The weakening of the track stocks dragged the securities firm's gold stocks in August, and only two portfolio yields were positive!But in September, many brokers are still optimistic about new energy

Author:Daily Economic News Time:2022.08.31

With the close of Hong Kong stocks at 4 pm on August 31, the "transcript" of the gold stock group in August 2022 was officially released.

Although the market has experienced adjustments in July and August of this year, the performance of the track stocks in July has made the overall yield of the "heavy warehouse" track stock market gold stocks winning the index. However, in August, especially the collective flames of the track stocks since the end of the end, the yield of the gold stock portfolio of the securities firm was obviously dragged down.

According to the statistics of each city, the average decline in the 388 gold stock targets in the market in August this year reached 4.89%, the Shanghai Stock Exchange Index fell 1.57%, the Shanghai and Shenzhen 300 Index fell 2.19%, and the GEM index fell 3.75%. It is worth mentioning that in the nearly 50 securities companies' gold stock groups, only two brokerage groups were positive in August.

Although since the end of August, the "New Half Army" track stocks have continued to adjust, but there are still many brokers continue to be optimistic about the track stocks represented by new energy in September.

In August, the performance of the securities firm's gold stocks running the market

Since the second half of this year, the concentrated power equipment, electronics, automobiles, machinery and equipment and other industries of the track stocks have always been the target of centralized recommendations for each securities company. And this trend has been strengthened in August. A month ago, the industry that ranked among the top gold stock groups in August was power equipment, machinery equipment, electronics, food, drinks, automobiles, military workers, that is to say In August, the gold stock group of the securities firms "heavy warehouse holding" the "new semi -army" track stock.

However, after undergoing strong performance for several consecutive months, the "New Half Army" track finally turned off in August, especially the decline since late August made some investors a little caught off guard. On August 31, the track stocks fell a large area.

According to CHOICE statistics, in August, in the case of application in the case of the industry, the yields of electricity equipment, machinery, equipment, electronics, automobiles, and military industry indexs all lost the broader market, namely: -7.88%, -7.34%,- 1.15%, -1.85%,-4.28%.

The performance of the track stocks also directly dragged down the performance of the securities company's gold stocks this month. According to the statistics of each city, the average decline in the 388 gold stock targets in the market in August reached 4.89%, while the Shanghai Stock Exchange Index fell 1.57%and the GEM index fell 3.75%.

Only 6 brokerage gold stocks run to the market from January to August

Although the market decline in August this year was less than July, the overall performance of the securities company's gold stock group was less than July.

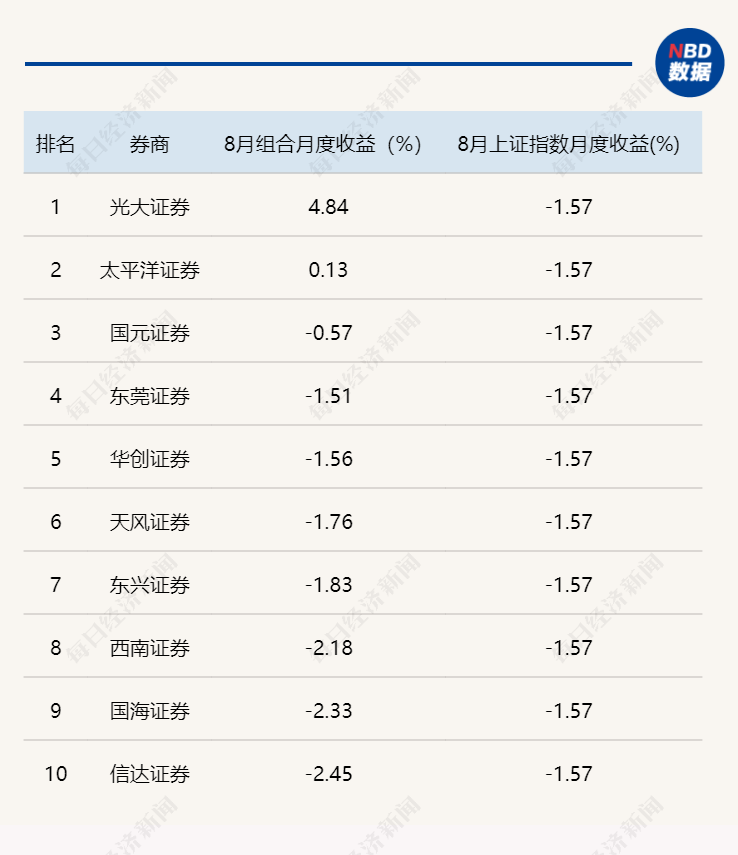

In August 2022, the top 10 brokerage gold stock groups in the industry (data source: per city)

In July, the gold -stock portfolio of individual securities firms achieved good returns with the successful betting of Taoist stocks. It no longer exists in August.

According to statistics, only two brokerage groups in nearly 50 brokerage companies were positive in August. The yield of open source securities gold stocks in August was -9.84%, ranking a big decline from July; the yield ranking in August also declined sharply from July.

In August 2022, 10 brokerage gold stock groups after the industry (data source: per city)

On the other hand, according to each city statistics, the yield of the gold stock portfolio of 5 brokerage firms in August is less than -8%, which are the monthly gold stock portfolio of Anxin Securities, Central Plains Securities, Guojin Securities, open source securities, and China Merchants Securities. Among them, the earnings ratio of Anxin Securities Gold Stock Portrait was -12.7%in August.

From January to August 2022, the top 10 brokerage gold shares in the industry (data source: per city)

According to each city statistics, as of August this year, the gold -stock portfolio with a cumulative yield is only a Fortune Securities and Gold Stock Portrait. During the same period, the yield of the Shanghai Stock Exchange Index was -12%, and the only gold stock portfolio that could win the Shanghai Stock Exchange Index was only Caitong Securities, Shen Wanhongyuan, Guosheng Securities, Everbright Securities, Open source Securities, and Pacific Securities.

From January to August 2022, 10 brokerage gold stock groups after the industry (data source: per city)

According to statistics from each city, as of August this year, the accumulated income ranking of the industry's ten gold stock portfolio is Dongguan Securities, Founder Securities, Yuekai Securities, Soochow Securities, Guojin Securities, Central Plains Securities, Great Wall Securities, China Merchants Securities , National Yuan Securities, Anxin Securities monthly gold stock group. Among them, in the first August, the yields of the gold-stock portfolio of five securities firms including Dongguan Securities, Founder Securities, Yuekai Securities, Soochow Securities, and Guojin Securities were less than -30%. This number reached a new high in the year.

Institutional discussion style switching

Although since late August, the "New Half Army" track stocks have emerged with a large round of adjustments, but many securities firms are still firmly optimistic about the performance of the track stocks in September.

The open source securities strategy team released the September configuration strategy of this morning stating that in the early days of liquidity recovery, the manufacturing opportunities in the economic structure or the leading recovery were still firmly optimistic about the growth style represented by the "new semi -army". In particular, it attaches great importance to the mid-market growth of 30-60 billion market value, and has a "gross profit margin+revenue" double-rising and valuable industries, including: battery, motor electrical control, energy storage, photovoltaic, wind power, machinery and equipment and military industry. Among the top ten gold stocks recommended by open source securities in September, many new energy stocks are still included.

The Anxin Securities Strategic Team recently issued a view that the value of the market may have a super decline in the market's judgment to maintain a shock market judgment, but the high -growth small and medium -sized disk in the mid -period is difficult to end. It is recommended that super -equipped industries include: automobiles (automotive parts and intelligence), energy storage and power grids (new energy -related supporting construction of green electricity industry chain), photovoltaic, food and drink, agricultural chemical, gold, military industry controlled controlled, controllable, and controllable, self -controlled, military industry, self -controlled, controlled, and controllable, and self -controlled military industry, self -controlled and controllable, and self -controlled, military industry, self -controlled, and controllable, and controlled by military industry, self -controlled, and controllable, and self -controlled military industry, and self -controlled military industry, self -controlled, and controllable, and self -controlled military industry, and self -controlled military industry, self -controlled, military industry, and self -controlled, military industry, and self -controlled, and controlled by military industry. medicine. After the 31st, CITIC Construction Investment pointed out in the September investment strategy released by CITIC. "" With the proportion of the turnover of some popular track industries/the replacement rate, etc. After setting up, grasp the prosperity, the medium -term strategic attention to the low penetration track, the short -term attention to the definition of the definition of the reverse variety+the strong tough consumer goods under the peak season. " Construction investment predicts that the demand for photovoltaic/wind power and new energy vehicles will gradually enter the peak season. At the same time, the release of silicon material production capacity and new car listing will be catalyzed.

On the other hand, many securities firms are currently more inclined to market style from growth to value. In the morning today, the Western Securities Strategic Team released in the September market outlook pointed out that from the perspective of asset allocation, the value of the allocation of large -cap stocks is gradually prominent, and the overall market style will return to the leader. In the middle period, inflation is still the most important investment in the year. It continues to pay attention to the concepts of popular consumption concepts such as food and beverages that benefit from inflation, stable performance, consumer industry such as home appliances and medicine, and virtual reality, games and other popular consumption concepts. From the perspective of the September of Western Securities, it contains a number of consumer industries such as food, beverage, home appliances and medicine. Brokers who are currently identifying style switching also include Caitong Securities and Minsheng Securities.

Daily Economic News

- END -

Henan's new crown virus detection reagent limited price linkage, more than 190 products reduced the average price of about 50%

In order to effectively respond to changes in the prevention and control situation of the epidemic and reduce the cost of large -scale nucleic acid screening and high -frequency detection, the Henan M

The two academicians arrived at the scene, and the Optics Valley chip company received nearly 600 million yuan B financing

Jimu Journalist Hu ChangxingIntern Xie JiaxingCorrespondent He JinlongOn June 25, ...