Dingsheng convertible bonds, Bett convertible bonds led the rise, convertible bond ETF (511380) trading premium

Author:Capital state Time:2022.09.02

In the early trading, the convertible debt ETF (511380) fluctuated and fluttered. The transaction premium during the trading was over 60 million. After the continuous net inflow of August continued to exceed 33%, the funds continued to continue the net inflow this week. Among the ingredients vouchers, Dingsheng Convertible Bonds, Huaxing Convertible Bonds, and Bett Convertible Bonds rose more than 5%, Mingtai Convertible Bonds, Guizhuang Convertible Bonds rose; Shangneng converted bonds, Jinlang convertible bonds, Songlin convertible bonds led the decline Essence

Behind the continuous stretching of convertible bonds in 2021, a large number of natural person investors accelerated their entry due to the "money -making effect" of the convertible debt market. Driven by high transaction volume, the valuation of convertible bonds rose all the way, and the "money -making effect" continued to increase; Since the official implementation of the new regulations for convertible bonds in August, the "demon debt" has accelerated the ebb, the risk of strong redemption has increased, and the valuation rate of low premium rates and high flexible convertible bonds has been compressed first, which has led to a decline in the market's "money -making effect" and returning to health rationality. ; From the perspective of transaction volume, the transaction volume of convertible bonds in August had fallen to about 50%before the implementation of the new regulations, and the proportion of natural person transactions fell to 55%. After the orderly development of the convertible bond market, institutional investors gradually increased their attention to the convertible bond market.

CITIC Construction Investment said that in September, the valuation of convertible bonds is still possible to further compress. If the equity market does not have a significant rebound, under the low "money -making effect", if natural person investors accelerate the departure, it may lead to the continuation of the transaction volume to continue The decline brings further pressure on the valuation of the convertible debt. On the other hand, if the average value of the implied volatility of the convertible bond market drops to a range of 35%-40%, the cost performance of convertible debt allocation will gradually appear again, ushering in a better configuration window.

- END -

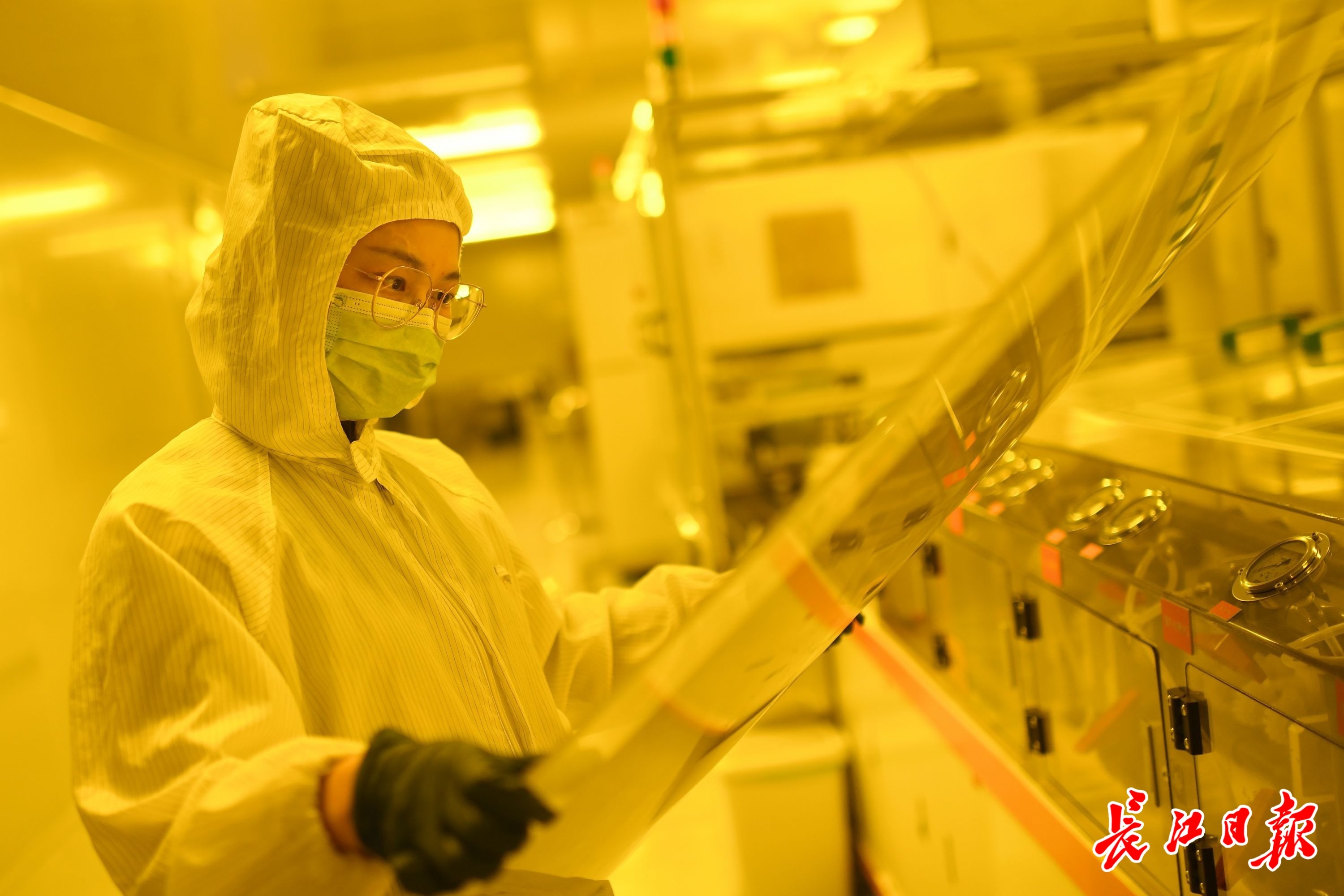

The number of new "little giants" in the fourth batch of national specialized specialized "little giants" chased the north, and Wuhan's "Little Giant" group started

Small and medium -sized enterprises can do major events. Some studies have shown t...

Let "Rizhao Blueberry" go nationwide -the 10th Blueberry Cultural Tourism Festival "Yanhu Jingpin" brand of Rizhao City is grandly released

On June 17, the Tenth Blueberry Cultural Tourism Festival hosted by the People's G...