More than 20 provincial audit reports disclose the common debt of the special debt, and take multiple measures to avoid idle funds

Author:First financial Time:2022.09.02

02.09.2022

Number of this text: 1716, the reading time is about 3 minutes older

Introduction: The special debt funds have become the focus of audit supervision. In recent years, audit reports from various places have disclosed some common problems, and they are gradually solving to give full play to the stable economic effects of bond funds.

Author | First Financial Chen Yi issue

Recently, most provinces and cities have disclosed the audit report of local budget execution and other fiscal revenue and expenditure (hereinafter referred to as the "Audit Report"). Among them, the issue of special bonds for local governments (hereinafter referred to as "special debt") is a big focus.

Zhao Wei, chief economist of Guojin Securities, told First Finance that as of late August, 23 provinces and cities have disclosed audit reports. 90%of the provinces and cities mentioned special debt management issues, which has increased from 2019. This may be due to the increasing importance of special bonds to local finances and strong demands for stable growth. It is necessary to improve the efficiency of special bonds.

Recently, Guizhou and Hubei have also disclosed audit reports, and the provinces have been expanded to 25, of which more than 20 provinces mentioned in special debt issues.

In order to cope with the impact of the epidemic and expand the government investment steadily, the scale of new special bonds has increased to more than 3 trillion yuan since 2020. This year, the scale is expected to exceed 4 trillion yuan. In recent years, special bonds have become an important starting point for implementing active fiscal policies. It is one of the most direct and effective policy tools for the government to drive investment, which has played an important role in stabilizing the macroeconomic economy.

Due to the large scale of special debt, in order to truly make good use of this money, the management of special bonds in recent years has become the focus of audit attention.

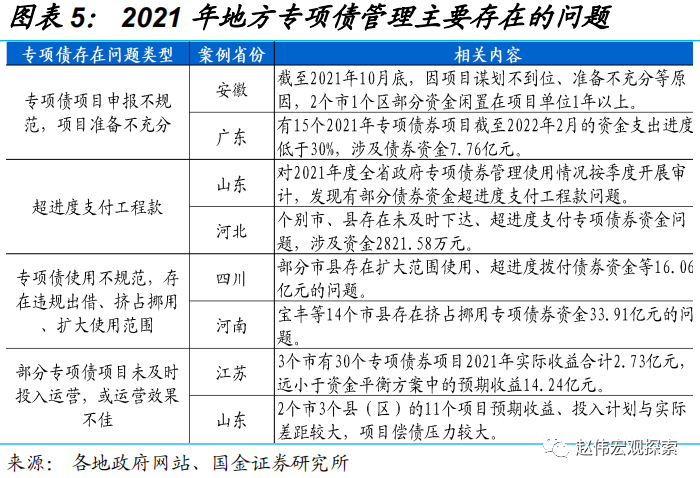

Zhao Wei sorted out and found that in the local audit report last year, the problems existing in special debt management are mainly. The project application is not standardized, the preparation is inadequate, the super -progress payment project funds, the scope of embezzlement, the scope of the use of the use, and the difficulty of operating or operating the project. There are four types of problems such as poor. Among them, the problems of insufficient project preparation and embezzlement are more common, and the problem of special debt management of nearly one -third of the provinces and cities has this problem.

For example, the Guizhou Audit Report pointed out that some special bond funds have not played benefits in a timely manner. As of the end of 2021, 27 projects in 16 regions did not start construction, and 2.921 billion yuan of special bond funds were idle. Due to the slow or suspension of project construction, 20 projects in 12 regions from 2020 to 2021 were 5.593 billion yuan. At the end of 2021, 620 million yuan was actually used.

The Beijing Audit Report stated that some bond funds have not implemented relevant management regulations. For example, 10 projects in 4 districts have the problem of using bond funds in the existing scope of bonds. They are mainly used for personnel subsidies and regular expenditures, involving 234 million yuan in funds.

Several financial and tax experts told the First Finance that in recent years, the Ministry of Finance and others have adopted a series of measures for special debt issues. Generally speaking, some issues of special debt have been improved.

Zhao Wei believes that in order to solve the issues related to special debt, the distribution of special debt quotas has been further optimized. This year, it is clear that "no pepper noodles are sprinkled with pepper noodles" and tilted to the area where the project reserves. The Ministry of Finance also cooperates with the Development and Reform Commission to strengthen the key areas of special bonds, the management of negative lists, and strict project review, etc. to improve the quality of special debt projects.

Some local audit reports show that the special debt in 2021 was about 15%of the special debt, and nearly 5 percentage points decreased from 2020.

In addition, in order to avoid idle funds for special debt, the Ministry of Finance will regulate the adjustment of the use of special debt funds, and the local debt funds that will not be able to spend in time will be adjusted to other major projects. This year's special bond issuance progress is rapid, and the State Council requires that the huge amount of funds are basically used before the end of August. Recently, some special debt funds are used for local dense adjustments.

Since August, the special debt projects adjusted by Gansu, Anhui, Sichuan, Ningbo and other places are not only projects in 2021 and previous years, but also special debt projects issued this year. The project is very rare. Experts believe that this is conducive to giving full play to the stable economic effects of special debt funds and avoiding idle funds.

In addition, the Ministry of Finance has also established a settlement penalty mechanism to strengthen some measures and measures such as deducting new limits, suspension of issuance and use, recovering idle funds, and reporting negative typical models to strengthen the restrictions on illegal and violations of special bonds.

In addition, the Ministry of Finance has recently pushed the special bond project penetration monitoring to the whole country. It can timely grasp the use of funds, project construction progress, and operation management in a timely manner. The performance management of special bond project funds is also gradually being implemented. Through the performance management of the full life cycle, the competent authorities and project units are promoted to strengthen management and improve the efficiency of funds.

Zhao Wei said that this year's new special debt is inclined to the east with more high -quality projects and less debt pressure, and the actual expenditure progress in the eastern region is relatively fast; The overall landing is slow. Since the beginning of the year, policies have further increased in terms of projects, funds, and coordination mechanisms, thereby promoting the acceleration of special debt funds.

Public data shows that in the first eight months of this year, the local issued a total of about 3.47 trillion yuan was issued to complete the annual amount (3.65 trillion yuan) of about 95%.

- END -

High -tech zone organizes a training meeting for major forestry harmful biological prevention and control

In order to solidly and effectively carry out major forestry prevention and contro...

Every IPO Weekly Issue 66 | 96 companies last week were accepted. At the end of the first half of the year, the A -share IPO financing was over 300 billion yuan

Under the general trend of the registration system, more companies have the opport...