There are countless sayings | May wealth management market product distribution has stabilized

Author:Cover news Time:2022.06.20

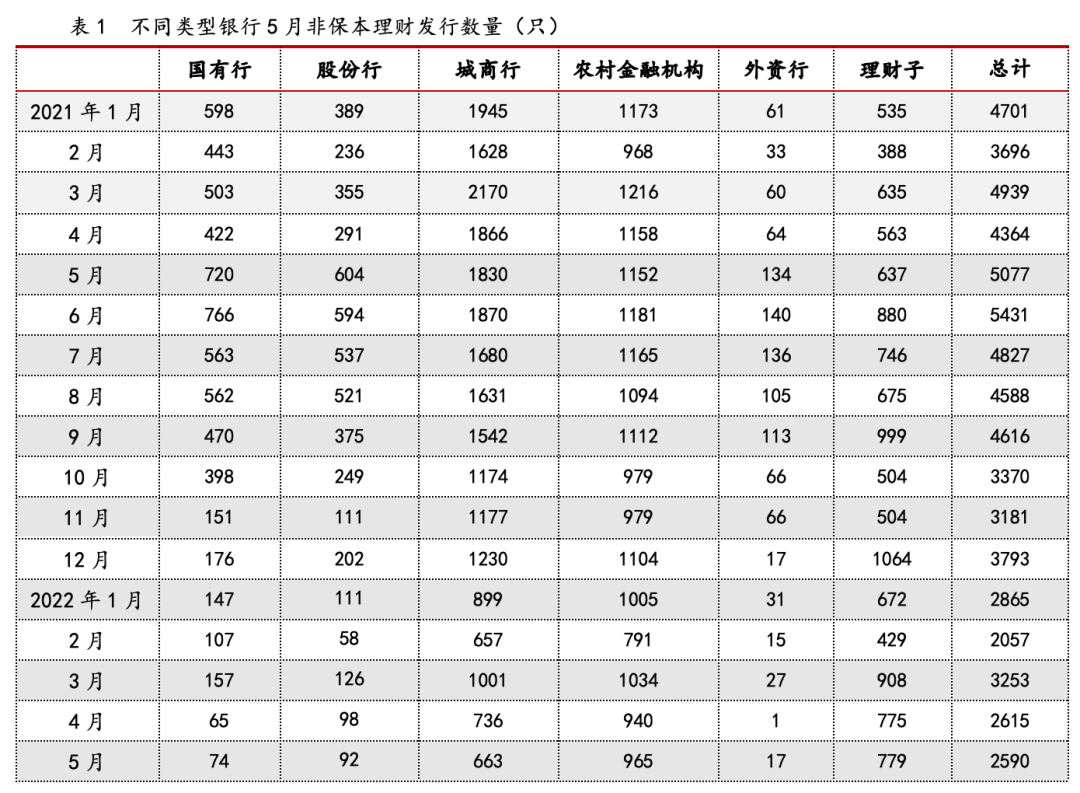

According to the statistics of Puyi Standard Standard, 2,590 non -guaranteed financial products in May, respectively, decreased by 49%year -on -year and 1%month -on -month. In May 74, 92, 663, 965, 17 and 779 of non -non -guaranteed wealth management products. The number of products issued by wealth management companies is relatively stable, and the number of banking institutions has continued to shrink.

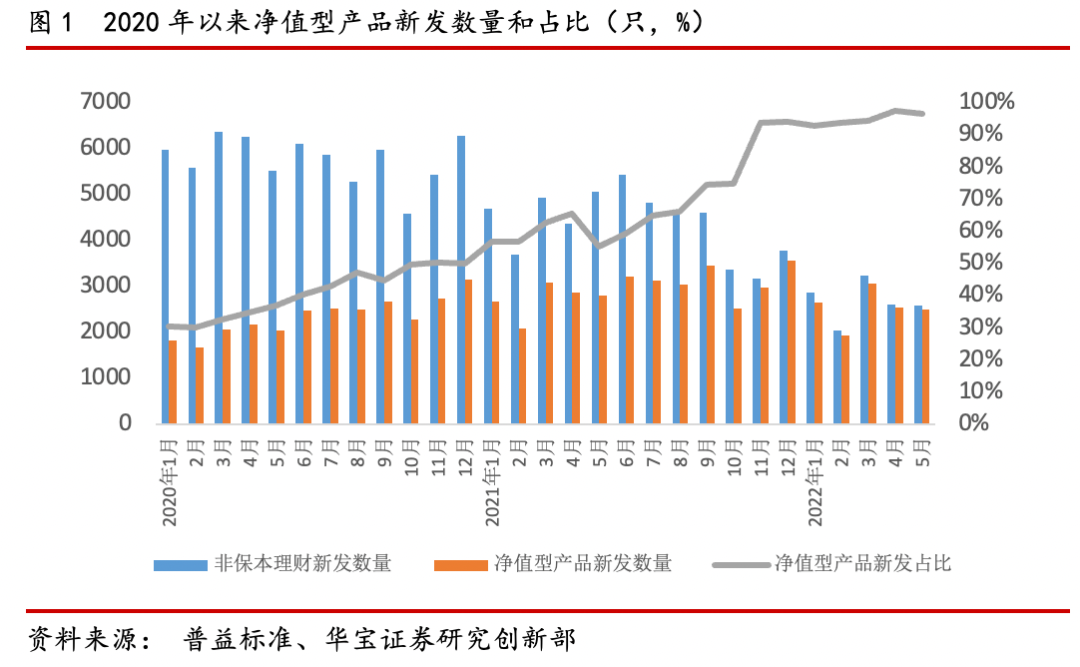

The degree of net worth of non -guarantee products remains high. Among the non -guaranteed wealth management products issued in May, 2501 net worth wealth management products were issued, and net worth products accounted for 96.56%. Among the net worth products, 2396, 67 and 37 were released in fixed income, mixed and equity products in May, respectively.

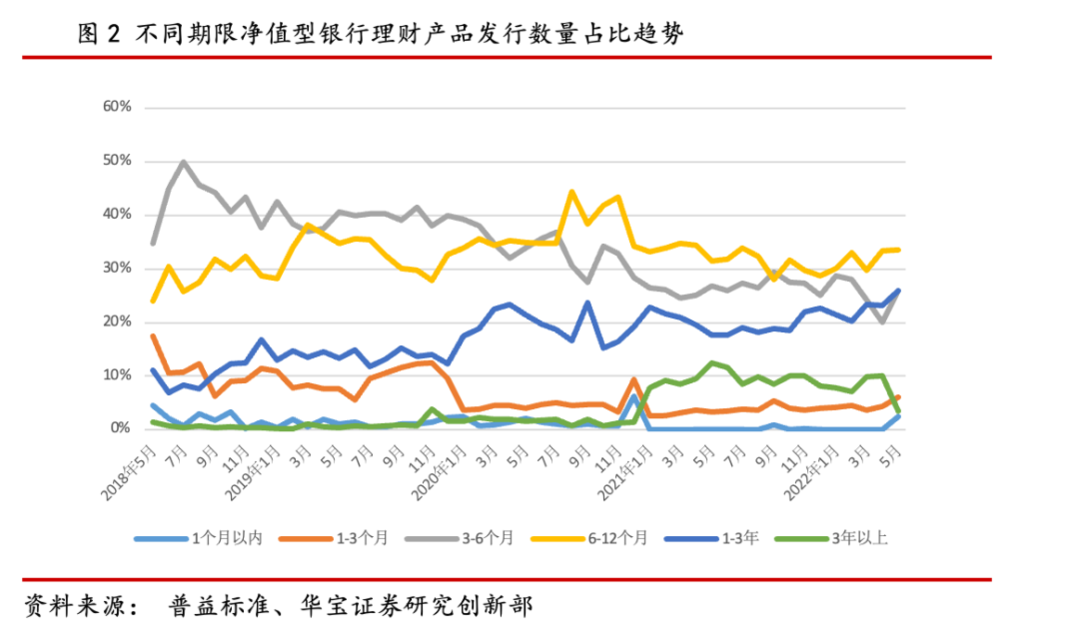

From the perspective of the issuance period, in May, the number of net worth products within 3 months accounted for 10%, the number of net worth products for 3-6 months accounted for 26%, and the number of net worth products for 6-12 months accounted for 34%, the number of net worth products in 1-3 years accounts for 26%, and the number of net worth products for more than 3 years accounts for 3%. In May, the proportion of the number of net worth products in the period of 6 months increased, and the proportion of products issued by long -term products for more than 3 years decreased significantly.

In terms of yields, the average performance comparative benchmark of net worth products is counted. 3.77%, 3.90%, 4.04%, 4.42%, and 4.71%; divided by product types, in May, the average value of the performance comparison of net worth wealth management products was 4.06%, mixed class 4.94%, and equity category 5.27% , Commodity and derivative categories 5.00%. The performance of fixed income products decreased by 27bp year -on -year, while the performance comparison of hybrid products increased by 26bp year -on -year.

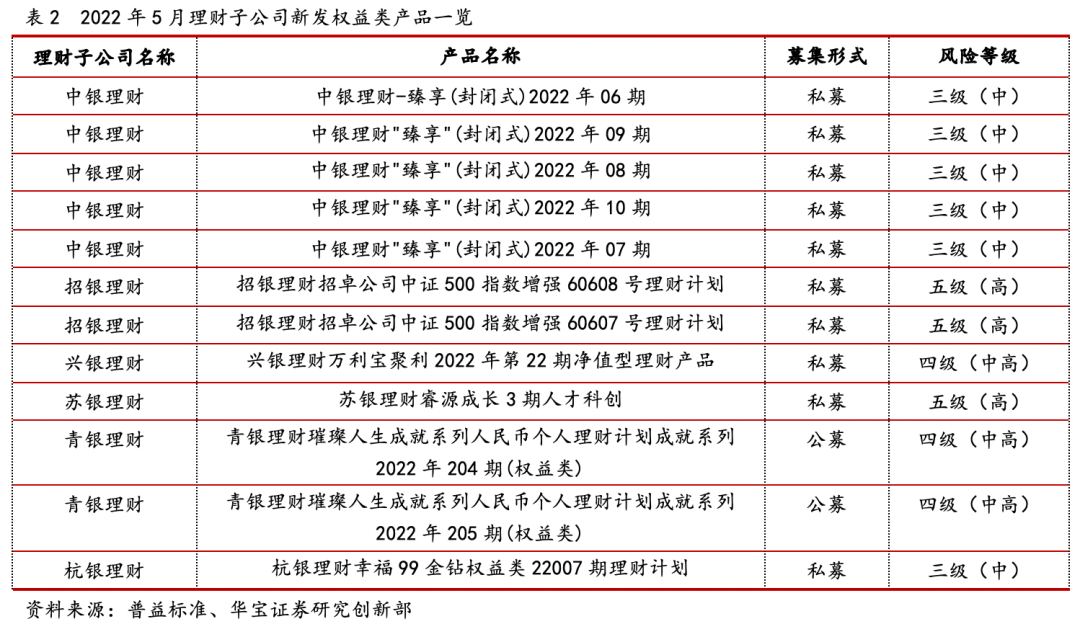

As of the end of May 2022, the old products moved from the mother bank to the wealth management subsidiary were excluded. The number of products newly issued by the wealth management subsidiary company will issue a total of 779 wealth management products, including 716 fixed income categories, mixed mixed There are 50 classes, 12 equity classes, and 1 commodity and financial derivative category. A total of 12 equity products were issued in May, two of which were public equity products.

In May, the performance of the issuance of net worth wealth management products issued by wealth management subsidiaries was benchmark. According to the product types and periods, the fixed income category was 3.94%, 6-12 months was 4.1%, and 1-3 years was 4.49. %And more than 3 years are 4.86%. The mixed class 1-3 years is 5.03%, and 5.66%of more than 3 years.

Specialized and new, that is, "professionalism, refinement, characteristics and novelty", which was first proposed by the Ministry of Industry and Information Technology in July 2011. At the end of 2018, the Ministry of Industry and Information Technology carried out the first batch of "specialized new" small giant enterprises. At the end of July 2021, the Central Politburo meeting first filed a "specialized new" small and medium -sized enterprise. In September 2021, the Bei Stock Exchange was established, and its core is to serve the "specialized new" SMEs to solve the financing problem of innovative SMEs.

Relevant experts said that overall, in the context of scientific and technological innovation and industrial upgrading, some specialized new enterprises with innovative ability and core competitiveness are expected to become the "invisible champion" in the future segment industry, which is worth digging. Chance.

Cover reporter Dong Tiangang

- END -

The proportion of Chinese assets for three years of A -share "getting rich" has continued to increase

Since June 21, 2019, A shares have been incorporated into the FTSE Russell Global ...

1 billion yuan!Sichuan Province First Single Science and Technology Innovation Company Bonds successfully issued Chengdu Industrial Investment Group: Mainly used for the second phase of the large fund investment, etc.

Shanghai Stock Exchange Bond WeChat public account forwarded media reports on the 17th. The article wrote: On June 15, Chengdu Industry Investment Group Co., Ltd. (hereinafter referred to as Chengdu