This year's semi -annual report disclosed the net profit of 14 listed companies in Ningbo

Author:Ningbo Evening News Time:2022.09.02

The listed company reported the disclosure. In the first half of this year, 110 Ningbo A -share listed companies existed a "transcript" with dual growth and net profit growth, revealing a strong warmth.

According to statistics from Oriental Fortune CHOICE, in the first half of the year, the total revenue of the A -share "Ningbo Legion" reached 351.964 billion yuan, an increase of 14.64%year -on -year; the total net profit attributable to mothers was 36.413 billion yuan, a year -on -year increase of 19.74%.

The bright performance of listed companies reflects the strong toughness and potential of Ningbo's economic development. The rise of the new energy industry has become a bright color of Ningbo's economy.

Nearly 60 % of the company's revenue increase

Five companies increased by more than 100% year -on -year

Despite the impact of repeated epidemic and external inflation, in the first half of the year, the overall operating performance of Ningbo listed companies still maintained a growth trend and showed full vitality.

The financial report shows that the revenue of nine Ningbo A -share listed companies exceeds 10 billion yuan, of which Jintian Copper industry tops the list. Compared with the same period last year, the list of three new energy tracks, Rongbai Technology, Shanshan Co., Ltd., and Oriental Rising. Long Yuan Construction fell out of the list.

In the first half of the year, 63 listed companies in Ningbo achieved revenue year -on -year, accounting for 57%, showing strong endogenous motivation. Among them, the revenue of Rongbai Technology, Yagore, Zhenyu Technology, Bohui, and Yongtai Yun's revenue increased by more than 100%year -on -year.

However, due to multiple unfavorable factors, in the first half of the year, 47 Ningbo A -share listed companies revenue declined. Among them, the development revenue of Bolida, Sherong Group, and Beijing Investment Development decreased year -on -year revenue of 45.44%, 44%, and 40.85%, respectively.

Almost all companies are profitable

14 companies increased by more than 100% year -on -year

In the first half of the year, 107 Ningbo A -share listed companies achieved profit, accounting for 97%. It highlights the strong profitability of Ningbo listed companies. Among them, the highest profit is still Bank of Ningbo, with a profit of 11.268 billion yuan in half a year.

Looking at the entire Zhejiang stocks, the profitability of Ningbo Bank is still at the top of the list, and it is far ahead of Zhejiang Commercial Bank (6.974 billion yuan), Bank of Hangzhou (6.593 billion yuan), Hikvision (5.759 billion yuan), etc.

According to the financial report, in the first half of the year, 63 Ningbo A -share listed companies achieved profit growth, accounting for 57%. Among them, the profit of 14 companies has doubled year -on -year. The top three are Chuangyuan (2309.13%), Ningbo Zhongbai (1238.41%), and Oriental Risheng (653.56%).

Chuangyuan is a cultural and educational supplies company deeply cultivated in overseas markets. In March of this year, major changes in equity have been completed. The Ningbo State -owned Assets Supervision Commission has become its actual controller.

It is worth mentioning that in the first half of the year, the net profit increased by the mother after deducting the non -deduction of Chuangyuan shares reached 8305.63%. Chuangyuan shares said that with the recovery of overseas markets, the company's revenue and gross profit margin have increased year -on -year from last year. Affected by fluctuations in the RMB exchange rate, exchange returns are more.

It is worth noting that the net profit of returning mother has increased by more than 12 times year -on -year, and the net profit after deducting non -deductible mother has decreased by 7.84%year -on -year. The change is so big because the "guarantee case" of Ningbo CICC was closed, and the expected liabilities were 315 million yuan. At the same time, the fair value of the fixed -increase stock was 43.87 million yuan.

The above -mentioned listed companies with high profit growth are mainly distributed in light industrial manufacturing, electrical equipment, chemical industry, machinery and equipment, semiconductor, etc. The new energy industry is undoubtedly the biggest winner.

In the first half of the year, German industry's revenue achieved revenue of 2.373 billion yuan, a year -on -year increase of 23.26%; net profit of home mother was 450 million yuan, a year -on -year increase of 100.41%.

In the context of domestic replacement, the semiconductor industry has a high prosperity. Jiangfeng Electronics revenue reached 1.086 billion yuan in the first half of the year, an increase of 50.18%year -on -year. The net profit of home was 155 million yuan, an increase of 156.24%year -on -year.

However, as the "first day group" of Ningbo A -share listed companies, automobile parts companies have performed poor performance and accounted for the highest proportion in the decline in profitability. Among them, Jifeng's losses were 168 million yuan in the first half of the year, and net profit decreased by 189.11%.

According to Jifeng, in the first half of the year, the epidemic caused a long period of suspension of production and suspension in some areas, and unfavorable factors such as high raw material prices, continuous shortage of chips, and high logistics costs also caused a lot of impact on the company's operations.

Reporter Wang Jing

- END -

Big River Torrent 丨 Populus Popular Seeds Germination of Gold 72 hours

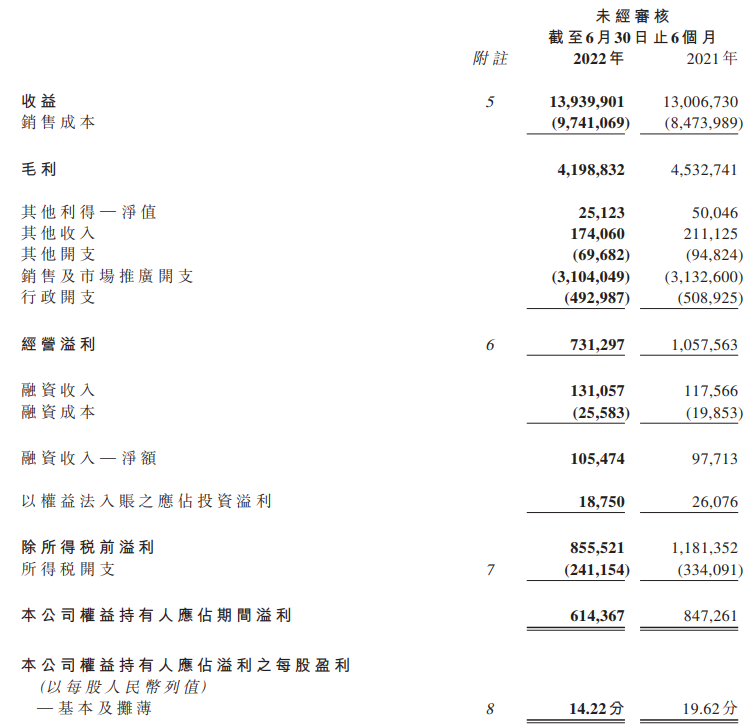

Increasing income, unified enterprises China shareholders in the first half of 2022 should account for 614 million yuan

On August 9, 2022, the Hong Kong stock listed company unified enterprise China (00...