Semi -annual report | Intime gold operating income of 3.994 billion yuan, an increase of 14.53% year -on -year

Author:China Gold News Time:2022.09.02

On August 29, Intime Gold Co., Ltd. issued a semi -annual report in 2022. The report shows that in the first half of 2022, the company achieved total operating income of 3.994 billion yuan, an increase of 14.53%year -on -year; net profit of home mother was 566 million yuan, a year -on -year decrease of 15.03%; the net cash flow generated by operating activities was 1.21 billion yuan, a year -on -year increase 56.59%.

The report pointed out that the main reasons for the decline in net profit of Yintai Gold are: the price of raw materials rose and the production cost rose; Yulong Mining was affected by some reasons, which caused the production progress to be affected; The reason for the increase in the net cash flow of operating activities is mainly due to the previous period of paying due to the maturity, and the sales of more initial inventory are sold in this issue.

In the first half of 2022, in the face of global inflation acceleration, continuous epidemic situation, and tight geopolitical situations at home and abroad, Intime Gold aimed at the business plan formulated at the beginning of the year, based on safety production All work.

In the first half of 2022, the cost of business costs of Yintai Gold was 2.998 billion yuan, an increase of 27.9%year -on -year, and the growth rate of 14.5%higher than operating income, resulting in a gross profit margin decreased by 7.85 percentage points year -on -year; net interest rate was 15.61%, a decrease of 5.62 compared with the same period last year last year. percentage point. From the perspective of business structure, the operating income of "metal commodity trade" is 2.196 billion yuan, and the revenue proportion is 55%. It is the main source of business income of Intime gold, but the gross profit margin is only 0.41%.

From the perspective of the single quarter indicators, Intime Gold achieved total operating income of 1.76 billion yuan in the second quarter, a year -on -year decrease of 10.96%, and a decrease of 21.24%month -on -month; net profit attributable to 292 million yuan, a decrease of 20%year -on -year, an increase of 6.74%month -on -month. The asset -liability ratio at the end of the second quarter was 25.60%, an increase of 3.04 percentage points compared to the end of the previous year.

From the perspective of inventory changes, as of the end of the first half of 2022, the book balance of Intime gold inventory was 888 million yuan, accounting for 8.57%of net assets, a decrease of 140 million yuan from the end of the previous year. According to financial reports, Intime Gold has not been prepared for inventory price decline in this period.

- END -

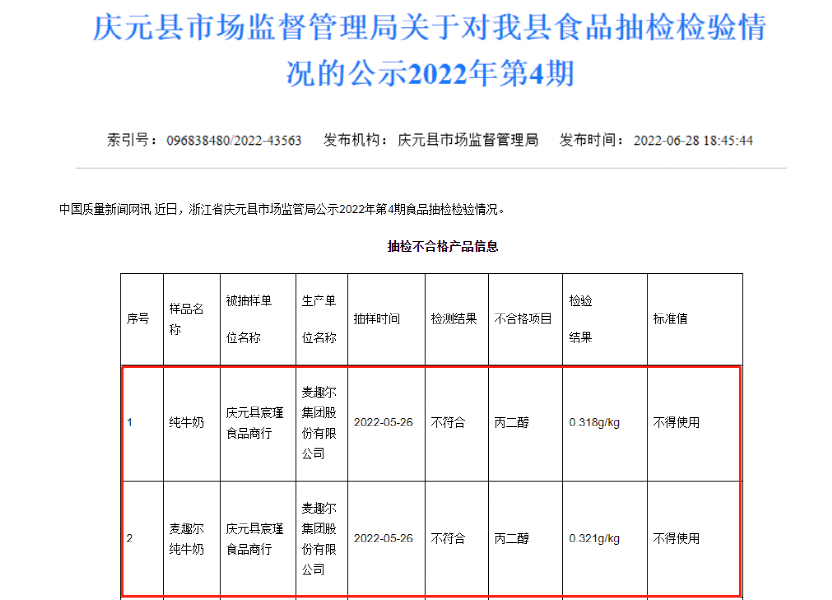

Drop the shelves, sealed!Well -known milk was detected by low toxic substances, and the latest response came

milkRich nutrition and easy to be absorbed by the human bodyCoupled with affordabl...

Resolutely support supervision and operate in accordance with laws and regulations

On August 4th, Simo issued an announcement in its official public account Simo Moo...