Zhengbang's short -term borrowing is high, financial expenses surge | IPO observation

Author:City world Time:2022.09.01

In the past, Jiangxi's richest man Lin Yinsun's Zhengbang Science and Technology funds were not secret. Zhengbang Technology first was a 540 million yuan business ticket default. Later, he was revealed that the phenomenon of pigs and pigs appeared because of the fact that it was unusual for the supporting households.

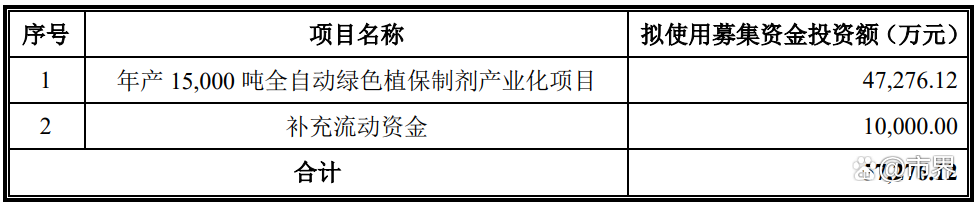

In this context, Zhengbang, a subsidiary of Zhengbang Group, submitted a prospectus to the Shenzhen Stock Exchange. In this IPO, Zhengbang's plan to issue no more than 72.9267 million shares, and it is planned to raise 572 million yuan, of which 472 million yuan is used for the construction of 15,000 tons of full automatic green plant protection preparation projects, and 100 million yuan is used to supplement mobile funds.

The prospectus shows that Zhengbang's protection is mainly engaged in the development, production and sales of pesticide -primary drugs and preparation products. In 2021, Zhengbang's sales revenue achieved sales revenue of 1.289 billion yuan, accounting for 73.51%of the company's total sales revenue. At the same time, the original drug achieved sales revenue of 418 million yuan, accounting for 23.86%of the company's sales revenue.

In the past few years, due to the high prosperity of the agricultural chemical industry, the operating performance of Zhengbang has increased rapidly. From 2019-2021, Zhengbang's insurance revenue has achieved operating income of 952 million yuan, 1.446 billion yuan, and 1.755 billion yuan. The net profit was 599.939 million yuan, 51.829 million yuan, and 86.1419 million yuan.

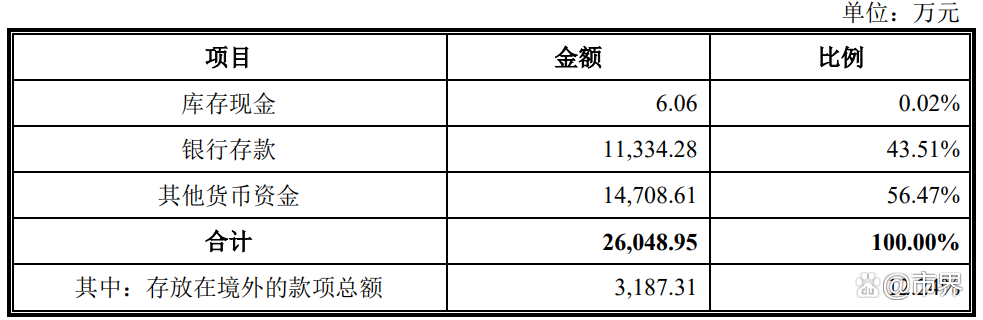

In terms of financial perspective, in the case of increasing revenue and net profit, the cash flow of Zhengbang's insurance should be very sufficient. But the facts are just the opposite. As of the end of 2021, Zhengbang had only 260 million yuan in monetary funds, of which 147 million yuan was limited funds. From the perspective of debt, the short -term borrowing of Zhengbang was as high as 352 million yuan, and the long -term loan was also 90 million yuan.

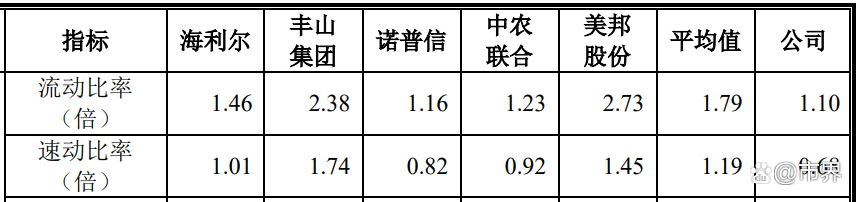

The proportion of Zhengbang's insurance flow and the ratio of speed is significantly lower than those of peers. The prospectus shows that as of the end of 2021, the company's mobile ratio was only 1.10. Generally speaking, the company's mobile ratio was 1.50-2.00 in the field of safety. The same industry can be comparable to the company in China and the United States.

In addition, the ratio of the rapids of the United States is as high as 1.45, the average speed ratio of the industry is 1.19, and the company's speed ratio is only 0.68 during the same period.

Regarding the weak debt repayment capacity, the explanation given by Zhengbang's insurement is that the company mainly through bank loan financing, which caused the company's short -term debt to increase significantly.

Data show that from 2019 to 2021, the short-term borrowing of Zhengbang's insurance was 315 million yuan, 497 million yuan, and 352 million yuan. Due to short-term borrowing highs, the financial expenses of Zhengbang's financial insurance also increased from 85.974 million yuan to 39.11 million yuan. This is also this is also this. As one of the important reasons for the company's profit growth in the same period as the increase in operating income.

The short-term borrowing high-load also allowed Zhengbang's asset-based asset-liabilities to remain high. From 2019-2021, the asset-liability ratio of the parent company was 76.00 %, 75.67 %, and 82.42 %, respectively. During the same period, the company's comparison company's average liability ratio was only 45.96 %, 45.38 %, and 42.13 %. Zhengbang's liability ratio was significantly higher than the comparison company in the same industry.

Short -term borrowing, high debt ratio, and weak debt repayment capabilities are not that Zhengbang's ability to make protection. The biggest reason is that Zhengbang made two dividends in 2019. In January 2019, Zhengbang made a profit distribution plan. The company distributed a profit of 259 million yuan to the only shareholder Zhengbang Science and Technology at the time. In November 2019, Zhengbang's Bao Bao was a dividend of 96.42 million yuan to Zhengbang. Yuan, we must know that the cumulative net profit in Zhengbang's insurance for the three years from 2019-2021 is only 197 million yuan.

Although Zhengbang Insurance in 2019 is a subsidiary of 100%Holdings of Zhengbang Technology. It is owned by the company's shareholders, so it is understandable that the company conducts large -scale dividends. However, Zhengbang's insurance is a company that has an independent legal person and an independent operation of finance. Because the dividends forced the subsidiaries into a tight funding situation, the fragrance of Zhengbang Technology was a bit ugly.

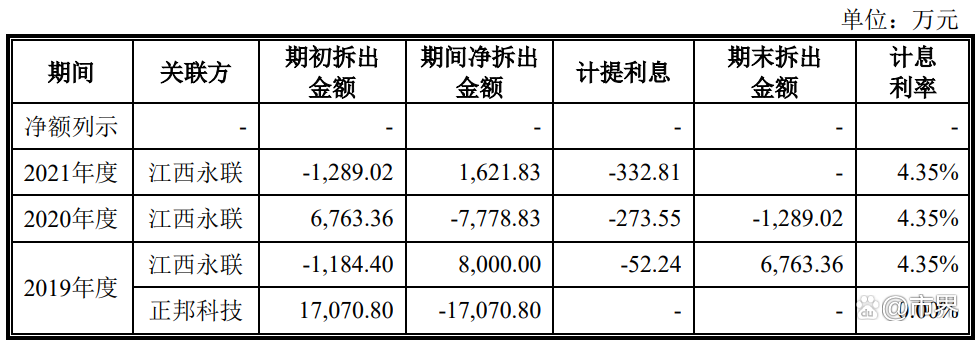

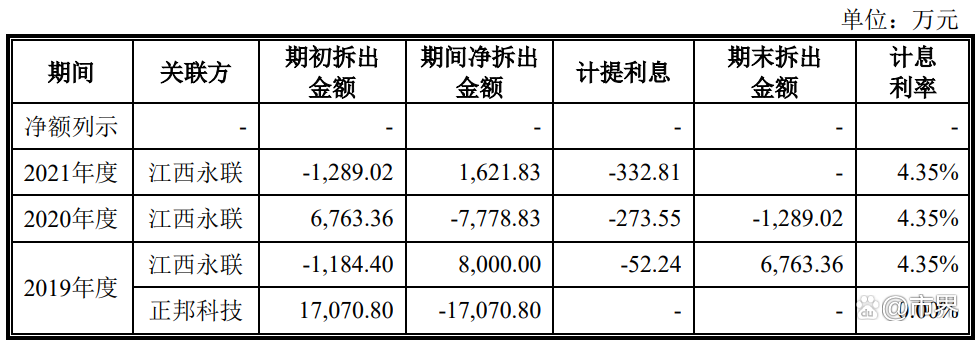

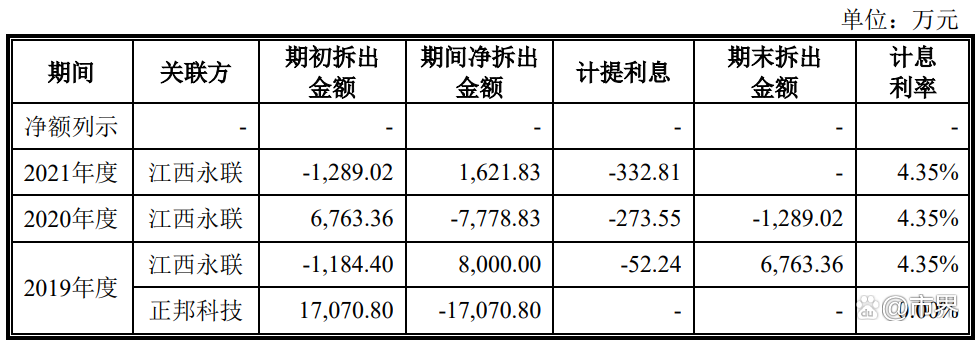

In addition, during the period as a subsidiary of Zhengbang Science and Technology, there was a large amount of funds with a large amount of funds between Zhengbang's insurance and Zhengbang Technology. During the borrowing of funds, Zhengbang Technology did not pay any interest to Zhengbang.

Zhengbang's insurement stated that Zhengbang Science and Technology borrowed Zhengbang's funding funds and caused the requirements for centralized management scheduling of listed companies, so it was not included in the corresponding interest.

The financial director of a listed company told the market that as long as it is a company with an independent legal person, whether it is a subsidiary or a parent company, it must not borrow funds without permission, and the bank needs to be commissioned to transfer loans.

However, because Zhengbang's insurance is a 100%holding subsidiary of Zhengbang Technology, the funds of Zhengbang's insurance are equivalent to the funds of Zhengbang Technology, so it is understandable that it is not included in interest in handling. This can also increase the profits of Zhengbang Technology.

In addition, the person also said that when the parent company asked the wholly -owned subsidiary to ask for funds, it could collect the funds of subsidiaries in the name of centralized scheduling, which is also common in the use of parent companies and subsidiaries. But essentially, centralized funds are still occupied by funds illegal, so this approach is not compliant in law.

(Author | Duan Nannan)

- END -

The price of gold rose to $ 2,500?Is Goldman Sachs Blowing the price of oil and blowing gold?

Recently, if you want to ask what topics are the hottest in the international capi...

"Really Limin Project"

In the workshop of Hunan Zhongxia Zhuzhou Electric Motorns Co., Ltd., the first subway vehicle created for Mexico City Metro Line 1 renovation project has successfully went offline recently. The brigh