The 7th issue of Tianci Liangji Daily 丨 6 ETFs increased by more than 1 billion last month; the game ETF collectively rose more than 3%; next Monday follows three new funds

Author:Daily Economic News Time:2022.09.02

1. Today's Fund News Speed Exhibition

1.6 ETF's share last month increased by over 1 billion copies

According to Wind data, 6 ETF share in August increased by more than 1 billion copies (excluding currency ETFs), of which science and technology 50, medical ETF and pharmaceutical ETF share increased by 3.51 billion, 3.126 billion, and 2.755 billion copies, respectively.

2. Semiconductor industry is favored by the Social Security Fund

Recently, the semi -annual report released by Science and Technology Board Company shows that there are social security funds in the list of the top ten circulation shareholders of 69 science and innovation board companies, of which 13 companies belong to the semiconductor industry. Among these 13 companies, the social security funds of the top ten circulation shareholders of 8 companies belong to new shareholders. Guoxin Technology, Longxinzhong Science and Technology, Tujing Technology and Peak Technology. (VIA: China Securities News)

3. Part of the private equity selection reduction

"Recently, our stock positions have been adjusted from more than 80 % of the previous period to about 50 %. The important considerations are that the structural market of individual stocks may have a round of tide." In the early stage of photovoltaic, lithium batteries, and new energy vehicles, the favorable factors of related fundamentals have been relatively full. The recent ebb of individual stock markets is also reasonable. (VIA: China Securities News)

40 billion private equity buying A -share companies, "Vietnam Line" is also constantly hand -made

On the evening of August 31, Sanxiong Aurora issued an announcement. In total, an increase of 14.902 million shares of the three male aurora unlimited sales, accounting for 5.32%of the company's total share capital, forming a "license". On September 1st, the Management Department of the Shenzhen Stock Exchange issued a supervisory letter to Abama assets, and the letter pointed out that when Abama's assets held a total of 5%of the three male aurora shares, they did not stop buying and selling Sanxiong in accordance with relevant regulations. Aurora's stock.

2. The latest developments of well -known fund managers

1. Cinda Austrian Feng Mingyuan: New Energy is still the most developed and dynamic segment industry

Feng Mingyuan stated in the interim report that although the new energy industry has been tested by multiple unfavorable factors such as high raw material prices, epidemic conditions, and international trade frictions, it is still the most developed subdivision industry at present. Obviously, we still hope to find investment opportunities in this segment. The current high raw material price and epidemic situation has eroded the profits of the local manufacturing industry. The profit and price -earnings ratio of related stocks have a double kill situation, but this is not uncommon. Similar scenes are repeated in each round of economic fluctuations. Excellent is excellent. Enterprises will get greater market share in the future economic recovery.

2. CCB Fund Tao Can: Industrial upgrading will be the key configuration direction

In an interview, Tao Can said that more and more Chinese manufacturing enterprises have the ability to upgrade industrial upgrading and have industrial upgrading needs in global labor division. Therefore, in the second half of this year Position, including new energy, semiconductor, military industry and other advanced manufacturing directions. In addition, the structural opportunity of the A -share market is to achieve industrial upgrading with technological innovation methods, thereby increasing the income of industrial workers, and thereby achieving the goal of consumption upgrade. Based on this logic, consumption upgrades are ranked second in the future asset allocation. At the same time, the consumption sector, including food, medicine and social services in the second half of the year, is expected to be boosted. (VIA: China Securities News)

3. Huinfu Fund Hu Xinwei, Southern Fund Sun Lu Min investigated Penghui

On August 30, the listed company Penghui Energy was investigated by the institution. Hu Xinwei, Huitianfu Fund, and Sun Lumin, Southern Fund, appeared. Data in the past six months show that Hu Xinwei has not held the stock in the management fund; Sun Lumin has not yet held the stock in the management of the fund.

4. Ruiyuan Fund Zhao Feng research Yingjie Electric

On August 31, Yingjie Electric, a listed company, was investigated by the institution. Ruiyuan Fund Management Co., Ltd. Zhao Feng appeared in it. Data in the past six months show that Zhao Feng has not held the stock in the management fund.

5. Investment Fund Hou Hao investigating Boliwei

Recently, the listed company Boliwei was investigated by the institution. Hou Hao of China Merchants Fund appeared in it. Data in the past six months show that Hou Hao has not held the stock in the management fund.

3. ETF market review today

After the broader market opened high, the three major indexes rose and declined. The performance of heavy stocks was low.

On the market, the Beidou navigation sector broke out, and the stocks in the sector set off a wave of rising. In addition, the low -themed stocks performed active. Affected by this, the three games ETF rose more than 3%, and the two film and television ETFs rose more than 2%. In addition, there were ETFs such as communication, VR, and information technology among the top ten increase lists.

In terms of decline, consumer sectors such as food have been adjusted, and 4 foods and diet ETFs fell more than 1.6%. In addition, non -periodic ETFs and Deep F60ETF fell more than 2%, but the turnover of these two ETFs was small.

Fourth, Tomorrow Focus on Xinfa Fund

1. Fund for abbreviation: Huatai Baoxingxincheng is preferred mixed

Fund type: mixed-partial stock

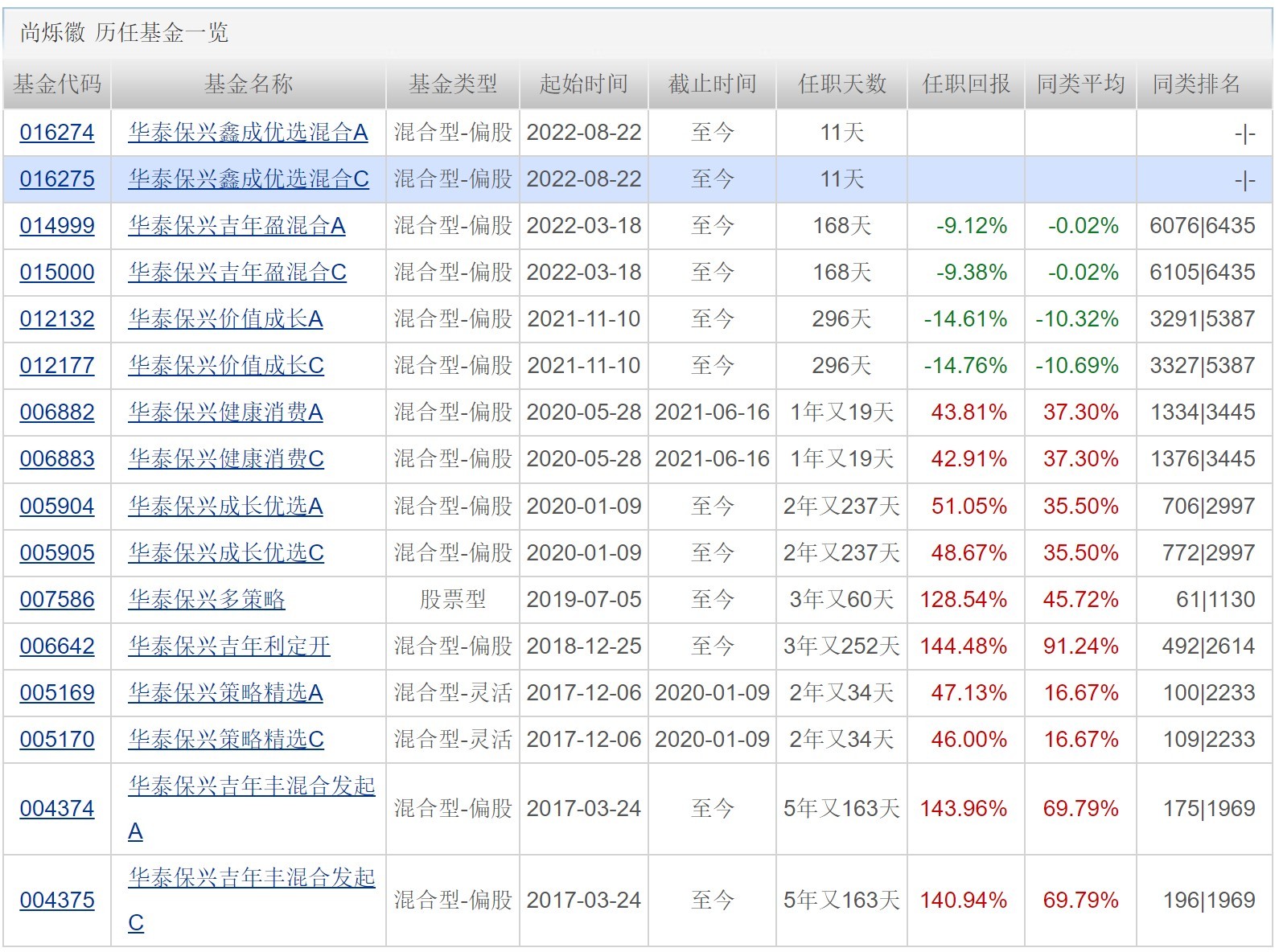

Fund Manager: Shang Shuohui

Performance comparative benchmark: CSI 300 Index yield*70%+total bond index (full price) yield yield*30%fund manager past performance:

2. Fund abbreviation: Hua'an actively pension target five -year holding mixed launch (FOF)

Fund type: FOF

Fund Manager: He Shi Straight

Performance comparative benchmark: China Securities 800 Index yield*75%+comprehensive wealth (total value) index yield yield*25%

Fund manager's past performance:

3. Fund abbreviation: Jianxin Xingsheng is preferred to hold a mixed year

Fund type: mixed-partial stock

Fund Manager: Sun Sheng

Performance comparative benchmark: CSI 300 Index yield*60%+Hang Seng Index yield (use valuation exchange rate converts)*10%+comprehensive full price (total value) index yields*30%

Fund manager's past performance:

Daily Economic News

- END -

Research results | From the Lun Nickel incident, the risk management of the futures market market in my country

As Chinese companies have gradually improved their positions in the global commodi...

Agricultural distribution of Hubei Branch exceeds 100 billion yuan this year

Agricultural distribution of Hubei Branch exceeds 100 billion yuan this yearPolicy finance should be guided, supplemented for shortcomings, reverse cycles. In order to help stabilize the economic ma