The first ranking of the same kind is 2%!How does China Merchants Fund Zhu Hongyu create "core competitiveness"?

Author:Capital state Time:2022.09.01

Since 2022, the market has been adjusted by the equity market. In the case of many investors facing the retracement of income, some high -quality funds still seize precious income for the holders in the retrograde. The core competitiveness of China Merchants stands out of similar funds.

Excellent performance: Since the establishment of the fund, the top 2% of similar rankings

The core competitiveness of China Merchants belongs to a partial stock hybrid fund. It was established on April 13, 2022. At that time, A shares were experiencing a large round of decline. This is a equity fund born in adversity. However But Fuyao went straight. Wind data shows that since its establishment (2022.4.13-2022.8.31), the fund has a yield of 27.00%, and 2%(42/3019) in the same type. The performance comparison of the same period fell by 1.01%, the CSI 300 declined 2.42%, and the blending index of partial stocks rose 5.19%.

In the market environment that fluctuates today, the core competitiveness of China Merchants can significantly win the performance of the performance comparative, and it is outstanding among many partial stocks. It may be due to the fund manager Zhu Hongyu's unique investment style.

In Zhu Hongyu's opinion, investing is like "cultivated land". In the early stage, a little loose soil, waiting for the time to plant and harvest. "After thinking about it, my mentality becomes much better. Can you explode? I don't predict the weather, and I don't think I have this ability. I am interested in how to choose good land and pick the seeds. "

Disclosure of holdings: Ten major heavy positions are divided into 5 major industries, accounting for 46% of the net value ratio of the fund

When talking about his own concentration of shareholding, Zhu Hongyu bluntly said that he did not want to be too concentrated. Unless the company that had long -term communication between long -term communication was extremely cheap, the long -term winning rate was particularly high. Buy enough. In his opinion, to realize the true and high income and low fluctuations in the true sense, you must constantly find different "land". If you invest in "cultivated land" in a certain industry, it is impossible to control fluctuations better.

Judging from the core competitiveness of the investment promotion, the fund's regular report shows that as of the end of the second quarter of 2022, the fund's top ten heavy stock stocks accounted for between 3%-7%, accumulating the fund's net value ratio ratio Less than 50%, and is divided into various industries such as household appliances, social services, transportation, pharmaceuticals, food and beverages, and other industries.

"Eggs cannot be placed in a basket." This decentralized risk reason is that many people understand, but when they are actually practicing, they may still have "treasure" on a single track or stock. This situation belongs to the high risk of obtaining high income. When it comes to market calls, it often suffers from major losses. In comparison, Zhu Hongyu's investment style looks more stable. In the process of making a combination, he always adheres to a principle, that is, to bear relatively low risks, to obtain relatively high income, and never bear high risks. Then Go to Bo Bo a high income.

In terms of operating strategy, Zhu Hongyu's ideal investment status is to buy in the case of high winning rate and high odds, that is, the company's fundamentals are good and the demand is long for a long time. At the same time Unlike the original hypothesis, or the expected benefits, or if you have a better choice, you will consider selling.

Reverse investment: actively layout when the price -earnings ratio is low and the market attention is low

Zhu Hongyu dares to reverse. He is good at actively layout when the price -earnings ratio is relatively low and the market attention is low. According to Wind data, as of the end of the second quarter of 2022, the average price -earnings ratio of the core competitiveness of China Merchants was only 13.48, and the average price -earnings ratio of the heavy stock holding of partial stocks in the same period was 29.07.

It is described in the book "Wall Street Godfather" Graham's "Smart Investor" that "the margin of security always depends on the price paid". The lower the price, the higher the safety margin. This coincides with Zhu Hongyu's investment concept. The relatively low valuation (price -earnings ratio) also means relatively low risk. In the case of the first safety margin, then to strive for relatively high high returns Essence

Zhu Hongyu did not like to squeeze the popular track, and even used to choose high -quality targets in the industry with relatively low market attention and not such a popular industry. According to Wind data, since the establishment of the core competitiveness of China Merchants, the five major heavy warehouses that belong to the fact that the same period (2022.4.13-2022.8.31) increased only in the middle and lower reaches. It is far less than the concepts of new energy, military industry, semiconductor, but still achieved relatively good performance.

From the perspective of this "reverse investment master", the low market attention does not necessarily affect future returns. Even the "sunset industry" does not mean that there is no chance. As long as the market is large enough, many so -called "sunset industry" have 10 The key to 20 times the opportunity is how big the competitive advantage of others is, and whether the cost curve is steep.

Zhu Hongyu, who has deeply cultivated investment research in the past 17 years, is not only valuable investment insights, but also a pioneer with an attitude to the market.He believes that the prosperity of the industry is not so important. Long -term determination is the top priority, including the long -term growth space of the industry, the competitive pattern of the industry, and the change of the company's status in the industry.With less concerned about the data of next week, next month, and next quarter, I value the long -term certainty of the industry and the company. ""This is Zhu Hongyu's consistent demand for himself, and perhaps it is also the core competitiveness of the investment promotion in the" secret weapon "that has emerged and has a competitive" secret weapon "in more than four months.

- END -

Reuters: Looking forward to the Asian market diving with the Wall Street market and the opening of this week is mainly selling strong assets to sell strong assets

China Well -off. September 5th. The decline in the end of Laoma Wall Street laid a...

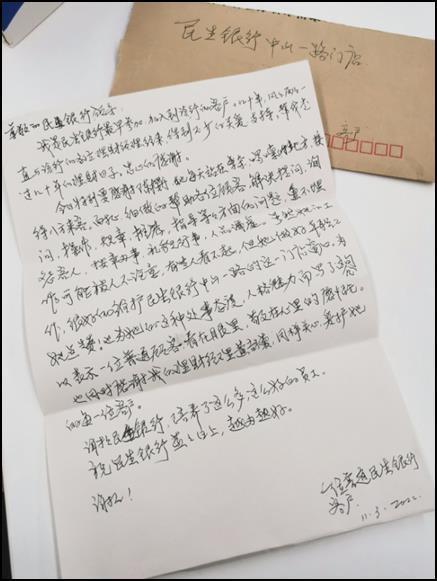

"Poly Livelihood" Minsheng Bank Guangzhou Branch: a handwriting commendation letter from customers

Text/Yang GuangPhoto/Interviewee ConferRecently, the client Ms. Liu came to the Do...