Who says "old energy" cannot have spring?These fund managers have laid out in advance ...

Author:China Fund News Time:2022.09.02

China Fund Daily Jia Zhanying

In the first eight months of this year, the trend of A shares was ups and downs. In the first four months, the three major indexes of A -shares fell together, and the Shanghai Index fell to 2863 points. The market shouted the slogan of "2800 points of defense".

After two rounds of "roller coasters" after the two rounds of March and April, the valuation of the A -share market has finally bottomed out from April 27. The science and technology board and the GEM have both rebounded more than 20%. 3400 points. 5. In June, the A -share market rebounded, but in July, the A -share shock recovered, and the three major indexes fell more than 4%.

However, since August, the market has entered the stage of shock adjustment again, and the sector differentiation has further intensified. The "Coal Super Crazy" market has come again, and the coal sector leads strongly, and petroleum petrochemicals and transportation increased. The rising track stocks fell collectively in the early stage, and the decline in automobiles and power equipment.

Regarding the reason for the soaring coal sector, fund managers said that due to the tight supply and demand relationship of domestic coal, it is transmitting profits to upstream coal companies through more flexible price mechanisms. Today, the coal sector is showing the value stock attributes of "high profit+high cash flow+high dividends+low valuation".

In addition, under the "double carbon" goal, coal companies are involved in new energy fields such as energy storage and hydrogen energy, and will add new catalytic factor to their valuation logic. This also increases the attractiveness of long -term funds in the coal sector.

Taking this opportunity, the Fund Jun also introduced the three fund managers of the three long -term optimistic coal sectors. They are Zhou Haidong, Hua Shang Fund, Huabao Fund Cai Murong, and Wanjia Fund Huanghai. By analyzing their respective investment styles and frameworks, help everyone understand the investment concepts behind these outstanding investors.

Chinese Business Fund: Zhou Haidong

In the fund circle, Zhou Haidong is a relatively low -key and restrained fund manager. It is neither blindly chasing the wind, nor holding a group, but a unique "first -hand cycle, one -handed growth" capacity circle.

Before entering the fund industry, Zhou Haidong had a wealth of industry experience. He was a researcher at a research institute in Shanghai and a researcher at China International Financial Co., Ltd. In 2010, he officially joined the China Business Fund and has now become the director of equity investment and the general manager of the equity investment department of the China Business Fund.

In fact, early industrial experience helped Zhou Haidong a deep understanding of the model changes and technological innovation of relevant listed companies; and long -term front -line investment research experience can help him fully tap the investment value of listed companies and formulate investment strategies. This It is also an unique reason for Zhou Haidong's investment strategy.

With the gradual expansion of the capacity circle, the founders also began to notice the manager of the treasure fund. As of August 31, Zhou Haidong's management scale was 11.690 billion yuan.

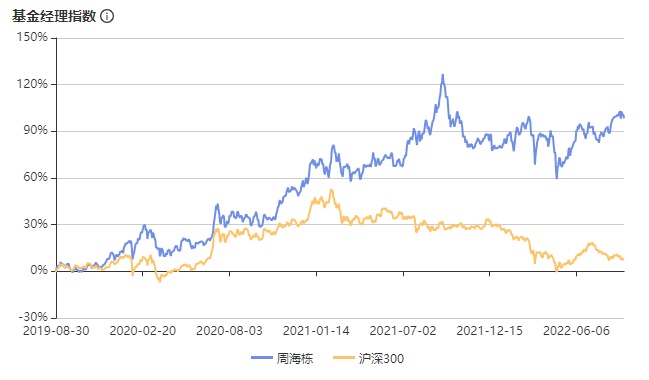

Of course, analyzing a fund manager before seeing his performance. Zhijun Technology shows that as of August 31, Zhou Haidong for nearly five years, with an annualized return rate of 18.3%, better than the Shanghai and Shenzhen 300. At the same time, the largest retreat in recent years is only 29.85%, and its average annualized income of partial stocks is higher than 87%of similar managers. In summary, Zhou Haidong has a good ability to obtain income for a long time, and the ability to control risks is relatively good.

If you choose a keyword for his investment concept, Zhou Haidong thinks that the "cycle" is the most appropriate. He believes that almost everything is weekly, and it may be no exception. Opportunities always appear cyclical. Just as the capital market is repeated in the alternation of Niuben. Of course, this "periodic" investment concept is closely related to his past experience experience.

Talking about his own investment strategy, Zhou Haidong introduced in the public account of the Chinese Business Fund that he was mainly through the top -down way, according to the follow -up of the macroeconomic and cyclical changes, to understand the sub -industry from the perspective of a large cycle, pay attention to the industry, pay attention to the industry, and pay attention to the industry. Changes in supply and demand structures. On this basis, combined with macro factors and valuations to make probability selection, the possibility of the game will occur in the future.

At the cycle level, Zhou Haidong mainly starts from the industry cycle of two to three years or even longer, and takes the constraints of supply as the primary consideration. When you see a long -term trend, you will make big decisions.

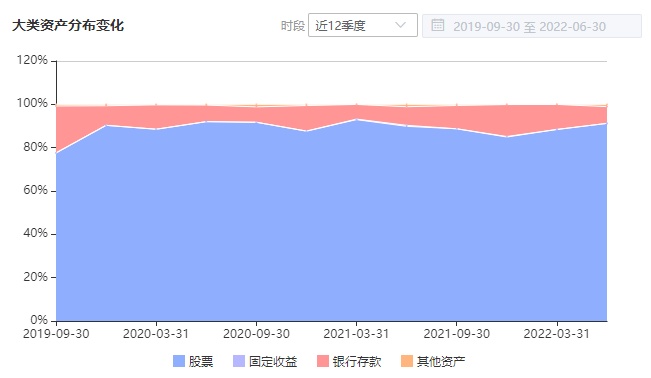

Implementing into a combination of investment practice, the operation and weakening time of the mid -to -high warehouse have become keywords for Zhou Haidong's asset allocation. In the asset allocation, Zhou Haidong often operates in the middle and high positions. When the position is less selected, the core fluctuation range of the product stock position is 80%-90%, which is significantly higher than that of the same industry.

Specifically, Zhou Haidong is good at screening individual stocks from top to bottom, and reverse investment to grasp the inflection point. Judging from the analysis of the group, Zhou Haidong rarely chased market hotspots as a reverse investment faction, and almost did not participate in tracks such as consumer stock technology stocks.

Taking its representative products as an example, it can be found that Zhou Haidong's holding style is mostly large -cap stocks, and the industry concentration is relatively high, but the concentration of heavy positions is relatively low. Most of the heavy position stocks are mainly leaders of various industries. The proportion of the quarterly return rate of the holding period exceeds 79%of the CSI finger, and the net profit of the return mother of the three nodes of the year before the beginning of the beginning, the year, and the following year is held. The significant increase in individual stocks in the growth rate has reached more than 80%, and many times accurately grasped the performance inflection point of individual stocks.

Judging from the latest quarterly report, the fund industry configuration is relatively concentrated, mainly distributed in non -ferrous metals, computers, and mining industries. The top ten heavy stocks holding the longest period of holding up to 8 quarters.

According to Zhou Haidong's view of the latest release of the Chinese Business Fund, when talking about the future investment layout, he said that he will continue to practice value investment concepts, pay attention to grasping investment opportunities of growth and cyclical style, and strive to dig in the industry with stable future and long -term trends in the future. A good company with a good price and excellent texture, and continuously observe the changes of these companies, and strive to be better risk -revenue ratio. To implement the industry level observation, the cycle industry fluctuates greatly in the short term, but from the perspective of medium and long -term dimensions, the price of commodities is more to observe the supply and demand structure and fundamentals. Investment mainly focuses on cost performance and valuation. At present, the cost -effectiveness and valuation may not be high. Most of the short -term opportunities will be tapped through the bottom -up way to configure some high -quality stocks.

Huabao Fund: Cai Murong

Like Zhou Haidong, Cai Murong is also a fund manager who pays attention to the cycle industry. And Cai Murong's low -key and easy -going personality also made the colleagues of Huabao Fund cordially call it "Lao Cai".

In terms of investment style, Cai Murong belongs to a more pure value -style fund manager. Because of this, when Cai Murong is looking for investment opportunities, he is more willing to find in an industry that is upward or will appear upward at the upward point. At the same time, it has certain requirements for valuations. Enterprises with growth potential or industries and stocks that are about to reverse.

Today, it is the tenth year of Cai Murong Management Fund. It is said that in ten years of grinding a sword, Cai Murong has become more and more well -known by investors in a seemingly not "fashionable" track like cyclical stocks. As of now, Cai Murong has 6 fund products with a management scale of 4.06 billion yuan.

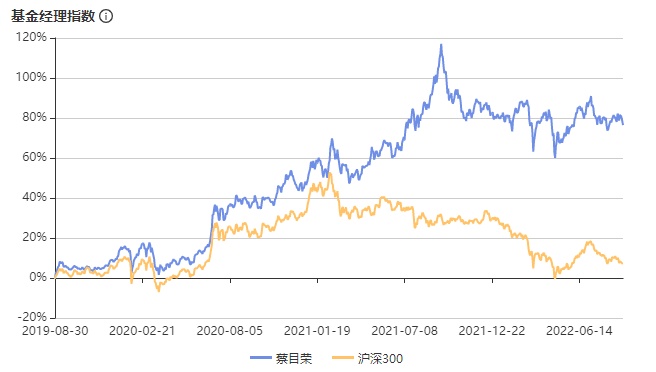

Looking back at Cai Murong's management performance, the performance is indeed outstanding. According to Zhijun Technology, as of September 1, Cai Murong has been in the past 5 years, with an annualized return rate of 10.93%, better than the Shanghai and Shenzhen 300. At the same time, the average annualized income of its partial stock hybrid funds is higher than 52%of similar managers, and the maximum retracement is 26.26%.

As a fund manager who focuses on the cycle industry, Cai Murong believes that the industry's prosperity is the most important link in the investment framework. In addition, because the personal character is more conservative, Cai Murong also pays more attention to valuation.

In the public account of Huabao Fund, Cai Murong introduced his investment framework himself. He said that he would find it in the industry in which the prosperity or the upward point of the turn was found in finding investment opportunities. During certain requirements, try to avoid industries and individual stocks with relatively high valuations.

Taking the product as an example, according to the latest second quarterly report, in the second quarter, the product maintained the configuration of the core sub -industries such as energy inflation, and the configuration of the new energy -related sub -industry in the core sub -industries such as oil and coal. Essence At the same time, due to the lack of demand in the second quarter, some sub -industry configurations that are harmed by the annual supply and demand relationship have been made accordingly.

During the investment process, because Cai Murong valued the valuation index more, he prefers sections and stocks that research and invest in low valuations. At the same time, Cai Murong emphasized that low valuations are not only low PE and PB, and sometimes referring to indicators such as sectors and individual stocks in history.

In order to be able to bring a better holding experience to the holder, Cai Murong, while holding a long -term reward, adds some short -term and medium -term sections that meet the market style and meet their own investment framework, in order to invest in the investment framework, in order Seeking long -term returns and short -term returns.

According to the positioning data, it can be seen that Cai Murong has indeed achieved the integration of knowledge and action, does not blindly follow the hotspots, and digs out whether the company has core competitiveness. Taking its representative fund as an example, in the regular position report, it can be found that the leading company similar to the non -ferrous metal, Cai Murong began to hold it as early as its low valuation. In 2020 Holding it into the Ganfeng Lithium, it has held it as a heavy warehouse stock. The coal plate is also good at Cai Murong. Two of the top ten heavy stocks are coal stocks.

Looking forward to the second half of 2022, Cai Murong said that the A -share market is expected to be opportunities and risks. Under the leadership of stable economic ideas in the short term, the domestic liquidity factors are expected to remain relatively friendly. The main uncertainty of stock performance will come from the matching of its own prosperity and its valuation. Analysis and judgment of industry fundamentals. From the perspective of the view of prosperity, the booming industry that can continue in the second half of the year can continue and can be achieved through performance, such as new energy, such as new energy, but it is expected to perform. Delays, but with the further rise of the economy, the fields that continue to be suppressed by multiple factors such as some consumer industries are expected to gradually have investment opportunities to dig. The risk perspective needs to focus on the exposure to overseas demand or supply chain, including the possibility of industrial disturbance caused by geopolitical conflicts.

Specific to the resource sector, "carbon neutral" will become the main line of configuration in the middle and long term. First of all, from the perspective of demand, the sustainable development of the new energy industry will make the investment of energy metal varieties an increasingly important configuration direction. Secondly, starting from the supply side logic, the global "carbon neutral" policy has brought significant constraints to the new capital expenditure of fossil energy and high energy consumption industries. In the peak demand season, it is still possible to continue to interpret energy commodities. Wanjia Fund: Huang Hai

As the saying goes, there are talented people in Jiangshan, and the same is true in the fund manager. And to say that in the first half of this year, the hot fund manager is the Yellow Sea of Wanjia Fund. Since this year, the top ten of the fund income ranking will be exclusively of 3 names.

The career of the Yellow Sea is also very rich. Although the experience of management fund has only two years, its experience in securities has exceeded 22 years. Huang Hai graduated from Shanghai University of Finance and Economics. From 2000 to 2004, he served as a strategic researcher at the BOC and Wanpin Securities Research Institute and Huabao Trust Investment Corporation as an investment manager. And joined Wanjia Fund in 2020. At present, the number of funds is 4, and the management scale is 2.052 billion yuan.

However, measuring a fund manager must use data to speak. Zhijun Technology shows that as of September 2, the annualized yield of Huanghai was 49.32%, which was better than CSI 300. At the same time, this year's largest retracement was 18.43%, and its average annualized income of partial stocks was higher than 98%of similar managers.

The investment philosophy of the Yellow Sea is a large -scale asset allocation through the top -down macro -strategy research, and combined with the bottom -up stock allocation strategy and bond investment strategy.

In the regular report, Huang Hai has also mentioned that its own stock investment strategy mainly includes: growth strategy, value strategy, theme strategy, directional issuance strategy, momentum strategy and deposit voucher investment strategy. Among them, the momentum strategy refers to the benefits that surpass the average market by buying strong stocks in the past period.

If the specific operation of the Yellow Sea is holding the position, it can be found that the Yellow Sea has maintained a high position for a long time, and almost all of the equity warehouses are more than 90%. And the shareholding concentration is high. Taking its representative fund as an example, the top ten shareholding accounts for about 69%per year.

At the same time, the turnover rate is generally higher than the average level of flexible configuration funds, and the transaction frequency is reduced in the second quarter of 2021.

It may also be because of the keenness of the industry's control, so that Huang Hai is highly probably obtained by the excess returns. Taking its representative fund as an example, since the management of Huanghai, the fund's annualized yield is 16.60%, and the net value growth rate of the recovery unit has a growth rate growth rate. It was 11.23%, and the interval net value surpassed the benchmark annualized yield of 7.48%, ranking the top 25%.

In terms of specific positions, Huanghai Investment is concentrated in the field of real estate and energy, which is particularly obvious in preference for coal stocks. With its currently largest fund, the largest management scale is for reference. In the second quarter of 2022, six of the top ten heavy stocks in the product accounted for nearly 50%of net assets.

Looking forward to the second half of the year, Huang Hai said that he will maintain a cautious and optimistic attitude. Although the domestic economy is still slowly recovering by the repeated and weak overseas economy; at the same time, we believe that inflation is still the most important theme of the global economy at the moment, energy and other upstream resources of the world, energy and other upstream resources The valuation of the product still has room for improvement. In short, the cost of value stocks in the current environment is still relatively high, which is the main configuration direction. At the same time, Huang Hai said that in the future, it may also hold part of cash in the future to prevent market fluctuations.

Risk reminder: The fund has risks, and investment needs to be cautious. Fund's past performance does not indicate its future performance. Fund research and analysis do not constitute investment consulting or consulting services, nor does it constitute any substantial investment suggestions or commitments to readers or investors. Please read the "Fund Contract", "Recruitment Manual" and related announcements carefully.

- END -

The year -on -year increase of 1.2 times, and the scale of new energy vehicles in the first half of the year reached a new high

Xinhua News Agency, Beijing, July 19 (Reporter Zhang Xinxin) Tian Yulong, chief en...

Zhou Zhenyu hosted a symposium on the open economy of Changde City

On the afternoon of August 18, Zhou Zhenyu, deputy secretary of the Changde Munici...