The A -share sector said 丨 Fed's interest rate hike does not change the A -share rising trend to return to 3300 new energy track stocks to perform active performance

Author:Cover news Time:2022.06.20

Cover Journalist Zhu Ning

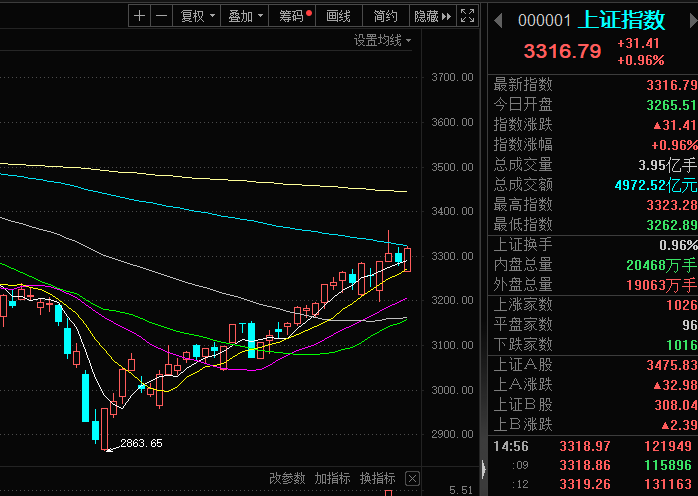

On June 17, the three major indexes of the A -shares opened low, and the shocks rose. The Shanghai Stock Exchange Index closed up by 0.96%.

On the same day, the turnover of the two cities was 1093.4 billion yuan, which was 12.8 billion yuan from the previous trading day; the net inflow of funds in the north was nearly 10 billion yuan. The stocks of the two cities rose and declined, nearly 2,300 stocks rose, and more than 2,200 stocks fell; of which, 74 daily limit stocks and 3 decline stocks.

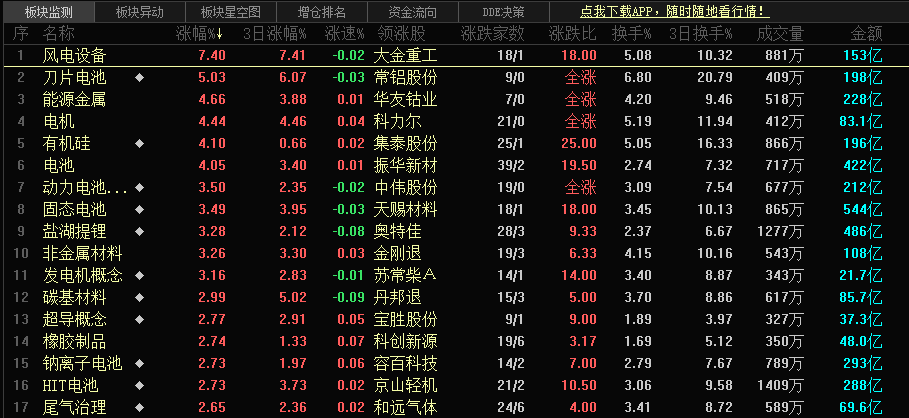

In terms of sectors, electric equipment, sodium ion batteries, organic silicon concepts, Ningde Times concepts and other sectors are active, and the performance of educational, Internet e -commerce, media and other sectors or concepts is sluggish.

Valuation is relatively low -bottomed new energy circuit attracts attention

On the market, the new energy industry chain was fully active, and the Ningde era rose 5.6%, with a turnover of nearly 13.6 billion yuan; the concept of the blade battery was active, the concept stocks were in the daily limit of winning stocks.

Data show that the sales of new energy vehicles in May have doubled year -on -year. In May, new energy vehicles were sold for 447,000 units, an increase of 105.2%year -on -year, which continued the trend of high -speed development. At the same time, after the news, after BYD and Long March, Hanma Technology recently announced the suspension of production of fuel vehicles. At the same time, a number of overseas car companies have also recently added the "club" to stop production of fuel vehicles.

Regarding the latest repeated motion of the new energy -related sector, some analysts believe that since the fourth quarter of 2021, due to the adverse factors such as upstream cost end pressure and the suppression of demand on the demand, the new energy vehicle sector has been adjusted significantly, and the overall regulation of the sector exceeds 40. %. This round of adjustment has better digesting the high valuation of the previous sector. Under the dynamic perspective, the current sector valuation is at the end of the past two years, providing investors with a good margin of security; Seeing that the pressure on the upstream cost is improved in the margin, the prices of lithium carbonate and lithium hydroxide begin to fall, which will be favorable for new energy upstream and downstream industrial chain companies.

Benefiting from the new energy track organic silicon sector performance is dazzling

On June 17, the organic silicon concept sector strengthened again. As of the closing, the sector increased by 3.91%. The daily limit of Jitai Co., Ltd., German Group and Silicon Bao Technology have risen by more than 8%. The strong market has increased by 15%in the nearly 6 trading days, far from winning the broader market.

Silicon is an important material that affects human development. Application scenarios are all dozens of fields such as architecture, electronics, new energy, and consumer health. From a price point of view, since the high price in 2021, the silicon market has fluctuated significantly. Entering June, the world has gradually entered the peak use of organic silicon, and the domestic downstream re -production re -production is accelerated. The demand end support is strong. The export growth rate of multi -silicon products exceeded expectations and obviously bottomed out. Earlier, mainstream manufacturing companies in Shandong, Zhejiang and other regions increased the price of organic silicon products. The amplitude of the overall order was different due to the volume of orders.

Guotai Junan predicts that in the next three years, the downstream market of organic silicon will usher in a large explosion in many fields. In 2022, China's organic silicon market size is about 66.7 billion yuan. It is estimated that by 2025, the relevant market will reach 94.5 billion yuan. Consumption upgrades will be the source of new incrementation of the organic silicon industry in the future.

The Federal Reserve ’s interest rate hike does not change the independent trend of A shares

In the early morning of June 16th, Beijing time, the Fed announced that 75 basis points raised interest rates, and raised the federal fund interest rate target range to 1.5%to 1.75%. Data show that this is a single maximum interest rate hike since 1994.

Facing the fluctuations of overseas markets, the A -share market has maintained toughness. On June 16, A shares continued to maintain stability. After the three major stock indexes opened slightly, the Shanghai Stock Exchange Index fell less than 1%, and the previous decline was recovered on the 17th.

Regarding the current independent trend of A shares, the reporter interviewed Zhou Maohua, Financial Analysts of Everbright Bank. It believes that the Fed's radical interest rate hike superimensation of the US economic prospects and market fluctuations have exacerbated some disturbances of the domestic market emotions. However, since the recent period, the domestic stock market has obviously obvious Out of independence; mainly the Sino -US economy and policies are in different cycles, the valuation of the Sino -US stock market is also at different stages, and RMB assets are expected to get out of independence.

At the same time, the current positive factors of domestic stock markets have increased, and the overall control of the epidemic is controlled. Domestic timely adopting targeted policies and measures to help enterprises relieve bailout, the market liquidity is reasonable and abundant, and the domestic stock market valuation is horizontal and vertical at a low position. The market confidence continues to improve. It is the "confidence" of A shares that have recently emerged from independent rise.

In the end, Zhou Maohua said: "The stock market will eventually return to the fund's fundamentals. From the perspective of the development prospects of the domestic and long -term fundamentals and the financial market, RMB assets are expected to become a global capital shelter with long -term allocation value. Combined with the recent market performance and internal and external economies, In terms of policy environment and valuation, the domestic market is expected to get out of independence. "

CICC also believes that there are three major factors for A shares to go out of independence. First, due to the continuous efforts of the "steady growth" policy, the epidemic has improved after the resumption of post -production and resumption. China's economic data in May is better than market expectations.Dispute by the manufacturing industry, the growth rate of industrial added value has risen, and infrastructure investment achieves a high -speed growth of 7.9%a month, and exports have exceeded expectations.Second, although the demand side such as consumption and credit is still dragged down by the epidemic, with the improvement of the epidemic improvement and the optimization of epidemic prevention policies, the economy may gradually stabilize in the future and support China's stock asset performance.Third, the liquidity period is upward, and the credit pulse shows that stocks still have room for rise.After the adjustment of domestic stocks in the past year, the risk premium reminder has a prominent valuation advantage.

- END -

Shouguang City promotes the conversion of old and new kinetic energy in depth

The Twelfth Party Congress report of the Provincial Provincial Congress proposes t...

Try to run from June 15!The latest notice of Hebei Medical Insurance Bureau →

The Hebei Medical Security Bureau on the launch of the outpatient medical expenses at the provincial level to handle the handmade reimbursement online for trial operation workProvincial insurance unit