Instead of Yang Huiyan!Hengli Petrochemical Chairman becomes the richest man in China, and the company's 75 billion short debt pressure is to be solved

Author:Red Star News Time:2022.09.03

The title of "Chinese Women's Richest Man" has a new owner.

For a long time, the richest man in China has been occupied by Yang Huiyan, co -chairman of Country Garden (02007.HK). Today, Fan Hongwei, chairman of Hengli Petrochemical (600346.SH), replaced her.

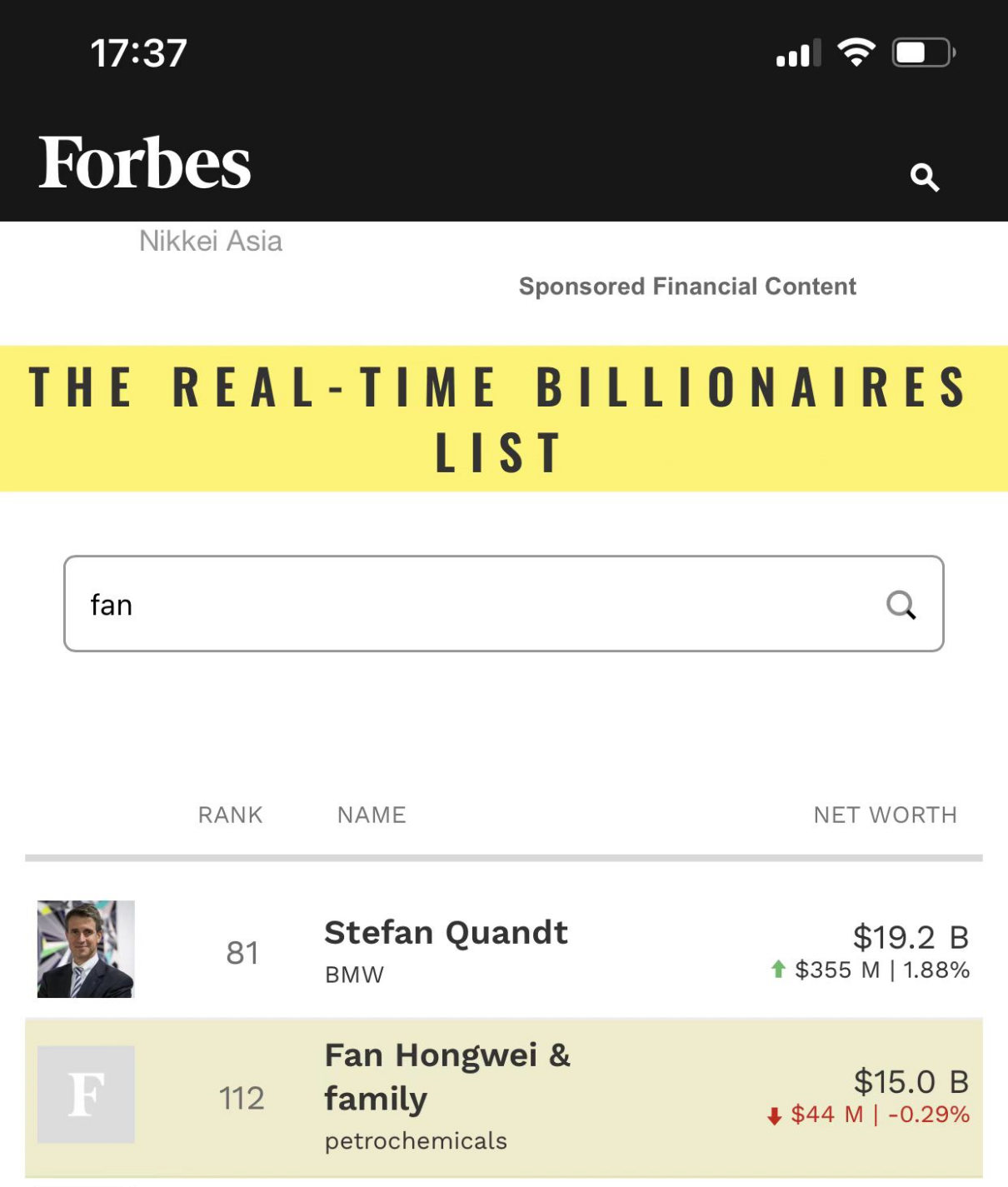

On August 30, 2022, on the Real Time Billionaires, the Fan Hongwei family ranked 118th in the world's rich man with a wealth of wealth of 15.1 billion US dollars (about RMB 104.19 billion), surpassing the Yang Huiyan family and Longhu Group's Wu Yajun. Essence Earlier, in the Hurun Global Rich List in 2022, Fan Hongwei and his husband Chen Jianhua ranked 48th, exceeding 55 Yang Huiyan.

However, the richest man was difficult. Hengli Petrochemical Half -annual report showed that the company's short -term liabilities had reached 70 billion yuan, and the guarantee amount to subsidiaries was as high as 166.377 billion yuan.

↑ Fan Hongwei Screenshot Self -Hengli Group WeChat public account

Chinese female richest man

From childhood accounting to Forbes best CEO

On August 30, 2022, on the Forbes Real -time Rich List, the Fan Hongwei family ranked 118th in the world's rich man with a wealth of $ 15.1 billion, surpassing the Yang Huiyan family and Wu Yajun of Longhu Group, and became the richest man in the new Chinese female.

As of the press release on September 3, the Fan Hongwei family entered 6 more on the Forbes real -time rich list, ranking 112. Yang Huiyan's ranking slipped to 221.

↑ Forbes real -time rich list

In fact, Fan Hongwei is a frequent visitor on the Forbes list. On the 2022 Forbes Global Billionaire List, her wealth value was 18.2 billion U.S. dollars, ranking 88th, second only to Yang Huiyan among the wealthy Chinese, and is the second female rich in China. In addition, she ranked 13th in the 2022 Forbes China Best CEO ranking and ranked 7th in 2022 Forbes Chinese Outstanding Business Women's Rankings.

↑ 2022 Forbes Global Billionaire List

According to the 2022 Hurun Global Rich List, Chen Jianhua and Fan Hongwei ranked 48th with 170 billion wealth value, which has surpassed Yang Huiyan, ranking 55th.

↑ 2022 Hurun Global Rich List

According to the information and media reports of Hengli official website, Fan Hongwei and Chen Jianhua were able to start in scratch.

When he was young, Fan Hongwei was an accountant of a textile factory in Suzhou; Chen Jianhua was an ordinary merchant who operated chemical fiber and raw silk trading. After the two got married, they started the road to entrepreneurship. In the 1990s, the collective weaving plant in Nanma Town, Suzhou was on the verge of closing. In 1994, Fan Hongwei and Chen Jianhua borrowed 3.69 million yuan to subscribe to the factory and renamed it Wujianghua Fiber Weaving Factory.

After Fan Hongwei and Chen Jianhua took over the handicraft factory, they carried out a series of expansion measures to eliminate the woven machine and introduce 1200 ingot network cars. In 1995, it began to develop and produce by selling raw materials out of the processing machine. Its home -shaped weaving households spread all over 7 towns and towns in the river and Zhejiang. In 2020, Jiangsu Hengli Chemical Fiber Co., Ltd. was formally established, and the total investment in the first phase of the project was as high as 2.2 billion yuan.

Starting from the textile industry, Fan Hongwei and Chen Jianhua have continuously expanded to the upper reaches of the industrial chain, and have been operating in the chemical industry for many years. Today, the industries of Hengli Group, which are co -owned by the two people, covers refining, petrochemical, polyester materials, etc., to create "crude oil -aromatics, ethylene -refined PTA acid (PTA), ethylene -polyester (PET) -civilian use The complete industrial chain of industrial silk, engineering plastics, film -textiles ", has a listed company Hengli Petrochemical, Songfa (603268.SH), and New Third Board Corporation Tongli (834199.NQ).

At present, the three listed companies are actually controlled by Fan Hongwei and Chen Jianhua. Chen Jianhua is the chairman and general manager of Hengli Group; the most important listed company Hengli Petrochemical, Fan Hongwei is the chairman and general manager; at the same time, Fan Hongwei is also traveling with the director.

The richest man is difficult to be

Hengli Petrochemical short debt exceeds 75 billion

Fan Hongwei surpassed Yang Huiyan to become a richest man, but the Hengli Petrochemical she managed faced a lot of difficulties.

Hengli Petrochemical products cover upstream and downstream of the industrial chain, including refining products, PTA, and polyester products. Since 2021, the prices of raw materials such as crude oil, natural gas and other raw materials have continued to fluctuate, and the growth of downstream industries such as real estate, textiles, and building materials has slowed down, the cost of high costs is insufficient. Essence

In the first half of 2022, Hengli Petrochemical handed over a semi -annual report of increasing increasing income. From January to June 2022, Hengli Petrochemical's revenue was 119.155 billion yuan, an increase of 13.94%year-on-year, and the net profit attributable to the mother was 8.026 billion yuan, a year-on-year decrease of 7.13%.

In fact, the development of Hengli Petrochemical has always been faster, but one of the reasons for its revenue is to continue to increase and watch subsidiaries.

In 2016, Hengli (predecessor of Hengli Petrochemical) completed the backdoor and landed on the capital market. In 2017, the company's annual revenue was 47.48 billion. In June 2019, the company was renamed "Hengli Shares" to "Hengli Petrochemical". The company's revenue in 2019 has reached 100.8 billion yuan.

The 2017 annual report showed that its corporate group constituted a total of 12 subsidiaries; by the first half of 2022, the number of subsidiaries had increased to 76.

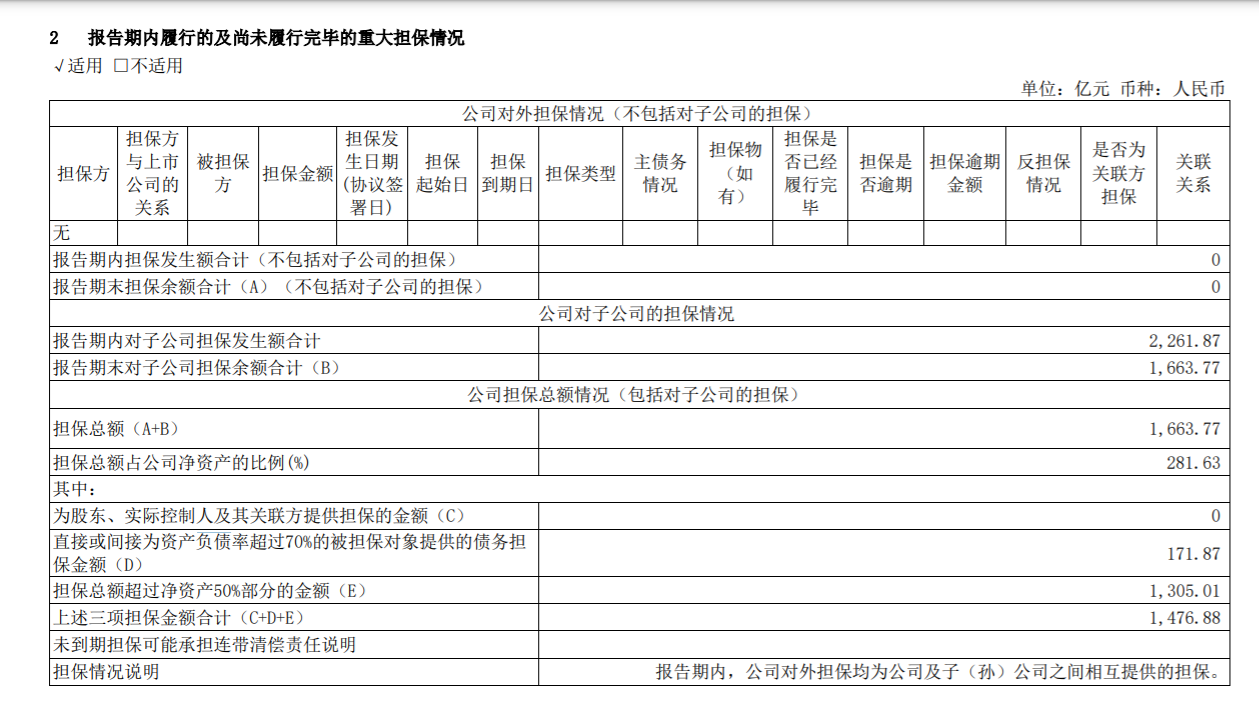

The continuous increase of subsidiaries can expand the company's scale and bring pressure. As of the end of June 2022, the company's total guarantee was 166.377 billion yuan, all of which were the guarantee of subsidiaries, and the total guarantee of the guarantee accounted for 281%of net assets. Among them, 17.1 billion yuan guaranteed amount, provided to companies with an asset -liability ratio of over 70%. ↑ Screenshot of the financial report

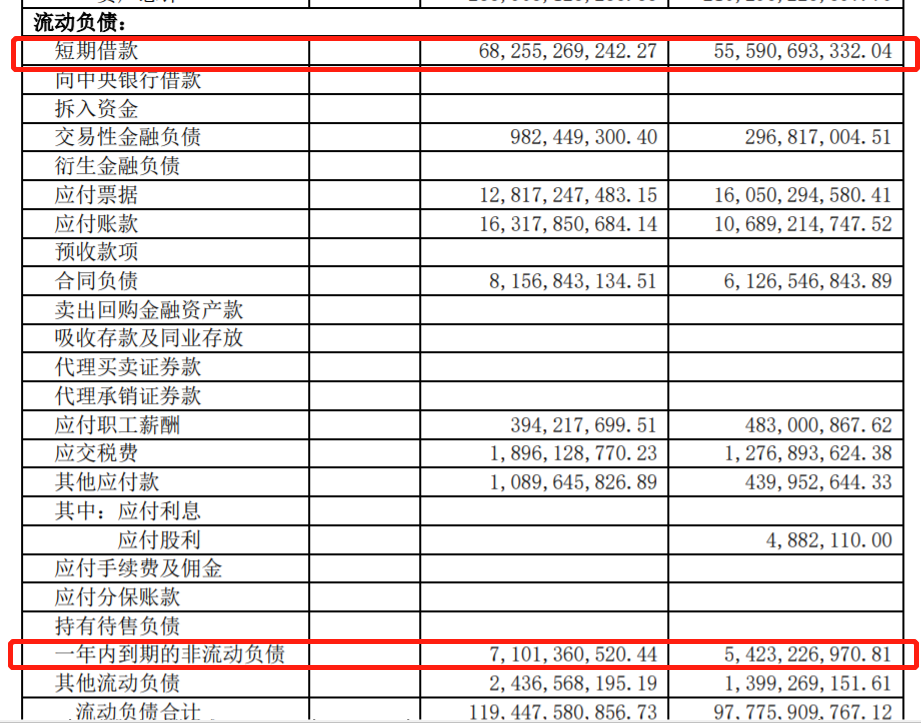

Hengli Petrochemical's debt pressure, especially short debt pressure, cannot be underestimated. In the first half of 2022, Hengli Petrochemical's asset -liability ratio was 74.96%, the mobile ratio was 0.68, and the speed ratio was 0.27. Among them, the short -term borrowing was as high as 68.255 billion yuan, and the non -current liabilities expired within a year were 7.101 billion yuan, totaling over 75 billion. However, as of June 30, 2022, monetary funds were only 25.578 billion yuan, which could not cover short debt.

↑ Screenshots of the annual report

In order to broaden financing channels, Hengli Petrochemical also issued a short -term financing voucher of 2 billion yuan in the first half of 2022. At present, debt repayment pressure has affected the company's income. In the first half of 2022, the company's financial expenses were 3.06 billion yuan, of which interest costs reached 2.719 billion yuan.

In the first half of this year, Hengli Petrochemical implemented the third and fourth phase of the share repurchase plan, with a total of 2 billion yuan in repurchase funds, but its company's stock price still fell 12.8%during the year. As of the close of September 2, it was reported at 19.15 yuan, a decrease of 0.31%.

↑ Stock price

The situation of the other two listed companies is not optimistic.

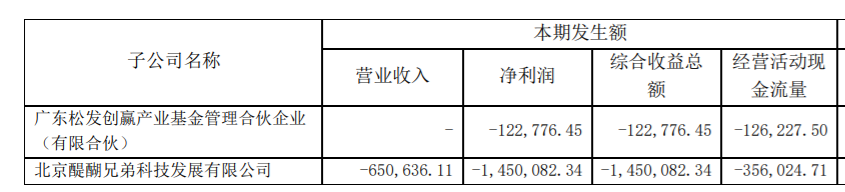

Since the first quarter of 2021, the net profit of Songfa has continued to lose money. In the first half of 2022, Songfa's operating income was about 105 million yuan, a year -on -year decrease of 43.43%; the loss of net profit at home was about 39.51 million yuan, a year -on -year decrease of 295%.

In recent years, Songfa has successively acquired Lianjun Ceramics and the brothers of the online education company. In 2021, Songfa's full calculation of the goodwill for the goodwill of the brothers and some Lianjun ceramics, but the two companies' performance was average, and the net profit was losing money.

↑ Screenshot of the financial report

Tongli, which is mainly based on boutique hotels, is affected by the environment. In 2020, the net profit lost of 9.4 million, and the net profit loss in 2021 was 12.5 million. In the first half of 2022, net profit lost 13.51 million.

In order to alleviate the pressure of funds, Tongli Travel borrowed funds from the parent company Hengli Group. As of June 30, 2022, Tongli Traveling Tongli's total payments were 101 million yuan, mainly for the controlling shareholder Hengli Group.

The corporate debt pressure is huge. Fan Hongwei is easy to stabilize the position of Chinese women's richest man.

Red Star News reporter Tao Yiyang

Editor Deng Yiguang Editor Yang Cheng

- END -

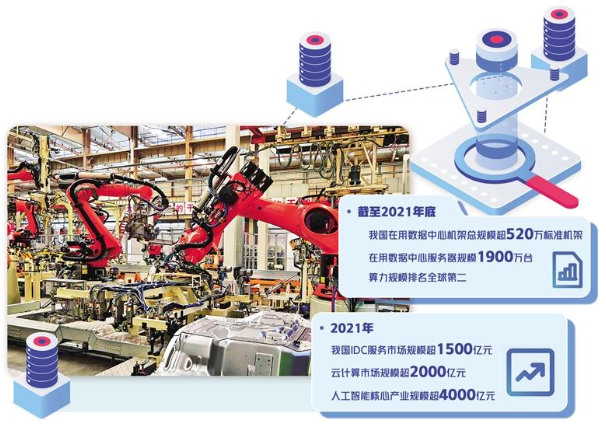

Calculate positive intellectual calculation leap

In a car manufacturing enterprise workshop in Qingzhou, Shandong, several robotics...

Tens of thousands of imported goods, 38,000 square meters exhibition hall ... the sixth cross -border e -commerce conference opened today

Elephant reporter Wang LinOn August 8th, the exhibition exhibition of the Sixth Global Cross -border E -commerce Conference opened at the Zhengzhou E Trading Expo Trading Center. At the site of 38,000