Tonghua Dongbao's revenue in the first half of the year fell 16.53% year -on -year will focus on the field of ventilation and hyperuricemia.

Author:Daily Economic News Time:2022.08.31

On the evening of August 30, Tonghua Dongbao (SH600867, stock price of 9.17 yuan, market value was 18.426 billion yuan) released the 2022 semi -annual report. Yuan, a year -on -year increase of 75.49%. The company plans to distribute a cash dividend of 2.5 yuan (including tax) every 10 shares.

Looking at the net profit of the mother alone, Tonghua Dongbao performed well, and it was even far better than another company of "A -share insulin double male" Gan Li Yae (SH603087, the stock price was 36.70 yuan, and the market value was 20.609 billion yuan). However, after the non-recurring profit and loss, including investment income, the company's deduction of non-net profit-32.67%year-on-year changes can still find the trace of the company's performance by insulin collection.

For the market after collection, in addition to the market in the institute, Tonghua Dongbao proposed a combination strategy of overtime retail and accelerated transformation. In the first half of this year, the company's innovative drugs in the field of diabetes and gout treatment have completed the first phase I of the clinical stage I.

On August 31, Tonghua Dongbao told the reporter of "Daily Economic News" that in terms of innovative drugs, except for the field of diabetes treatment, gout and hyperuricemia will become one of the key areas of the company in the future.

Under the special collection of insulin, revenue and deduction of non -net profit double drop

In addition to the separate subjects and subsidiaries involved in the real estate and building materials industries, Tonghua Dongbao's main business is biopharmaceuticals. At present, the main business covers biological products, Chinese medicines, and chemicals. The treatment field is mainly diabetes, endocrine, and cardiovascular and cerebrovascular.

Among them, insulin products that bring the company's "domestic three -generation insulin faucet" have always been the main company's revenue.

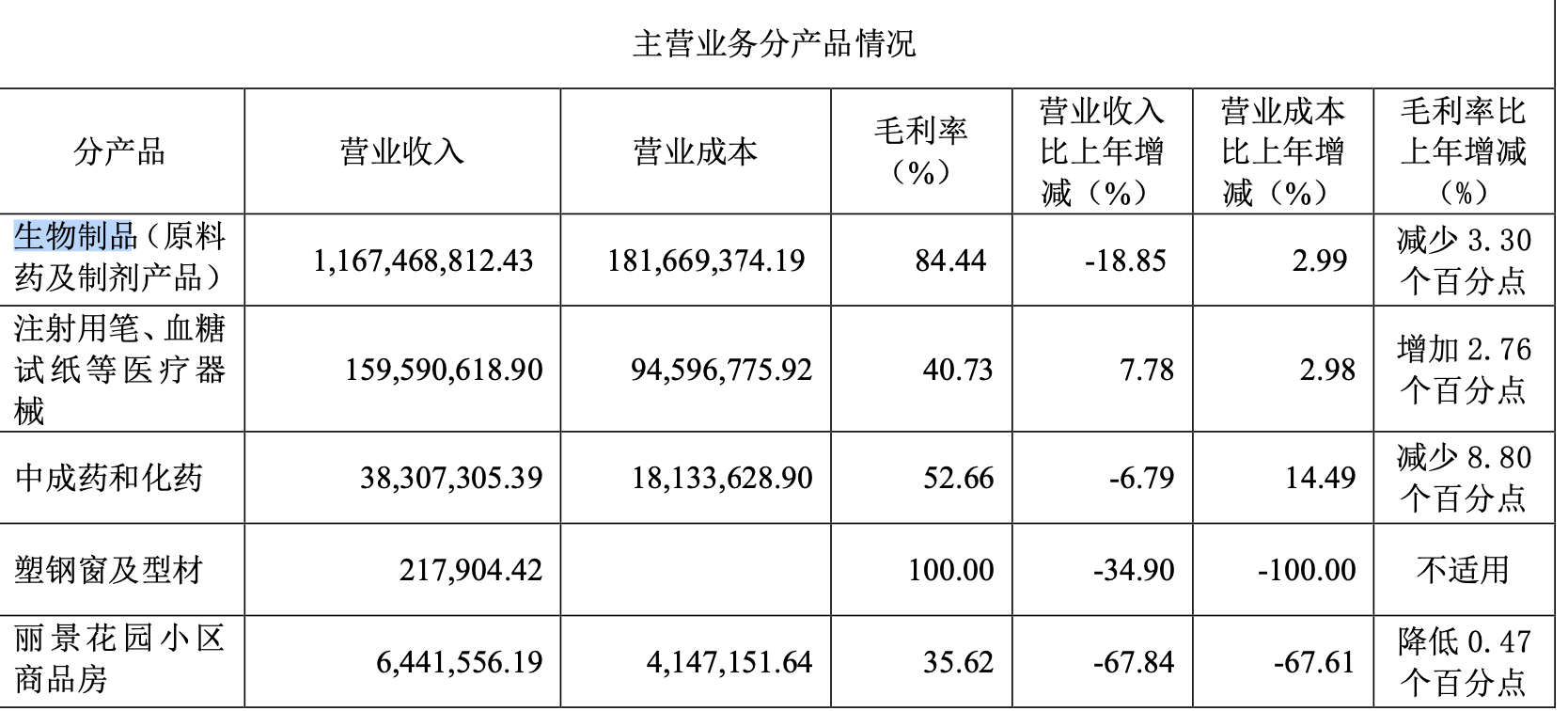

The semi -annual report shows that the company's biological products (raw medicines and preparation products) achieved operating income of 1.167 billion yuan, accounting for 84%of the total operating income. 3.3 percentage points.

The second place in revenue is the medical device such as injection pen, blood sugar test strip, etc., which achieved operating income of 160 million yuan in the first half of the year, an increase of 7.78%year -on -year; Chinese medicine and chemical drugs achieved operating income of 38.3073 million yuan, a year -on -year decrease of 6.79%.

From the perspective of profitability, Tonghua Dongbao Pharmaceutical Industry in the first half of the year was 78.44%, a year -on -year decrease of 4.11 percentage points. In addition to the gross profit margin of medical equipment such as injection, blood sugar test strips, etc., the gross profit margin of biological products (biomedical drugs and preparation products), Chinese medicine and chemical medicines decreased by 3.30 and 8.80 percentage points, respectively.

Tonghua Dongbao's main business situation in the first half of 2022 Source: Company Announcement

In addition, the company's operating income in the first half of this year decreased by 16.53%year -on -year, for the first time in the past three years. In this regard, Tonghua Dongbao said that in the first half of the year, the national special set of insulin was implemented. The decline in the price of insulin products and the impact of the epidemic in some areas caused the company's operating income to decrease accordingly.

At the same time, the company has a one -time sales or return of the difference between the original supply price and the implementation price of the collection of collection before the implementation of the circulation process. Essence

It is worth mentioning that although the revenue declined, Tonghua Dongbao's net profit attributable to the mother in the first half of the year achieved a year -on -year increase of 75.49%. In this regard, Tonghua Dongbao said that the main reason is that the company sells the foster biological part of the shares, and investment income has increased.

In other words, if the non-recurring profit and loss including investment income, Tonghua Dongbao's revenue and net profit decreased in the first half of the year, and the year-on-year change rate was -16.53 and -32.67%, respectively.

On August 31, people on Tonghua Dongbao told the reporter of "Daily Economic News" that the price reduction of product prices, channel control and channel inventory of insulin sets of insulin sets are The company's first half of the performance, especially the main reason for the decline in the second quarter performance. However, the channel control and channel inventory brought by insulin collection and channel inventory are the one -time adjustment factors. If the impact of these disposable factor, the company's income decline in the first half of the year is far less than the decline in the price of collection, and the performance fluctuations are also in Within control.

The person said that with the advent of the era after the insulin collection, the company's performance has been relatively limited, and the sales volume of product sales is rapidly growing, so as to offset the pressure brought about by the decline in the price of most products. Even if the income and net profit in the second half It may decline year -on -year, but the amplitude will be much easier.

Accelerating the transformation of innovative pharmaceutical companies, gout and hyperuricemia are the key areas of investment

Since May this year, insulin collection has begun to implement in various cities across the country. As products have delivered the market at a more favorable price, its impact on enterprises has also appeared in the semi -annual report.

Taking another company of "A -share insulin double male" Gan Li Pharmaceutical as an example, all six insulin products won the bid for all high -ranking products. The company's operating income and net profit attributable to the mother in the first half of the year decreased by 43.42%and 153.01%, respectively.

Although Tonghua Dongbao's 5 insulin products (full series of insulin products) won the bid at a relatively mild class B price, in the face of the whereabouts of the performance of the performance, Tonghua Dongbao's market strategy also needs to change.

The semi -annual report shows that the company plans to use the implementation of the collection of collection to accelerate the company's admission speed and sales growth across the country. According to the semi -annual report, as of the end of July, the company's glycry insulin has entered more than 4,100 hospitals in the second and secondary levels of the country, and more than 1,400 hospitals in the second and secondary of the country have entered the country. In the first half of 2022, the company's glyphosate insulin sales were nearly 3 million, achieving a year -on -year increase of over 100%, and the insulin of the door winter began to volume. On the other hand, Tonghua Dongbao has increased investment in foreign markets such as retail channels and private hospitals. Since March 2022, the company has completed the construction of e -commerce channels and offline pharmacies in 20 provinces.

In order to open up the barrier of blood glucose management inside and outside the hospital, Tonghua Dongbao also continued to strengthen the development of the integrated management platform and POCT project (blood glucose detection system by the bed).

At the same time, Tonghua Dongbao has accelerated the pace of transformation to innovative pharmaceutical companies and deployed to a wider range of treatment fields.

At present, the company's research project includes three types of new drugs in the field of diabetes therapy, two new drugs in the field of gout/hyperuricemia, and chemical oral drugs in the field of gout therapy. In the research products, THDBH120/121, THDBH110/111, Somalugptide injection and other varieties cover multi -indications such as hypoglycemic, weight loss, NASH (non -alcoholic fatty hepatitis).

Tonghua Dongbao told the reporter of "Daily Economic News" that in addition to the martial artin 30 injection and door winter insulin 50 injection in the year, the company’s Licolu peptide injection is expected to be approved in the second half of next year. Tonghua Dongbao's two hotspots in the near future.

In terms of Tonghua Dongbao, in terms of innovative drugs, except for the field of diabetes, gout and hyperuricemia will become one of the areas of the company's key investment in the future. At present, the lack of safety and efficacy in the market has both gout and hyperuricemia therapy drugs. The company has the potential for "explosive" in the company's research. If the clinical progress is going well in the future, it is expected to become a new highlight of the company.

Daily Economic News

- END -

Trampoline leader Sanbaishuo IPO over the meeting: half of the overseas revenue of building buildings accounted for more than 90 %

Cover reporter Ma MengfeiOn July 21, Qingdao Sanbaishuo Health Technology Co., Ltd...

What laws do abuse of health codes violate?

Wen | Xiong Zhi Liu MengdiRecently, the Zhengzhou Discipline Inspection Commission issued the results of the Red Code Incident survey. The truth of this hot Internet hot event has gradually become c