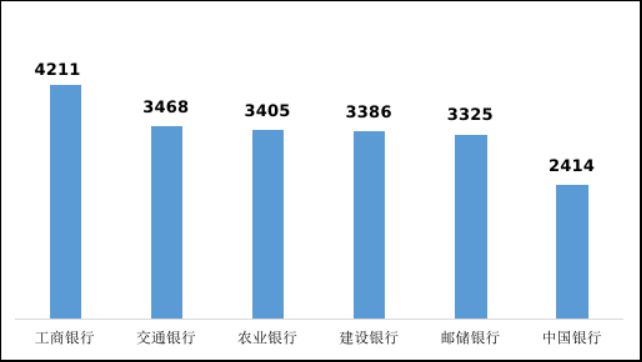

ICBC's net profit is the first

As of the end of June, ICBC consolidated the first major advantage, with a net profit of 172.6 billion yuan in the first half of the year, a year -on -year increase of 4.9%; the realization of operating income was 443.8 billion yuan, a year -on -year increase of 4.1%; the total assets reached 38.74 trillion yuan.

Following the CCB, the net profit reached 161.730 billion yuan, an increase of 4.95%over the same period last year; the total assets were 3.3.69 trillion yuan, an increase of 11.35%.

The net profit of the Agricultural Bank of China was 129 billion yuan, with a growth rate of 4.98%; operating income reached 387.2 billion yuan, a growth rate of 5.9%; total assets exceeded 32 trillion yuan.

The Bank's after -tax profits were 124.3 billion yuan, an increase of 4.86%year -on -year, and the profit after taxation of the Bank's shareholders was 119.9 billion yuan, an increase of 6.30%year -on -year; the total assets reached 2.855 trillion yuan, an increase of 4.98%over the beginning of the year.

The operating income and profits of the postal savings bank achieved a double -digit increase, of which the net profit attributable to bank shareholders was 47.114 billion yuan, an increase of 14.88%year -on -year; the operating income was 173.461 billion yuan, an increase of 10.03%year -on -year; the total assets were 13.43 trillion yuan , Increased by 6.66%compared to the end of the previous year.

In the first half of the year, the net profit achieved net profit of 44.04 billion yuan, an increase of 4.81%year -on -year; the net operating income was 143.568 billion yuan, a year -on -year increase of 7.10%. Among them, the net interest net income was 850.93 billion yuan, an increase of 8.42%year -on -year; 7.84%over the end of the previous year.

Polymeter pressure

Talking about the operation of the first half of the year, Liao Lin, the president of the ICBC, said that the revenue, preparation, and net profit of the first half of the year have stabilized, and the annualized ROA and ROE have maintained a good level. The operating characteristics of special "continued to be highlighted.

From the perspective of the chairman of the Agricultural Bank of China, there are three main drivers of the profit of the bank in the first half of the year. The first is to correctly understand the relationship between banks and the real economy and prosperity, reasonably make profit from the real economy, make up the price with quantity, stable income and growth; second, the quality of assets is basically stable, which is due to the improvement of the bank's own management level. It is also effective with the effective efforts of macro policies, maintaining the market entity, and slowing the close stress of the provision; in addition, it is the orderly release of the preliminaries in the early stage.

At the same time, the decline in the decline in the overall operation of the banking industry has also attracted much attention.

In the first half of the year, the overall loan interest rate of the banking industry declined. From the data released by the People's Bank of China, the average interest rate of newly issued general loans in the banking industry in the first half of the year decreased by 44bp, and the average interest rate level was at a low level.

"Faced with the downward situation of loan interest rates, we are optimizing the structure around the structure, and as much as possible to alleviate the impact on the interest rate difference between the loan interest rate through the adjustment of the business structure. In the first half of the year, the net interest difference was achieved. Continue to maintain a higher level in the big bank. "Liu Jianjun, president of the postal savings bank, said that on the asset side, the bank increased the distribution of differentiated advantages and credit, and maintained a good level of risk pricing. At the liability side, the bank continues to promote the decline in liabilities, especially the three -year and five -year deposit of the three -year and five -year deposit. While stabilizing the interest rate level, the deposit interest rate has decreased by 1bp.

Lin Li, deputy governor of the Agricultural Bank of China, believes that the decline in net interest margins is mainly due to the initiative of Agricultural Bank of China to increase and make benefits from key areas such as rural revitalization, inclusive finance, green development, scientific and technological innovation, manufacturing, and infrastructure. The momentum is better.

"In the second half of the year, the net interest margin is expected to be under pressure, but the marginal decline will narrow, and the probability will maintain a trend of steady decline. From the perspective of the asset side, our bank will continue to make the real economy in an orderly manner, loan interest rate collection, loan interest collection, The rate will have a certain degree of decline. From the perspective of the debt side, the effect of the reform of the deposit interest rate mechanism and the marketization adjustment mechanism of the deposit will continue to appear. We will take the initiative to optimize the cost control measures. express.

It is expected to maintain profitable growth in the second half of the year

For the second half of the year, various banks also show sufficient confidence.

Liao Lin said that in the next stage, the theme of ICBC's work is still based on "stability, advancement, and reform". The first time it is "stable". Requires, conscientiously practice the political and people's nature of financial work, efficiently coordinate the prevention and control of the epidemic, inspect and rectify and financial services, and make every effort to help stabilize the economy, consolidate the good operation, and promote high -quality development.

Gu Yan said that the Agricultural Bank of China has the confidence to continue to maintain a steady profit growth in the second half of the year. On the one hand, the long -term good situation of China's economy has not changed. In the second half of the year, with the further implementation of various policies, my country's economy will rise steadily. On the other hand, from the perspective of its own customer foundation and the layout of the organization, the Agricultural Bank of China spans urban and rural areas. Basically, half in the countryside, half in the city, building a "moat" for the face of uncertainty and challenges. At the same time, the digital transformation of the Agricultural Bank of China has greatly improved the management level. Through risk recognition monitoring and the optimization of early warning models, the accuracy, timeliness and effectiveness of risk management and control are continuously improved. In addition, the Agricultural Bank of China has sufficient and has a solid financial foundation.

- END -

The CBRC names many banks!ICBC complaints for the first state -owned bank

Zhongxin Jingwei On July 28th, the website of the China Banking Regulatory Commiss...

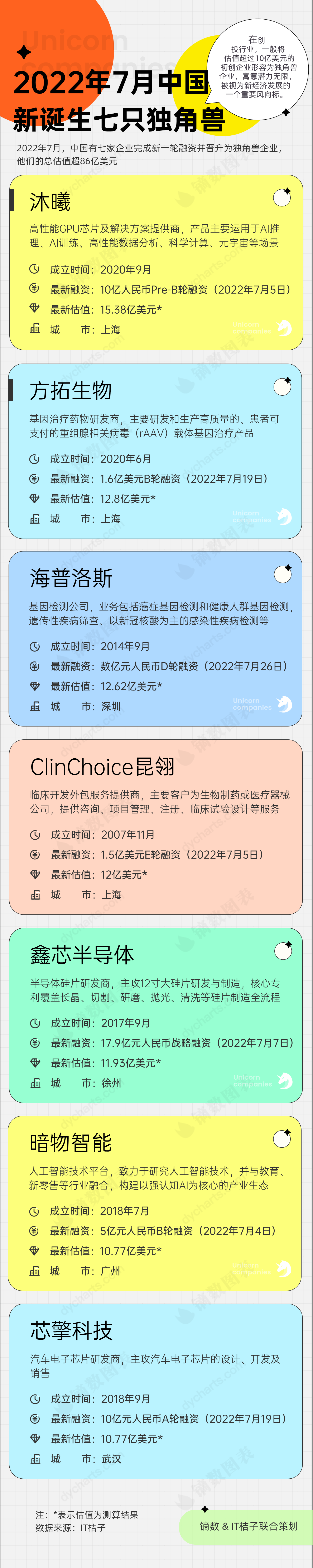

Seven unicorns born in China in July 22: Covering chip, medical care and other fields

In July 2022, seven companies in China completed a new round of financing and were...