In the past 5 years, net profit has shown the first negative growth of the "Sweeping Mao" stone technology shift?

Author:Daily Economic News Time:2022.09.01

On August 29, "Sweeping Mao" Stone Technology (SH688169, the stock price of 325.81 yuan, a market value of 30.473 billion yuan) announced the half -annual report in 2022.

In the first half of the year, Shito Technology had a negative growth of the first net profit since 2017. One of the reasons for dragging the net profit performance is the increase in sales expenses in the first half of the year. The semi -annual report shows that in the first half of the year, the sales cost of Stone Technology exceeded 500 million yuan, which was closer to the 262 million yuan in the same period last year.

On August 30, for the growth of the company's sales expenses in the first half of the year, Stone Technology told the reporter of "Daily Economic News" in writing that the growth rate of sales expenses was high due to previous companies' investment in marketing less and low bases. When asked about the performance expectations of the second half of the year, Stone Technology stated that it was fully prepared this year, and the continuous growth of the industry and the continuous expansion of its own business were full of confidence.

The first increase in income since listing has increased the inventory and sales of sales simultaneously.

After the net profit growth was ended in 2021, in the first half of 2022, Shito Technology had a negative increase in net profit for the first time.

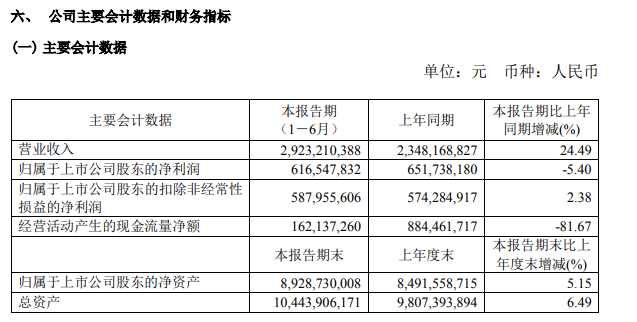

In the first half of 2022, Shito Technology achieved total operating income of 2.923 billion yuan, an increase of 24.49%year -on -year, and net profit was 617 million yuan, a year -on -year decrease of 5.4%. This is the first time since the listing of Stone Technology has increasing income and increasing profit, and it is also the first negative increase in net profit since 2017.

Image source: Announcement Screenshot

From 2017 to 2020, the net profit performance of Stone Technology has been very eye -catching, with a year -on -year growth rate of 696.05%, 359.11%, 154.52%, and 74.92%. By 2021, the net profit growth of Stone Technology suddenly slowed to 2.41%.

Stone Technology stated in the semi -annual report that thanks to the effectiveness of the new product research and development, the expansion of domestic channels, the effectiveness of the domestic channels, and the effectiveness of marketing. In the first half of the year, the company's operating income increased greater than the same period of the previous year. In order to further expand the market at home and abroad, the sales costs have increased more, including advertising and market promotion costs, increased salary costs for sales departments; and decreased profit or loss generated by long -term remittances.

In terms of R & D investment, in the first half of the year, R & D investment in Stone Technology increased by 13.74%year -on -year to 226 million yuan, and the proportion of R & D investment accounted for further increase to 7.74%. In the past few years, the R & D investment of Stone Technology has been steadily increasing. From 2019 to 2021, the research and development costs of Stone Technology were 193 million yuan, 263 million yuan, and 441 million yuan, respectively; the proportion of revenue was 4.59%, 5.80%, and 7.55%, respectively.

At the level of sales, in the first half of the year, the sales volume of stone technology sweeping robots exceeded 1.1 million units, and the sales revenue of scanning robots reached 2.922 billion yuan. As of the end of the reporting period, the domestic online listing share of the stone brand reached 23.57%.

But at the same time, the inventory of Stone Technology has also increased significantly. In the first half of this year, the inventory value of Stone Technology increased from 595 million yuan to 906 million yuan, a year -on -year increase of 52%. Regarding the reasons for rising inventory, Stone Technology explained that it was caused by the increase in the stock preparation of the company's new product listing at the end of the report.

At the same time, due to the increasing increasing receivables of the company, the sales payment was not all inflow; the increase in stock inventory and the increase in sales expenses caused increased capital payment. In the first half of the year, the net cash flow generated by the operating activities of stone technology It was 162 million, a decrease of 81.67%compared with the same period last year.

Regarding the performance expectations of the second half of the year, Stone Technology told the "Daily Economic News" reporter that due to various factors, the company's pressure in 2021 is a common phenomenon. As a global enterprise, the scope of stone science and technology is covered by many major markets such as Europe, North America, Japan and South Korea. In terms of impact on the company's stock price.

"But since last year, we have been actively trying to disperse and resolve risks. And because of experiencing the storm last year, we have also made more fully preparations this year. And overseas markets, the company also has a richer SKU this year, and the response method will be more flexible. Diverse. Therefore, we are full of confidence in the continuous growth of the industry and the continuous expansion of our own business. "Stone Technology said.

Sales costs are close to double the company: lay the foundation for longer development

In the first half of 2022, the sales cost of Stone Technology reached 501 million yuan, an increase of 91.22%year -on -year from 262 million yuan in the same period last year, close to double.

Judging from the past financial reports, the growth rate of sales expenses of Stone Technology has not been low. From 2019 to 2021, the year -on -year growth rate of stone technology sales was 116.66%, 75.24%, and 67.74%, respectively. In contrast, the growth rate of operating income during the same period was 37.81%, 7.74%, and 28.84%, respectively.

Regarding the growth of the company's sales expenses in the first half of this year, Stone Technology said that the high growth rate of sales costs was due to previous companies' investment in marketing less and low bases. In addition, investing in sales is a decision made by the company's cautious considerations under the multiple factors such as the size of the enterprise and market competition.

Stone Technology Product Picture Source: Company's official website Stone Technology further stated that at the company's 1-N stage, more users need to know and know the stone brand, and pass the good products and good value. Therefore, the company focuses on omni -channel sales and brand building strategies. It is a necessary condition to increase sales investment through marketing and products to expand brand channels and expand market influence.

"Chairman Chang Jing also often emphasized internally that although this will cause the company's short -term performance figures to not look good enough, we cannot do nothing because of this. The short -term sales investment is to laid the foundation for a longer -term development. We must look at the problem with long -term vision to see the problem. ","

In 2020, after the stone technology landed on A shares, the stock price once exceeded the thousand yuan mark in June 2021, becoming the first high -priced stock of the science and technology board, known as "sweeping the ground". However, as of today (September 1), the stock price of Stone Technology was 325.81 yuan, and the total market value hovered around 30 billion yuan.

In this regard, Stone Technology said that stock price fluctuations are caused by many factors. The first is that the company has increased stocks during the implementation of the annual equity distribution of 2021. Due to the increase in the scale of the share capital after the increase and the unchanged shareholders' equity, the stock price declined. The announcement disclosed that the company increased by 0.4 shares per share with capital provident fund to all shareholders, with a total increase of about 26.725 million shares. After the increase, the total share capital was about 93.5288 million shares.

In addition, Stone Technology also stated that on the impact of stock price fluctuations on the company, Chang Jing, chairman of Stone Technology, also said that the company's development plan will not be affected by short -term stock price fluctuations, and it will continue to advance according to normal rhythm and way. "Investment should be invested. If you don't invest in the company, there is no future, and the company has less invested now. It may be good recently, but the company may not be good in the future. In the long run, it will be greater than the advantages."

Daily Economic News

- END -

National Bureau of Statistics: The price of pigs in mid -July increased by 1.3% over the early days

The website of the National Bureau of Statistics announced the changes in the market price of important production data in the field of circulation in mid -July 2022: According to the monitoring of th

The contract area of the 5th Expo Enterprise Exhibition accounts for about 90% of the planned area

The reporter learned from the supply and demand docking of the Fifth Expo Technolo...