Investing in the 12 -year reward of this Shiyuan's 12 -year return 17.8 times the Shanghai Mingda plan to earn "a lot of money" continues to reduce its holdings

Author:Daily Economic News Time:2022.08.31

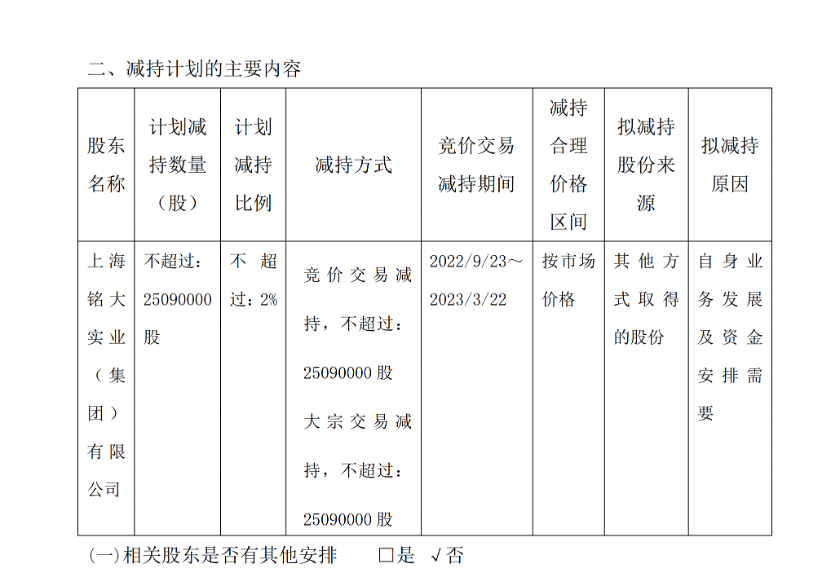

On August 31, this Shiyuan (SH603369, the stock price of 46.2 yuan, and a market value of 58 billion yuan) issued an announcement saying that the company's shareholder Shanghai Mingda Industrial (Group) Co., Ltd. (hereinafter referred to as Shanghai Mingda) intends to reduce its share shares, and the plan is planned to reduce the number of holdings. No more than 2.59 million shares, no more than 2%of the total share capital of this world.

"Daily Economic News" reporter noticed that since 2016, Shanghai Mingda has continued to reduce its holdings of this world. Shanghai Mingda has already invested in before the listing of this world. In 12 years, the investment brought about 17.8 times the return.

This life is frequently reduced

As of now, Shanghai Mingda holds about 43.8438 million shares in this world, accounting for 3.49%of the total share capital of this world.

According to this announcement, Shanghai Mingda plans to reduce its holdings from September 23, 2022 to March 22, 2023 to reduce holdings of the general transaction or concentrated bidding, which does not exceed 25.09 million, that is, not exceeding 2% of the total share capital of this Shiyuan. Essence

Photo source: Screenshot of the announcement of this Shiyuan

Regarding the reasons for the reduction of Shanghai Mingda, this World Yuan disclosed in the announcement that it was "the development of its own business and the need for fund arrangements."

It is worth noting that Shanghai Mingda's reduction of holdings has been limited to the reduction frequency. According to the announcement of this Shiyuan, those who reducing their holdings through the method of transaction shall be reduced by the total number of holdings within 90 consecutive natural days. The total number of reductions within the day shall not exceed 1%of the total number of shares in this world.

In addition, in recent years, this world has frequently reduced its holdings by shareholders and executives. Wind data shows that since August 2019, in addition to Shanghai Mingda, the directors and supervisors of the world's fate, including Ni Congchun, Wang Weidong, Wu Jianfeng, Yang Dong, and Zhou Suming, also frequently reduced their holdings.

I earned 17.8 times in 12 years

Shanghai Ming had already invested in before the IPO of this world. In April 2010, Shanghai Mingda invested in about 250 million yuan in cash, accounting for 13%of the registered capital. Shanghai Mingda's 13%of the shareholding of this world has remained before the IPO of this world.

In July 2014, this world was successfully listed.

At the end of 2016, Shanghai Mingda began to reduce its holdings. Wind data statistics show that since the end of 2016, Shanghai Mingda has reduced its reference market value of about 2.67 billion yuan. As of now, Shanghai Mingda still holds 43.8438 million shares of this world, calculated at the closing price of 46.2 yuan on August 31. This part of the market value is about 2.03 billion yuan.

In other words, Shanghai Mingda's investment in today's fate will be invested in this world for 250 million yuan in 2010. As of now, the total value of about 4.7 billion yuan is exchanged, with an investment return of about 17.8 times.

Qixinbao shows that Shanghai Mingda's shareholders are natural persons. Chen Dehua, Wang Miao, Jiang Wei, and Xu Yan hold 50%, 30%, 10%, and 10%equity of Shanghai Mingda.

According to Shanghai Mingda official website, Shanghai Mingda was established in December 2002. It is a large -scale industrial investment group in China that has influenced the diversified business system supported by the three core industries of "culture, creativity, and investment". In the field of industrial investment, it focuses on the fields of the Internet of Things, new materials, new energy and other fields, and strategically invest in many domestic and foreign listed companies and high -tech industry companies.

Choice data shows that Shanghai Mingda is still Hongye Futures (SZ001236, the stock price is 12.32 yuan, the market value is 12.4 billion yuan), Electric Studios (SZ002730, the stock price of 8.85 yuan, market value of 3.2 billion yuan) and Aipu shares (SH603020, share price of 10.92 yuan, market value, market value The top ten shareholders of 4.2 billion yuan).

In the first half of the year, the net profit of returning to the mother increased by 21.22%

According to this semi-annual report of this World, in the second quarter of this year, the Bank of China Co., Ltd.-China Proclaimed Baijiu Index Hierarchical Securities Investment Fund reduced its holdings of this world, and the number of shares reductions was about 990,000 shares. Lianshui Jinyuan Trading Co., Ltd., Lianshuiji Trading Co., Ltd. and Hong Kong Central Settlement Co., Ltd. have risen in the second quarter of this year.

Although some shareholders have reduced their holdings, from the perspective of performance, the performance of today's fate has remained steady growth. In the first half of this year, this year's business revenue achieved approximately 4.65 billion yuan, an increase of 20.66%year -on -year; the net profit attributable to shareholders of listed companies was about 1.62 billion yuan, an increase of 21.22%year -on -year.

Picture source: Screenshot of this semi -annual report of this world

It is worth noting that in the first half of this year, the liquor industry performed strongly, and the profit growth rate of today's fate was lower than the overall level of the industry.

According to this semi -annual report, the National Bureau of Statistics and the China Wine Industry Association data were quoted. In the first half of this year, there were 961 liquor companies above designated size. The total production of liquor companies above designated size above designated size was 3.7509 million liters, a year -on -year increase of 0.42%; cumulative accumulated; cumulative cumulative; Completed product sales revenue of 343.657 billion yuan, an increase of 16.51%year -on -year; the cumulative total profit was 136.670 billion yuan, an increase of 34.64%year -on -year.

Regarding the growth of operating income in the first half of the year, the explanation of this world is that the sales of products above Class A or above have increased a lot.According to the division of alcohol in this world, its special A+class is a product with a factory price of more than 300 yuan, and the special A category is 100 to 300 yuan.In the first half of this year, the front line of the market played the "Hundred Days Conference War" assembly number in the big discussion, which greatly boosted the confidence and morale of the marketers, showing the confidence of not being afraid of challenges and not being afraid of difficulties.The marketing system has changed from uniform to diversified change, adjusted the organizational structure, implemented the operation of sub -brand, and improved its professionalism.

Daily Economic News

- END -

96 have entered the top 500 in the world!State -owned enterprise ten -year transcript

On June 17, the Propaganda Department of the Central Committee of the Communist Party of China held a series of theme press conferences of the Ten Years of China to introduce the reform and developm

Steady into the quality and appear on CCTV!This result, Qiantang is C position!

In the first half of this year, the total import and export of cross-border e-comm...