Who is even worse to step on Lei Hengda?The man behind Xu Jiayin has suffering

Author:Costrit Finance Time:2022.09.01

Evergrande has once again become the focus of attention.

On the evening of August 31, Evergrande Real Estate announced that the 2022 semi -annual report cannot be disclosed on time; the recently released "Fortune" World Fortune 500 list, Evergrande's name has not appeared for the first time in seven years; The suspension of the stock suspension has been suspended for almost half a year.

During the scenery, a glorious glory; the nest is over, and the egg is finished. With the major changes in the operating situation of Evergrande, the men behind Xu Jiayin are difficult to "be alone" ...

Hong Kong "Big Brother" Liu Xiong

Fighting goose all the day, the opposite goose pecks his eyes

When it comes to the big guys behind Evergrande, the first thing to mention is Xu Jiayin and Liu Xiong, a rich man in Hong Kong.

Liu Yanxiong, born in 1951, has a sharp vision and courage. He has galloped in the Hong Kong stock market with a sniper for the year.

In March 2008, Evergrande launched a global roadshow and publicized. The market valuation was between 120 billion and HK $ 130 billion. But the sudden financial storm made Evergrande's listing plan forced to strand. "House leakage is even more rainy." Evergrande's 33 -in -construction project also faced the risk of stopping work due to the capital gap of up to 10 billion yuan.

The peak circuit turned, and Boss Xu paid several Hong Kong tycoon on the Hong Kong table, including Liu Xiong. In June 2008, Xu Jiayin received $ 506 million in war investment funds from his Hong Kong friends, and spent the capital chain crisis. In 2009, Evergrande Hong Kong stocks were listed, and Liu Xiong became an investor in Evergrande's listing.

Source: Network

However, such a big man who often "hit geese" in the capital market was pecked at Evergrande.

In April 2017, the Chinese Real Estate purchased 580 million China Evergrande shares, opened a journey to hold China Evergrande, and purchased a total of 860 million China Evergrande shares. In addition to the part of the Chinese Real Estate's shareholding, Liu Xiong's wife Chen Kaiyun personally warehouses in China Evergrande and bought about 315 million China Evergrande shares.

From 2017 -2018, China Evergrande's stock price exploded, with a market value of up to 300 billion Hong Kong dollars. Xu Jiayin repeatedly won the rich list. At the time, the couple received 1.7 billion yuan in high dividends. Liu Xiong and Chen Kaiyun also became Evergrande's "loyal fan".

In other words, during the peak of Evergrande, Liu Xiong could have at least tens of billions of imported bags, but unfortunately, it may be that greed for him to overestimate Evergrande, so he has never cash ...

Everyone knows the current things that the decline of the real estate market, coupled with Evergrande's thunder, faces liquidity funds, Evergrande's stock price has fallen sharply. At this time, the wealthy businessman in Hong Kong finally saw the "hopeless return of blood" and had to choose to cut the meat to leave the venue.

In November last year, the Chinese Real Estate announced the sale of up to 751 million authorized shares of Evergrande. This authorized shares accounted for about 5.67%of the issued shares of Evergrande Group. 12 months after the end.

This means that Liu Yanxiong will Clear Evergrande shares in this year.

Source: Chinese Real Estate Announcement

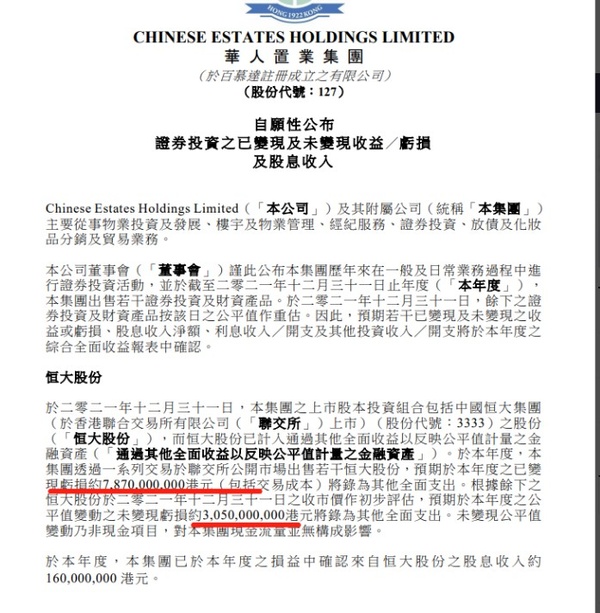

On January 7, 2022, the Chinese Real Estate announced that China Evergrande shares were sold in the open market in 2021. It is expected to record a loss of approximately HK $ 7.87 billion (about RMB 6.43 billion). At the same time, with a preliminary assessment of the closing price on December 31, 2021, the remaining unclear losses generated by the remaining holdings this year were approximately HK $ 3.05 billion. These two total losses were about 10.92 billion Hong Kong dollars, which was almost equivalent to the total revenue of Chinese home property from 2016 to 2020.

"Good Brother" Zhang Jindong

Give up and righteousness, it is difficult to break the deadlock

The founder of Suning and Xu Jiayin's first public meeting was in September 2017. After meeting, Zhang Jindong said that the chairman of Jiayin and I had a rhinoceros, and it was closed.

Zhang Jindong also announced that it is necessary to promote the comprehensive strategic cooperation between Suning and Evergrande and work together to deploy the scene consumption in the era of smart retail. Such a business cooperation naturally promoted "brotherhood", and the two even drank a glass of wine.

Source: Network

The depth of friendship is reflected fast. Soon after, Suning invested 20 billion yuan in strategic investment in Evergrande.

At that time, Zhang Jindong vowed to the media and investors to guarantee that if Evergrande could not reorganize as scheduled, it would definitely take the 20 billion back. But the "hand -cup wine" drank, what else is you and me.

On the evening of September 29, 2020, Evergrande issued an announcement saying that it signed a supplementary agreement with 86.3 billion in the 86.3 billion battle investment with the total amount of Evergrande Real Estate, and the consent of the war investment agreed to the long -term holding of ordinary equity.

At the same time, a photo of a group photo spread throughout the circle of friends. At the signing ceremony with the war investment, Xu Jiayin attended the signing ceremony with a group of strategic investor executives. Among them, there is Zhang Jindong.

Source: Evergrande official website

It is worth noting that at that time, Zhang Jindong did not expect that because of these 20 billion, Suning would quickly fall into a liquidity crisis. In the month when the capital increase agreement was signed, Suning's consolidated caliber liabilities reached 136.1 billion, and the scale of interest debt exceeding 70 billion yuan. Subsequently, many bonds in Suning Tesco plummeted.

Even the trust company with a thunderbolt exceeding 100 billion yuan and the performance fell into losses, and agreed to give up the rights and interests of the repurchase and turned to ordinary holdings. The relationship between Boss Xu and Zhang Jindong was evident.

However, Evergrande's crisis is at most one of Suning. Beginning in the second half of 2020, Suning has exposed debt problems. Zhang Jindong has worked hard to save himself through equity pledge, but it still has no help. In the past few years, Zhang Jindong bought some assets everywhere, or invested in some companies heavily. It seems that Suning Group is getting bigger and bigger, but these assets do not make money, but have become dragging. Suning's debt continued to rise, exceeding 300 billion yuan. In July 2021, Zhang Jindong helplessly transferred Suning Tesco and lost his control equity. He also resigned from all positions such as Chairman Suning and completely out of the situation.

Suning today is not good. Recently, Suning once reported "bankruptcy liquidation". According to the semi -annual report released by Suning Tesco a few days ago. In the first half of the year, Suning Tesco's revenue in 2022 was 37.2 billion yuan, a decrease of 60.25%from 93.6 billion yuan in the same period last year; net loss was 2.74 billion yuan, of which 1.712 billion yuan in the second quarter.

Low -key rich Wang Wenyin

"Xu Jiayin is excellent and great"

Earlier, Wang Wenyin, chairman of Zhengwei International Board of Directors for Xujiayin. Wang Wenyin has invested 5 billion yuan in strategic investment in Evergrande.

In fact, in Xu Jiayin's circle of friends, Wang Wenyin is a relatively low -key person, but his strength must not be underestimated.

Wang Wenyin is known as the "World Copper King" in the industry. According to the latest data in 2021, Zhengwei Group ranked 48th in the Fortune 500 of Chinese private enterprises with nearly 700 billion yuan (100.280 billion US dollars) revenue positions and 68th in the Fortune Fortune 500. In April 2022, Wang Wenyin ranked 91st in the 2022 Forbes Ranking for $ 17.7 billion.

Source: Zhengwei Group

Although it has a huge scale, Zhengwei has always implemented Wang Wenyin's "low -key" style and maintains mysterious colors. To this day, Zhengwei International Group is not a listed company. Only the Zhengwei subsidiary Xi'an Zhengwei New Materials Co., Ltd. will invest in Zhengwei New Materials as a strategic investor.

There is also a story circulating between Xu Jiayin and Wang Wenyin.

On August 1, 2017, the Army Festival was a good day for Xu Jiayin.

On this day, the Evergrande defeated the R & F team over the Football Association Cup and advanced to the semi -finals. On the same day, Evergrande moved from Guangzhou to Shenzhen.

After moving into Shenzhen, Xu Jiayin began to visit the "big guys", one of them was Wang Wenyin.

At the time of meeting, Wang Wenyin took out two treasures of Mo Bao and sent it to Xu Jiayin.

One is "doing very people, doing very much things, and building a very contribution." The other is "Xu Di's blood, family feelings, impression of China, extraordinary achievements, cross -border achievements, and far away, great shores, great shores Life, the big artifacts. "Then in the latter, it contains the" Xu family's excellent and great "Tibetan poem.

Source: Zhengwei Group

Shandong High Speed Sun Liang

"Timely" with "timely" under high pressure

Evergrande's largest investors are Shandong Expressway Group with two rounds of participation in two rounds, with a total investment of 23 billion yuan.

In 2009, he was the chairman of Shandong Expressway. In July 2018, Sun Liang, who was 60 years old, stepped down as all his positions in Shandong Expressway. Recently, Sun Liang, the former chairman of Shandong High -speed, was under investigation for suspected illegal crimes. The Shandong Expressway's battle against Evergrande was during the period of Sun Liang as the chairman.

According to reports, Sun Liang and Xu Jiayin met in a event in 2013. The two met late and hated each other. They had arranged for half an hour of communication and talked for more than an hour. Then Sun Liang gave strong support in Evergrande's expansion.

In addition, in Sun Liang's many years of capital operation, it has inextricable connections with Evergrande Group and Xu Jiayin. Sun Liang is regarded as a man standing behind Xu Jiayin.

In 2017, the year before Sun Liang's retirement, Evergrande wanted to "deep rooms" back to A, so he pulled the super friend circle to help out, and the Shandong Expressway Group became Evergrande's second largest shareholder.

From the left to the fifth from the left to the fifth left, the fifth left is: Wang Wenyin, Sun Liang, Xu Jiayin, Zhang Jindong

In October 2020, in the crisis of the Evergrande Bonds to the equity, under the high pressure of the three -year action plan of the non -main business of Shandong Province, Shandong high -speed decision to launch a combat investment.

So, Evergrande cannot be redeemed by 23 billion yuan of investment funds, 5.66%of the equity, who can take such a big plate?

In the end, the Shenzhen Municipal SASAC came to the bottom.

On November 20, 2020, Shandong High -speed issued an announcement that its Jinan Changying Jincheng will transfer the equity of 1.17%of Evergrande Real Estate to Shenzhen Talent Anju Group.

On December 11 of the same year, Shandong Expressway once again transferred the remaining 4.7%of Evergrande Real Estate to Shenzhen Talent Anju Group.

It is worth noting that Shandong High Speed is not as great as other war investing. On the contrary, after Shandong High Speed Highway Evergrande, Evergrande divided 28.41 billion, 44.61 billion and 27.52 billion yuan from 2017 to 2019, and the three -year bonus obtained by Shandong high -speed speed was about 5.76 billion yuan. Including the 2 billion premium of Evergrande's equity and a dividend of 5.76 billion yuan in three years, Shandong's high -speed profit was 7.76 billion yuan, and the return rate was as high as 33.7%.

- END -

Yiwei Lithium Energy: As of the date of this announcement, the company's controlling shareholder, actual controller and their consistent actors have pledged a total of 59.4 million shares

Every time AI News, Yimei Lithium (SZ 300014, closing price: 100.3 yuan) issued an...

Academician experts gathered and corporate elite, and the China Optics Valley Artificial Intelligence Conference was held in Han

Jimu Journalist Li BansongCorrespondent Chen YanOn August 6, the 3rd China Optics...