Insurance agent variation: 30 years of warmth and return

Author:Economic Observer Time:2022.09.04

Chinese life insurance companies, which are overwhelming in people's sea tactics, re -discovered the value of "professional" in the turning around. However, it is clear that the insurance market has become more sensitive and picky compared with 30 years ago. Can "talented people" return life insurance to the growth track?

Author: Jiang Xin

Figure: Tuwa Creative

Guide

One || For life insurance companies, the transformation of Ping An's experience is becoming the consensus of exploring and transformation of the life insurance industry. This is easy to reminiscent of the scene where AIA insurance returns to the Chinese market 30 years ago. It is precisely this company introduced the insurance agent model and brought the "elite model".

冷 || Misunderstanding, Leng Yu and even rejected, and AIA's first batch of agents have encountered it. However, AIA has always insisted on its own model. AIA activates the domestic insurance market, but more people have the dream of wealth to the domestic insurance company.

Three || In 2009, the number of insurance agents has jumped to 2.9 million. This year, the insurance law was revised, and the State Council vigorously promoted the comprehensive measures of "decentralization of service". The access conditions for insurance marketers gradually relaxed, and domestic insurance companies opened the era of the sea tactics of "pulling people".

, || In 2020, a few months of physical isolation brought about by a sudden new crown pneumonia's epidemic was as high as four or five million people who left the insurance marketing team like Feng Ying. The departure of Feng Ying also means that the second half of the development of China's insurance industry has officially started.

Wu || Finally realized that the helm of the insurance company who had gone to the end of the big waves found that high -quality and youthful talents were the most important.

A "grabbing" war in insurance is starting fiercely.

This time is aimed at the so-called "elite" talents. They come from famous domestic schools or return overseas. They have proven their excellence in their careers. They are between 28-45 years old and even in the past, and even accurate insurance marketing. Target population. Now, a new platform is waiting for them.

On July 23, the leader of the domestic insurance company shouted in the air, calling on the excellent talents in their minds to "change careers for dreams", and Ping An hoped to be this platform and let them show their skills as insurance elites.

It's not just Ping An to join the robbery team this year. Taikang Life actively recruits the partners of the great health career and AIA will further upgrade the "Excellent Marketing 3.0 Strategy" with the acceleration of the non -first -line layout, and the new Chinese people's life focuses on the "youthful, professional, and urbanization". Life has opened a high -quality development talent strategy "Shanhai Plan" ...

Behind the difference is the shock that the life insurance industry has never experienced. Look at a set of data: In just three years, the number of agents has begun to decrease sharply from the peak of 2019 to more than 4 million; the new single premium revenue of the insurance channels of large insurance companies has declined in an appointment from 2018 to 2020 9.2%, as of the end of 2021, decreased by 5.7%year -on -year. "There are not many fruits at low places, and there are still red fruits that are mature at the high place," the life insurance company hopes that these high -quality agents can seize the opportunity of the needs of high net worth individuals and aging. And new growth.

Those who are familiar with the development of the life insurance industry will feel that the scene of embrace the elite agent seems to have known each other.

That's right, this is the classic play used by AIA in 1992 to return to the Mainland. It is the introduction of the insurance agent system, bringing "elite models", and cultivating the first agent known as 36 diamond ... It is a suitable candidate for many insurance companies today, but at the time, this was not the first choice.

Chinese life insurance companies, which are overwhelming in people's sea tactics, re -discovered the value of "professional" in the turning around. However, it is clear that the insurance market has become more sensitive and picky compared with 30 years ago. Can "talented people" return life insurance to the growth track?

Grabbing

"Dare to do it!" This is the slogan that Ping An Life shouted for those potential talents.

On July 23, Ping An Life held a 2022 "Excellent+Talent" recruitment plan conference, aiming to recruit young talents with ambitions, knowledge, dare to think about, and cultivate high -quality, high performance, high -quality "three highs "Agent team.

To this end, Ping An Life has taken excellent conditions. This includes the longest 18 -month training allowance, which can be obtained up to 60,000 yuan per month. Within 12 months of the beginning, there will be escort allowances to ensure that the agent's revenue is transferred. ; There is also a top newcomer for high performance, with a one -time reward of 200,000 yuan ... "Since three years of admission, this time, this time is very strong, more attractive than when I was entering the company at the time." Cai Xinqi said.

Cai Xinqi joined Ping An in 2019, and since then the insurance industry. This year, China's insurance agent reached its peak -9.12 million. In fact, the number has fallen like an avalanche since then.

This year, Ping An established the Leading Group for Life Insurance Reform, and Ma Mingzhe personally coached. Ping An obviously realized the existence of risks very early. At the 2019 Ping An Performance Conference, Ma Mingzhe said that starting from 2018, the market, environment, and consumer demand of life insurance have changed greatly. In 2-3 years, studying the reform of life insurance.

Cai Xinqi is a member of the reform period. After the university, she has always been concerned about her family. She is a full -time mother. Because of the idea of holding insurance for the family, she listened to the Ping An preaching and "crashed by mistake" as an agent. She said, "Although she was full of full -time at home, if it was not a peaceful soldier line, it was still under human sea tactics, and she might not join." They are all college degree or above. With the incentive of the new "excellent +" talent program, she also started to establish her own team.

A Da Daxun Fei recording pen, a set of professional image photos, this is a gift she gave each new team partner. The recording pen is used to recording the process of communication with the customer for re -inspection, and the professional photo is to give customers a good professional image and professional service experience. "Good image, good quality, bachelor's degree, communication ability, good expression ability, and excellent character" is her standard for her team.

The adjustment of interest is the most obvious and most direct feeling. Cai Xinqi said that since this year, the commission of some new products has declined, which benefits customers, but at every month or some important time nodes, the company's commission and cash incentives to the agent are more considerable. The commission of 20%of the first annual premium will now give 10%of the commission, which will bring more income to the outstanding agent. What is more attractive to the potential is the increase in the basic salary (the additional subsidy will be given according to the performance). The previous salary was only a few thousand yuan, and now the outstanding performance can get a basic salary of 20,000 to 30,000 yuan. For example, Cai Xinqi said that if a luxury home salesman or a bank's private business manager, has a good customer relationship, it is not impossible for a million annual income.

And to impress Cai Xinqi to make him decide to make an increase in the increase in the benefits of the excellent+plan. "On the basis of the previous business level, the distribution of new marketing interests has been added. Those who meet this requirement can be promoted to the new marketing director with a person's performance. People can also obtain management benefits, which will allow agents to have greater enthusiasm to find high -quality members. "

Cai Xinqi has joined Ping An's three years, and is catching up with Ping An's adjustment period. The number of agents has dropped from 1.2 million in 2019 to 538,000 this year. %Improvement.

For life insurance companies, Ping An's transformation is becoming a consensus on exploring and transformation of the life insurance industry. This is easy to reminiscent of the scene where AIA insurance returns to the Chinese market 30 years ago. It is precisely this company introduced the insurance agent model and brought the "elite model". At that time, it seemed to be exactly the same as today's insurance company.

past

Xu Zhengguang, the first general manager of AIA Shanghai Company, once said in an article that he always remembers the first lesson in the first approved insurance agent he just recruited. He particularly emphasized "being human" and "professional ethics". This was at the end of 1992, when few people knew what life insurance was at that time.

Some of the 36 people were originally a civil servant of the government, some were teachers in large middle schools, some were staff members of enterprises and institutions, and some came from foreign enterprises. Some of them graduated from Shanghai Jiaotong University, and some originally engaged in tour guides in Beijing. They were well -treated, but they were attracted by AIA regardless of "going to the sea" and became the first batch of "Mr. Running Street".

For the Chinese insurance industry at the time, these agents were a symbol. The People's Daily at the time called it "AIA impact wave". On September 25, 1992, the US International Group obtained the first foreign insurance business license after China's reform and opening up. The widely recognized "Insurance Law" was written in the newly promulgated in 1995, opening up the new world of domestic insurance marketing.

In 1994, after the introduction of Xu Guangzheng's colleague, Huang Yigeng, and other Taiwanese life insurance companies, Ping An officially kicked off the prelude to the trial of the agent system of the domestic insurance company. In addition to Ping An, other local players have also begun to wake up, and learn and copy the "agent model". Open outlets, set up institutions, and pull teams. The scale of life insurance has expanded rapidly.

In 1996, Dong Meihua met her master recruited in front of the street stalls in Shanghai, which joined the insurance industry and became the "insurance leftovers" today. Born in the suburbs of Shanghai, she graduated from a technical secondary school and entered a state -owned factory, but she did not want to deal with the machine for a lifetime. At that time, there seemed to be no more choices. Until the company began to appear in the off -the -job wave, she was the most simple one who left. "At first I didn't figure out what insurance is, and I dare not find the people I know. I can only contact strange customers according to the words of the master." She said.

Until now, Dong Meihua still remembers his psychological activities when he greeted strange customers on the bus for the first time. Zhang Bao Fan -The policy comes from her aunt. "At that time, the insurance products were very simple. The terms were clearly written on one or two pages. Under the recommendation, the aunt bought 5 children's insurance." But when Dong Meihua was about to issue orders, the aunt's phone came to-- I don't want to buy it, because my mother does not recommend buying insurance, and the company who is worried about her work will be a liar. Dong Meihua finally promoted the policy to compensate by her own losses to the losses of her aunt. This made Dong Meihua truly become an insurance agent, and also allowed her to taste the income that had never been tasted, which caught up with the first golden decade of the insurance industry.

Shortly after the first signature, Dong Meihua met the second insurance customer on the bus. After a month of work, she received the salary of 1,800 yuan (20 % off the trial salesman's income at the time), which was more than three times the income of civil servants at that time. "At that time, the conditions were very difficult. The streets and lanes were the same as selling goods, especially to sweep the building. Some people immediately closed the door when they heard that they would sell insurance. For Dong Meihua, "At that time, everyone didn't understand insurance. The market was almost blank. As long as they went out to visit hard, they would basically gain."

Huang Yigeng once evaluated the personal agent system at the time. If there were more than 1 million agents in the market, they could visit 1 million families in one day with a bag to visit a customer every day. You can visit 265 million families. Soon after, it may be that all families have been visited by agents. No matter whether he buys, at least he knows insurance and no longer exclude.

Similar misunderstandings, Leng Yu and even rejected, and AIA's first agent has encountered it. However, AIA has always insisted on its own model.

In 2002, Wang Yan graduated from China University of Political Science and Law to study overseas. When he returned from studying abroad, China, who had just joined the WTO, changed every day.

At that time, the insurance industry was a vanguard of the opening of the financial industry to the outside world. Before entering the WTO, the gate of the insurance companies applied for a branch of the branch to run the horse. Taking the Xinhua Life Insurance as an example, only 4 branches in 2001 have only 4 branches in the company. , 9 branches, at the end of 2003, the above two numbers became 29 provincial branches and 89 central branches. In addition, several insurance companies have also started listing competitions. These have brought about the large expansion of the agent.

In 2004, Wang Yan returned to China. He likes to deal with people and does not like to work in the case. He was soon attracted by the high -profile talent recruitment of insurance companies. At the recruitment fair at the Beijing National Exhibition, he communicated with 8 foreign companies a day. After a few months of understanding, he chose AIA to start the first stop of the insurance career.

The reason why Wang Yan has focused on several foreign companies, especially AIA, because they have always adhered to a rational route, related training systems are relatively sound, the proportion of college graduates is large, and the quality of agents is relatively high. "At that time, many companies were relatively extensive. When they recruited them, they would go out to run the business without training. They could sell a few of them, and the rest would be destroyed by themselves."

Despite his thoughts, after learning that Wang Yan was selling insurance, teachers and classmates kept introducing work for him, but he declined.

He clearly remembered that the original newcomer training class was 70 or 80 people, and he actively caminated the monitor himself. He still insisted that only four or five people left in the insurance industry. These people still called their squad leader.

This is why Wang Ye summarized his achievements today -adhere to long -termism. When customers have achieved their careers from single young people to forming families, their careers are successful, and they will grow with customers under trust and stickiness.

Like all agents, Wang Yan, who was new to the small order accident insurance of dozens of dollars and hundreds of dollars, completed his original accumulation through one by one with the AIA policy.

AIA activates the domestic insurance market, but more people have the dream of wealth to the domestic insurance company.

Crowded

In 2009, the number of insurance agents has jumped to 2.9 million. This year, the insurance law was revised, and the State Council vigorously promoted the comprehensive measures of "decentralization of service". The access conditions for insurance marketers gradually relaxed, and domestic insurance companies opened the era of the sea tactics of "pulling people".

Feng Ying, 45, entered the insurance industry in such a tide. Previously, she was a teacher of a rural primary school. One day in 2010, a distant cousin found her sales insurance. Feng Ying was attracted by her decent dresses and freedom of work. In the end, Feng Ying did not buy insurance, but became a colleague with her cousin -she became an agent. people.

Feng Ying, who graduated from high school, chose the first battle in the village he was teaching. From the parents of the students to the neighbor of the neighborhood to the relatives of her and her in -laws, Feng Ying quickly showed his own sales talents. Although there were not many deposits at that time, when Feng Ying introduced the product's interest, he could also be able to have interest, but also could also be able to have interests and can also be able to have interests and can also have interests. When providing protection, there are still many people's hearts.

Soon, Feng Ying became the sales elite of his business department. In 2015, as the interest rate of the bank fell, universal insurance products became the darling of the agent's hands. Feng Ying, who had a certain customer resources, took his own employees to change his job to Huaxia Insurance. With more material incentives, Feng Ying won the battle. It once made the team nearly a hundred people. "At that time, the increase in members was too crazy. There was an unwritten standard in the industry. Those with ID cards and breaths can be pulled to sell insurance. As long as literacy speaks, it can be done well." Feng Ying clearly remembers that when the craziest of the members, she once brought a dozen students in replace the new recruitment personnel to participate in the qualification examination of the agent. Dong Meihua was also impressed by the memory of this time. "At that time, I remembered that the company had a big increase in members. The lecturer would joke with everyone like this. I took the mirror to find it on the street.

In the 2008 financial crisis, AIA was founded by the parent company. Wang Yan left AIA and chose Mingya Insurance Brokerage Company in 2010. Before 2015, Wang Yan said that he had been dormant for a long time. Until 2016, Ming and Asia began to recruit nationwide, and the industry also gradually recognized the value of the intermediary. He waited for the opportunity to take off.

After the five -year "accumulation", Wang Yan's team team led by the most popular from the most popular to 1,600 people from the previous 200 people, which is the largest team in Mingya.

Feng Ying once led the team partner to participate in the offline lectures of up to thousands of people. In addition to the superior agent on the stage, there are also stars and well -known host platforms. There are even Buddhist masters. "Except for objects, including houses and cars, insurance companies may have sent everything." Feng Ying joked. For a period of time, Feng Ying's refrigerators, television, washing machines, and electric bicycles were drawn from the insurance company.

In 2019, the number of insurance agents reached its peak -9.12 million, which was their position in the world's second largest insurance market.

mutation

In 2020, a sudden physical isolation caused by the sudden new crown pneumonia's epidemic, directly pressing the exhibition key to Feng Ying's exhibition industry.

The team that opened the door a few years ago was gone, and it was unable to conduct offline training. Many older partners operated their mobile phones. In addition, housework needs to handle, and some people once broke with Feng Ying.

Because most people in the team are much different from Feng Ying, with the rise of Internet insurance, Feng Ying finds that many people are becoming more and more difficult to do business. People who are almost older are not budget because of retirement. , And finally came into contact with young people to visit, but they knew nothing about the Internet celebrity products they asked, let alone in -depth analysis and comparison, because in the training class, most of them heard the benefits of their own products.

Feng Ying, the captain, has kept studying. In addition to listening to the company's training courses, he will also invite children to find a marketing course on the Internet to listen to it.

But the people who buy insurance are also changing. They no longer blindly listen to the words of the agent, but have a clearer understanding of products and needs and compare them.

On one occasion, Feng Ying heard that a big hotel chef wanted to buy critical illness insurance and went to eat to contact. As a result, before that, there were already companies from China Life, Ping An and other companies in China talked with her potential customers, but the chefs were all. No signing. One day during the chef on vacation, Feng Ying and several colleagues gathered in his house for PK. Several agents compared one by one according to the terms. Eventually, with the advantages of the product cost -effectiveness, Feng Ying won the victory. Sell 20 or thirty insurance policies.

In 2022, the epidemic was repeated. After the team had only 3 people left and did not open the order for a month, Feng Ying also left the insurance industry under the persuasion of the child. And some partners in Feng Ying's team, some went to takeaway, some opened courier outlets, and some sold skewers on the street.

In fact, as much as four or five million people who left the insurance marketing team like Feng Ying. The departure of Feng Ying also means that the second half of the development of China's insurance industry has officially started.

When Feng Ying was trapped in the offline exhibition industry, Wang Yan completed his performance and additional staff on his mobile phone and computer. Especially under the influence of the epidemic, his team did not increase.

In Zhihu's discussions and questions about insurance, netizens from the Ming Asian insurance agent are always available. Among the communicationers of these insurance consciousness, Wang Ye is the figure of Wang Yan, and knowing that Wang Ye is also the cornerstone of Wang Ye's establishment team place. Of the 33 branches of Mingya, almost every company has members of the family. Part of these members come through the reasons and reasons, and they are more gathering through the Internet. This is also something Feng Ying is unimaginable.

Today, there are many post -80s and 90s practitioners like Wang Yan looking for their potential customers here. On the video platforms such as Douyin and Xiaohongshu, there are a lot of insurance topics and content output every day. They are the main customer acquisition channels for many new intermediary platforms. "It is not appropriate to sell for six years, what can you do?" "Many times we originated from understanding or not, and longing for the fact that the essence of the workplace still has some universal qualities ... as long as it is excellent, or some have some some of them, or have some some of them. GM success quality, such as self -driving forces, is likely to make money. "

The busy Wang Yan still answered the question on Zhihu. But at the same time, he will use more time to operate his own video number to live broadcast on the team's wealth planning and other issues ... The team of the team calls him "Mom", because he can always answer his doubts, and he will be annoying. In his own opinion, it was "24 hours a day as long as you wake up and return to WeChat." return

In 2019, Dong Meihua grew from the initial foreign service salesman to an inside manager. However, after ten years of internal diligence, Dong Meihua, who was the deputy general manager of the big boy Shanghai Branch, resigned and returned to the front line.

She said that the idea of originally transformed into the internal diligence was to better come out to do foreign diligence. The career of foreign service was "the belonging of life".

Prior to this, in the rapid development of the insurance industry, I realized that I had a lack of academic qualifications and improved their education. Later, I learned the Internet and computers, and finally went to a securities company to experience it. Short board.

In the second year after the team was established, the lover of a large -scale life insurance company was "pulled into the water" for the management of a large life insurance company to take care of her Meihua family.

Now, Dong Meihua's jurisdiction has reached the scale of nearly a hundred people. The team is based on high education, high quality, scientific and technological, and younger talents. Some of them are returnees, some are business owners, some are managers, some are professional financial practitioners ... … Team's undergraduate degree accounted for more than 90%. This is very different from the insurance agent team that she just entered the insurance industry.

"There is no so -called selection at the beginning, as long as it seems to be able to do insurance, it is easy to make insurance sales utilitarian. Some agents will stand on a personal perspective for their own income and company plan for their own income and company plan. Products instead of considering customer needs. Some will even help customers conceal the past diseases in order to make orders. There are also personal honors and incentives. At the same time as growth, extensive operations have also brought huge negative impacts -mentioning insurance, many people think that it is a deceiving thing; the increase in employees is too fierce, and insurance is regarded as a pyramid scheme; for agents, for agents, Not only does the family do not think this is a normal job, but also the pressure in the society is also under pressure from the insurance industry. "Looking back at the past, Dong Meihua intersects.

At this time, the growth of the life insurance industry has changed. In the past, the extensive operation method, under the influence of the decline in the decline of the demographic dividend, the age of the consumer body, the economic expectations brought about by the new coronary pneumonia, the new crown pneumonia epidemic situation will have been low. There are almost few fruits. Finally realized that the helm of the insurance company who had gone towards the end of the road found that high -quality and youthful talents were the most important.

Compared with the industry pessimist, Dong Meihua is full of confidence. In her opinion, it is the best era in the insurance industry in the past years, and it will continue to be beautiful in the future. During the Shanghai epidemic, Dong Meihua's Meihua family manpower and performance all showed adversity growth.

Different from her first joining the insurance industry 26 years ago, Dong Meihua has a new way of playing.

Practicing a basic principle -respecting and awe -inspiring industry development laws, today's insurance has entered the era of professional consulting services from the sales era. High -quality, professional, and professional talents are the talent cornerstone of the insurance team.

At the same time, let 50 -year -old herself maintain a young mentality and be a "new" insurer, young, professional, high -quality, non -utilitarian, service type, digitalization.

The times have changed and demand has changed. When the 30 -year -old Dong Meihua rode an electric car to explain what insurance was in the customer, Cai Xinqi, 30, finally took the energy to the road after recruiting a driver to the driver.

A set of survey data of the Foresight Industry Research Institute shows that the 26-55-year-old population is the main force of insurance consumption, accounting for more than 70%. Consumers are more cautious in the purchase of insurance. They are mainly concerned about insurance products, insurance institutions and services such as insurance products, insurance institutions, and services when purchasing insurance. The factors that are more concerned.

Although it was only three years in the insurance industry, Cai Xinqi has realized that under the goal of maintaining performance growth, the average premium of increasing the average amount of increases is much easier than increasing the number of reports. So she anchored her high net worth of investment assets of more than 10 million, and the first key to open their hearts was the ultimate service and professionalism.

Let insurance return to its origin, return to guarantee, and cannot be separated from the efforts of Dong Meihua, Wang Yan, and Cai Xinqi, which is just like the initial development of the Chinese life insurance industry. But everything is not as good as it was.

When Wang Yan squeezed time to prepare for the insurance premium trust configuration, Feng Ying was no longer busy.

She was sitting in front of the Mahjong table to kill the Quartet. "I was nervous when I saw your phone number before, and I was afraid of proving insurance. Now I speak more and more comfortable when I speak." A brand friend opened his heart, but he asked him carefully. "The son fancy a insurance on the Internet. The product wants to ask you to help analyze. "

Feng Ying sighed in his heart and had reached the era of the customer's active configuration, but he did not seize the footsteps of the times.

Those who disappear in the list of Fortune 500 companies take care of infants and young children: high -priced education or "kidnapping" the old man, the United States restricts high -performance semiconductor exports, which areas will be affected?

- END -

Lanling County actively explores the development path of charity in the new era

Build a happy homeland to help rural revitalization——A Lanling County actively explore the development path of charity in the new eraCharity Charity News (Liu Enhao reporter Ye Qing) Since this year...

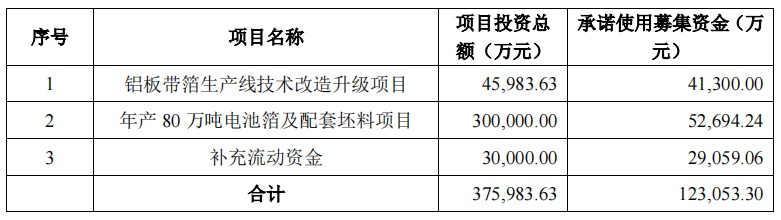

Ding Sheng New Material: Formulate a fundraising of not over 2.7 billion yuan, for annual output of 800,000 tons of battery foil and supporting billet projects, etc.

On July 20, 2022, the A -share company Ding Shengxin (603876.SH) announced that th...