Who will relay the "tornado" of Everbright Securities, the main funds raised Red Tower Securities by 22%of the "Brokerage Ranking"

Author:Huaxia Times Time:2022.06.19

China Times (chinatimes.net.cn) reporter Wang Zhaohuan Beijing report

In the past week, the daily rising wave of brokerage stocks swept the entire A -share, which enhanced the popularity of the market, and once again made investors see hope. The seller's securities firms non -silver analysts have taken the opportunity to hold an online communication meeting, which is too busy.

However, on June 16, the "floor" of Everbright Securities stirred the entire sector, and brokerage stocks collectively "flame". For a week (June 13th to June 17th), Everbright Securities has stepped down the position of the boss, and replaced it with the former Internet celebrity securities firm Red Tower Securities.

According to the statistics of the same flower Shunshun, on the 17th, 156 million main funds flowed into the Red Pagoda Securities of Sweeping goods. In the past week, Hongta Securities has increased by 22.7%, ranking first in the list; Great Wall Securities rose 15.7%, ranking second; CITIC Construction Investment rose 14.7%, Everbright Securities rose 8.6%, ranking third and fourth.

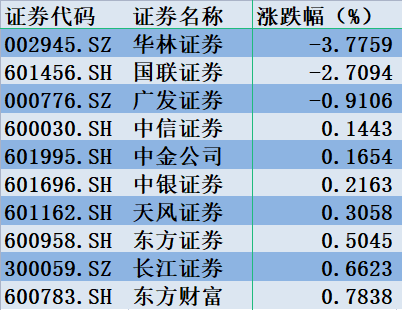

On the list, Hualin Securities fell 3.7%, ranking first; Guilian Securities fell 2.7%, and Guangfa Securities fell 0.9%, ranking second and third.

Daily daily tide sweeping A shares

On June 15, the brokerage sector set off a wave of daily rising, and the daily limit of Everbright Securities stimulated the enthusiasm of the entire market and completed the fifth daily limit board. As of the close of the day, the securities firms index rose 3.38%, Oriental wealth rose by 8%, and the turnover exceeded 20 billion in A shares; Great Wall Securities and Hongta Securities have risen.

Affected by this, A -share insurance stocks also had a riots, and 800 billion insurance stock giants China Life Life rare daily limit. The Shanghai Index returned to 3,300 points, and the GEM index rose 3%once. The turnover of the Shanghai and Shenzhen cities was 1.3 trillion on the day, the largest single -day transaction amount since February 24.

However, Cheng Ye also funds, defeat and funds. On June 16, Everbright Securities ended the inertia daily limit, a large amount of funds fled, and the sector overall cools down.

On June 17, interesting things happened, Everbright Securities was consolidated at a low level, Hongta Securities took over the daily limit banner. In the afternoon, the large single -sealing board was directly boiled, and the market enthusiasm was once again.

"Huaxia Times" reporters showed that through the statistics of Flower Shun, a total of 6.026 billion yuan in net outflows of the brokerage sector in the week of the brokerage sector, and the cumulative net outflow of Oriental Wealth was 1.631 billion yuan, ranking first in the two cities; the cumulative net outflow of Everbright Securities was 1.089 billion yuan.

An Anxin Securities released the latest report analysis pointed out that the market traffic is active and significantly recovered, and the wide credit expectations boost market confidence. Since June, the average daily basis turnover was 1122.9 billion yuan, an increase of 22%month -on -month, and the balance of the two merges was 154 million yuan, an increase of 1.3%month -on -month.

On June 10, the central bank disclosed financial data in May. The growth rate of social finances rose from 10.2%to 10.5%, and newly added 2.79 trillion yuan, an increase of 839.9 billion yuan year -on -year; Increased 392 billion yuan. In May, M2 rose sharply from 10.5%to 11.1%.

The report pointed out that social finance and credit to be over market expectations. The next step in credit easing expectations is expected to accelerate the landing to boost market confidence, drive market transaction emotions to improve, and facilitate the growth of brokerage brokerage business revenue.

At the same time, the capital market reform policies are frequent, and it is good for securities company investment banks and heavy capital business. The high -quality development of public funds has benefited from the most beneficiary of brokers.

Anxin Securities believes that due to the sharp fluctuations in the market at the beginning of the year, the valuation of the securities firm sector fell to 1.4 times PB, and some head brokers valuations were close to or below 1 times PB, which was at the historical bottom. The history of the re -enrollment, the continuous liquidity loosely superimposed capital market reform policy was introduced, and the brokerage sector has obtained significant excess returns, and it is optimistic about the valuation of the sector.

"The recent quotation of the brokerage sector is indeed very fierce, and it is a daily limit of the sector, which often corresponds to the staged high point of the market. The fundamentals of the industry have not changed much in the short term. Shareholders should look at it rationally and avoid blindly chasing the rise blindly. . "A chief analyst of a listed broker bluntly said to the reporter of Huaxia Times.

At the same time, some market participants have also expressed their views: brokers are no longer the leading indicators of A shares, but they have returned to the uplifting varieties that come back.

Accelerate the transformation of wealth management business

On the evening of June 17, the China Securities Industry Association ranked statistical rankings on 38 indicators such as the size and various business income of securities companies in accordance with the audited data of various securities companies, and released the ranking of the 2021 securities company's operating performance indicators.

In 2021, the scale of assets in the securities industry has steadily increased, and comprehensive strength has been further enhanced. As of the end of 2021, the industry's total assets were 1.053 trillion yuan, and net assets were 2.51 trillion yuan, an increase of 20.0%and 12.5%over the end of the previous year; the industry's net capital was 1.99 trillion yuan, an increase of 10.7%over the end of the previous year.

In 2021, the performance of the securities industry continued to improve, the industry achieved operating income of 496.795 billion yuan, and the net profit was 221.877 billion yuan. The net assets of 2021 securities industry were 9.23%, an increase of 1.4 percentage points from the previous year.

It is worth noting that the securities industry has accelerated the transformation of wealth management business, and the ability to serve the market's investment and financial management demand has been further enhanced.

In 2021, the voucher industry continued to make the transformation of wealth management business, and realized the income of brokerage business by 152.962 billion yuan, an increase of 19.6%year -on -year. At the same time, the revenue of agency sales of financial products was 19.075 billion yuan, an increase of 51.7%year -on -year; the income of investment consulting business was 5.375 billion yuan, an increase of 14.9%year -on -year. Customer asset scale reached 7.254 trillion yuan, an increase of 18.6%year -on -year. In 2021, the transaction amount of securities transactions of the securities transaction of the proxy agencies of the voucher industry reached 6.06777 trillion yuan, an increase of 30.7%year -on -year. In addition, the active management capabilities of securities companies have further enhanced, and the income of asset management business has stabilized. In 2021, the income of asset management business was 28.393 billion yuan, an increase of 9.0%year -on -year.

"Huaxia Times" reporter noticed that in the 2021 asset management business income ranking, Oriental Securities ranked first with 3.49 billion yuan, CITIC Securities ranked second for 2.93 billion yuan, Huatai Securities ranked 1.85 billion yuan Third, Guotai Junan ranked fourth, and Haitong Securities ranked last.

Can the enthusiasm of the sector continue?

CITIC Securities released the latest report that risk preferences increased the market turnover to trillion, and the valuation of the brokerage sector increased. Betta driver overlapping low valuation is the characteristic of this round of rise. At present, the valuation of the brokerage sector is at 21%of the level since 2018, and it is still at a historical low. Looking forward to the future, the Beta factor is short -term driver. Supply -side reform and wealth management business is still the main line of medium and long -term investment.

The report analysis pointed out that in the short term, affected by rising market traffic activity and the recovery of the capital market, the subject matter may be fully benefited from the inflow of market funds in the short term, showing a strong beta attribute. However, the long -term valuation of securities companies will still be determined by Roe. Looking forward to the future, through product innovation, the investment trading business needs to drive transformation to customers, and to undertake the wave of residents' wealth transfer configuration through wealth management transformation, which is an effective path for brokerage ROE. In the process of continuing the concentration of the securities industry, only brokerages that have α advantages in risk pricing, capital scale, fintech and talent mechanism can stand out.

CITIC Securities has given the three main lines of the current stock selection of the securities industry as: a comprehensive broker benefiting from the industry's supply -side reform. At the stage of high -quality development in the industry, the business model of the securities industry is upgraded, and the industry pattern is concentrating on the head; at the same time, the securities industry's asset management business will accelerate the transformation of active management, and the new model of investment consulting services is being established. Wealth management is optimistic about wealth management The advantages of the track.

In addition, brokerage stocks are the vane of the market trend and have strong beta attributes. From the perspective of varieties, the new brokerage stocks, small brokerage stocks, mergers and acquisitions and theme stock elasticity. From time to time, at the beginning of the market, the Beta factor has obvious positive income, but its investment -available window period is often shorter. These "popular stocks" need to rely on strong transaction capabilities.

Liu Xinqi, an analyst at Guotai Junan Securities, believes that the institutional business will become the next point of the growth of securities firms. It is recommended that institutional business accounts for a higher proportion of business and stronger institutional business products.

The current market's interpretation of the weakening of the stock price of securities firms is mostly based on the external causes of investors' preferences. It is believed that the reason for the rationalization of the market is increased, thereby reducing the preferences of assets with lower definition of securities firms, but this explanation ignores the explanation neglect The essence of the internal factors of determining the stock price is caused by the improvement of the elasticity of the stock stocks.

In Liu Xinqi's view, investors' institutionalization is the general trend. Residents are more investment in standardized financial assets through asset management products to provide huge development space for future institutional business of securities firms. Only by continuously improving its own productization capabilities can securities firms strengthen the core competitive advantage of institutional customers and share a share in the booming institutional business.

In the past five years, brokers with productization ability have gradually moved from valuation to a valuation and even valuation premium, reflecting the changes in the profit driving force of the brokerage industry. Compared with retail business, the profit margin and profitability of institutional business are higher. Therefore, in terms of institutional business, brokers with stronger productization capabilities will also have higher space and certainty in their profit growth in the future, and they should enjoy higher valuations.

Editor: Editor Yan Hui: Xia Shencha

- END -

The 7th China Innovation Challenge Jiangsu Sai launched

Recently, the Ministry of Science and Technology launched the seventh China In...

2000000000!The project of Dongting Lake will be supported by the central government

The reporter learned from the Provincial Department of Finance today that with the competitive review and publicity organized by the Ministry of Finance, the Ministry of Natural Resources, and the Min