The main competitors' net profit in the first half of the year all fell five brands to support about 90 % of the revenue of niche makeup brands, Lalami Cross A shares

Author:Daily Economic News Time:2022.09.01

Photo source: Photo Network-500666725

The promoters behind brands such as Naris (Naris) and Byphasse are sprinting A shares behind brands.

Guangzhou Larami Information Technology Co., Ltd. (hereinafter referred to as Lalami) is mainly engaged in comprehensive e -commerce services for overseas cosmetics brands. With the good scene of the industry, Lalami has also achieved dozens of times of revenue in several years. Since then, the company's main competitors have landed on A shares, but the company has not caught up with the pace of peers.

Today, the industry situation is no longer in the past. In the first half of this year, the net profit of the four listed companies that were regarded by the company as the main competitors fell or even lost money. Although the Lalami profit data was not announced in the first half of this year, the revenue growth rate of Lalami, the reporting period (2019 ~ 2021, the same below), and the net profit in 2020 fell.

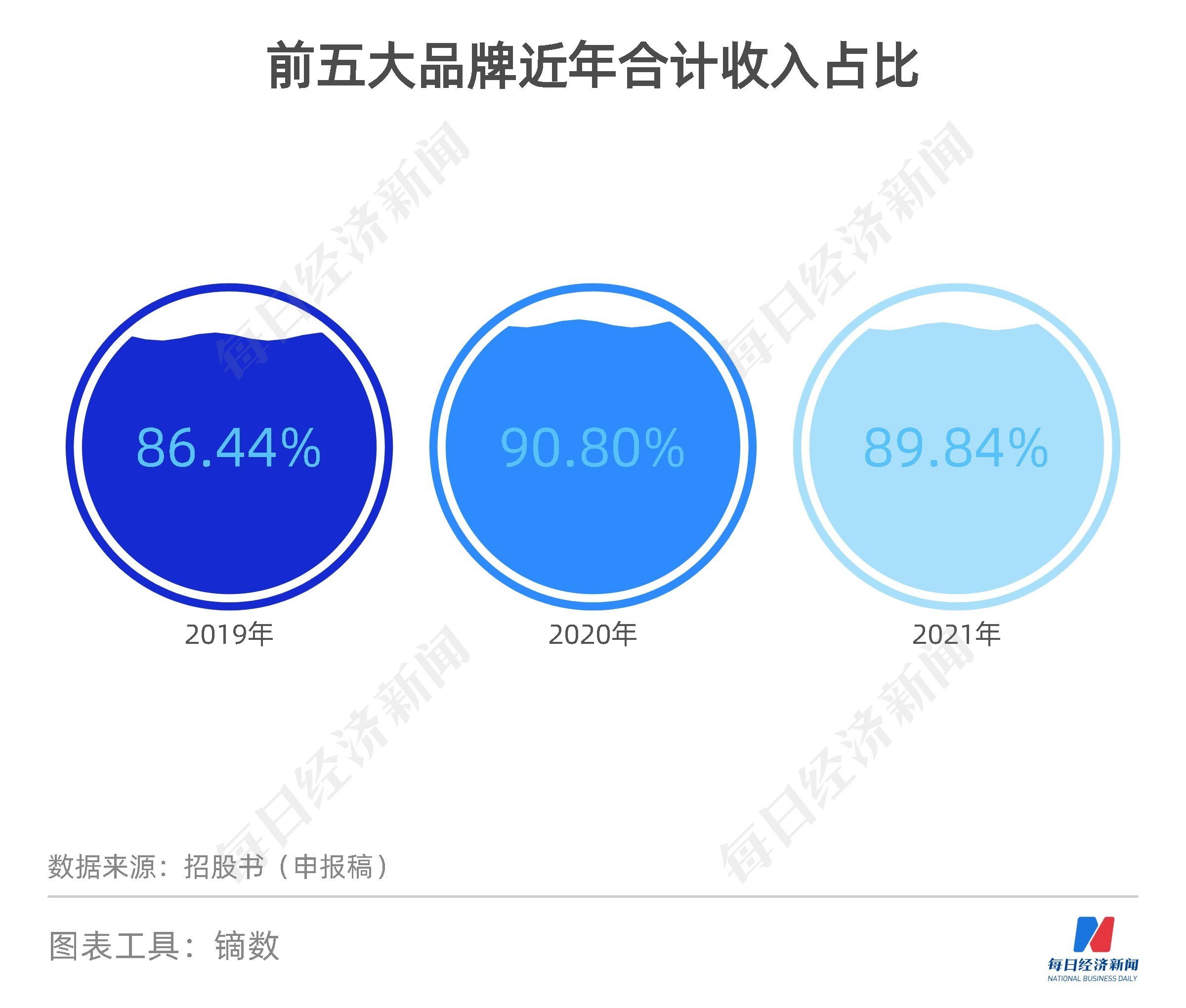

Not only that, Larami also faces the problem of high cooperative brand concentration. According to the company's prospectus declaration draft (hereinafter referred to as the prospectus), each period of the reporting period, the total revenue of the top five brands such as Naris (Naris) accounted for 86.44%, 90.80%, and 89.84%, respectively. The reporter noticed that in the peers, the brand party announced for various reasons that it was not uncommon for the termination of cooperation with e -commerce service providers.

In 2020, the net profit attributable to mother fell 9.06% of 9.06%

Larami was established in August 2012. Today, the company's controlling shareholder is Zhuhai Larami, and the actual controller Li Tiantian.

There are also well -known companies in Lalami's shareholders. Search (SZ002503, the stock price is 137 yuan, and the market value of 3.876 billion yuan) holds 14.8692%of the company's total share capital.

In addition, in 2015, Chahongji (SZ002345, a stock price of 4.87 yuan, and a market value of 4.327 billion yuan) Qianhai Tide still obtained 17%of Larami equity at a price of 68.12 million yuan through capital increase subscription and equity transfer. Essence Since then, after a series of capital increase and equity transfer, Tide Macromey currently holds 15.9581%of Larami.

Why can Larami be favored by well -known shareholders? According to the announcement of Chahongji in September 2015, in the first half of 2014 and the first half of 2015, Lalami realized revenue of 23.218 million yuan and 70.167 million yuan, respectively; net profit was 644,400 yuan and 3.356 million yuan, respectively.

Larami also promised to Chahongji and search. After financial regulations, sales from 2015 to 2017 will not be less than 250 million yuan, 400 million yuan and 600 million yuan, respectively.

In 2014, only 23.2182 million yuan was revenue, but it promised that the sales in 2017 were not less than 600 million yuan, which means that the revenue scale is needed to achieve more than 20 times within three years.

Larami's foundation at that time may be related to the industry situation. 2015年~2017年,被拉拉米视为主要竞争对手的丽人丽妆(SH605136,股价12.64元,市值50.80亿元)、壹网壹创(SZ300792,股价28.90元,市值68.98亿元)、若Yuchen (SZ003010, the stock price of 15.43 yuan, a market value of 1.878 billion yuan) and Kaichun (SZ301001, the stock price of 22.15 yuan, and a market value of 1.772 billion yuan), the net profit has achieved rapid growth. For example, Li Renli makeup, compared with the net profit of 32.7128 million yuan in 2015, the net profit of the mother in 2017 exceeded 200 million yuan, and the net profit of the two years has doubled. From 2019 to 2021, the four companies have also landed in A shares one after another.

For the IPO, Larami has long been planned. Souyou announced in August 2015 that Larami will strive to formally submit an IPO application in 2018. However, Larami's launch road did not seem to be smooth, and it was not pre -disclosed until July this year.

What is the performance of Lalami today? Although the data was not disclosed in 2017, Lalami revenue in 2019 has reached 700 million yuan. Specifically, from 2019 to 2021, the company realized revenue of RMB 760.8673 million, 783.551 million yuan, and 84,034,400 yuan, respectively, with net profit attributable to 63.87 million yuan, 58.882 million yuan, and 60.175 million yuan, respectively.

It can be seen that the performance of Larami during the reporting period is no longer rapidly growing. In 2020 and 2021, the company's revenue growth rate was only 2.98%and 7.25%, respectively; the net profit attributable to mothers in 2020 fell 9.06%.

The first five brands of revenue account for about 90 %

Can the once high -speed growth still come back?

Lalamine's main business income can be divided into Internet retail services and offline distribution according to service categories. During the reporting period, Internet retail services are the main components of Lalamine's main business income. Related income accounts for 92.76%, 90.08%, and 88.24%of the main business income. Among the Internet retail services, the income ratio contributed by e -commerce operations is less than 1%. E -commerce retail and e -commerce distribution are the company's main source of income.

Under e -commerce retail and e -commerce distribution models, the source of Larami profits is mainly the difference in the purchase and sales price of the product. How can we maximize the purchase and sales difference and profit? Most of the brands that Larami choose to cooperate are relatively niche overseas brands. With a low popularity, the Lalamine brand cultivation and marketing are more difficult. Therefore, the brand party gives the company sufficient profit space. From 2019 to 2021, the top five brands in cooperation with Larami include Naris (Naris), Avene (Avene), ByPhasse (Bonce), GIFRER (skin buds) and Ziaja (Qi Yeya). The total revenue of these five brands accounted for 86.44%, 90.80%, and 89.84%, respectively, and the concentration of brand sales was high.

Can the five major brands in the future maintain a stable cooperation with Lalami? It is not uncommon to terminate cooperation with agents in the industry. For example, some brands such as Lancome, Paris L'Oreal, and other brands have terminated cooperation with Liren Liney makeup due to their own sales teams, adjusting online sales channels, and market competition. In 2017, Lancome and L'Oreal, Paris, ranked among the top ten brands in the retail business of Li Renli Makeup E -commerce, and related sales revenue accounted for 28.85%of the company's revenue.

On August 31, Bao Yuezhong, a new retail expert in the fast -moving consumer industry, said in an interview with the reporter of "Daily Economic News" through WeChat that the current online channel development of the cosmetics industry has even exceeded offline channels. In the future, more brands may be online business. Recends it from the main operation. From this perspective, the future development of Larami has great uncertainty.

The Lalamine prospectus also reminded whether the company can continue to obtain authorization after the expiration of the authorized distribution contract, including the company's promotion sales situation during the authorization period, the sales strategic adjustment of the brand side, Brand party reputation management, etc. For its own strategic considerations, some brands may choose to operate the flagship store of e -commerce platforms.

"Daily Economic News" reporter also noticed that during the reporting period, among the top five brands in cooperation with Larami, in addition to Naris (Naris) and Avene (Avene) related sales revenue continued to grow, of the other three major brands, BYPHASSE (Beonce) related sales revenue has declined for two consecutive years, and sales revenue related to GIFRER (skin buds) and Ziaja (Qi Yea) also declined in 2021.

The net profit of the main competitors fell in the first half of the year

Whether it can achieve good performance is also related to the industry environment and corporate channel construction.

According to Star Map data, during the 618 period of this year, the sales of beauty sales of the entire network were 41 billion yuan. Compared with 51.2 billion yuan in 618 in 2021, it fell 19.9%year -on -year. The recent beauty popularity seemed to decline.

As a competitor of Larami, the four companies of Liren Makeup, Yizhong, Ruo Yuchen and Kaichun's first half of the year have also experienced decline. Among them, Li Renli Makeup and Ruo Yuchen's net profit fell by 97.03%and 77.11%, respectively, and Kaichun even lost 14.53 million yuan.

In this regard, if Yuchen's semi -annual report analyzed that due to the multiple factors such as the epidemic, the residents on the one hand were weakened in the current and future economic expectations, income confidence, and consumption confidence; on the other hand, since the second quarter The reasons for short -term closed control management, some consumers are difficult to receive online shopping products, and the willingness to buy demand is reduced.

Bao Yuezhong believes that there are many problems in the current cosmetics industry, the most important of which are two aspects of products and channels: on the one hand, the demand for young people is very important now, and how to carry out corresponding product innovation is very critical; on the other hand The development trend of the online and offline diversification channels of the cosmetics industry is obvious, and the future industry channels tend to be highly integrated online and offline. How the corresponding product structure adjustment, delivery system construction, and the improvement of online and offline user experience are all related to whether it can build a comprehensive channel. "The current channel construction is not simply moving the goods to Tmall, and more improvements need to be made."

In fact, with the rapid development of new e -commerce platforms, the traffic of traditional online platforms is being divided. In this regard, many companies have also deployed new online channels. For example, in May of this year, Beauty Makeup once stated on the interactive platform of investor relations that in the future, the company will continue to expand the advertising efficiency of emerging marketing platforms such as the number of Douyin shops and enhance the number of emerging marketing platforms such as Douyin, seize the platform support opportunities, expand on the shaking The market share of the audio platform is a good foundation for long -term sustainable growth.

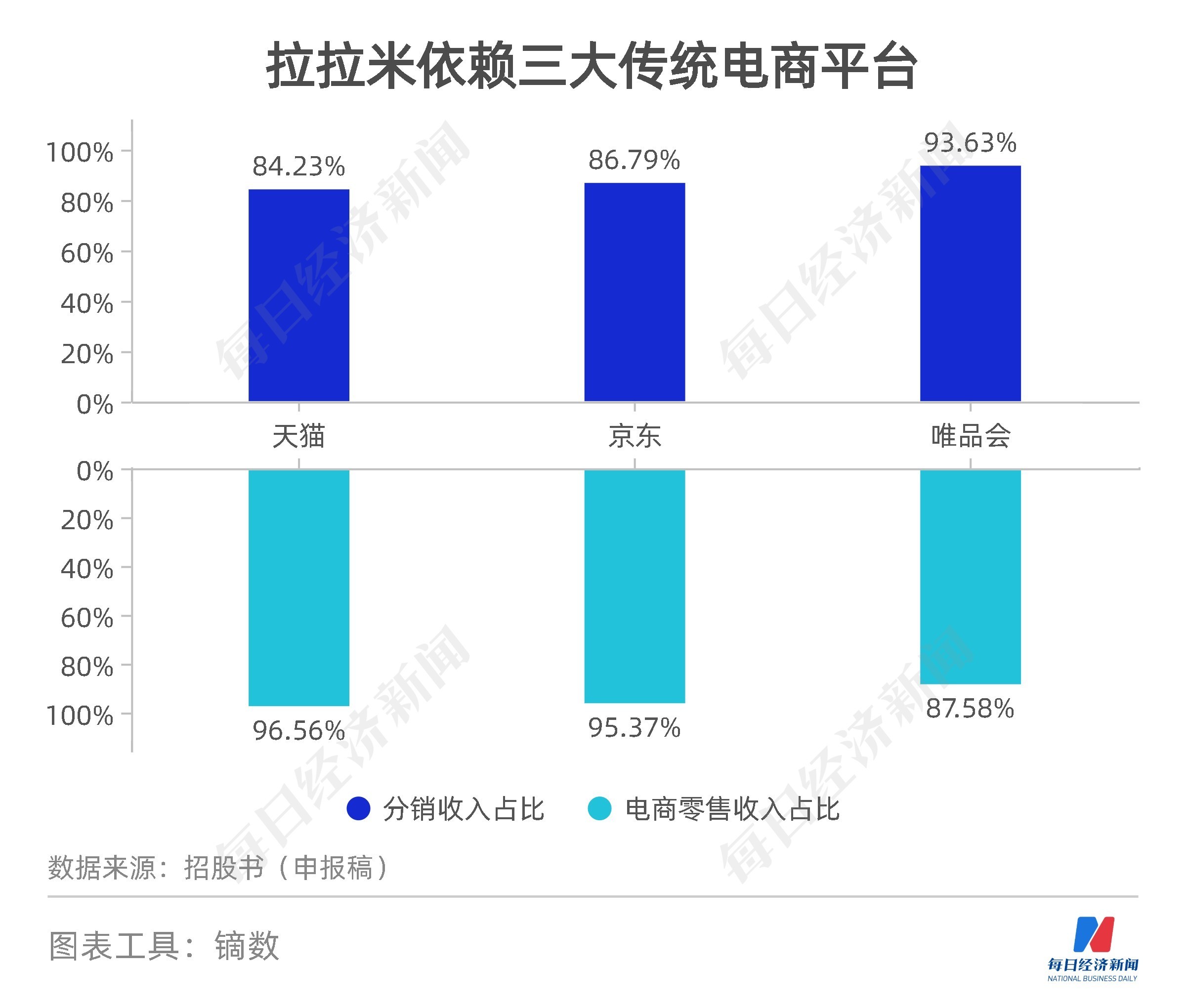

It is worth noting that the sales of imported brand cosmetics e -commerce represented by Lalami are mainly concentrated on Tmall, JD.com, Vipshop and other platforms. Specifically, during the reporting period, the distribution revenue of Tmall, JD, and Vipshop's three major platforms accounted for 84.23%, 86.79%, and 93.63%of Lalamia's distribution revenue to the platform customers; Lalami passed Tmall and Jingdong through Tmall and Jingdong. The proportion of Vipshop's three major platforms for e -commerce retail revenue accounted for 96.56%, 95.37%, and 87.58%of e -commerce retail revenue, respectively.

Bao Yuezhong said that the current e -commerce channels are gradually diversified. When traditional channels such as Tmall, Jingdong, and Vipshop are relatively stable, Douyin e -commerce, content e -commerce, short video, live e -commerce and other channels have developed very quickly.For agents such as Larami, the exploration of the new model may require a certain cost and time, and the income during the period may not reach expectations, which will restrict the development of enterprises to a certain extent.Regarding the IPO -related issue, on August 31, the reporter of "Daily Economic News" called Lalami and sent an interview email to the company, but as of the press time, no reply was received.

Daily Economic News

- END -

How do companies resume work?Can employees flow across the region?Tianfu New District Authoritative questioning

According to the Announcement on the Publication of the Popularization of Social Epidemiums and Order in the Prevention and Control of Social Epidemic in order to restore normal production and living

National Bureau of Statistics: In May

The State Council News Office held a press conference today (June 15). Fu Linghui, a spokesman for the National Bureau of Statistics and Director of the Department of National Economic Comprehensive S